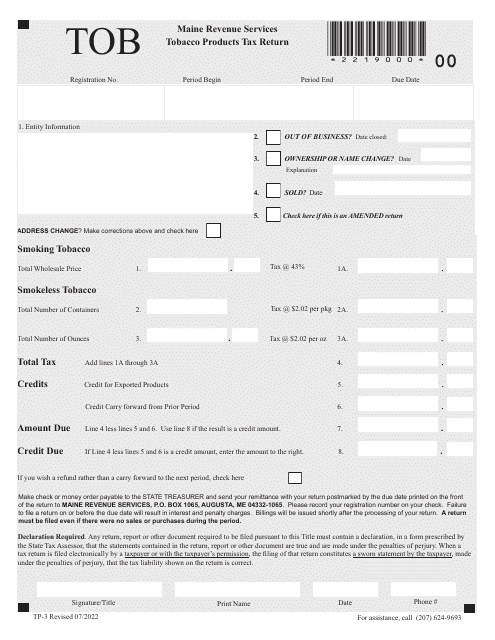

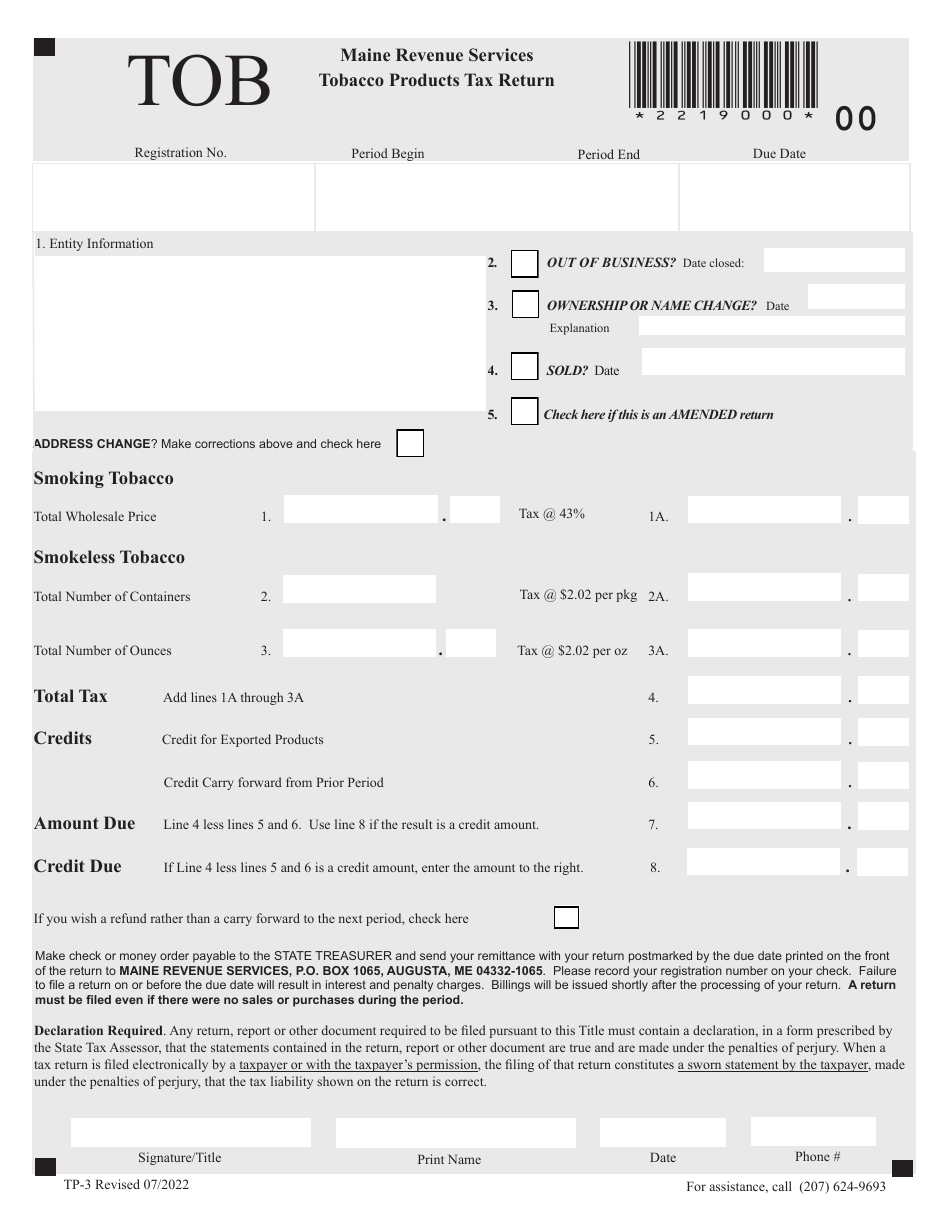

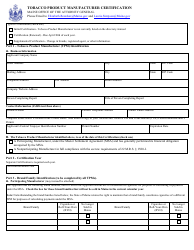

Form TP-3 Tobacco Products Tax Return - Maine

What Is Form TP-3?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TP-3 form?

A: The TP-3 form is the Tobacco Products Tax Return in Maine.

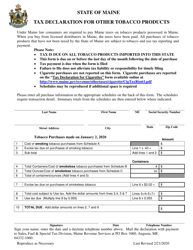

Q: Who needs to file the TP-3 form?

A: Any business that sells or distributes tobacco products in Maine needs to file the TP-3 form.

Q: What information is required on the TP-3 form?

A: The TP-3 form requires information about the quantities and sales of tobacco products, as well as tax calculations.

Q: When is the TP-3 form due?

A: The TP-3 form is due on a monthly basis, typically by the 15th of the following month.

Q: Are there any penalties for late filing of the TP-3 form?

A: Yes, there may be penalties and interest for late filing or underpayment of taxes.

Q: Is there a minimum threshold for filing the TP-3 form?

A: Yes, businesses with less than $8,000 in tobacco product sales per year are exempt from filing the TP-3 form.

Q: Do I need to include payment with the TP-3 form?

A: Yes, the TP-3 form should be accompanied by payment for the tobacco products tax owed.

Q: Can I claim a refund on the TP-3 form?

A: No, the TP-3 form is for reporting and paying tobacco product taxes, not for claiming refunds.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-3 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.