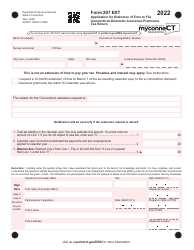

This version of the form is not currently in use and is provided for reference only. Download this version of

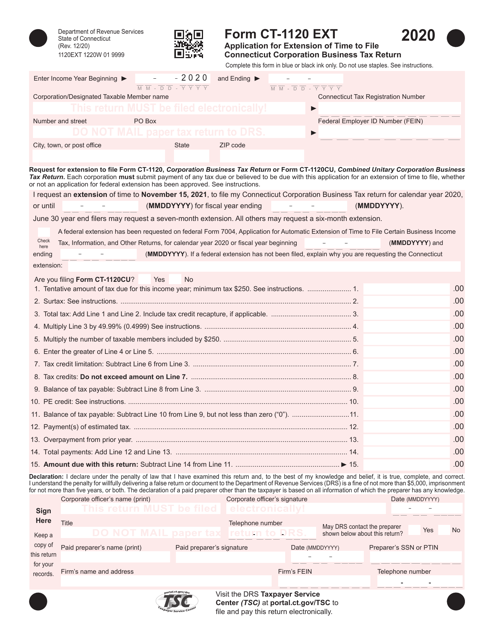

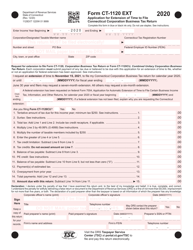

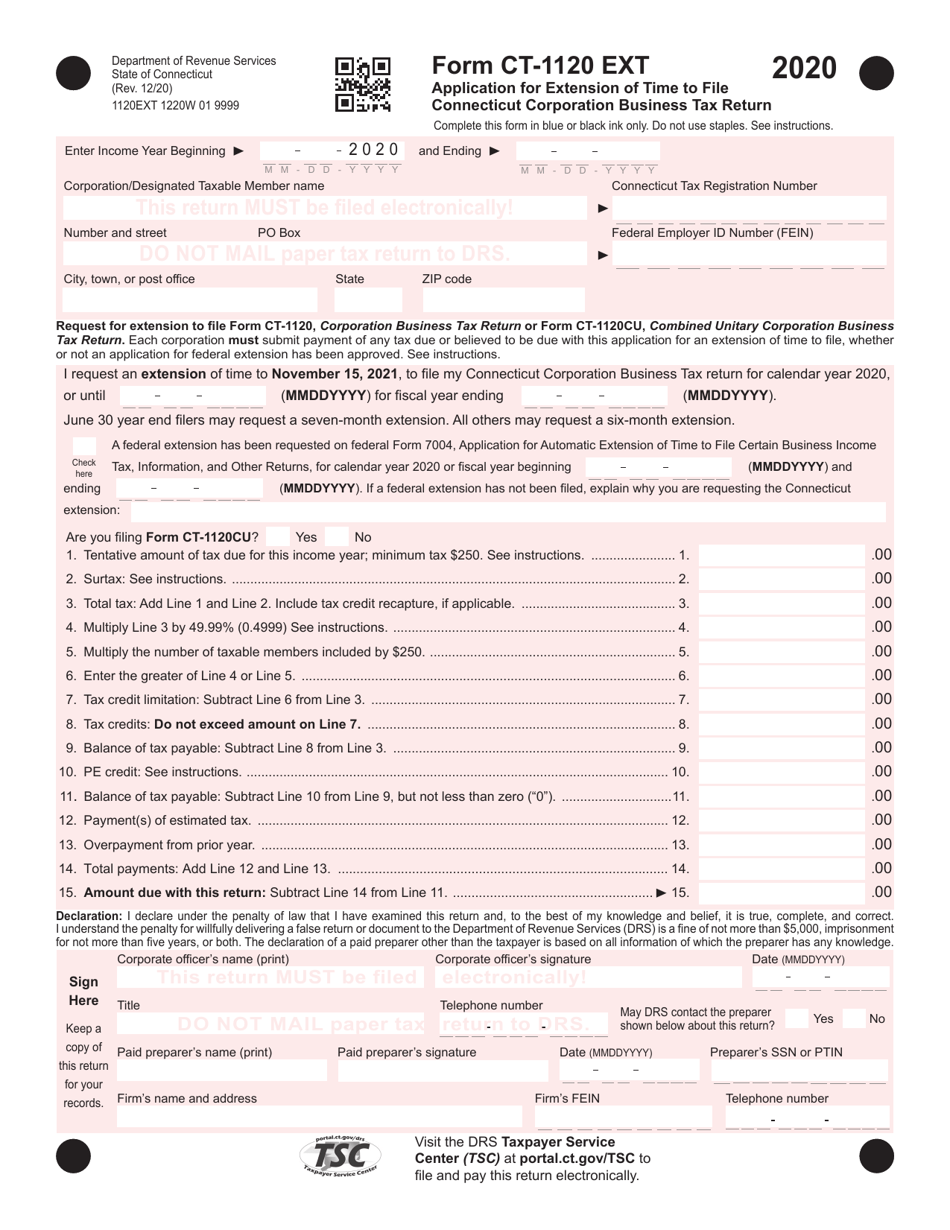

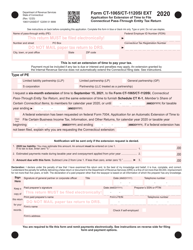

Form CT-1120 EXT

for the current year.

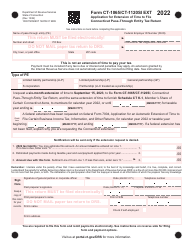

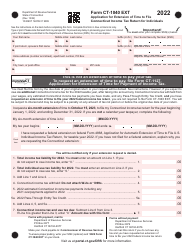

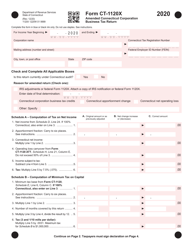

Form CT-1120 EXT Application for Extension of Time to File Connecticut Corporation Business Tax Return - Connecticut

What Is Form CT-1120 EXT?

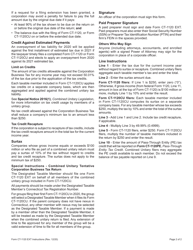

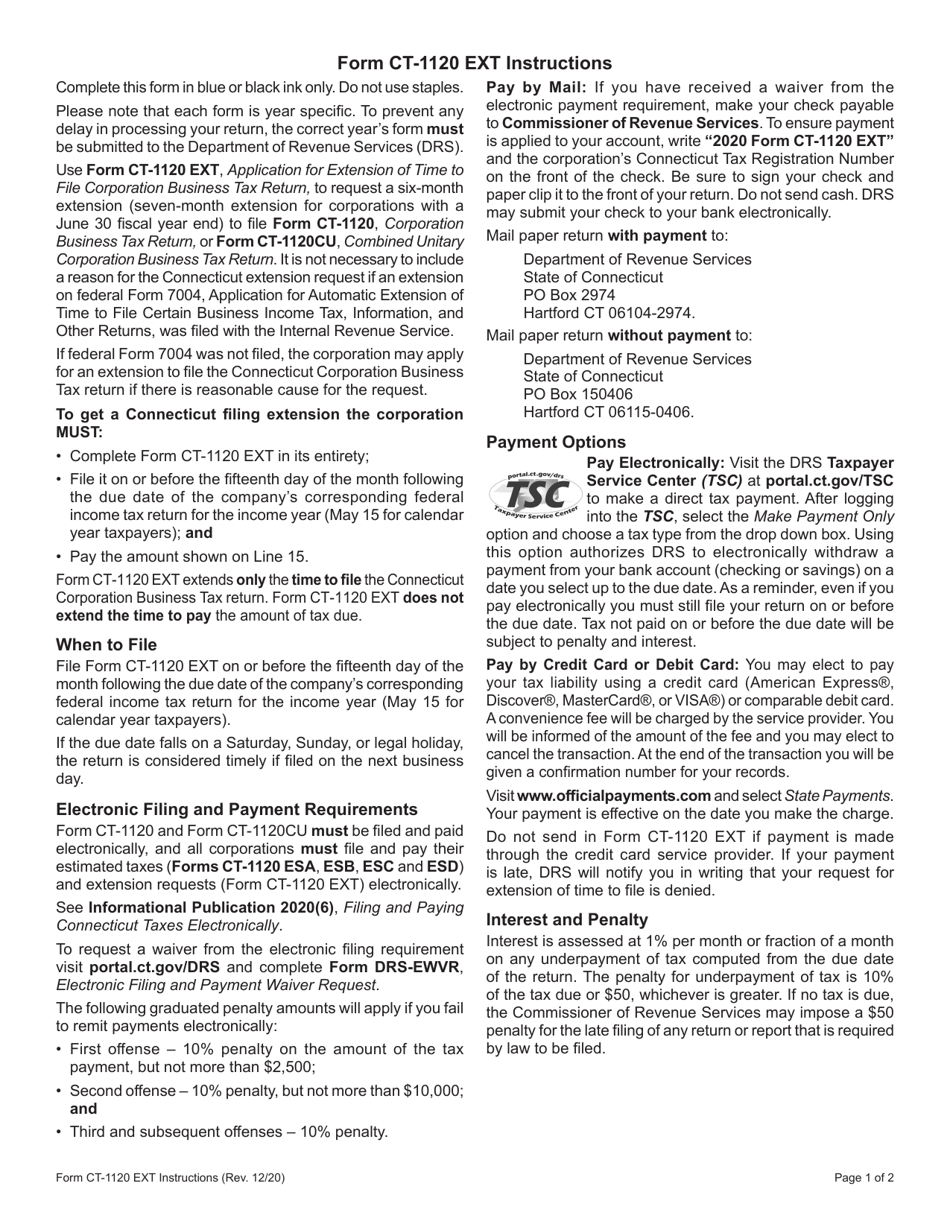

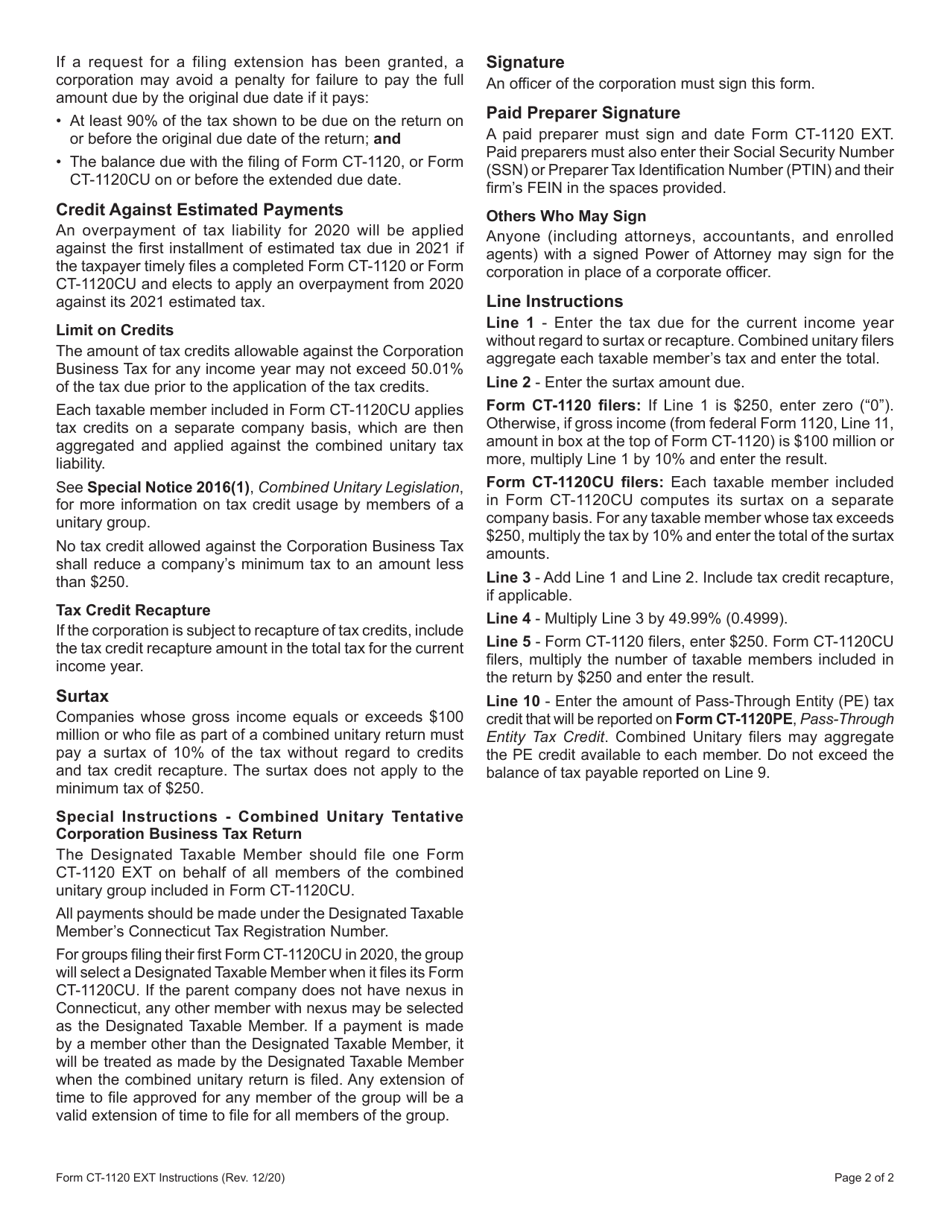

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120 EXT?

A: Form CT-1120 EXT is an application for extension of time to file Connecticut Corporation Business Tax Return.

Q: Who needs to file Form CT-1120 EXT?

A: Any corporation that needs more time to file their Connecticut Corporation Business Tax Return.

Q: What is the purpose of Form CT-1120 EXT?

A: The purpose of Form CT-1120 EXT is to request an extension of time to file the Connecticut Corporation Business Tax Return.

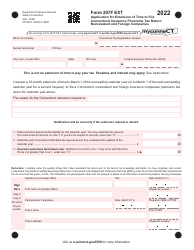

Q: How do I fill out Form CT-1120 EXT?

A: You must provide the required information on the form, including your corporation's name, address, tax year, and estimated tax liability.

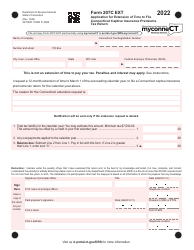

Q: When is Form CT-1120 EXT due?

A: Form CT-1120 EXT is due on or before the original due date of the Connecticut Corporation Business Tax Return.

Q: Are there any penalties for filing Form CT-1120 EXT?

A: If you file Form CT-1120 EXT and pay the estimated tax liability on or before the original due date, there are no penalties for late filing.

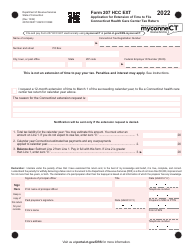

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 EXT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.