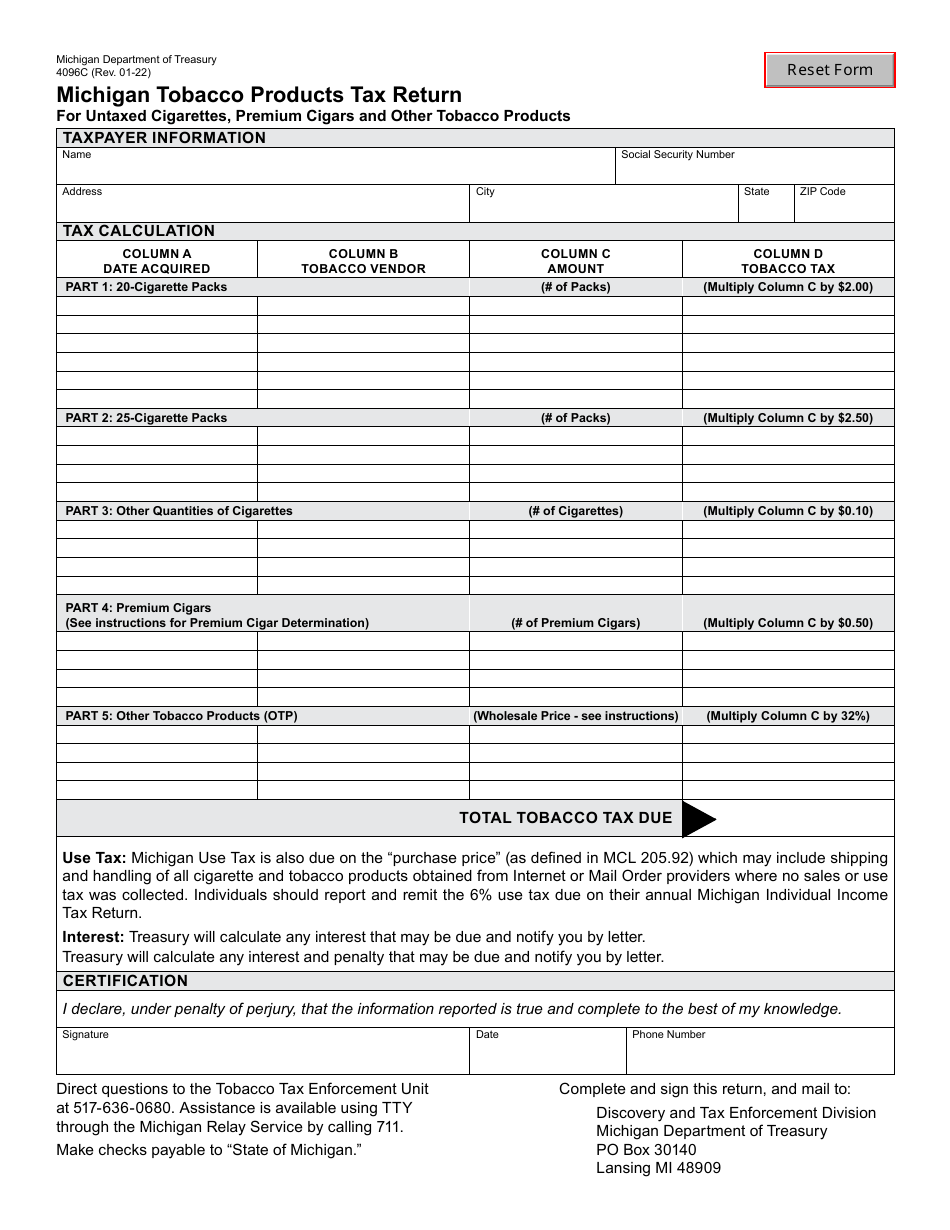

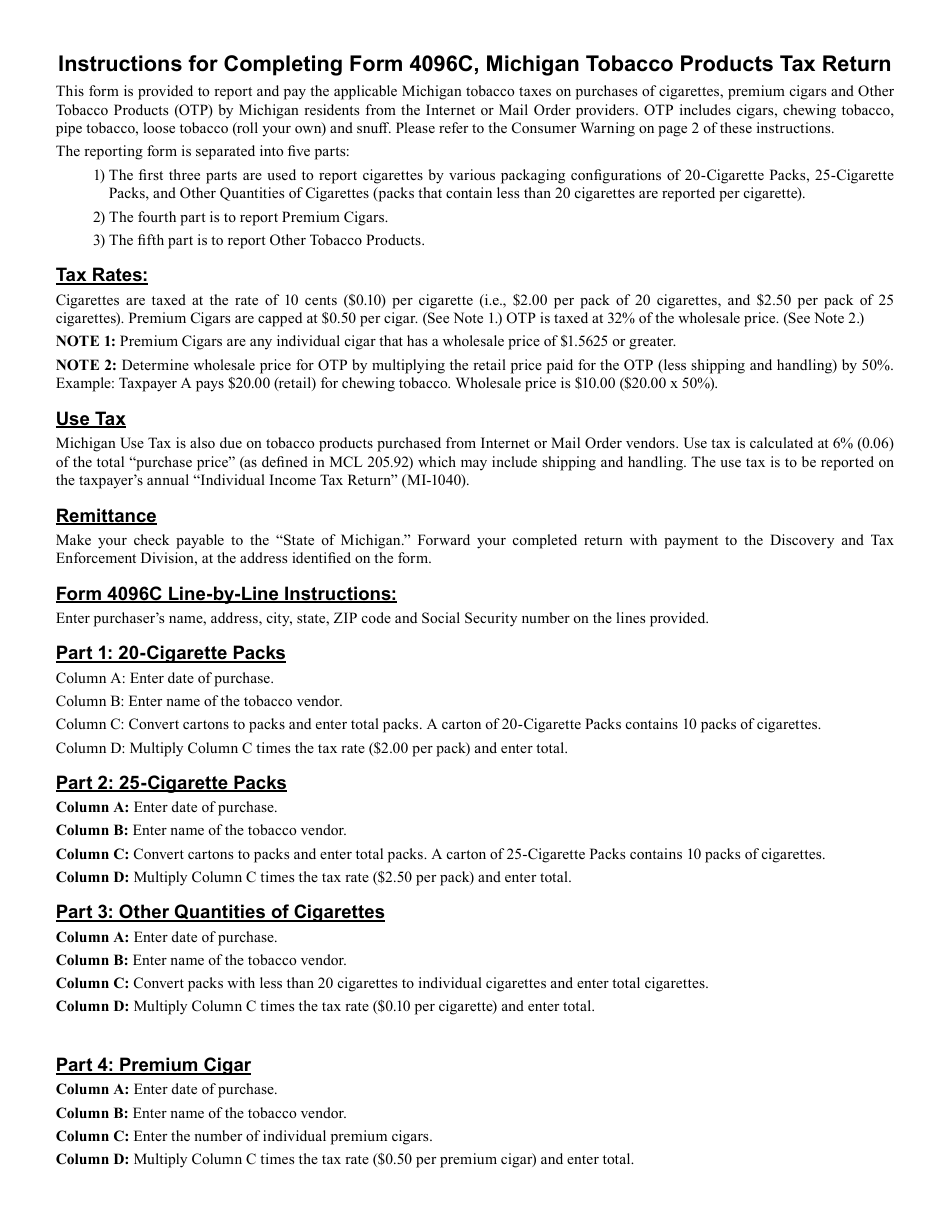

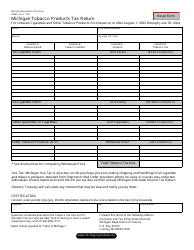

Form 4096C Michigan Tobacco Products Tax Return for Untaxed Cigarettes, Premium Cigars and Other Tobacco Products - Michigan

What Is Form 4096C?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4096C?

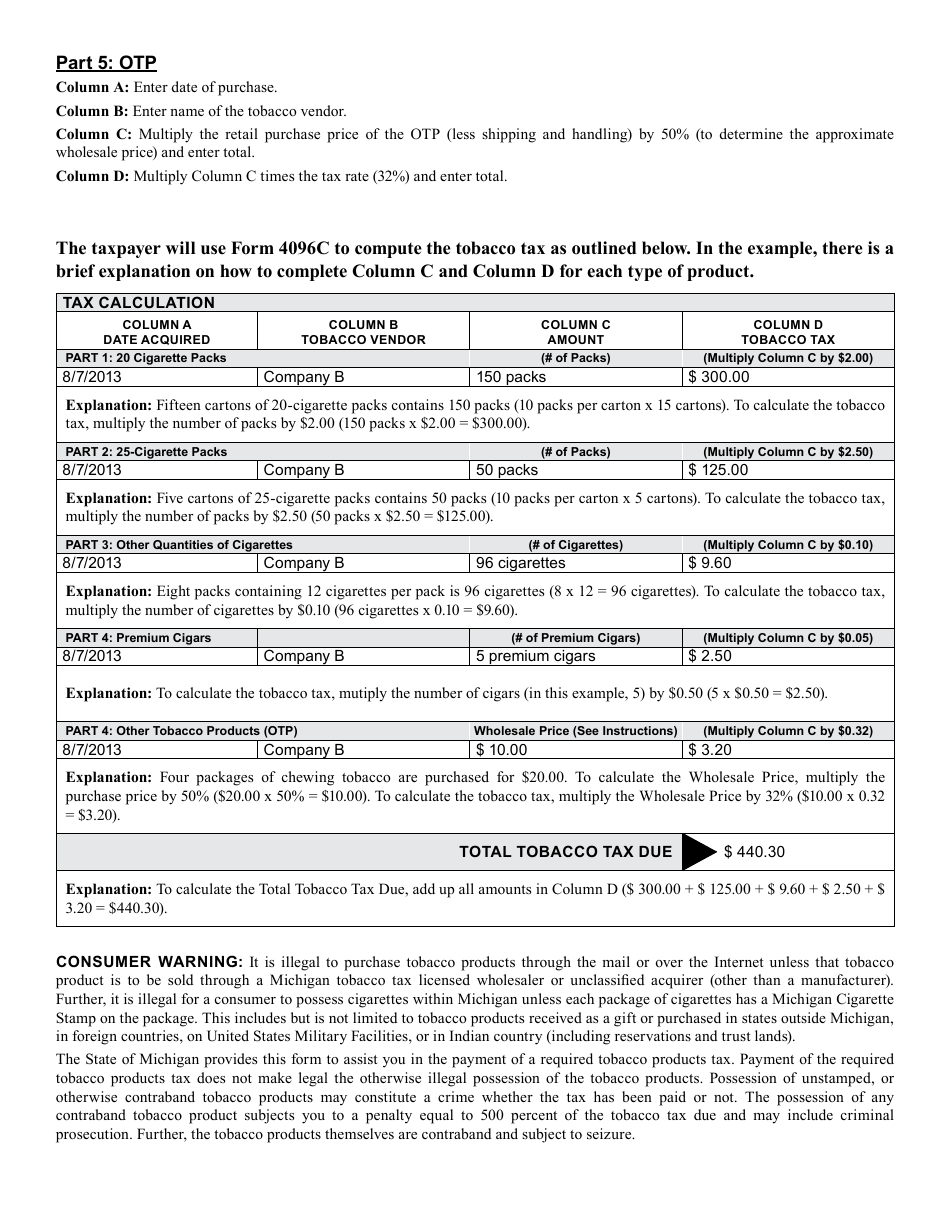

A: Form 4096C is a Michigan Tobacco Products Tax Return for reporting untaxed cigarettes, premium cigars, and other tobacco products.

Q: Who needs to file Form 4096C?

A: Individuals or businesses engaged in the sale or distribution of untaxed cigarettes, premium cigars, or other tobacco products in Michigan need to file Form 4096C.

Q: What is the purpose of Form 4096C?

A: Form 4096C is used to report and pay the appropriate tobacco products tax on untaxed cigarettes, premium cigars, or other tobacco products sold or distributed in Michigan.

Q: How often should Form 4096C be filed?

A: Form 4096C should be filed monthly by the 20th day following the end of the reporting month.

Q: Are there any penalties for late or incorrect filing of Form 4096C?

A: Yes, there are penalties for late or incorrect filing of Form 4096C, including interest charges and possible criminal charges.

Q: What should I include with my Form 4096C?

A: You should include a complete and accurate summary of your sales or distributions of untaxed cigarettes, premium cigars, or other tobacco products, along with the appropriate payment for the tobacco products tax.

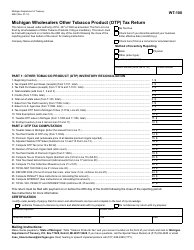

Q: Are there any exemptions or deductions available for Form 4096C?

A: Yes, there are certain exemptions and deductions available for Form 4096C. Consult the instructions provided with the form for more information.

Q: Can I file Form 4096C electronically?

A: Yes, electronic filing options are available for Form 4096C. Check the instructions provided with the form for more information.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4096C by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.