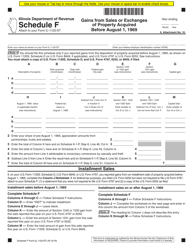

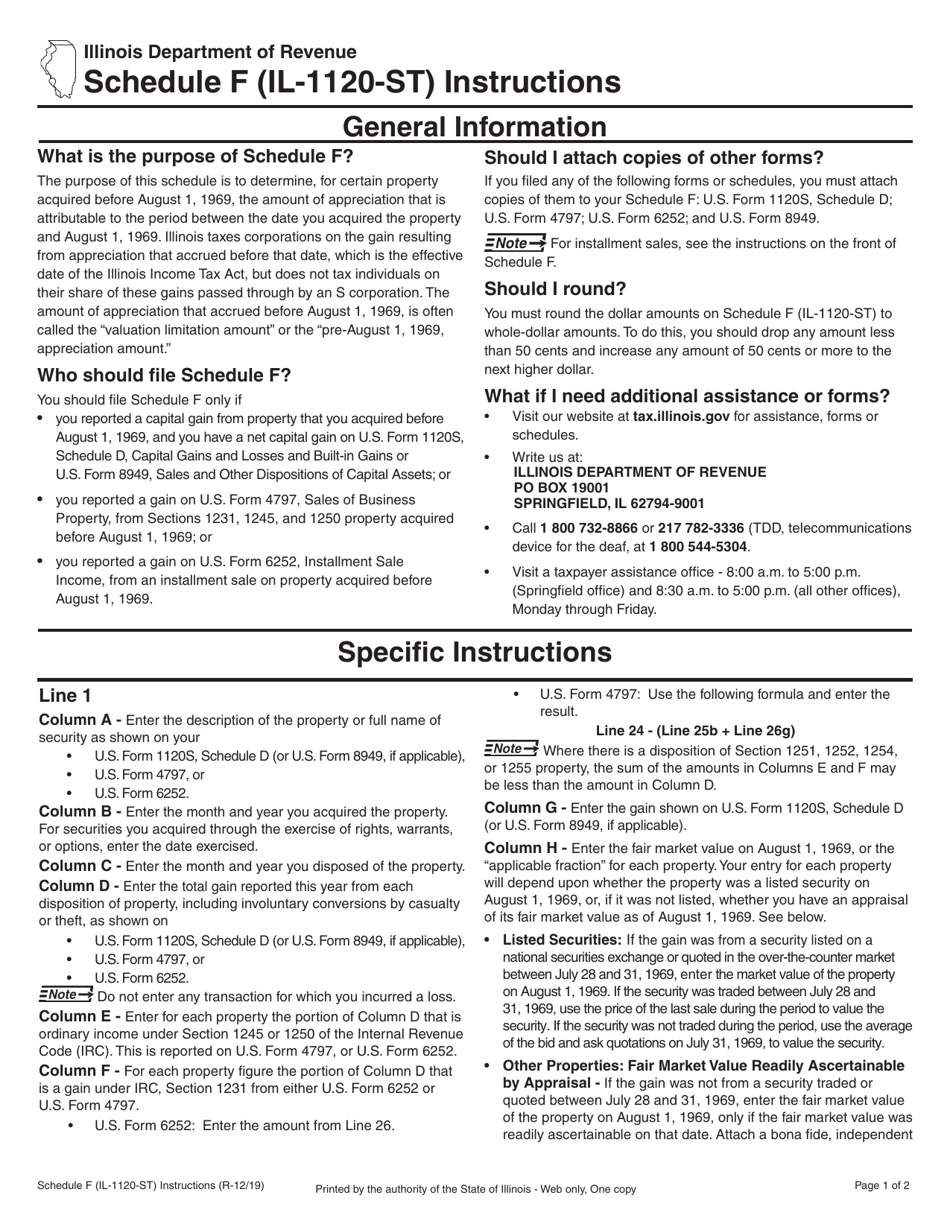

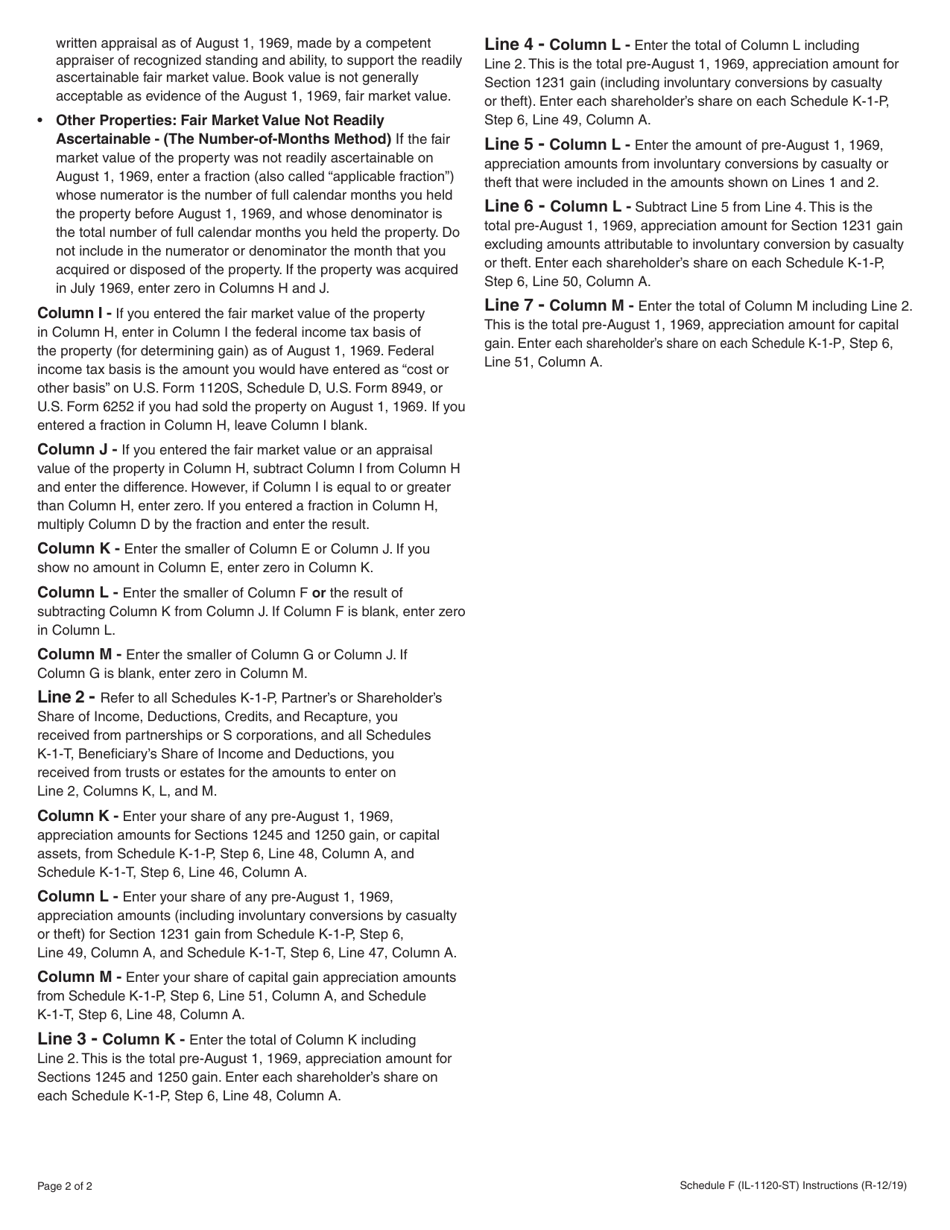

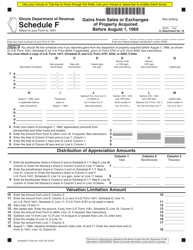

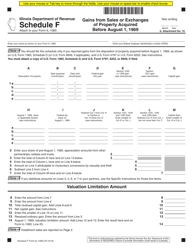

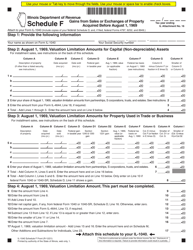

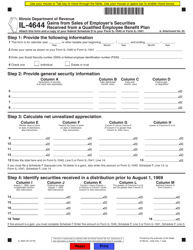

Instructions for Form IL-1120-ST Schedule F Gains From Sales or Exchanges of Property Acquired Before August 1, 1969 - Illinois

This document contains official instructions for Form IL-1120-ST Schedule F, Gains From Sales or Exchanges of Property Acquired Before August 1, 1969 - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-1120-ST Schedule F is available for download through this link.

FAQ

Q: What is Form IL-1120-ST Schedule F?

A: Form IL-1120-ST Schedule F is a form used in Illinois to report gains from sales or exchanges of property acquired before August 1, 1969.

Q: What does Schedule F cover?

A: Schedule F covers gains from sales or exchanges of property acquired before August 1, 1969.

Q: Who needs to file Form IL-1120-ST Schedule F?

A: Individuals or businesses in Illinois who have gains from sales or exchanges of property acquired before August 1, 1969 need to file Form IL-1120-ST Schedule F.

Q: When is Form IL-1120-ST Schedule F due?

A: Form IL-1120-ST Schedule F is due on the same date as the Illinois income tax return, which is generally April 15th.

Q: Can I file Form IL-1120-ST Schedule F electronically?

A: Yes, Form IL-1120-ST Schedule F can be filed electronically if you are using approved tax preparation software.

Q: What if I have no gains to report on Form IL-1120-ST Schedule F?

A: If you have no gains to report on Form IL-1120-ST Schedule F, you may not need to file the form. However, it is recommended to consult with a tax professional to determine your specific filing requirements.

Q: Do I need to include supporting documentation with Form IL-1120-ST Schedule F?

A: You may need to include supporting documentation with Form IL-1120-ST Schedule F, such as records of property sales or exchanges. It is important to consult the instructions for the form or seek guidance from a tax professional to ensure compliance with the filing requirements.

Q: What if I have additional questions about Form IL-1120-ST Schedule F?

A: If you have additional questions about Form IL-1120-ST Schedule F, you can refer to the instructions for the form or contact the Illinois Department of Revenue for further assistance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.