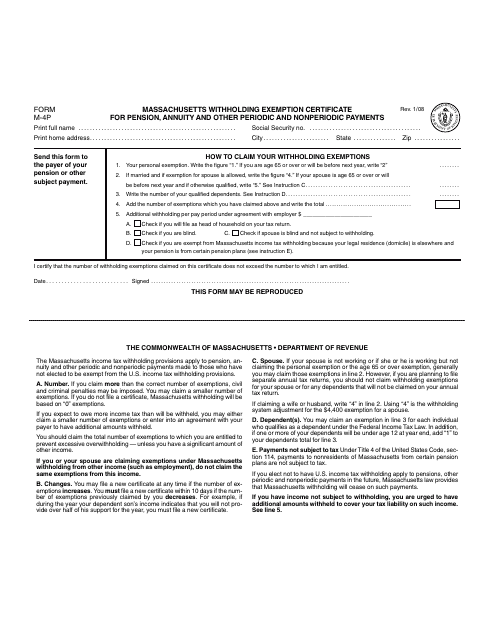

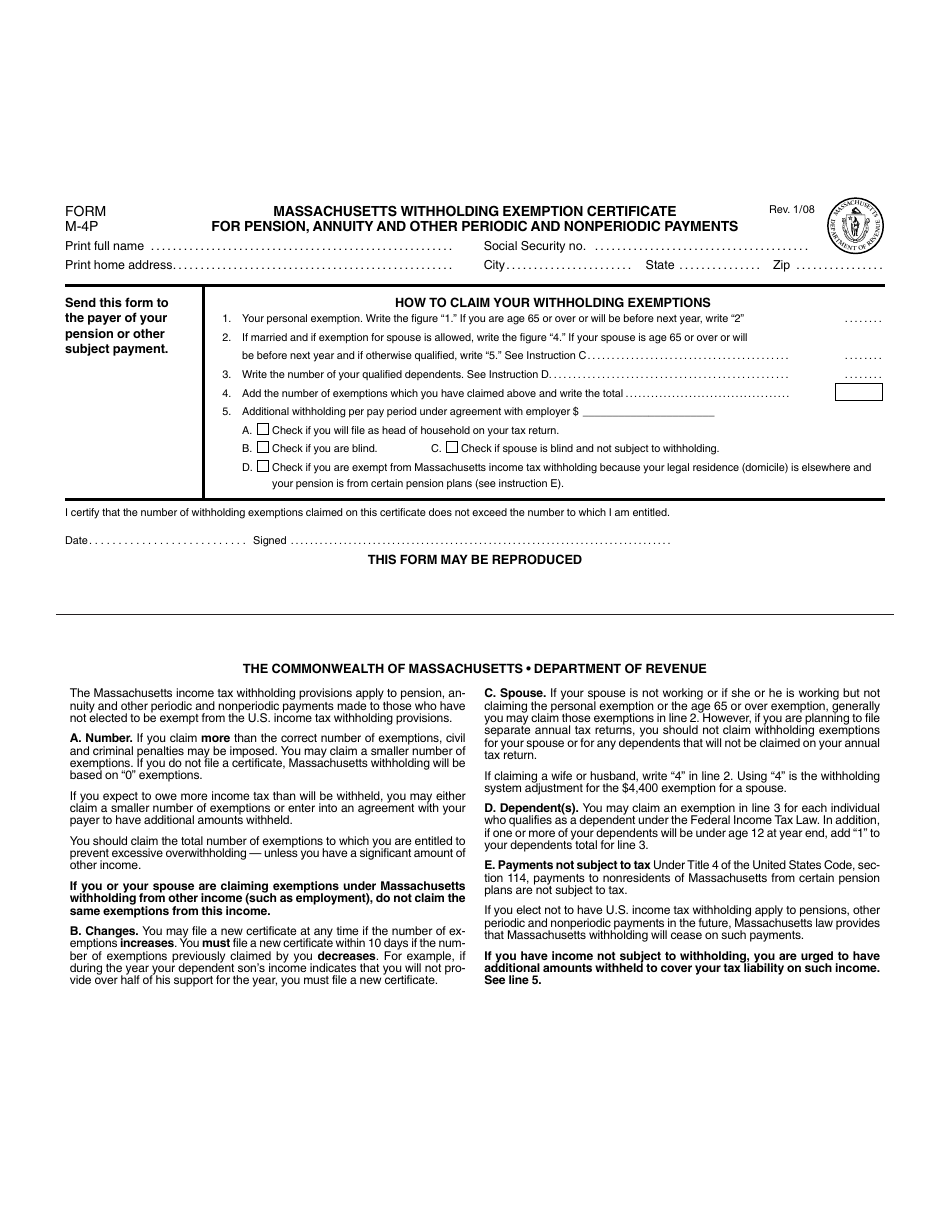

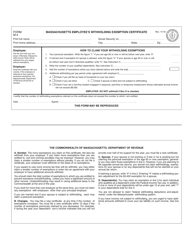

Form M-4p Massachusetts Withholding Exemption Certificate for Pension, Annuity and Other Periodic and Nonperiodic Payments - Massachusetts

What Is Form M-4p?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-4p?

A: Form M-4p is the Massachusetts Withholding Exemption Certificate for Pension, Annuity and Other Periodic and Nonperiodic Payments.

Q: What is the purpose of Form M-4p?

A: The purpose of Form M-4p is to determine the amount of tax to withhold from certain types of payments in Massachusetts.

Q: Who needs to fill out Form M-4p?

A: Individuals who are receiving pension, annuity, and other periodic and nonperiodic payments in Massachusetts may need to fill out Form M-4p.

Q: What information is required on Form M-4p?

A: Form M-4p requires the individual's name, address, Social Security number, marital status, and their exemption allowance.

Q: How often should Form M-4p be filled out?

A: Form M-4p should be filled out whenever there is a change in the individual's personal or financial circumstances that could affect their tax withholding.

Q: Can I claim exemptions on Form M-4p?

A: Yes, you can claim exemptions on Form M-4p if you meet certain criteria outlined in the instructions.

Q: Are there any filing deadlines for Form M-4p?

A: There are no specific filing deadlines for Form M-4p. However, it is recommended to submit the form as soon as possible after any changes occur.

Q: What happens if I don't fill out Form M-4p?

A: If you don't fill out Form M-4p, taxes may be withheld from your payments at the default rate, which may not be accurate for your situation.

Q: Can I make changes to my withholding on Form M-4p?

A: Yes, you can make changes to your withholding on Form M-4p by submitting an updated form to the appropriate payer.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-4p by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.