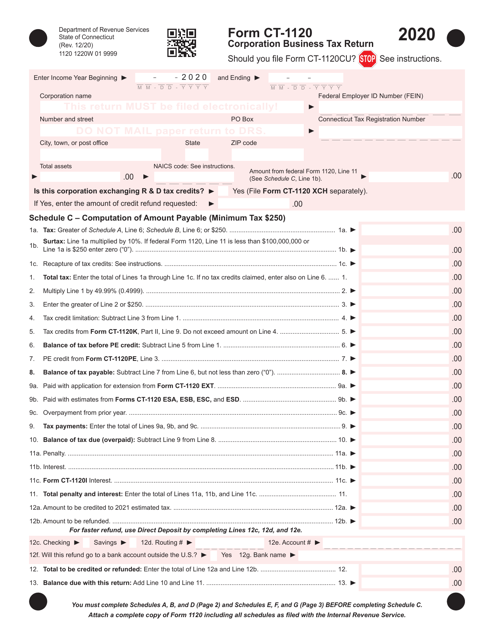

This version of the form is not currently in use and is provided for reference only. Download this version of

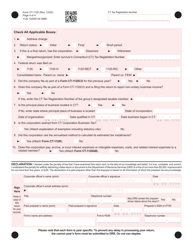

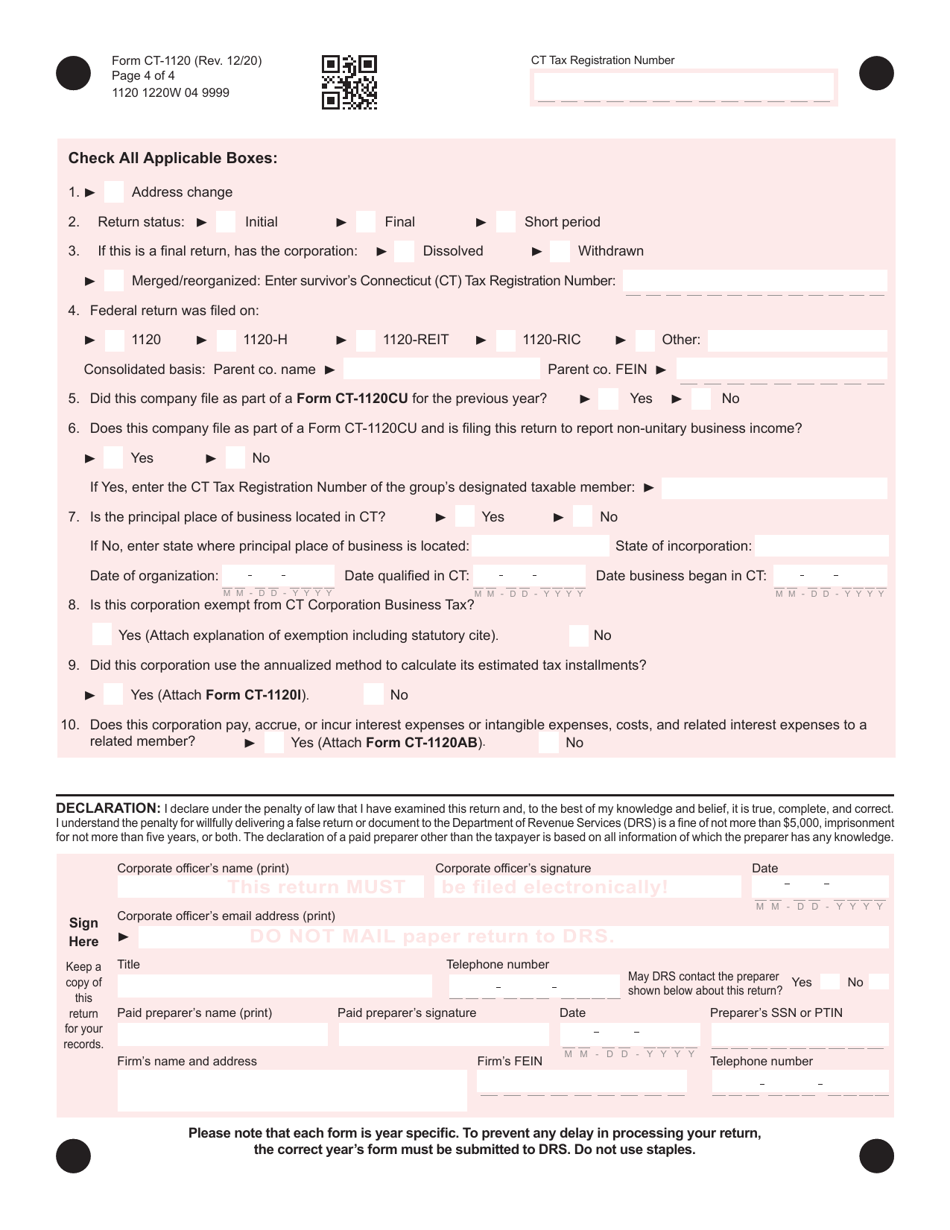

Form CT-1120

for the current year.

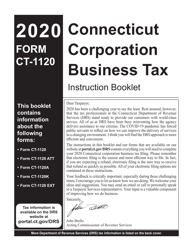

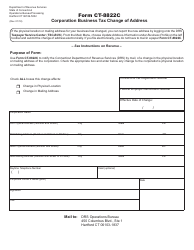

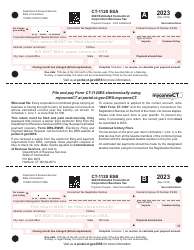

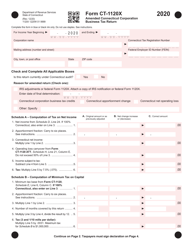

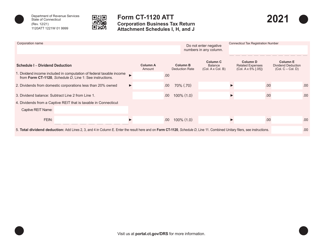

Form CT-1120 Corporation Business Tax Return - Connecticut

What Is Form CT-1120?

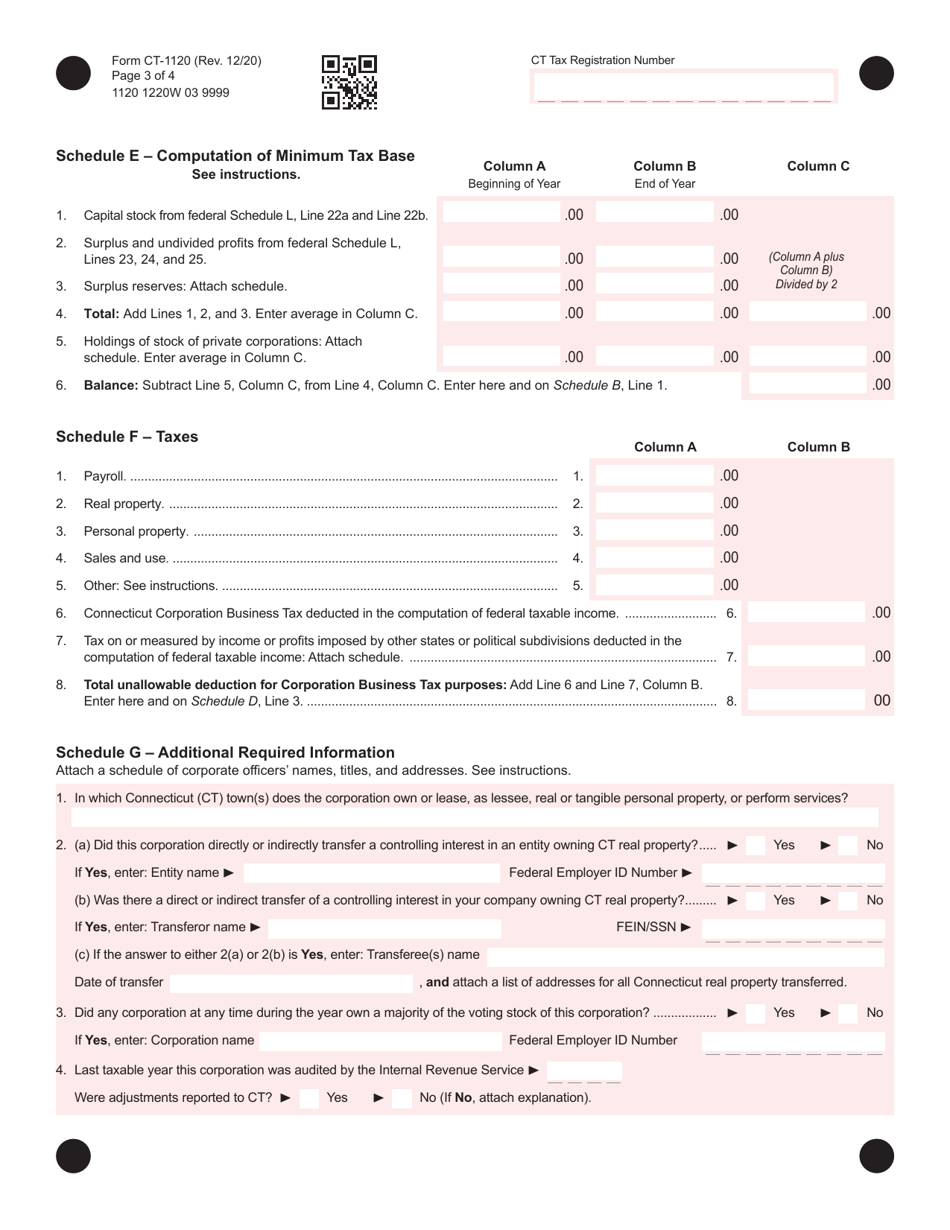

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120?

A: Form CT-1120 is the Corporation Business Tax Return for the state of Connecticut.

Q: Who needs to file Form CT-1120?

A: All corporations doing business in Connecticut, including non-profit organizations, must file Form CT-1120.

Q: When is the deadline to file Form CT-1120?

A: The deadline to file Form CT-1120 is the 15th day of the fourth month following the close of the tax year.

Q: Are there any extensions available for filing Form CT-1120?

A: Yes, corporations can request a six-month extension to file Form CT-1120.

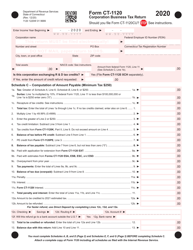

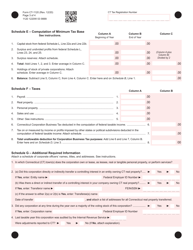

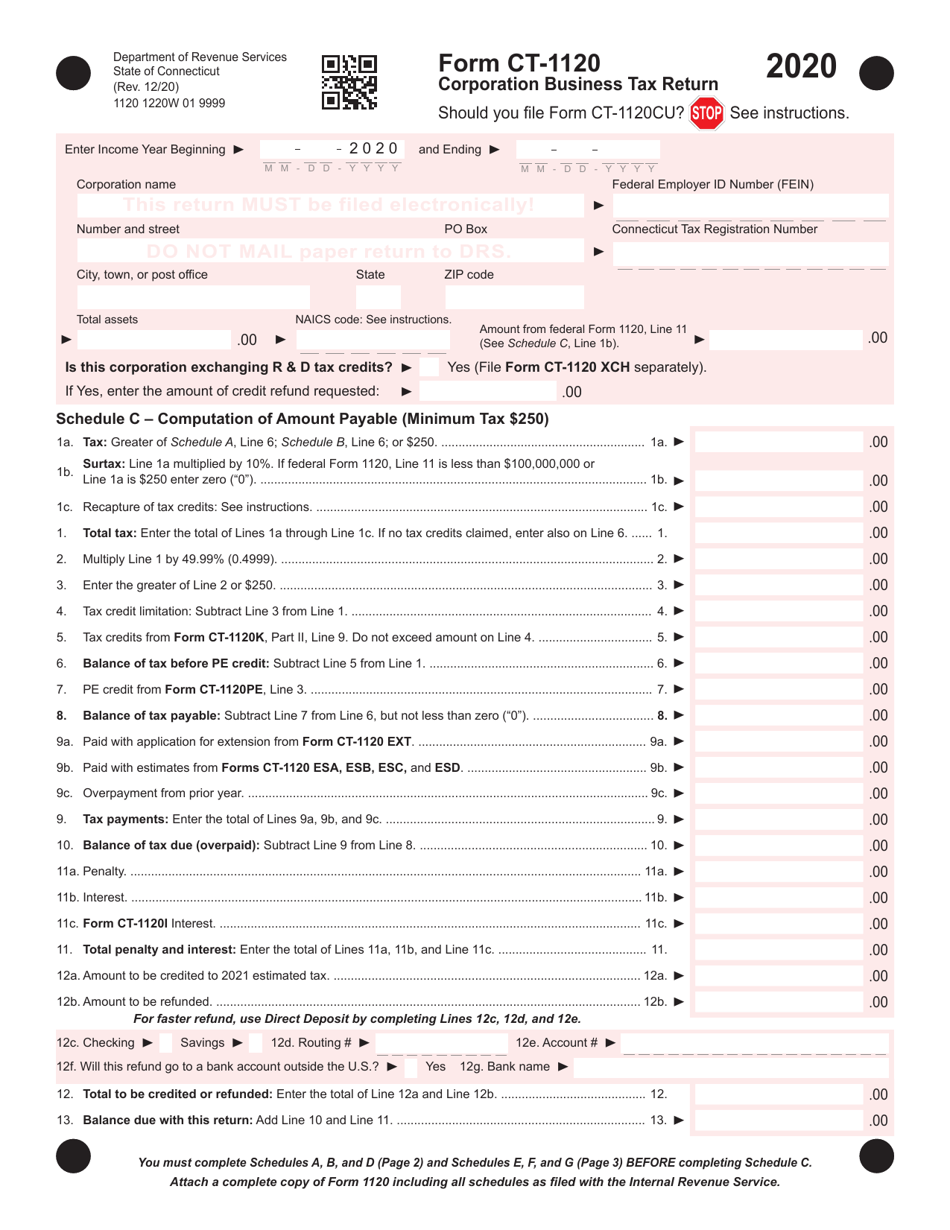

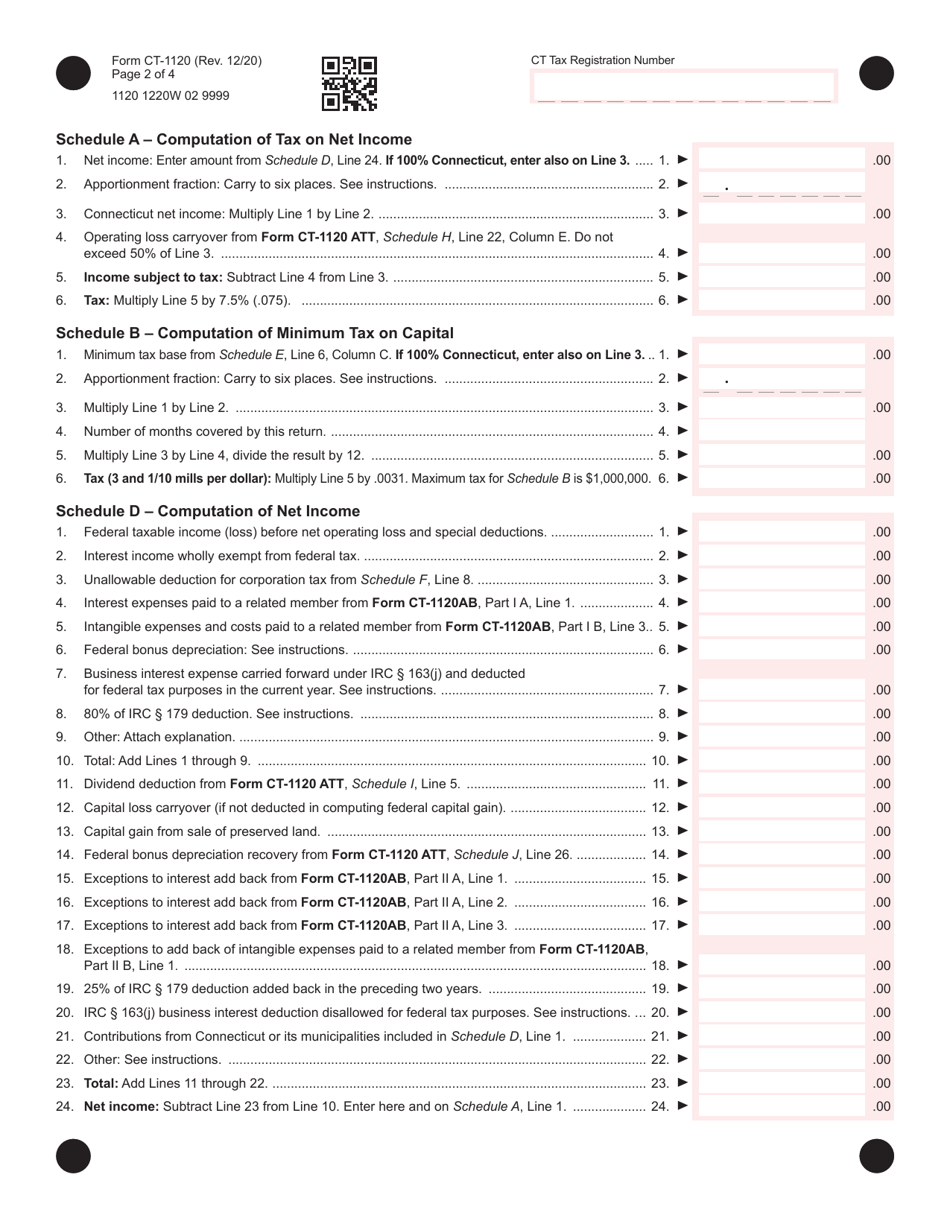

Q: What information is required to complete Form CT-1120?

A: Some of the information required to complete Form CT-1120 includes the corporation's income, expenses, credits, and tax liability.

Q: Are there any penalties for not filing Form CT-1120?

A: Yes, there are penalties for not filing Form CT-1120, including late filing penalties and interest on any unpaid tax amounts.

Q: Can I e-file Form CT-1120?

A: Yes, Connecticut allows corporations to e-file Form CT-1120.

Q: How can I pay the tax due with Form CT-1120?

A: You can pay the tax due with Form CT-1120 by electronic funds transfer, credit card, or by mailing a check or money order.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.