This version of the form is not currently in use and is provided for reference only. Download this version of

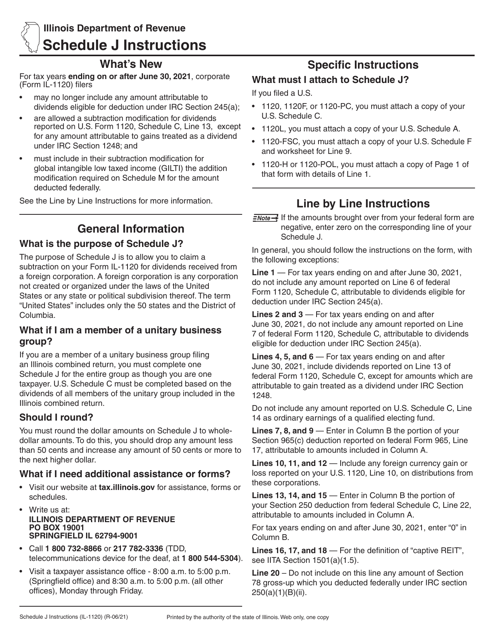

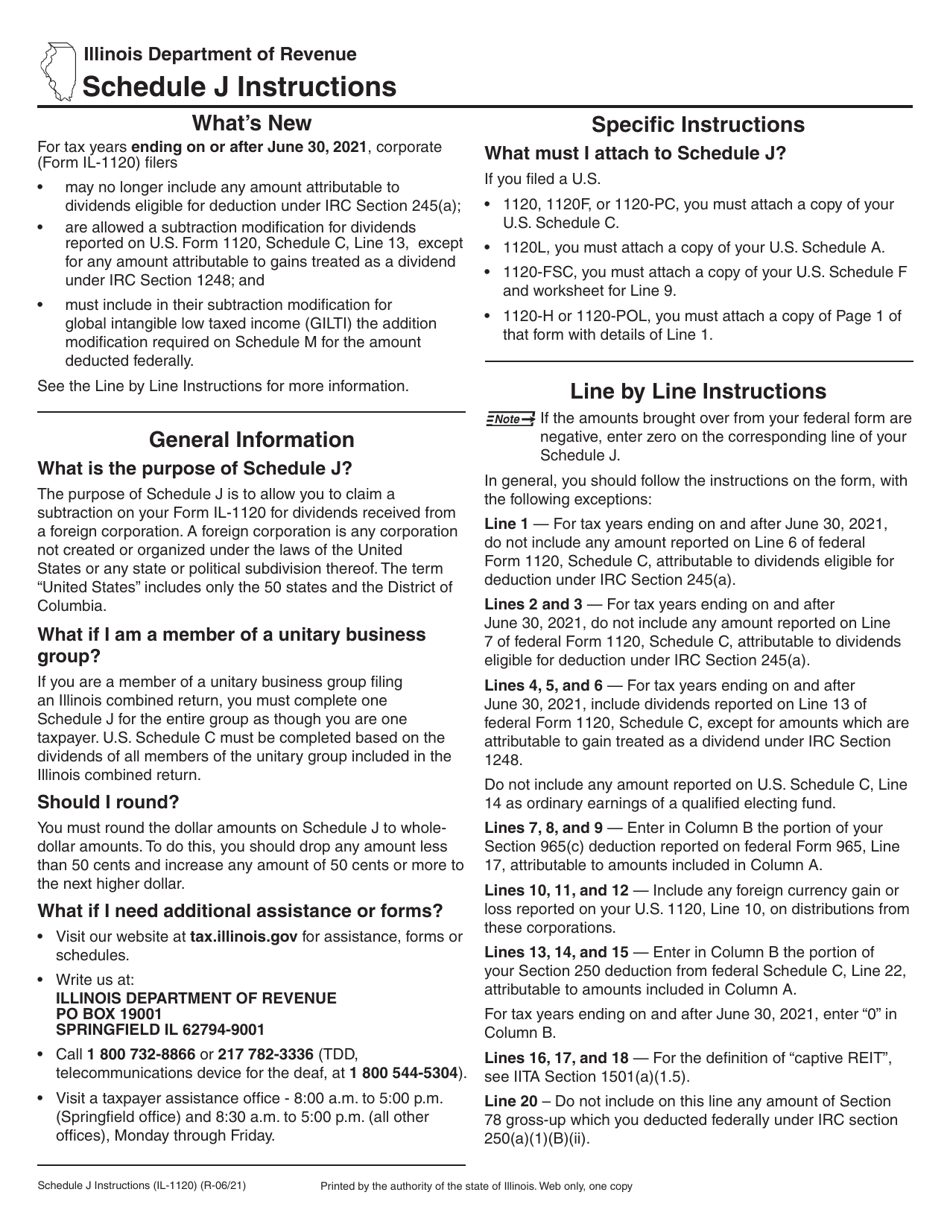

Instructions for Form IL-1120 Schedule J

for the current year.

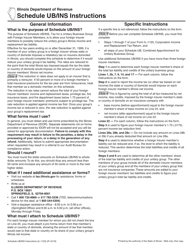

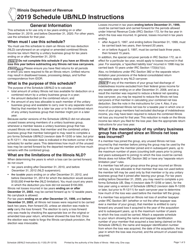

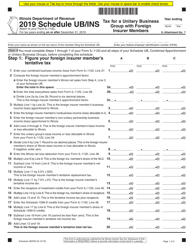

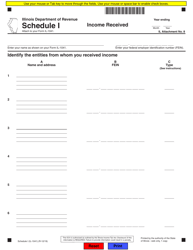

Instructions for Form IL-1120 Schedule J Foreign Dividends - Illinois

This document contains official instructions for Form IL-1120 Schedule J, Foreign Dividends - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form IL-1120 Schedule J?

A: Form IL-1120 Schedule J is a tax form used by corporations in Illinois to report foreign dividends.

Q: What are foreign dividends?

A: Foreign dividends are dividends received by a corporation from foreign sources.

Q: When is Form IL-1120 Schedule J used?

A: Form IL-1120 Schedule J is used when a corporation has received foreign dividends and needs to report them for tax purposes in Illinois.

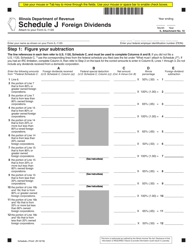

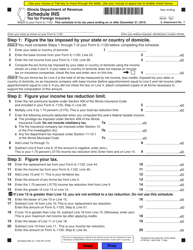

Q: How do I complete Form IL-1120 Schedule J?

A: You will need to provide information about the foreign dividends you received, including the name of the foreign corporation, the country it is located in, and the amount of dividends received.

Q: Are there any special requirements for reporting foreign dividends on Form IL-1120 Schedule J?

A: Yes, you may need to provide additional documentation, such as a copy of the foreign corporation's financial statements or supporting documents to verify the amount of dividends received.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.