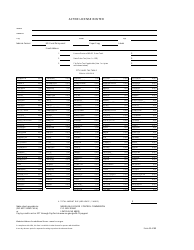

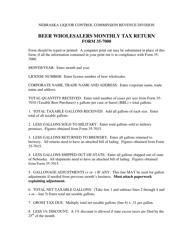

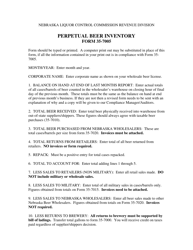

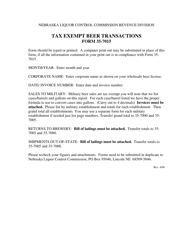

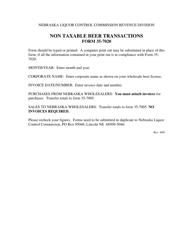

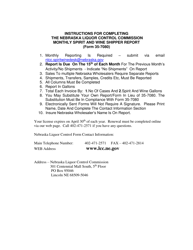

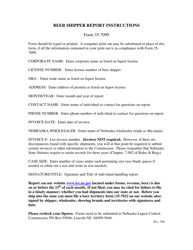

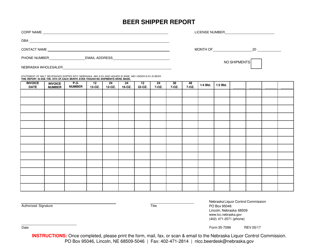

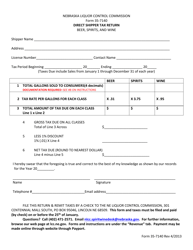

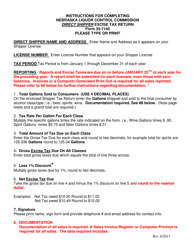

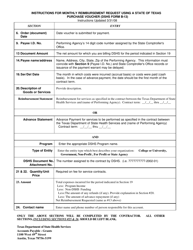

Instructions for Form 35-7010 Taxable Beer Purchases - Nebraska

This document contains official instructions for Form 35-7010 , Taxable Beer Purchases - a form released and collected by the Nebraska Liquor Control Commission.

FAQ

Q: What is Form 35-7010?

A: Form 35-7010 is a form used for reporting taxable beer purchases in Nebraska.

Q: Who needs to file Form 35-7010?

A: Any individual or business that purchases taxable beer in Nebraska needs to file Form 35-7010.

Q: When is Form 35-7010 due?

A: Form 35-7010 is due on the 20th of each month following the month in which the taxable beer was purchased.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nebraska Liquor Control Commission.