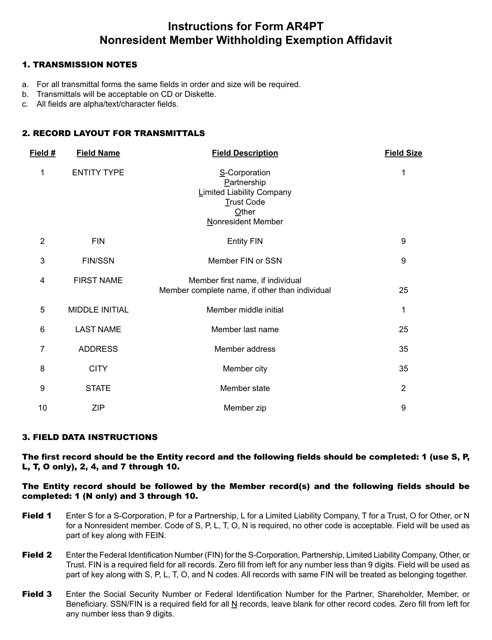

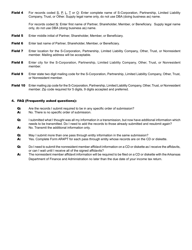

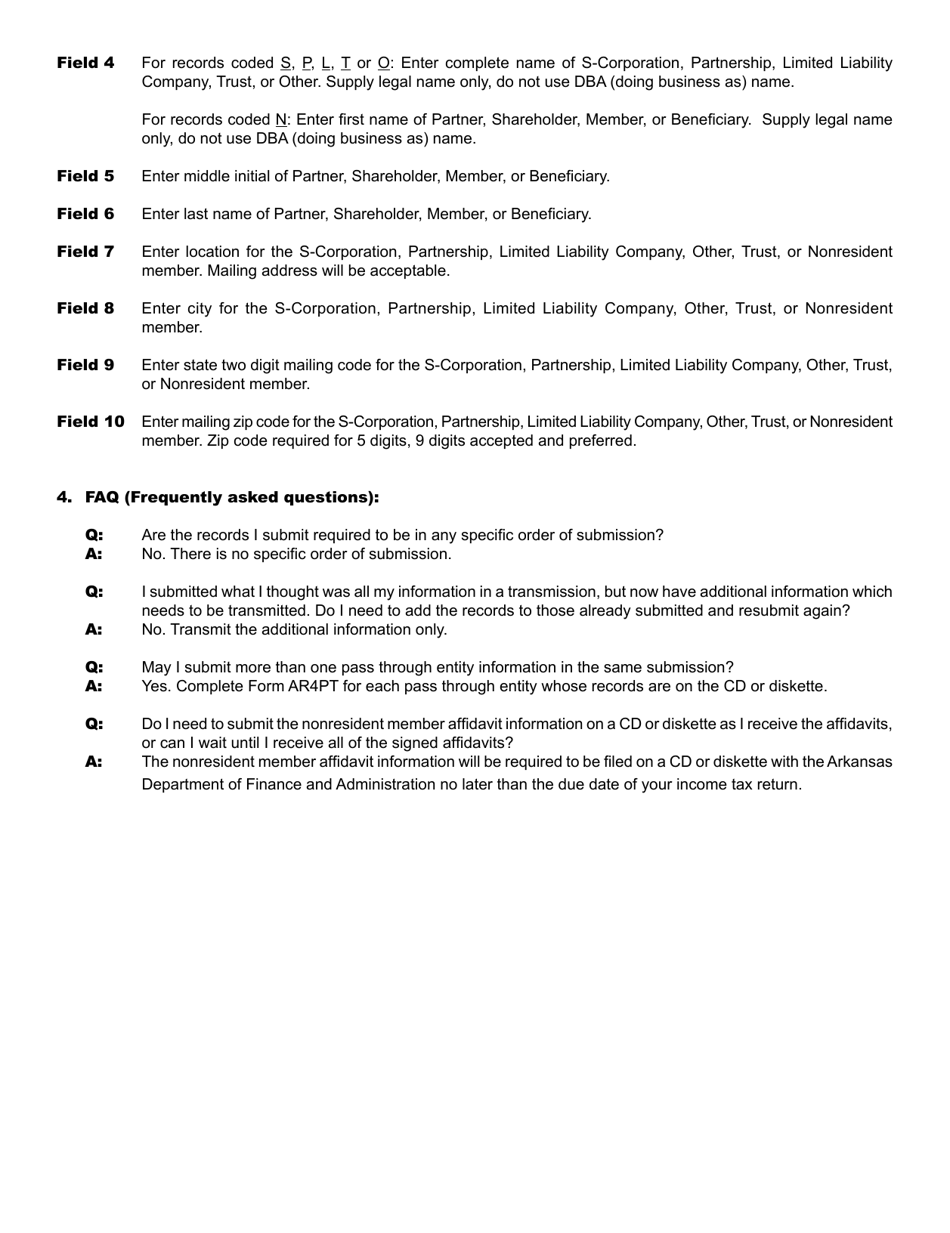

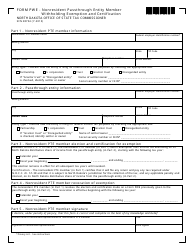

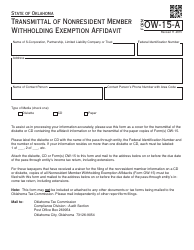

Instructions for Form AR4PT Nonresident Member Withholding Exemption Affidavit - Arkansas

This document contains official instructions for Form AR4PT , Nonresident Member Withholding Exemption Affidavit - a form released and collected by the Arkansas Department of Finance & Administration.

FAQ

Q: What is Form AR4PT?

A: Form AR4PT is a Nonresident Member Withholding Exemption Affidavit for Arkansas.

Q: Who needs to fill out Form AR4PT?

A: Nonresident members who want to claim an exemption from withholding tax in Arkansas need to fill out Form AR4PT.

Q: What is the purpose of Form AR4PT?

A: Form AR4PT is used to claim an exemption from withholding tax on income earned by nonresident members in Arkansas.

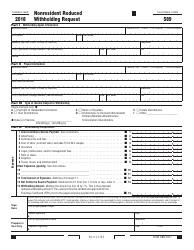

Q: What information do I need to provide on Form AR4PT?

A: You need to provide your personal information, information about the entity you are a member of, and details about your income and withholding.

Q: When is the deadline to submit Form AR4PT?

A: Form AR4PT must be submitted within 30 days after the end of the calendar quarter in which the income was distributed.

Q: Do I need to attach any documents with Form AR4PT?

A: You may need to attach supporting documents, such as a copy of your federal income tax return.

Q: What penalties may I face for not filing Form AR4PT?

A: Failure to file Form AR4PT may result in penalties and interest charges on the withholding tax due.

Q: Can I claim an exemption from withholding tax in Arkansas if I am a nonresident member?

A: Yes, you can claim an exemption from withholding tax in Arkansas by filling out Form AR4PT.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arkansas Department of Finance & Administration.