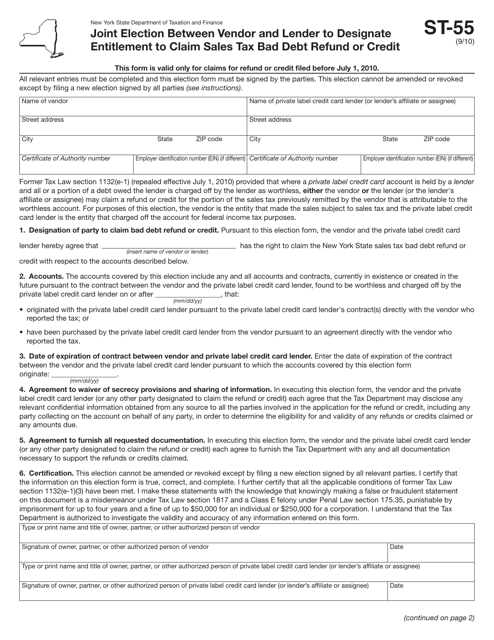

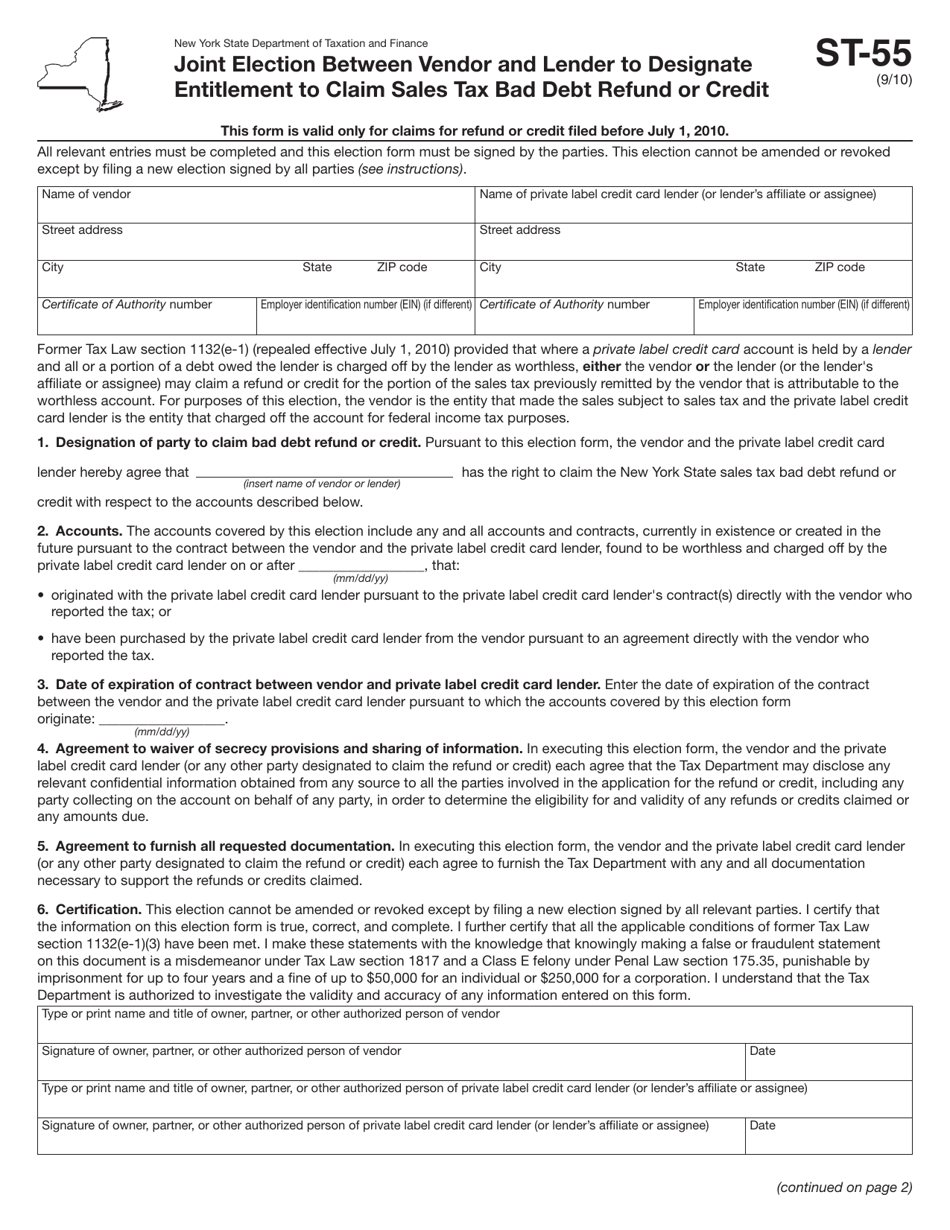

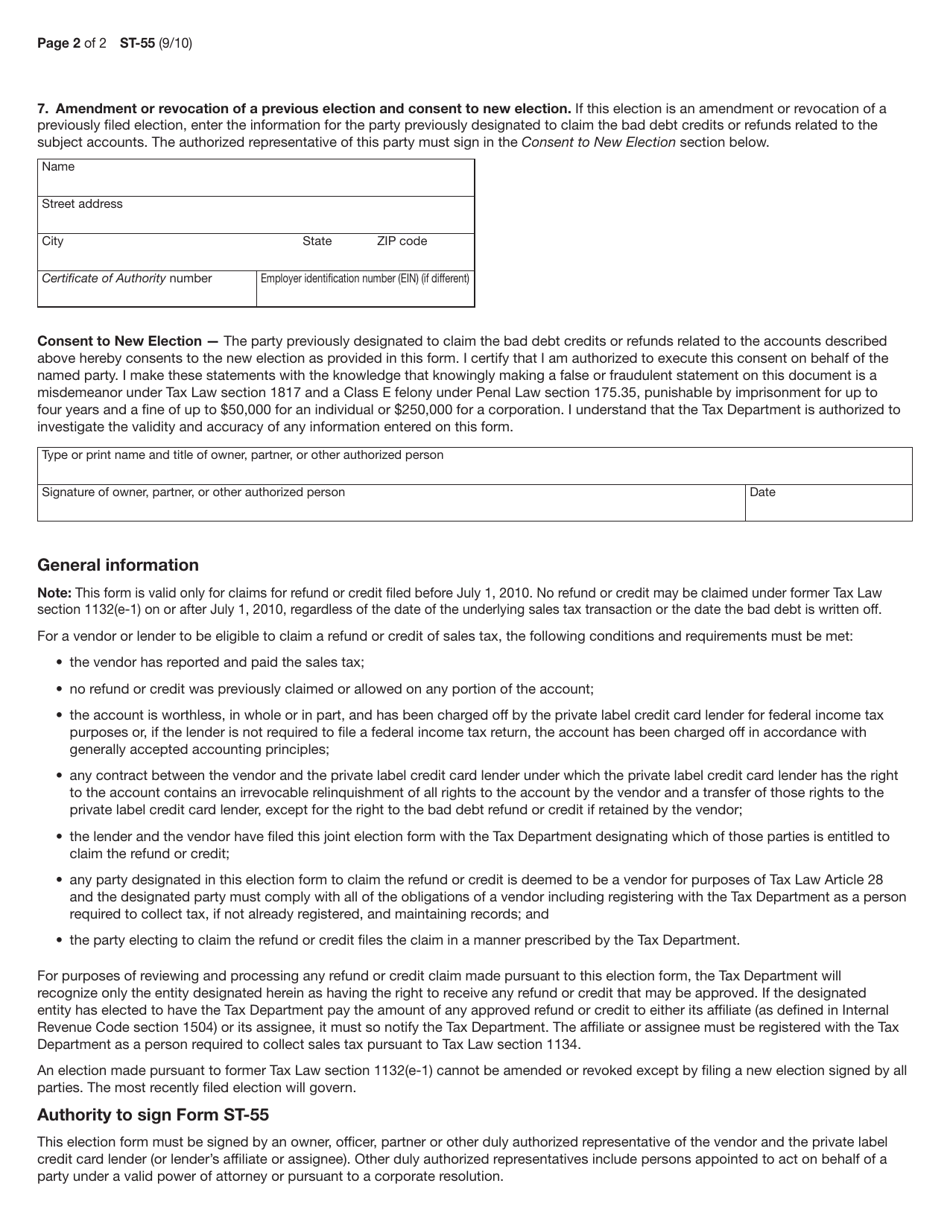

Form ST-55 Joint Election Between Vendor and Lender to Designate Entitlement to Claim Sales Tax Bad Debt Refund or Credit - New York

What Is Form ST-55?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-55?

A: Form ST-55 is a joint election form used in New York.

Q: Who can use Form ST-55?

A: Vendors and lenders in New York can use Form ST-55.

Q: What is the purpose of Form ST-55?

A: The purpose of Form ST-55 is to designate entitlement to claim sales tax bad debt refund or credit.

Q: What is a sales tax bad debt refund or credit?

A: A sales tax bad debt refund or credit is a reimbursement or credit given for unpaid sales tax on bad debts.

Q: Why is this form important?

A: This form is important because it allows vendors and lenders to establish their entitlement to claim sales tax bad debt refund or credit.

Form Details:

- Released on September 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-55 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.