This version of the form is not currently in use and is provided for reference only. Download this version of

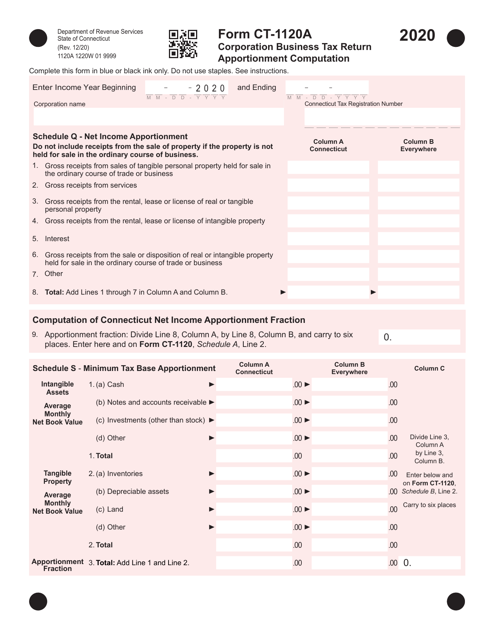

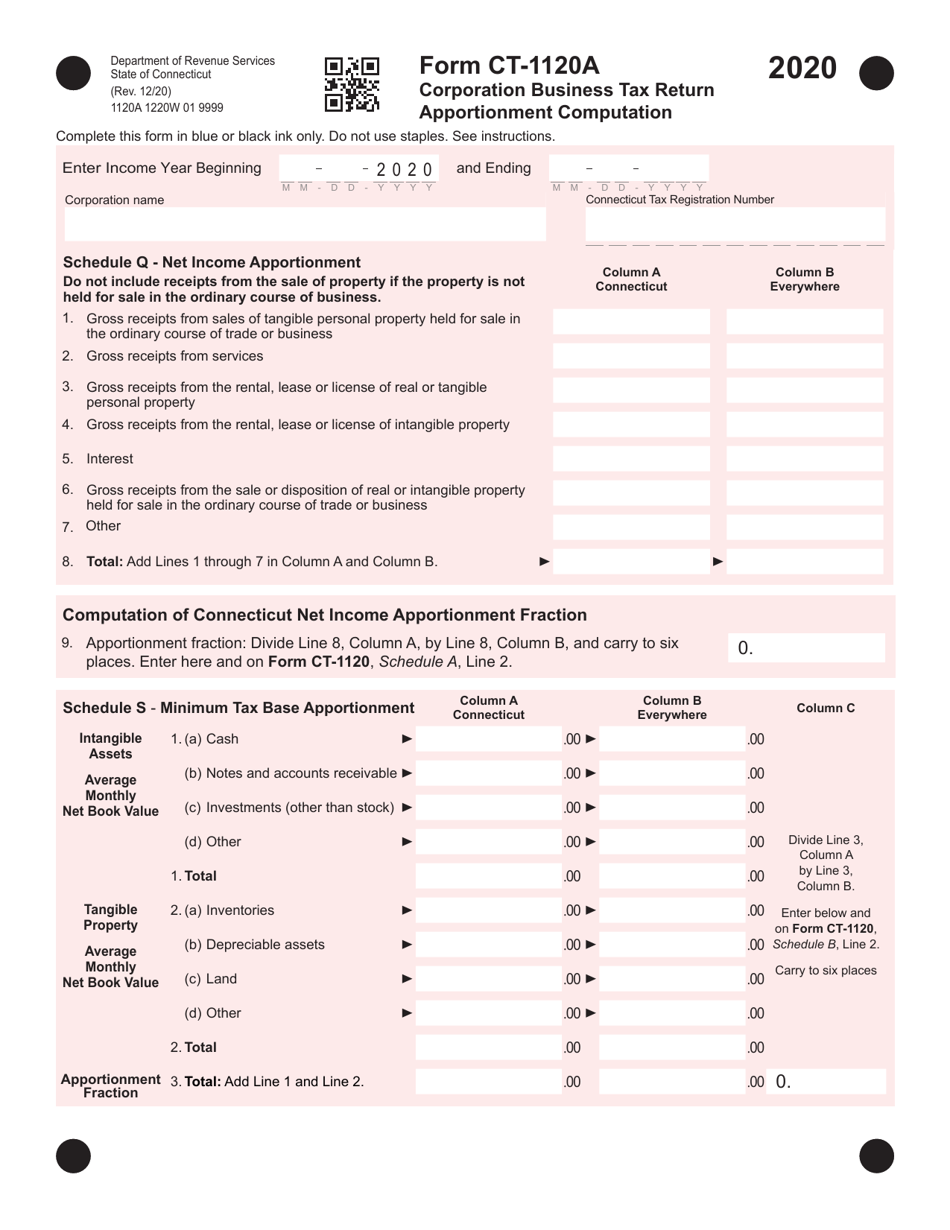

Form CT-1120A

for the current year.

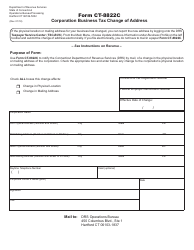

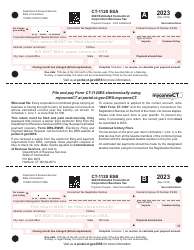

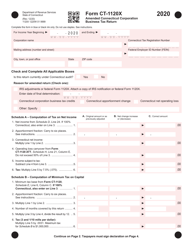

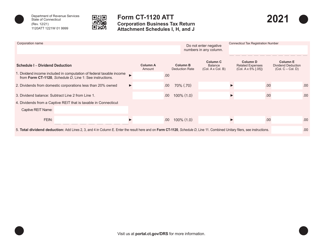

Form CT-1120A Corporation Business Tax Return Apportionment Computation - Connecticut

What Is Form CT-1120A?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120A?

A: Form CT-1120A is a Connecticut Corporation Business Tax Return Apportionment Computation form.

Q: Who needs to file Form CT-1120A?

A: Corporations doing business in Connecticut and subject to the Corporation Business Tax need to file Form CT-1120A.

Q: What is the purpose of Form CT-1120A?

A: The purpose of Form CT-1120A is to calculate the apportionment factors for determining the corporation's tax liability in Connecticut.

Q: What information is required on Form CT-1120A?

A: Form CT-1120A requires information about the corporation's sales, property, and payroll in Connecticut, as well as in other states.

Q: Is there a deadline for filing Form CT-1120A?

A: Yes, Form CT-1120A is due on or before the 15th day of the fourth month following the close of the corporation's taxable year.

Q: Are there any penalties for not filing Form CT-1120A?

A: Yes, failure to file Form CT-1120A by the due date may result in penalties and interest charges.

Q: Can Form CT-1120A be electronically filed?

A: Yes, Form CT-1120A can be electronically filed using the Connecticut Taxpayer Service Center.

Q: Is there a fee for filing Form CT-1120A?

A: No, there is no fee for filing Form CT-1120A.

Q: Can I amend my Form CT-1120A if I made a mistake?

A: Yes, you can file an amended Form CT-1120A to correct any errors or omissions.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120A by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.