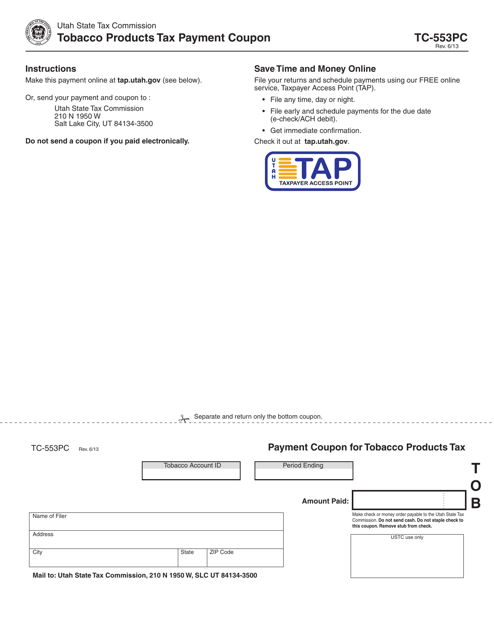

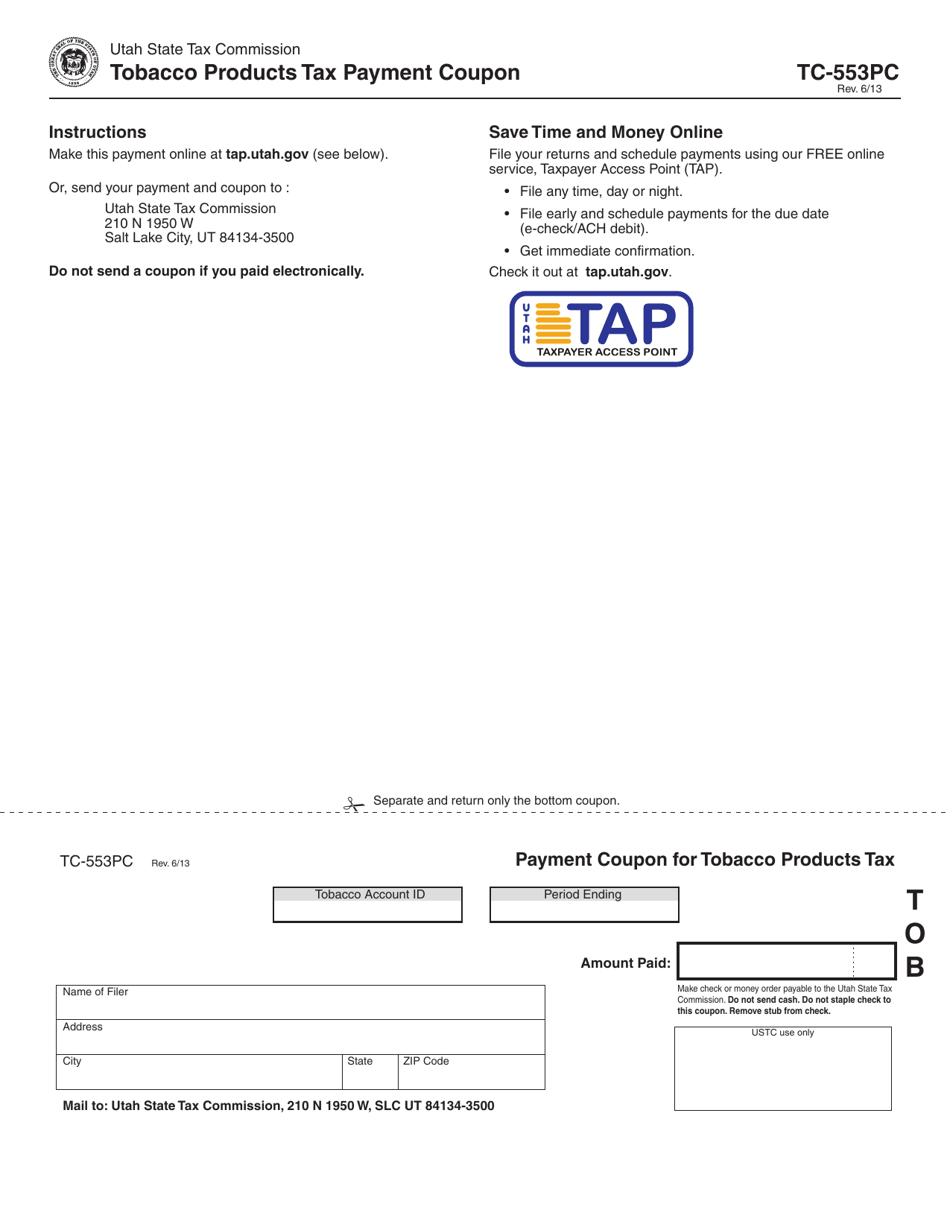

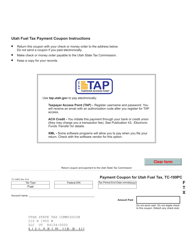

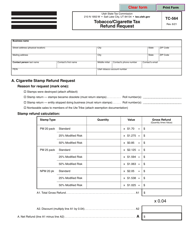

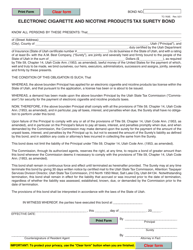

Form TC-553PC Tobacco Products Tax Payment Coupon - Utah

What Is Form TC-553PC?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-553PC?

A: Form TC-553PC is a Tobacco Products Tax Payment Coupon.

Q: What is the purpose of Form TC-553PC?

A: The purpose of Form TC-553PC is to facilitate the payment of tobacco products tax in Utah.

Q: Who should use Form TC-553PC?

A: Form TC-553PC should be used by businesses or individuals who owe tobacco products tax in Utah.

Q: How should I fill out Form TC-553PC?

A: You should fill out Form TC-553PC by providing the required information, including your name, address, and the amount of tobacco products tax you owe.

Q: Are there any penalties for late payment of tobacco products tax?

A: Yes, there may be penalties for late payment of tobacco products tax in Utah. It is important to timely file and pay your tax obligations to avoid penalties.

Q: Can I file Form TC-553PC electronically?

A: No, Form TC-553PC cannot be filed electronically. It must be filed by mail with the required payment.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC-553PC by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.