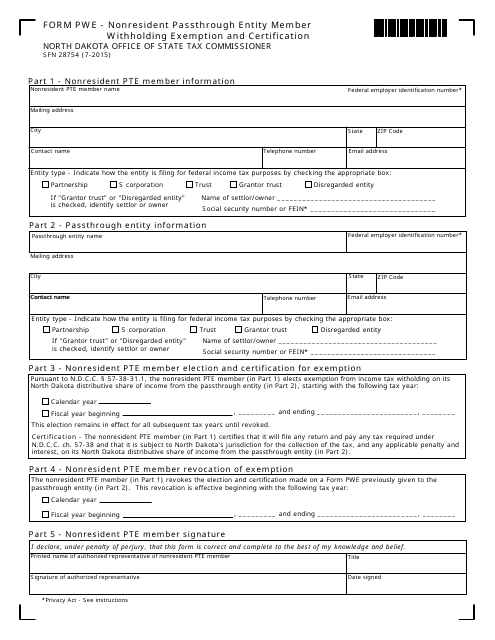

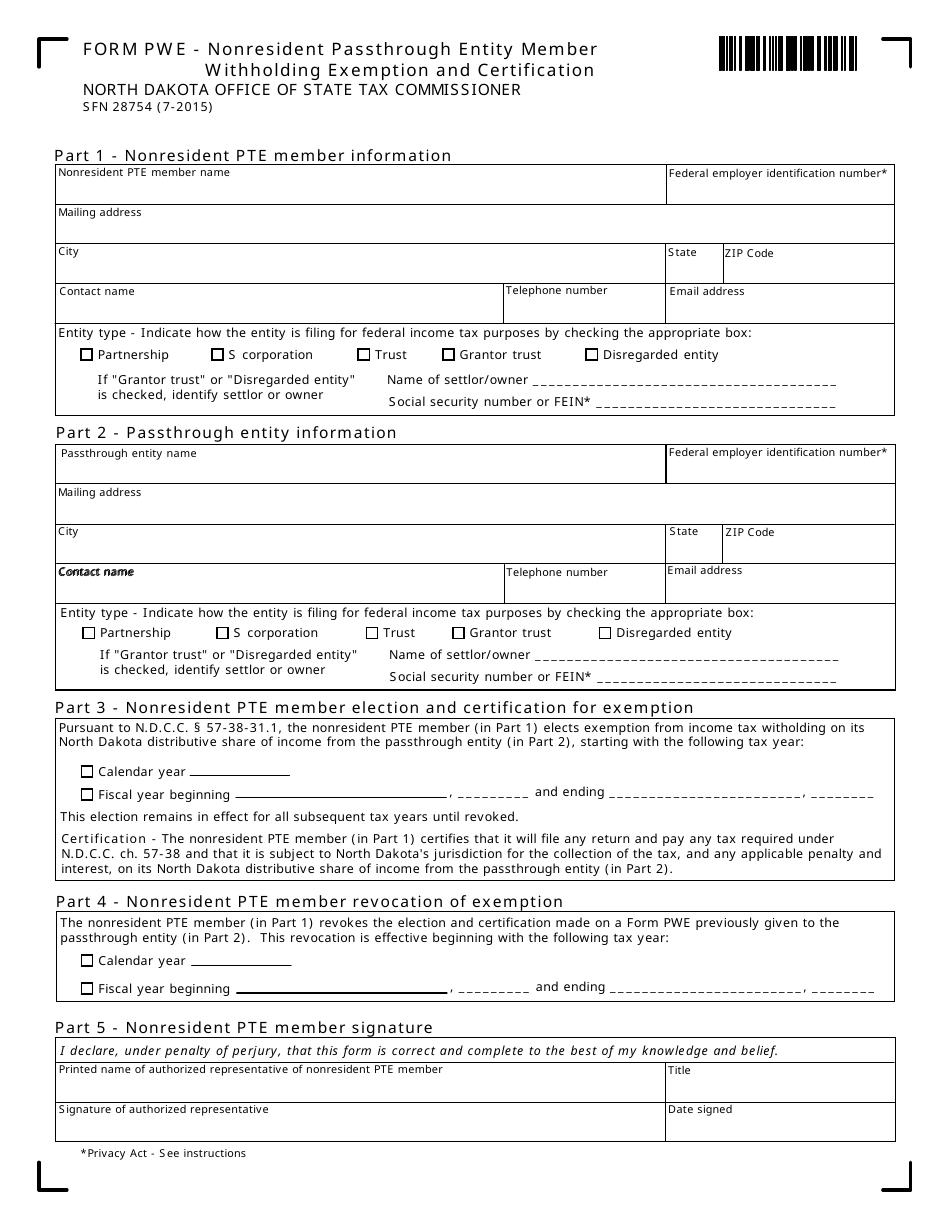

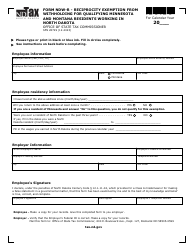

Form SFN28754 (PWE) Nonresident Passthrough Entity Member Withholding Exemption and Certification - North Dakota

What Is Form SFN28754 (PWE)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form SFN28754?

A: Form SFN28754 is the Nonresident Passthrough Entity Member Withholding Exemption and Certification form.

Q: What is the purpose of form SFN28754?

A: The purpose of form SFN28754 is to certify that a nonresident passthrough entity member is exempt from withholding tax in North Dakota.

Q: Who needs to fill out form SFN28754?

A: Nonresident passthrough entity members who are exempt from withholding tax in North Dakota need to fill out form SFN28754.

Q: Is form SFN28754 specific to North Dakota?

A: Yes, form SFN28754 is specific to North Dakota and is used for withholding exemption and certification in the state.

Q: When should form SFN28754 be submitted?

A: Form SFN28754 should be submitted to the North Dakota tax authority before the income is paid to the nonresident passthrough entity member.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28754 (PWE) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.