Instructions for Form CT-1120, CT-1120 ATT, CT-1120A, CT-1120K, CT-1120 EXT - Connecticut

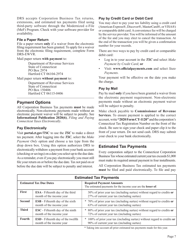

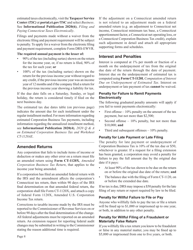

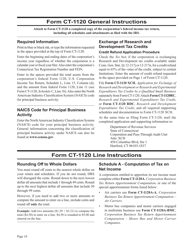

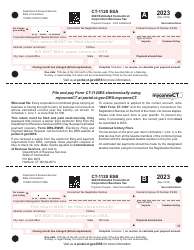

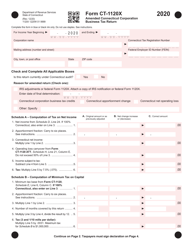

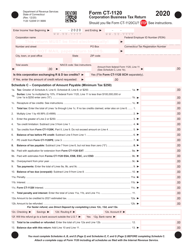

Form CT-1120 Corporation Business Tax Return - Connecticut

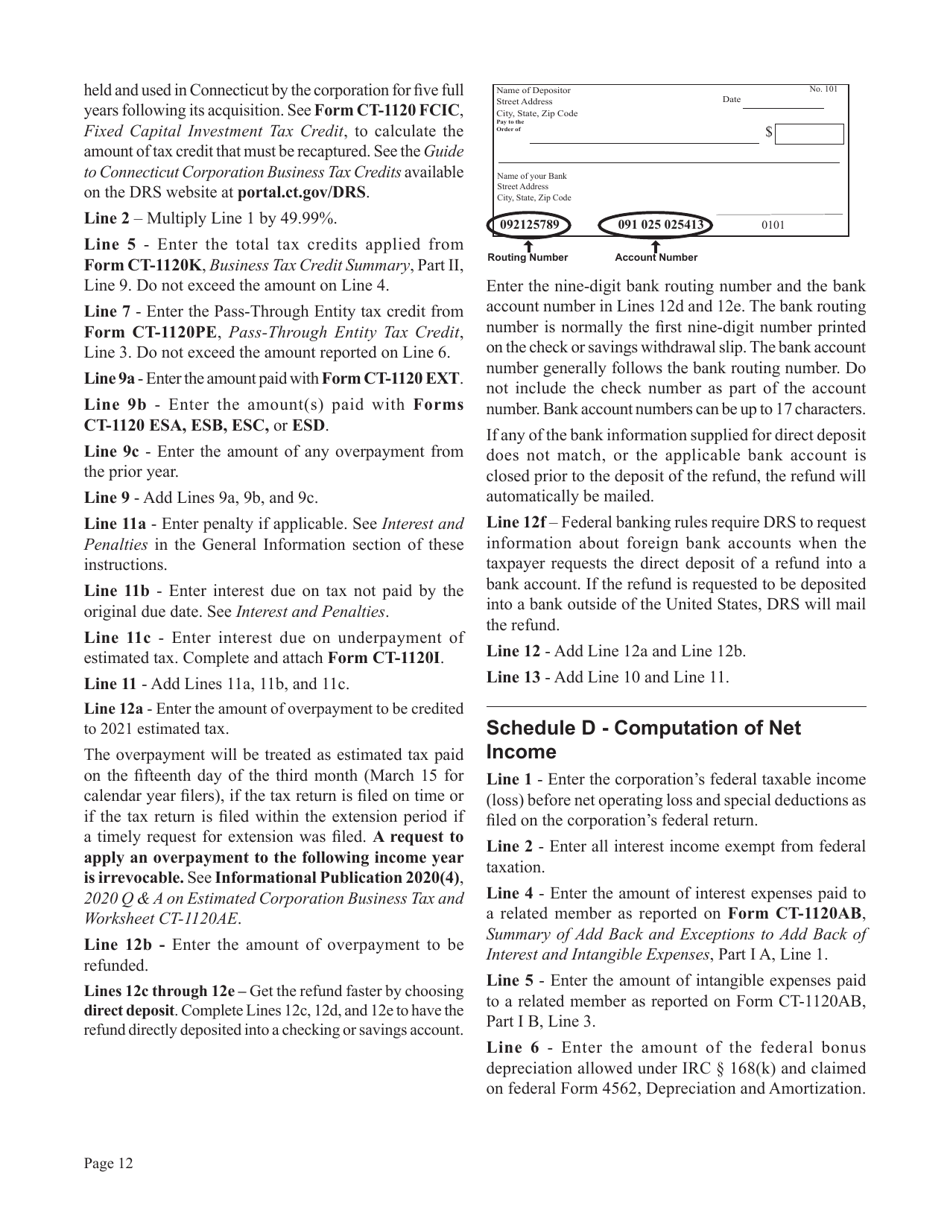

Form CT-1120 Corporation Business Tax Return - Connecticut

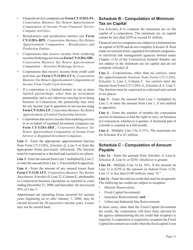

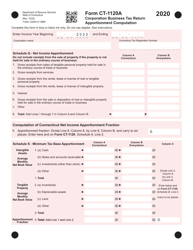

Form CT-1120A Corporation Business Tax Return Apportionment Computation - Connecticut

Form CT-1120A Corporation Business Tax Return Apportionment Computation - Connecticut

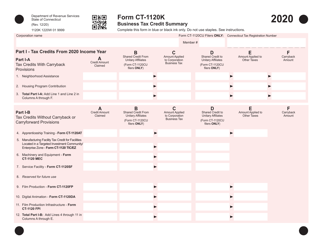

Form CT-1120K Business Tax Credit Summary - Connecticut

Form CT-1120K Business Tax Credit Summary - Connecticut

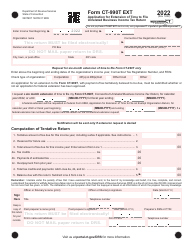

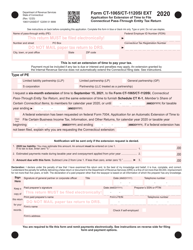

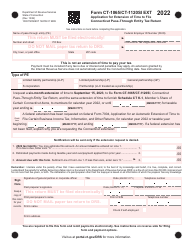

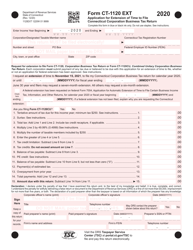

Form CT-1120 EXT Application for Extension of Time to File Connecticut Corporation Business Tax Return - Connecticut

Form CT-1120 EXT Application for Extension of Time to File Connecticut Corporation Business Tax Return - Connecticut

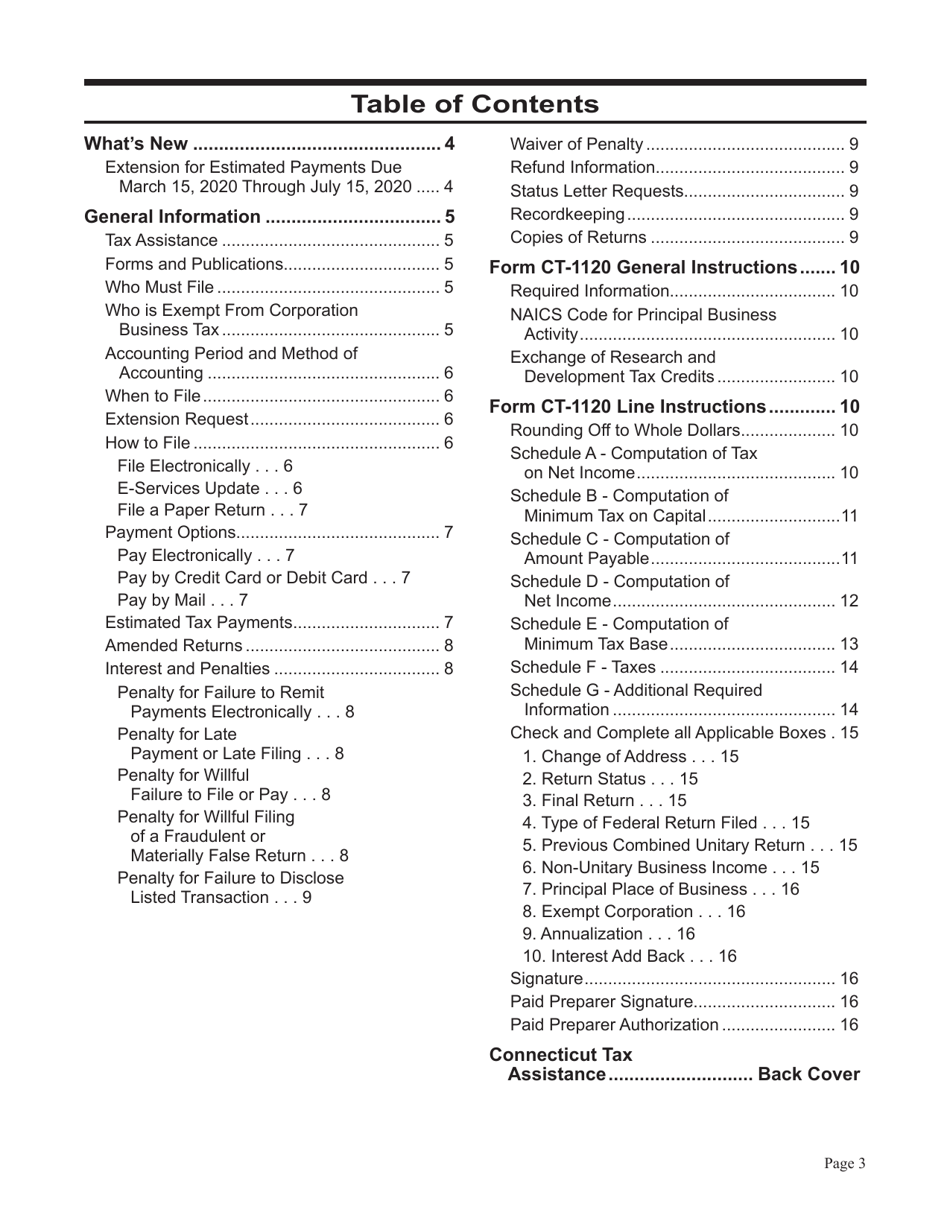

This document contains official instructions for Form CT-1120 , Form CT-1120 ATT , Form CT-1120A , Form CT-1120K , and Form CT-1120 EXT . All forms are released and collected by the Connecticut Department of Revenue Services. An up-to-date fillable Form CT-1120 is available for download through this link. The latest available Form CT-1120A can be downloaded through this link. Form CT-1120K can be found here. The newest Form CT-1120 EXT can be downloaded here.

FAQ

Q: What are these forms for?

A: These forms are used for filing taxes in the state of Connecticut.

Q: What is Form CT-1120?

A: Form CT-1120 is the Connecticut Corporation Business Tax Return.

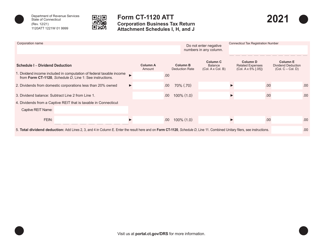

Q: What is Form CT-1120 ATT?

A: Form CT-1120 ATT is the Attachment to CT-1120, used for providing additional information.

Q: What is Form CT-1120A?

A: Form CT-1120A is the Annual Report of Income and Expense.

Q: What is Form CT-1120K?

A: Form CT-1120K is the Connecticut Composite Income Tax Return.

Q: What is Form CT-1120 EXT?

A: Form CT-1120 EXT is the Application for Extension of Time to File Connecticut Corporation Tax Return.

Q: Are these forms specific to Connecticut?

A: Yes, these forms are specifically for filing taxes in the state of Connecticut.

Q: Do I need to fill out all of these forms?

A: No, you only need to fill out the forms that are relevant to your tax situation.

Q: When are these forms due?

A: The due dates for these forms vary, so it is important to check the instructions or consult with a tax professional.

Instruction Details:

- This 18-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Connecticut Department of Revenue Services.