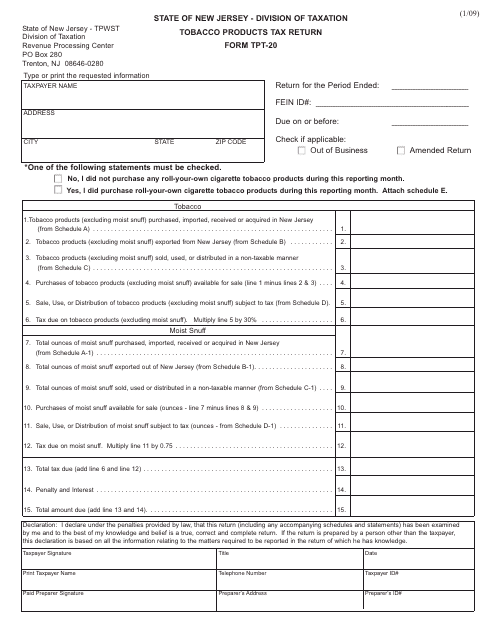

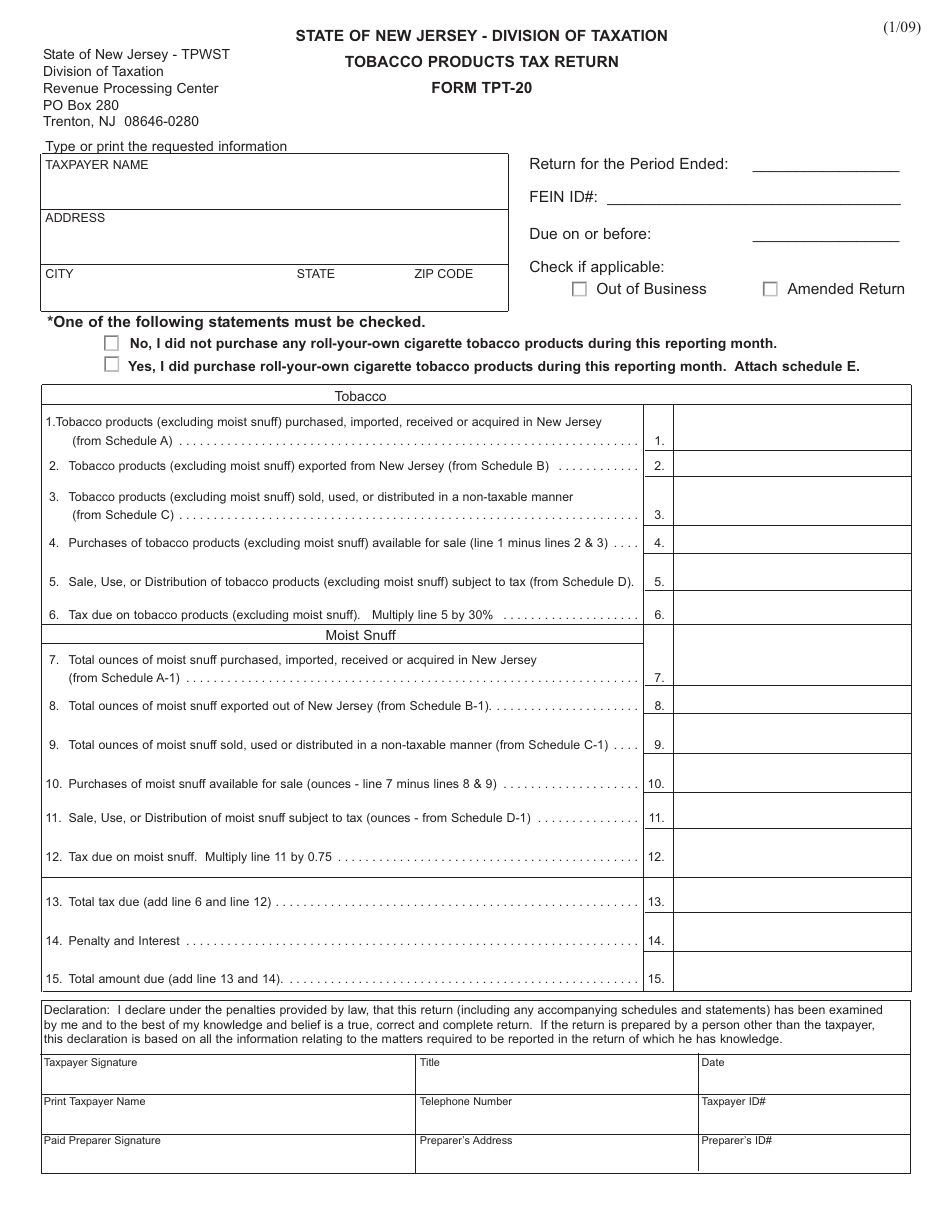

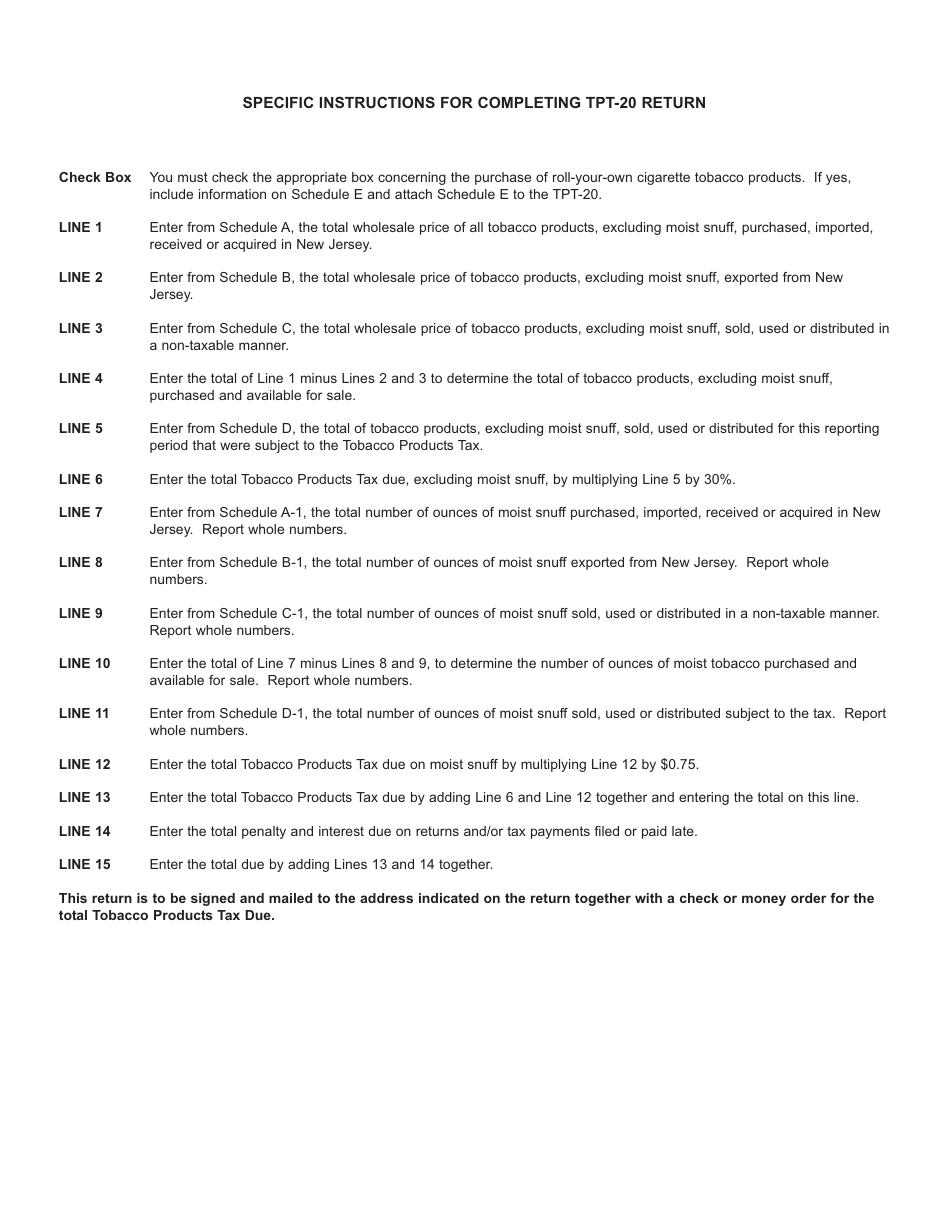

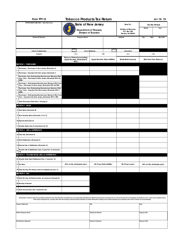

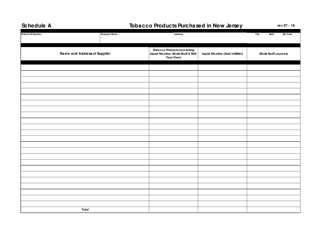

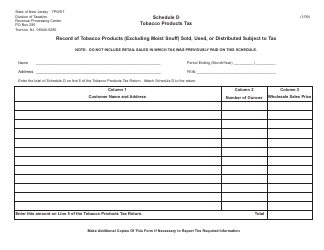

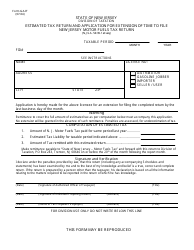

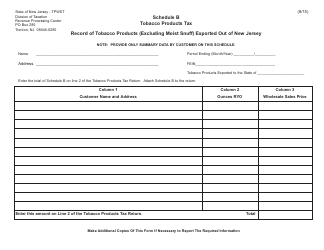

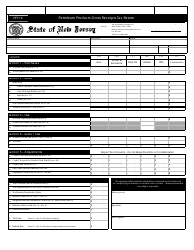

Form TPT-20 Tobacco Products Tax Return - New Jersey

What Is Form TPT-20?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TPT-20?

A: Form TPT-20 is a tax return used for reporting tobacco products tax in New Jersey.

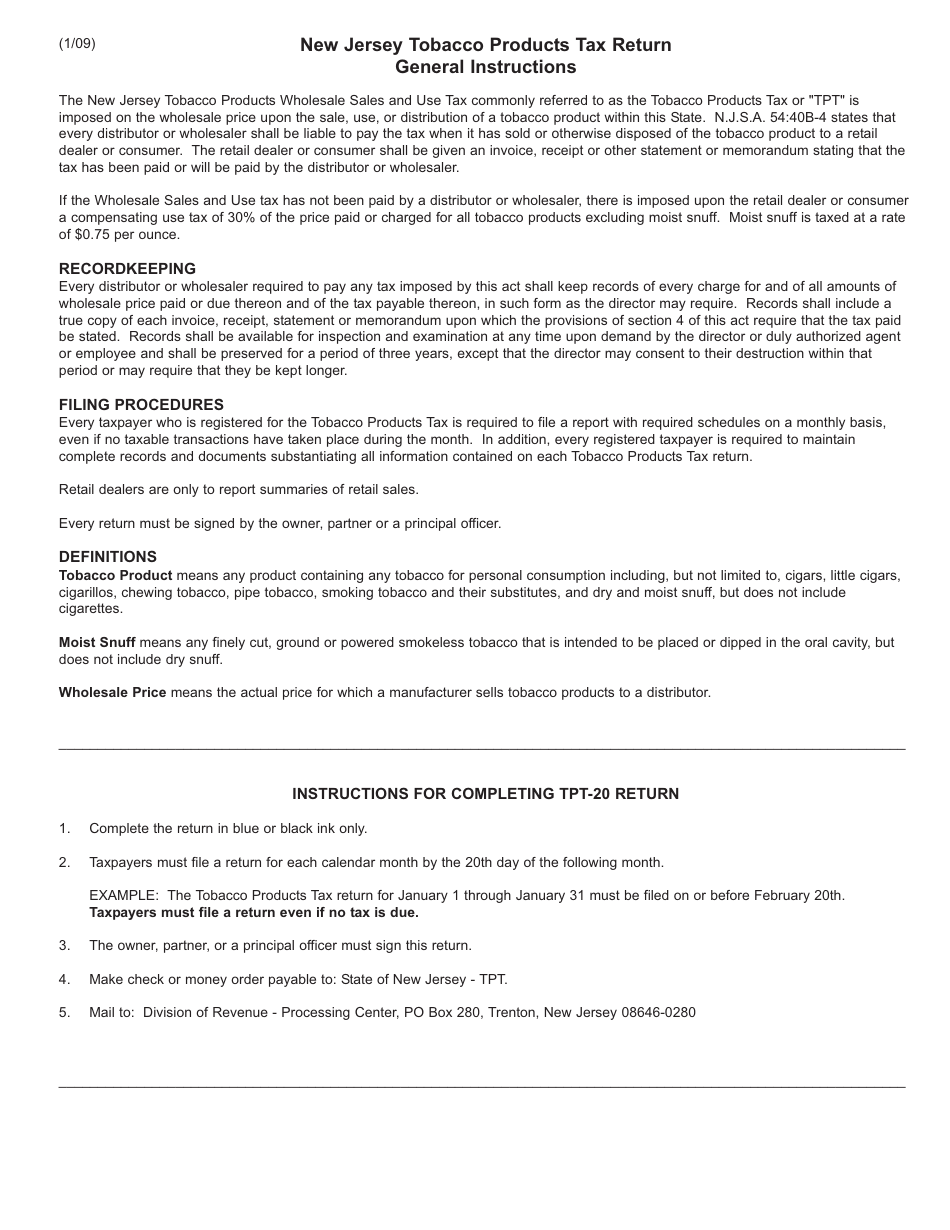

Q: Who needs to file Form TPT-20?

A: Anyone engaged in the sale or distribution of tobacco products in New Jersey needs to file Form TPT-20.

Q: What is the purpose of Form TPT-20?

A: The purpose of Form TPT-20 is to report and remit the tax on tobacco products sold or distributed in New Jersey.

Q: When is Form TPT-20 due?

A: Form TPT-20 is due on a quarterly basis, with the due date falling on the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form TPT-20?

A: Yes, there are penalties for late filing of Form TPT-20. It is important to file the return and remit the tax by the due date to avoid penalties.

Q: What should I do if I have questions or need assistance with Form TPT-20?

A: If you have questions or need assistance with Form TPT-20, you can contact the New Jersey Division of Taxation's customer service.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TPT-20 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.