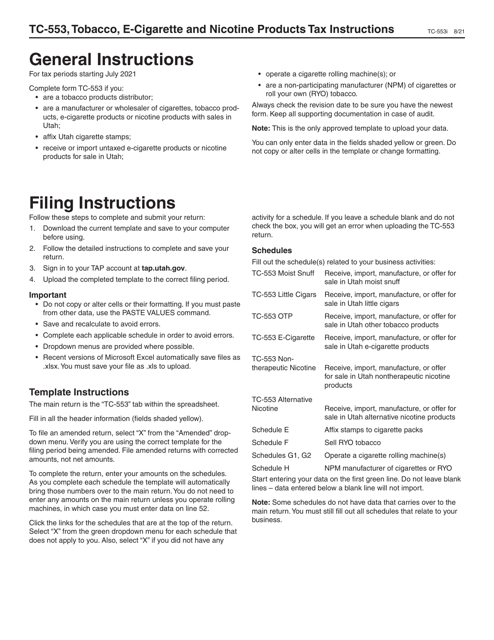

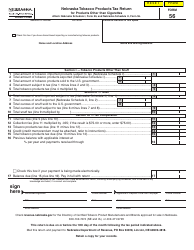

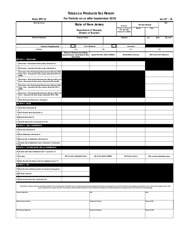

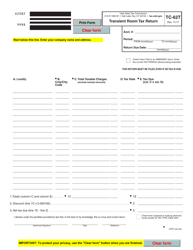

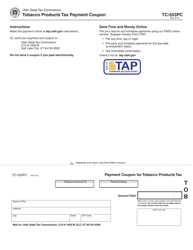

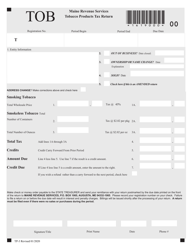

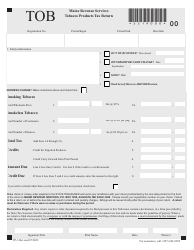

Instructions for Form TC-553 Tobacco Products Tax Return - Utah

This document contains official instructions for Form TC-553 , Tobacco Products Tax Return - a form released and collected by the Utah State Tax Commission.

FAQ

Q: What is Form TC-553?

A: Form TC-553 is the Tobacco Products Tax Return.

Q: Who needs to file Form TC-553?

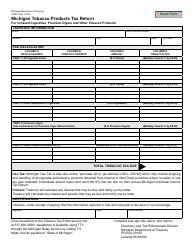

A: Anyone engaged in the business of selling or distributing tobacco products in Utah needs to file Form TC-553.

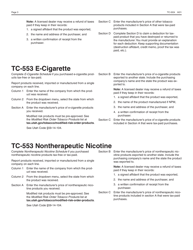

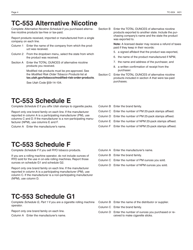

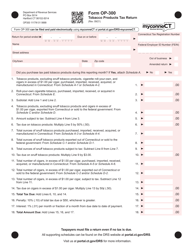

Q: What information is required on Form TC-553?

A: Form TC-553 requires information such as total sales of tobacco products, wholesale purchases, and tax due.

Q: When is Form TC-553 due?

A: Form TC-553 is due on the 20th day of each month for the previous month's sales.

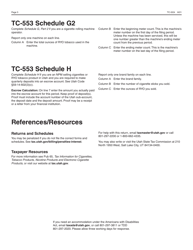

Q: Are there any penalties for late filing or payment of Form TC-553?

A: Yes, there are penalties for late filing or payment of Form TC-553. The penalty is based on the amount of tax due.

Q: Is there any exemption from tobacco products tax in Utah?

A: No, there is no exemption from the tobacco products tax in Utah.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Utah State Tax Commission.