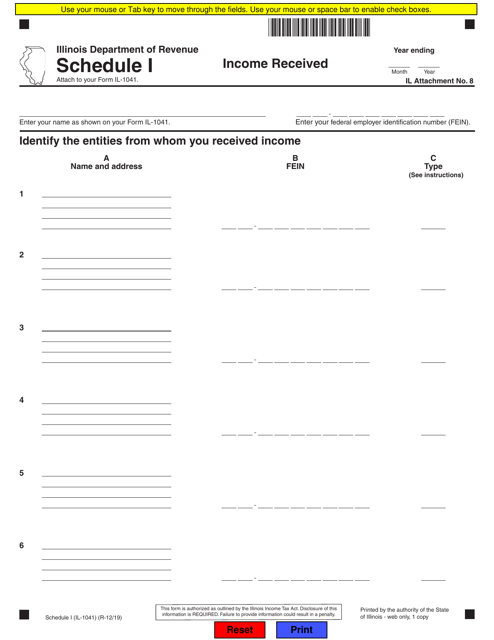

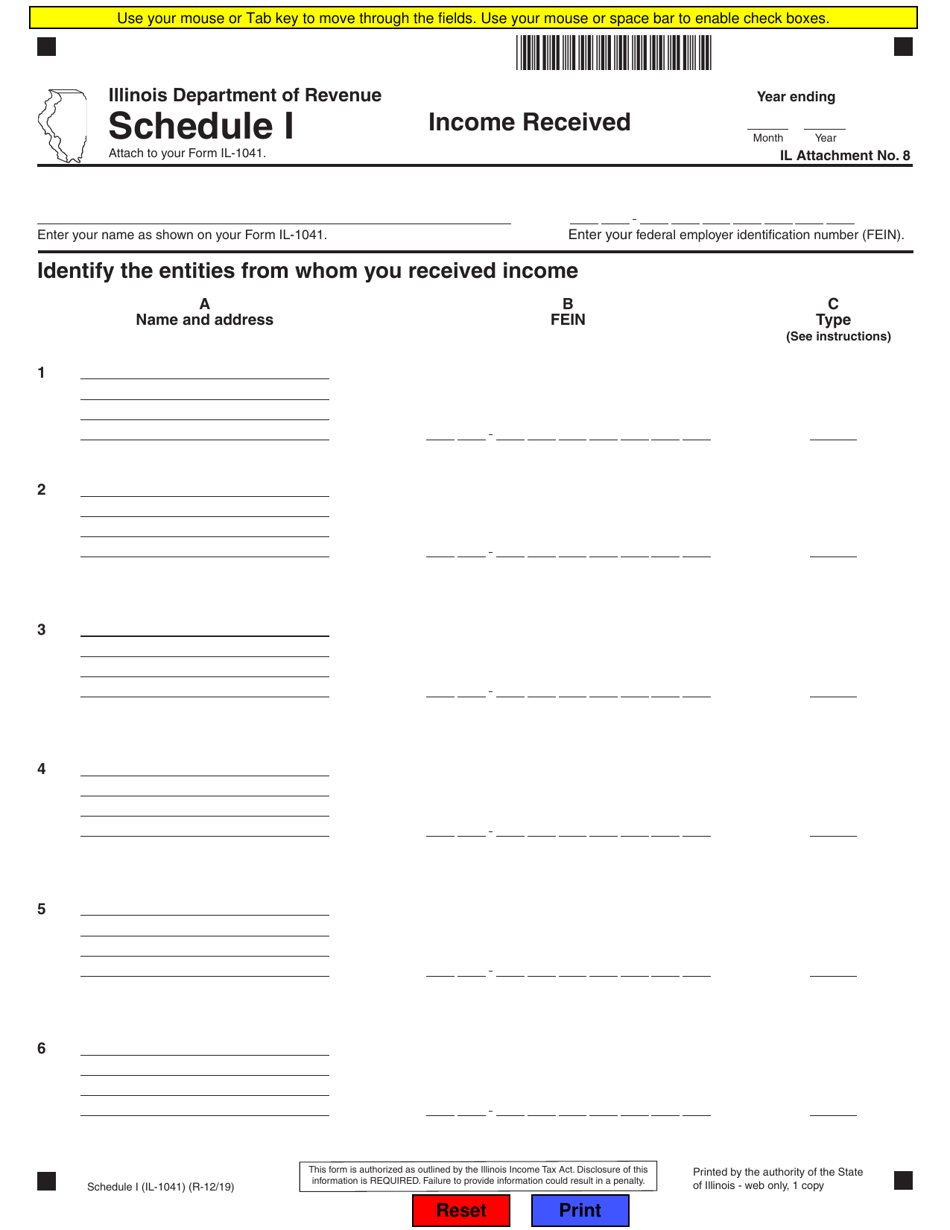

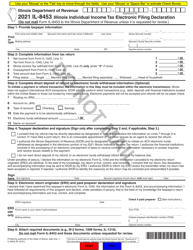

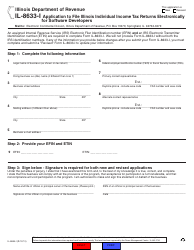

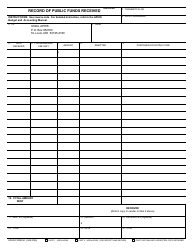

Form IL-1041 Schedule I Income Received - Illinois

What Is Form IL-1041 Schedule I?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1041 Schedule I?

A: Form IL-1041 Schedule I is a form used to report income received by an Illinois estate or trust.

Q: Who needs to file Form IL-1041 Schedule I?

A: Illinois estates and trusts that have received income during the tax year need to file Form IL-1041 Schedule I.

Q: What types of income should be reported on Form IL-1041 Schedule I?

A: Form IL-1041 Schedule I should include income such as interest, dividends, rental income, and capital gains.

Q: When is the deadline for filing Form IL-1041 Schedule I?

A: Form IL-1041 Schedule I is generally due on the same date as the Illinois estate or trust income tax return, which is typically April 15th.

Q: Is there a penalty for not filing Form IL-1041 Schedule I?

A: Yes, failing to file Form IL-1041 Schedule I or filing it late may result in penalties and interest charges.

Q: Can I e-file Form IL-1041 Schedule I?

A: Yes, Illinois allows for the electronic filing of Form IL-1041 Schedule I.

Q: Do I need to include supporting documentation with Form IL-1041 Schedule I?

A: Yes, you should keep records of the income reported on Form IL-1041 Schedule I, as well as any supporting documentation, in case of an audit.

Q: Can I amend Form IL-1041 Schedule I if I made a mistake?

A: Yes, if you made a mistake on Form IL-1041 Schedule I, you can file an amended return using Form IL-1041-X.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1041 Schedule I by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.