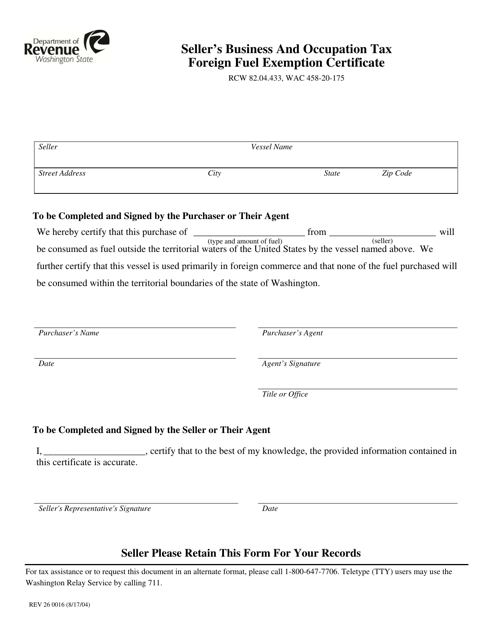

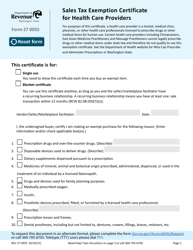

Form REV26 0016 Seller's Business and Occupation Tax Foreign Fuel Exemption Certificate - Washington

What Is Form REV26 0016?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV26 0016?

A: Form REV26 0016 is the Seller's Business and Occupation Tax Foreign Fuel Exemption Certificate specific to Washington State.

Q: Who needs to use Form REV26 0016?

A: Sellers who want to claim an exemption from the business and occupation tax on the sale of fuel to nonresidents of Washington State can use this form.

Q: What is the purpose of Form REV26 0016?

A: The purpose of Form REV26 0016 is to provide documentation to support the exemption claim and ensure accurate reporting of fuel sales.

Q: What information is required on Form REV26 0016?

A: The form requires information such as the seller's name and address, the buyer's name and address, the type and quantity of fuel sold, and the buyer's intended use of the fuel.

Q: Is there a deadline for submitting Form REV26 0016?

A: Yes, sellers must submit Form REV26 0016 to the Washington State Department of Revenue within 30 days from the date of the sale.

Q: Are there any filing fees associated with Form REV26 0016?

A: No, there are no filing fees required for submitting Form REV26 0016.

Q: What should I do if I have questions or need assistance with Form REV26 0016?

A: If you have any questions or need assistance with Form REV26 0016, you can contact the Washington State Department of Revenue directly for guidance.

Form Details:

- Released on August 17, 2004;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV26 0016 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.