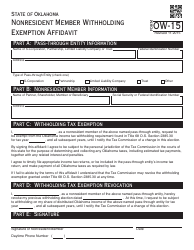

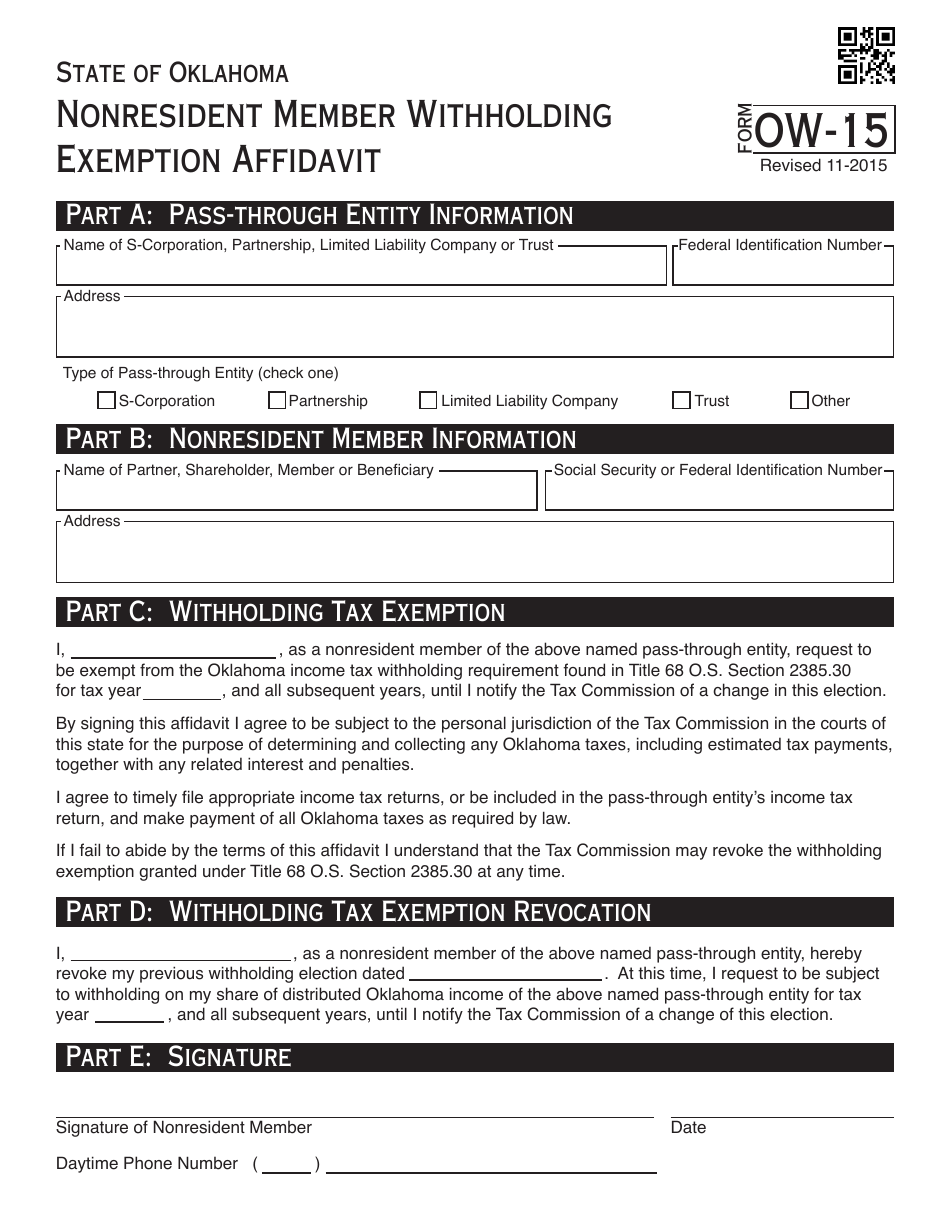

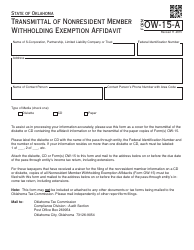

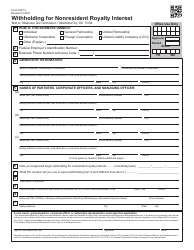

OTC Form OW-15 Nonresident Member Withholding Exemption Affidavit - Oklahoma

What Is OTC Form OW-15?

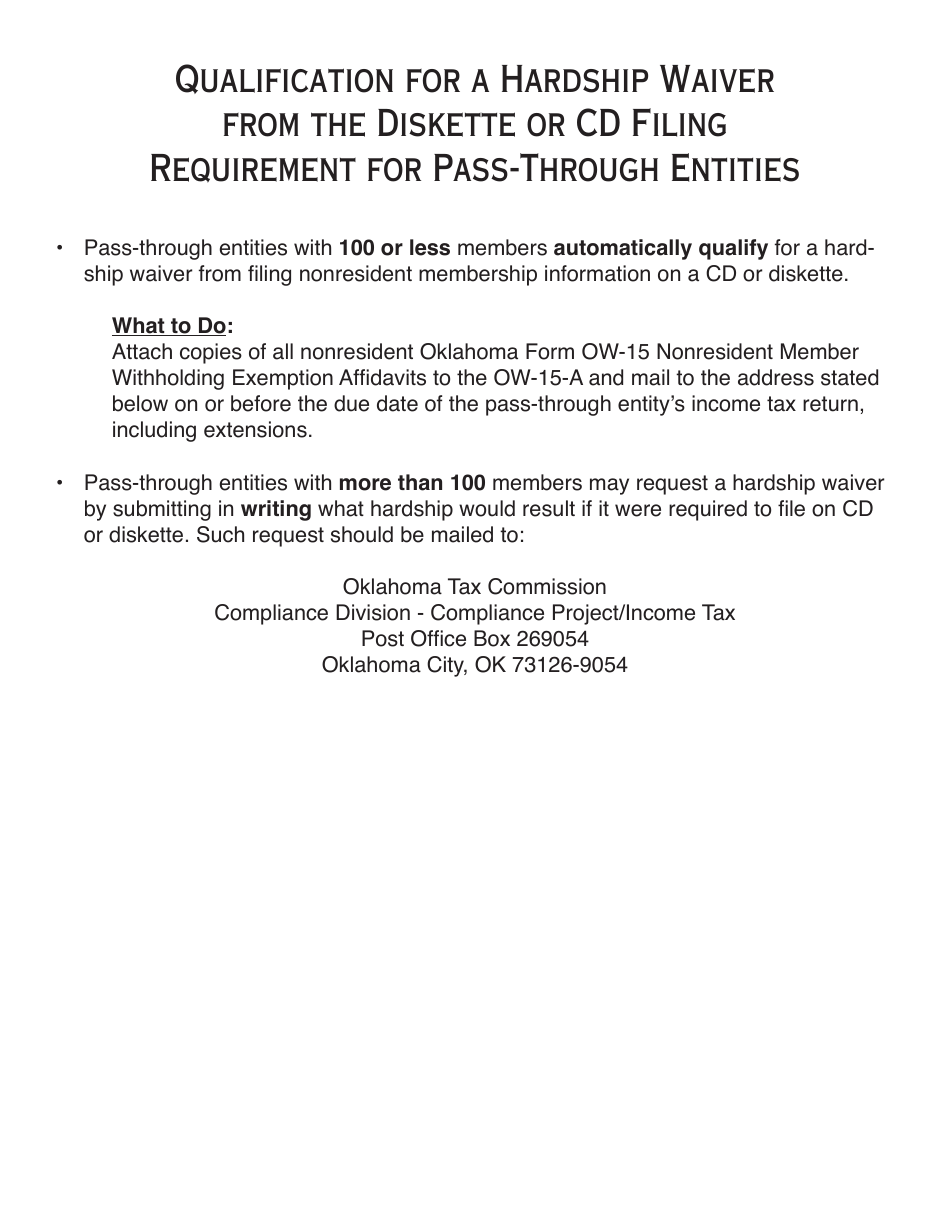

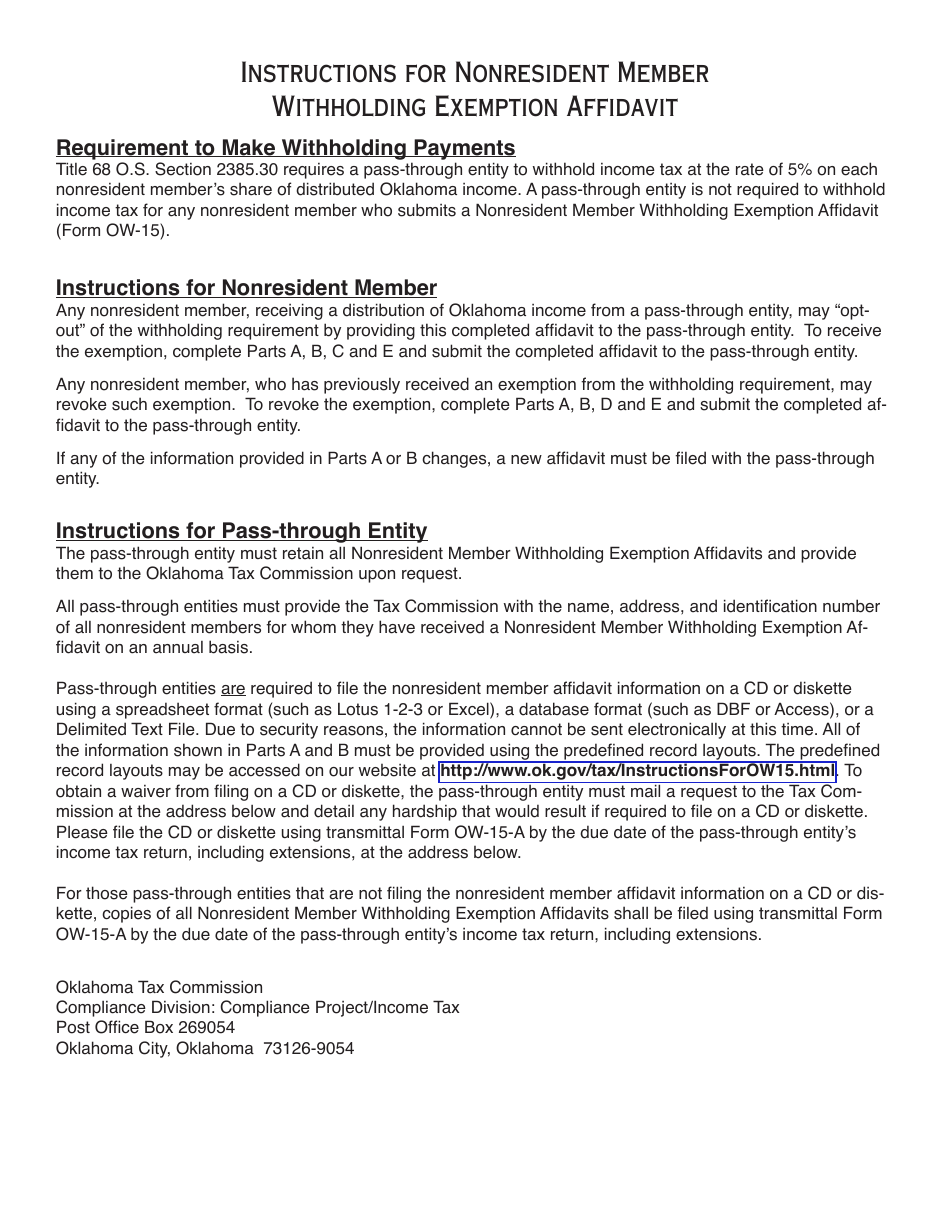

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-15?

A: OTC Form OW-15 is the Nonresident Member Withholding Exemption Affidavit for Oklahoma.

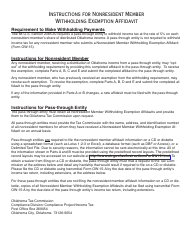

Q: Who needs to fill out OTC Form OW-15?

A: Nonresident members who want to claim an exemption from withholding on their Oklahoma income tax.

Q: What is the purpose of OTC Form OW-15?

A: The purpose of OTC Form OW-15 is to declare that the nonresident member qualifies for an exemption from withholding on their Oklahoma income tax.

Q: Is OTC Form OW-15 required for all nonresident members?

A: No, OTC Form OW-15 is only required if the nonresident member wants to claim an exemption from withholding on their Oklahoma income tax.

Q: When should I submit OTC Form OW-15?

A: You should submit OTC Form OW-15 before the first payment subject to withholding is made.

Q: Is there a fee to file OTC Form OW-15?

A: No, there is no fee to file OTC Form OW-15.

Q: How long does it take for OTC Form OW-15 to be processed?

A: The processing time for OTC Form OW-15 varies, but it typically takes a few weeks.

Q: What should I do if I made a mistake on OTC Form OW-15?

A: If you made a mistake on OTC Form OW-15, you should contact the Oklahoma Tax Commission to request a correction.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OW-15 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.