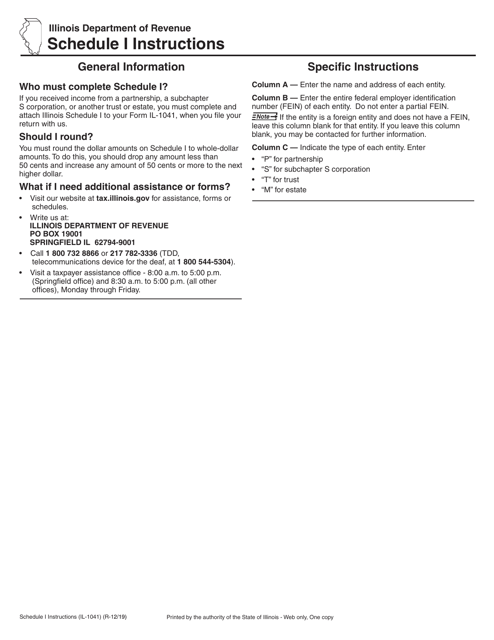

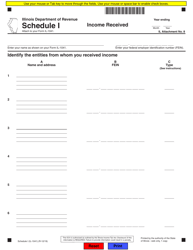

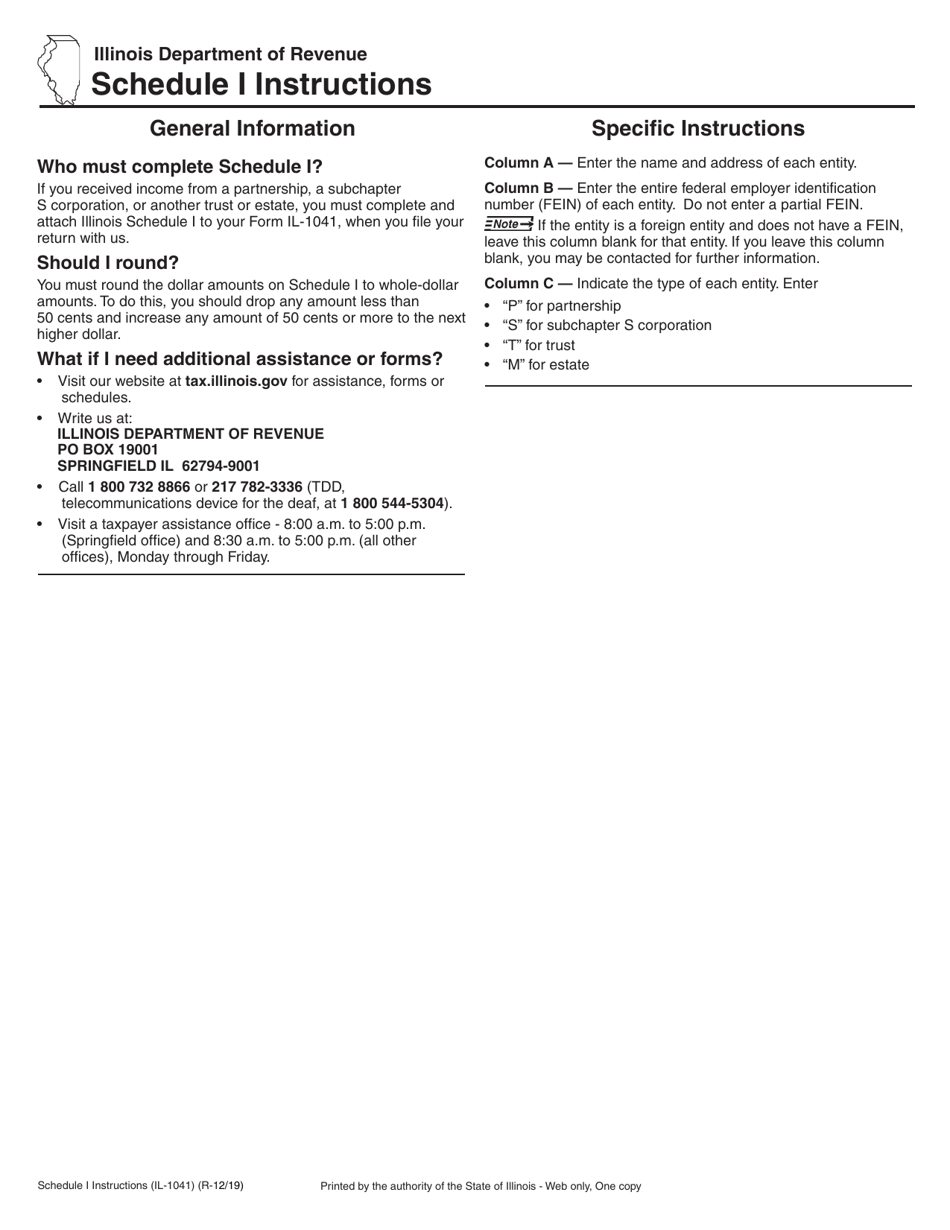

Instructions for Form IL-1041 Schedule I Income Received - Illinois

This document contains official instructions for Form IL-1041 Schedule I, Income Received - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-1041 Schedule I is available for download through this link.

FAQ

Q: What is Form IL-1041 Schedule I?

A: Form IL-1041 Schedule I is a supplemental schedule that is used to report the income received by the estate or trust in the state of Illinois.

Q: What kind of income should be reported on Schedule I?

A: Schedule I should include all taxable income received by the estate or trust, including interest, dividends, rental income, and business income.

Q: Do I need to file Schedule I if there was no income received?

A: If the estate or trust did not receive any income during the tax year, you do not need to file Schedule I.

Q: What is the deadline for filing Form IL-1041 Schedule I?

A: Schedule I should be filed along with Form IL-1041 by the original due date of the estate or trust's tax return, which is typically April 15th.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.