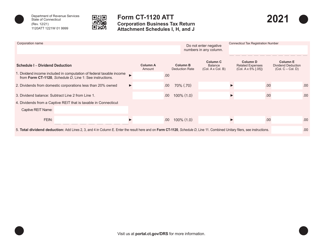

This version of the form is not currently in use and is provided for reference only. Download this version of

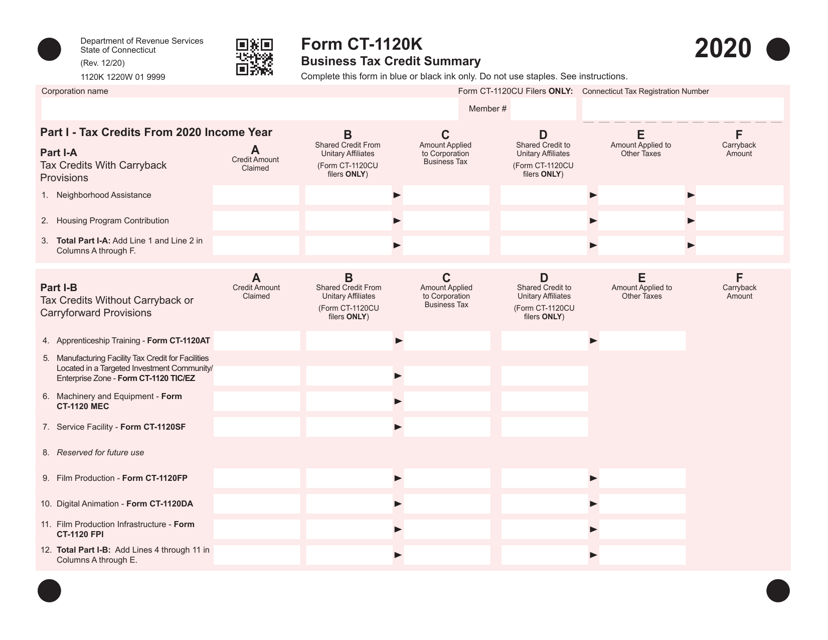

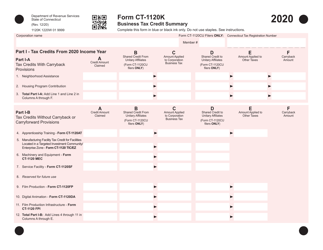

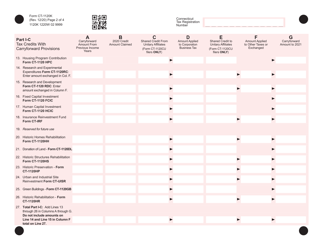

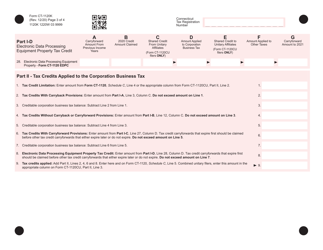

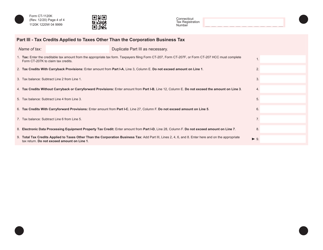

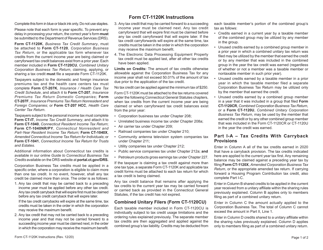

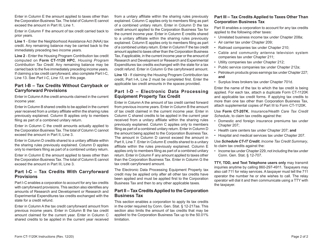

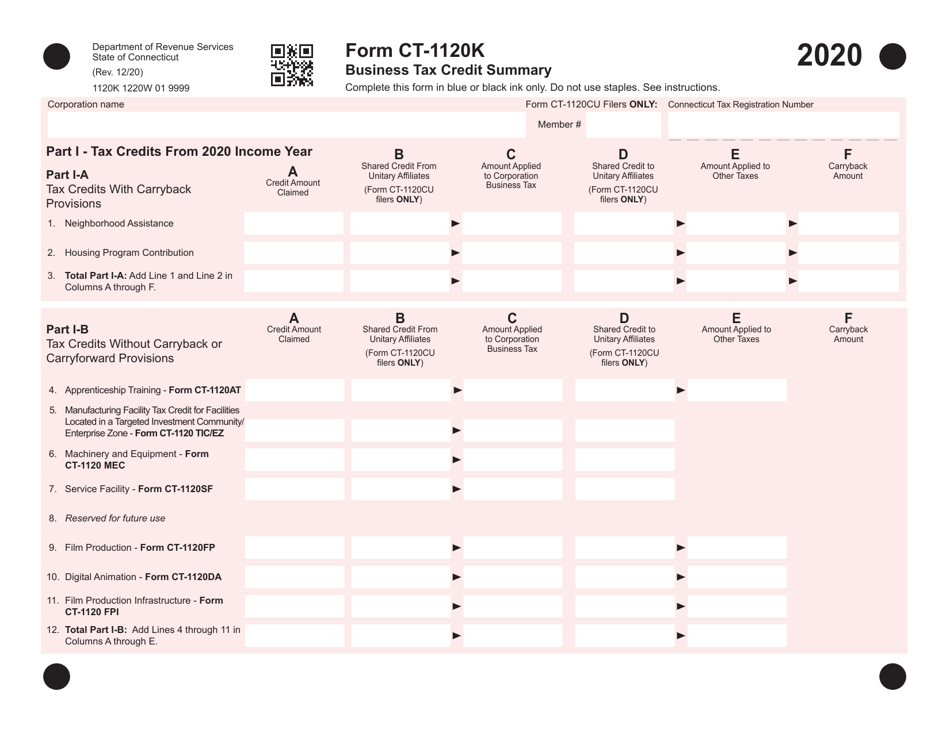

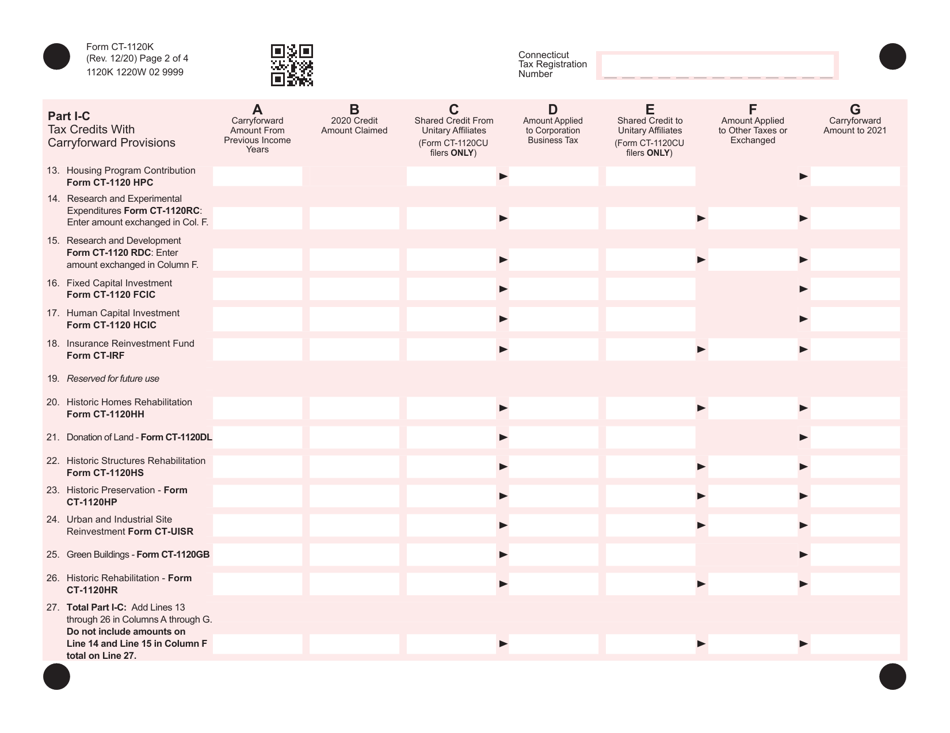

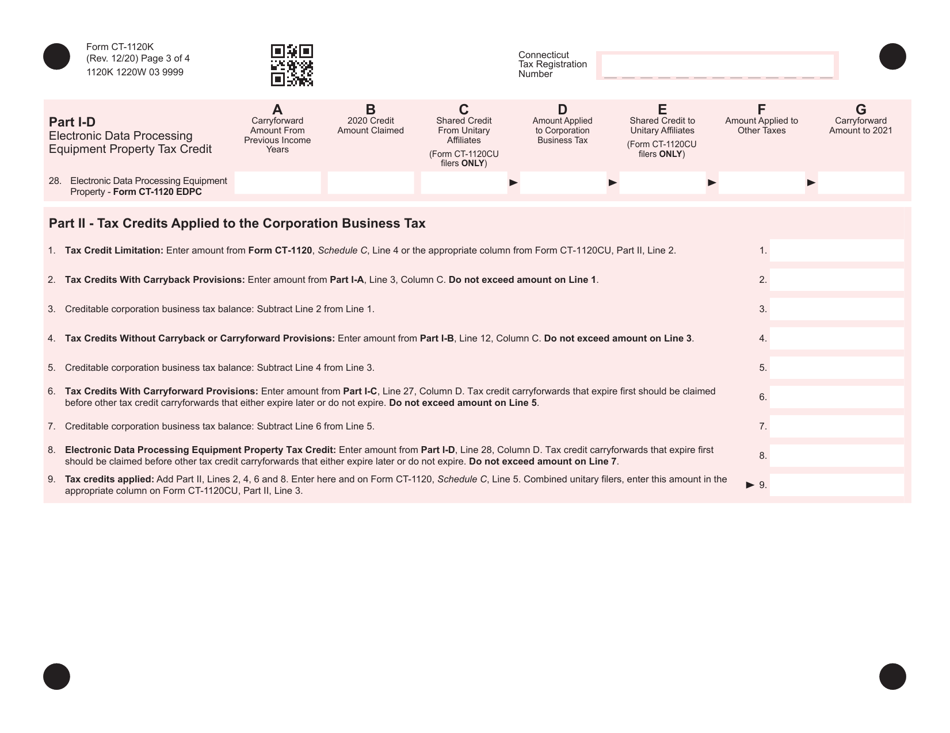

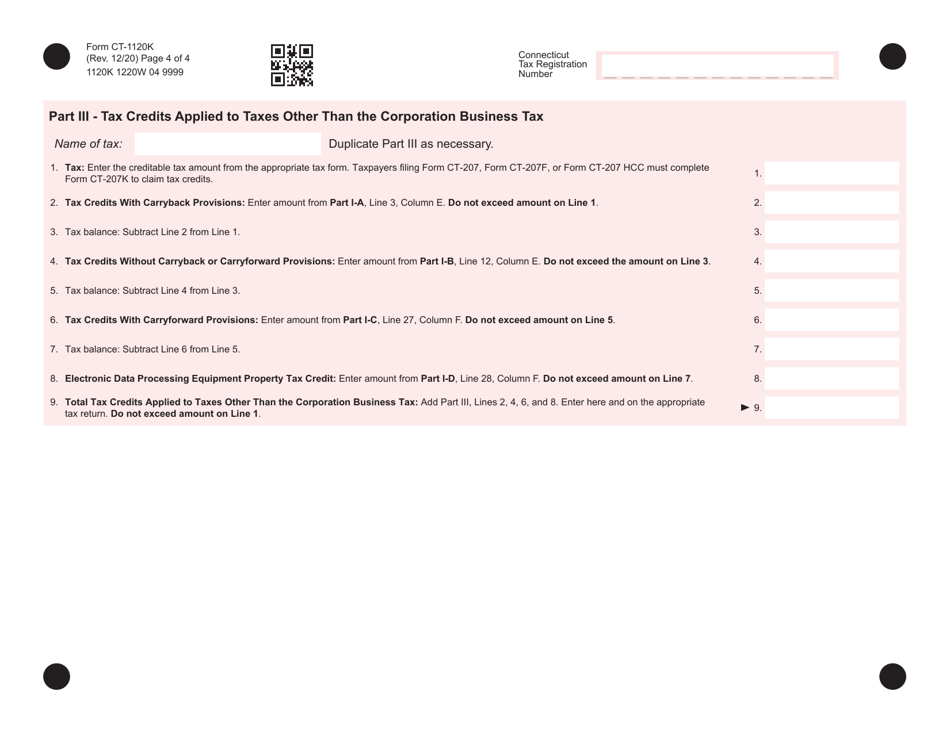

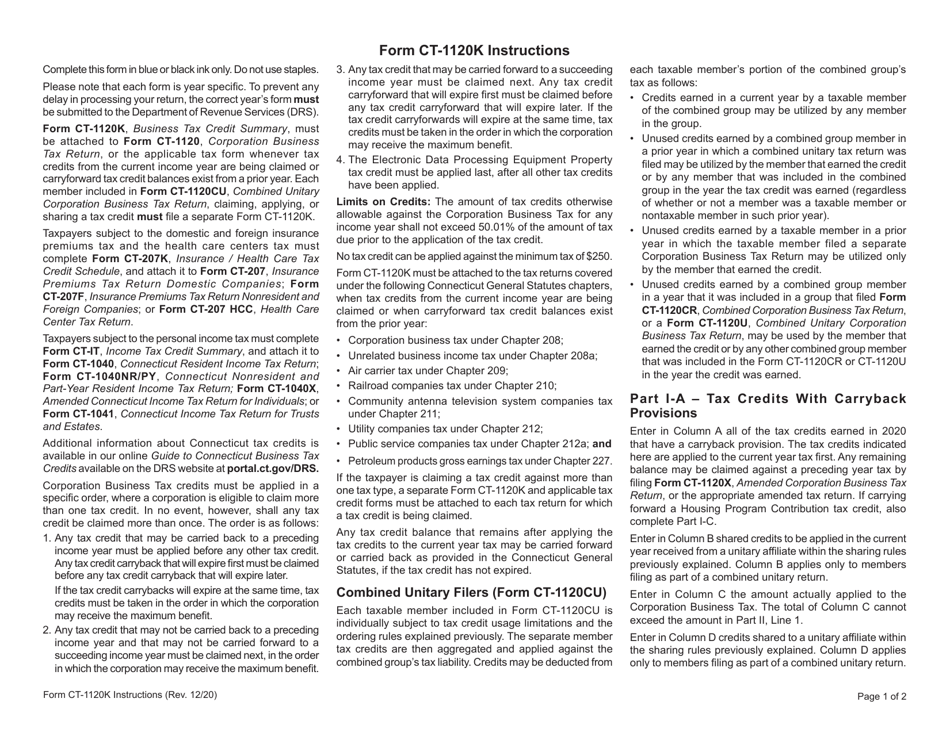

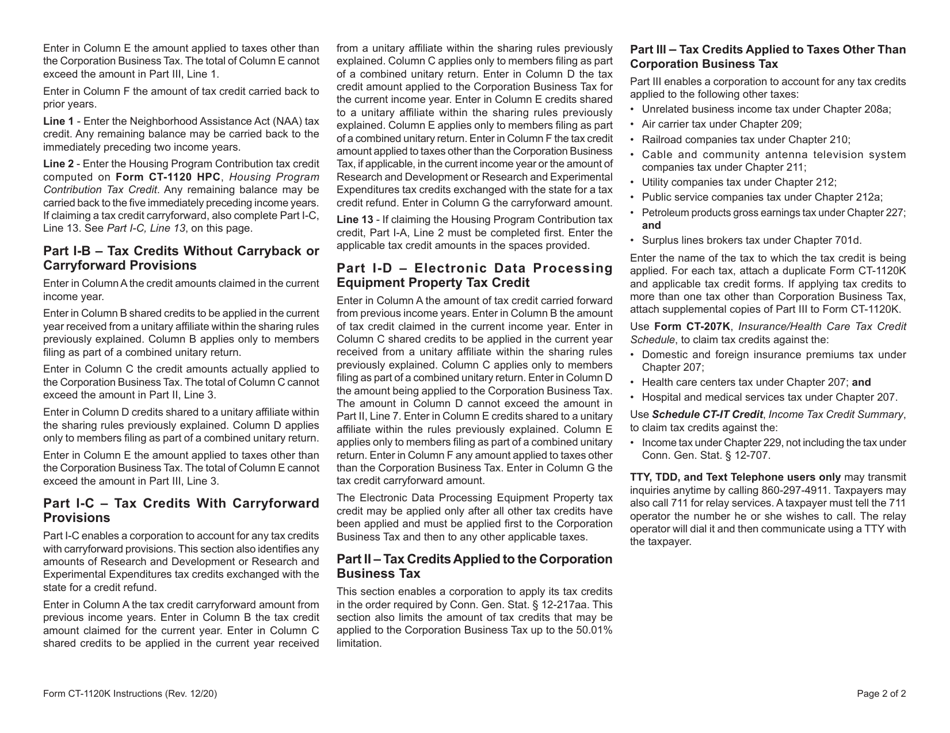

Form CT-1120K

for the current year.

Form CT-1120K Business Tax Credit Summary - Connecticut

What Is Form CT-1120K?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120K?

A: Form CT-1120K is the Business Tax Credit Summary for businesses in Connecticut.

Q: Who needs to file Form CT-1120K?

A: Businesses in Connecticut that want to claim tax credits.

Q: What is the purpose of Form CT-1120K?

A: The purpose of Form CT-1120K is to summarize and report the tax credits claimed by a business.

Q: When is Form CT-1120K due?

A: Form CT-1120K is generally due on or before the same due date as the business tax return for the corresponding tax year.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120K by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.