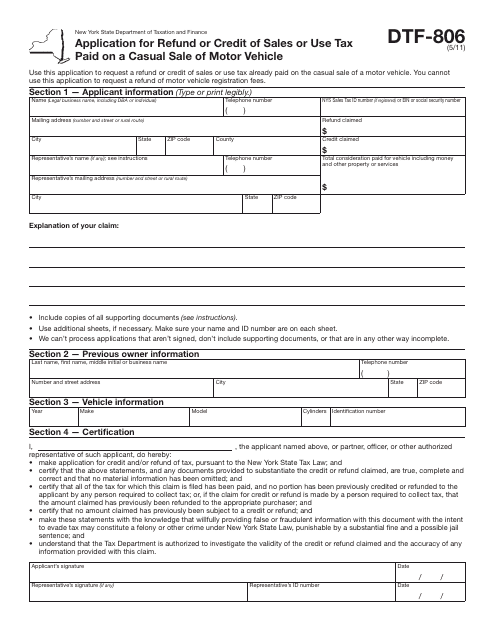

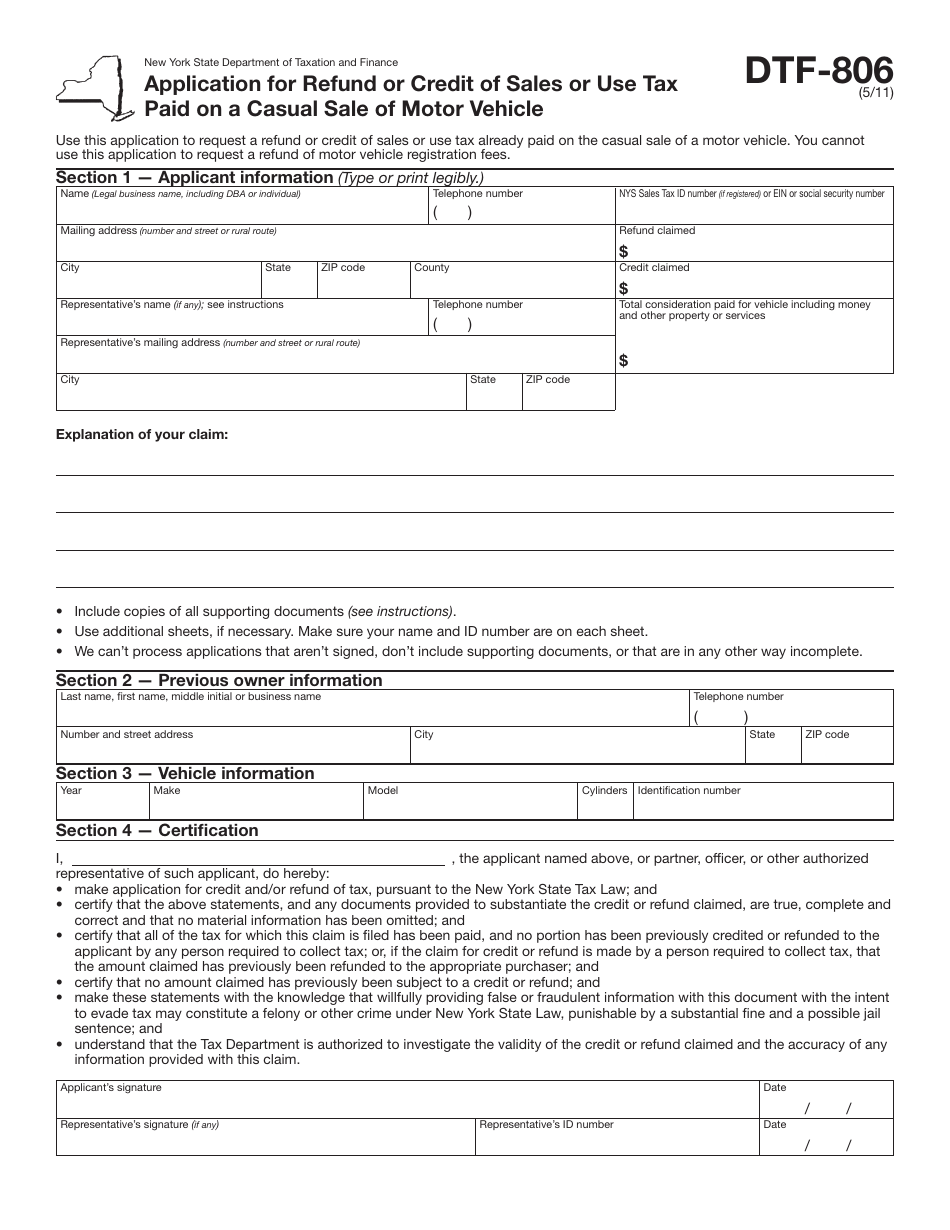

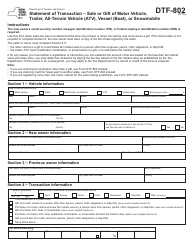

Form DTF-806 Application for Refund or Credit of Sales or Use Tax Paid on a Casual Sale of Motor Vehicle - New York

What Is Form DTF-806?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-806?

A: Form DTF-806 is the application used to request a refund or credit of sales or use tax paid on a casual sale of a motor vehicle in New York.

Q: Who can use Form DTF-806?

A: This form can be used by individuals who have paid sales or use tax on a casual sale of a motor vehicle in New York.

Q: What is a casual sale?

A: A casual sale refers to the sale of a motor vehicle by an individual who is not in the business of selling motor vehicles.

Q: How can I get a refund or credit for sales or use tax?

A: You can use Form DTF-806 to apply for a refund or credit of sales or use tax paid on a casual sale of a motor vehicle in New York.

Q: Is there a deadline to file Form DTF-806?

A: Yes, you must file Form DTF-806 within three years from the date of the casual sale of the motor vehicle to request a refund or credit of sales or use tax.

Q: Are there any fees associated with filing Form DTF-806?

A: No, there are no fees associated with filing Form DTF-806.

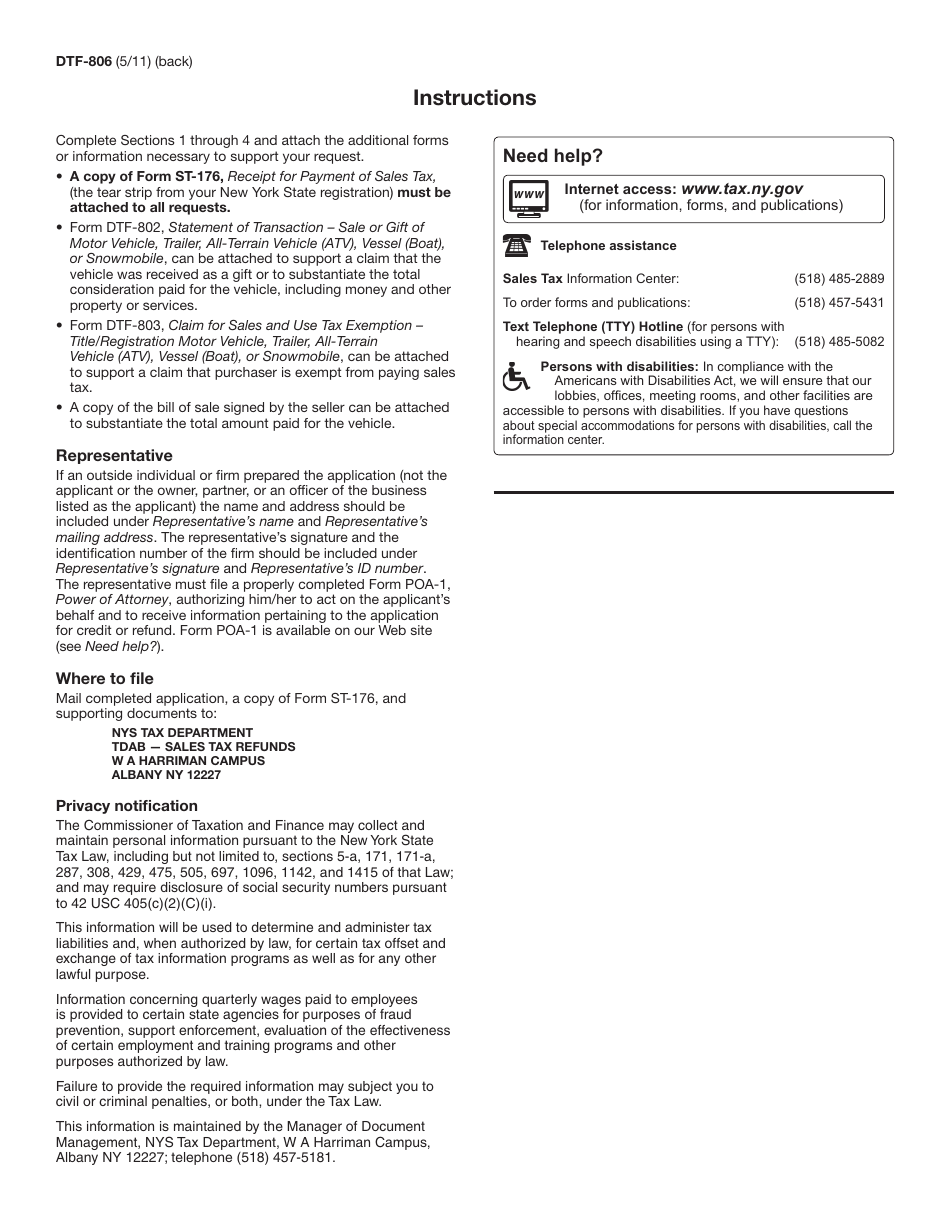

Q: What documents do I need to include with Form DTF-806?

A: You need to include a copy of the bill of sale or other documentation that shows the amount of sales or use tax paid on the casual sale of the motor vehicle.

Q: Can I submit Form DTF-806 electronically?

A: No, as of now, Form DTF-806 cannot be submitted electronically. It must be filed by mail.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-806 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.