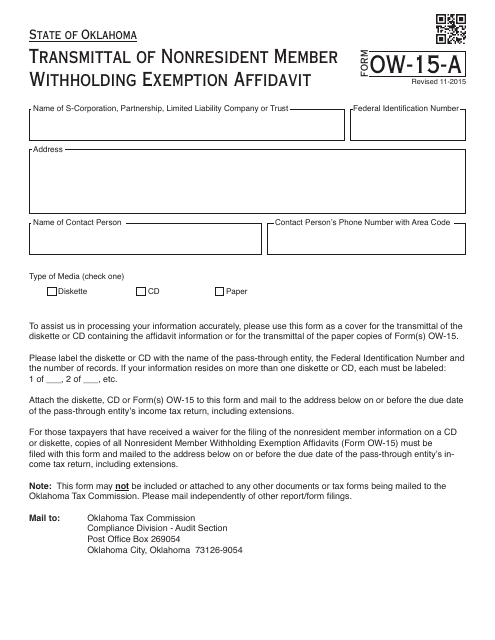

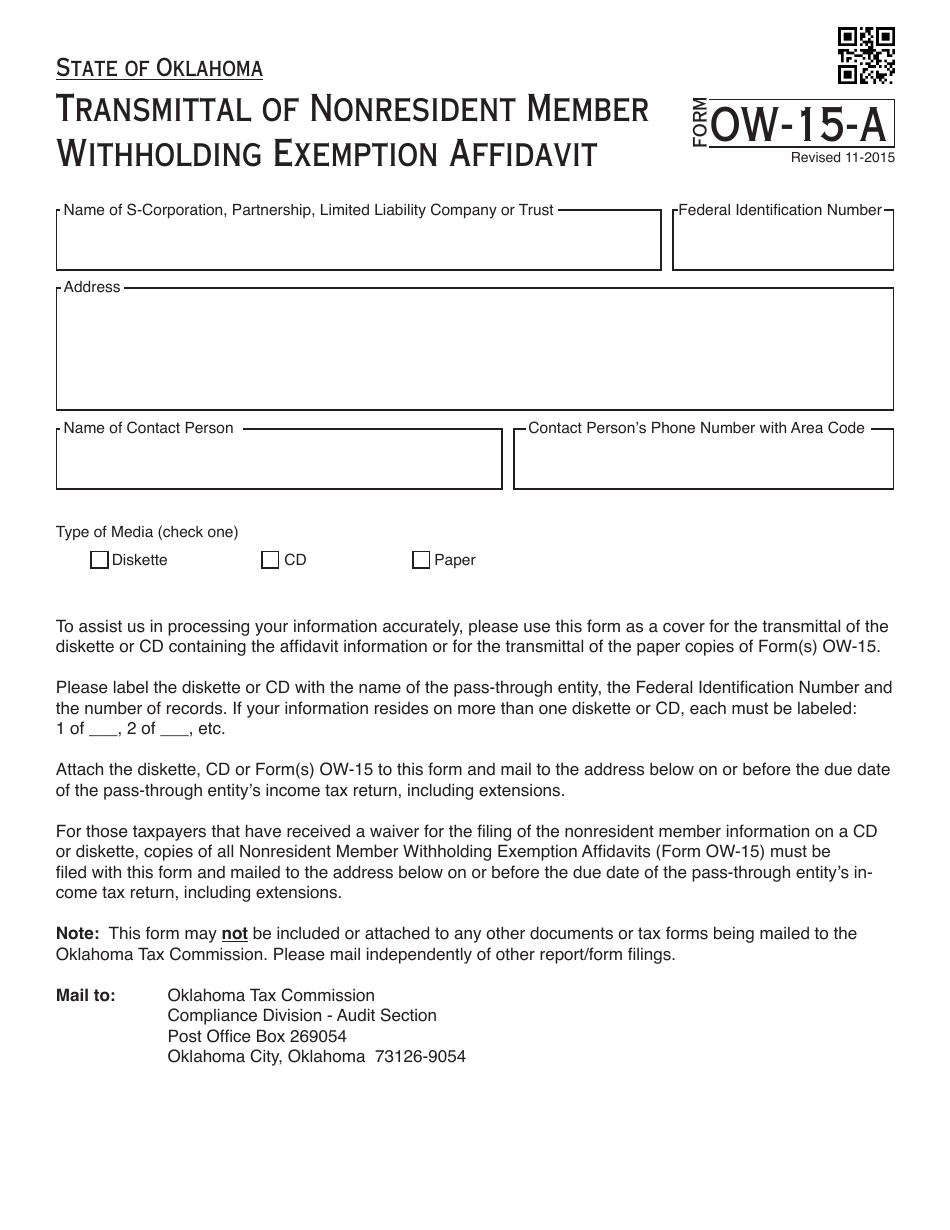

OTC Form OW-15-a Transmittal of Nonresident Member Withholding Exemption Affidavit - Oklahoma

What Is OTC Form OW-15-a?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-15-a?

A: OTC Form OW-15-a is a transmittal form used to submit the Nonresident Member Withholding Exemption Affidavit for Oklahoma.

Q: Who needs to use OTC Form OW-15-a?

A: Anyone who needs to submit the Nonresident Member Withholding Exemption Affidavit for Oklahoma.

Q: What is the purpose of OTC Form OW-15-a?

A: The purpose of OTC Form OW-15-a is to transmit the Nonresident Member Withholding Exemption Affidavit to the appropriate authorities in Oklahoma.

Q: What is the Nonresident Member Withholding Exemption Affidavit?

A: The Nonresident Member Withholding Exemption Affidavit is a form used to claim an exemption from withholding taxes for nonresident members of an entity.

Q: Are there any filing fees associated with OTC Form OW-15-a?

A: No, there are no filing fees associated with OTC Form OW-15-a.

Q: Is OTC Form OW-15-a specific to Oklahoma?

A: Yes, OTC Form OW-15-a is specific to Oklahoma and is used for state tax purposes.

Q: Are there any penalties for not filing OTC Form OW-15-a?

A: There may be penalties for failing to file OTC Form OW-15-a, depending on the specific circumstances. It is important to comply with all tax filing requirements.

Q: What information is required on OTC Form OW-15-a?

A: OTC Form OW-15-a requires information such as the entity's identification number, nonresident member details, and an affirmation of the exemption.

Q: Can OTC Form OW-15-a be used by individuals?

A: No, OTC Form OW-15-a is specifically for entities and is not used by individuals.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OW-15-a by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.