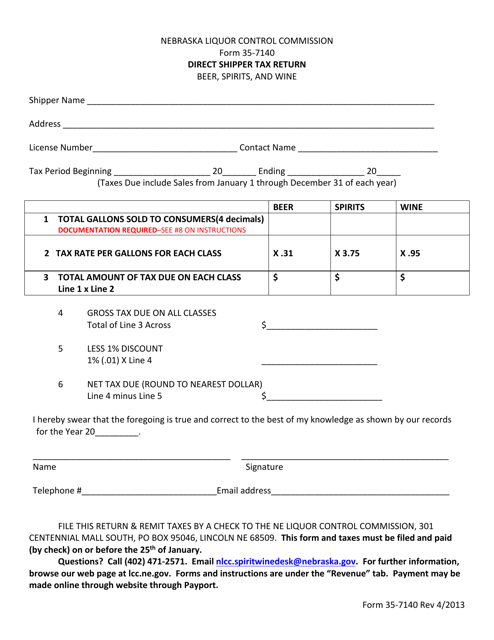

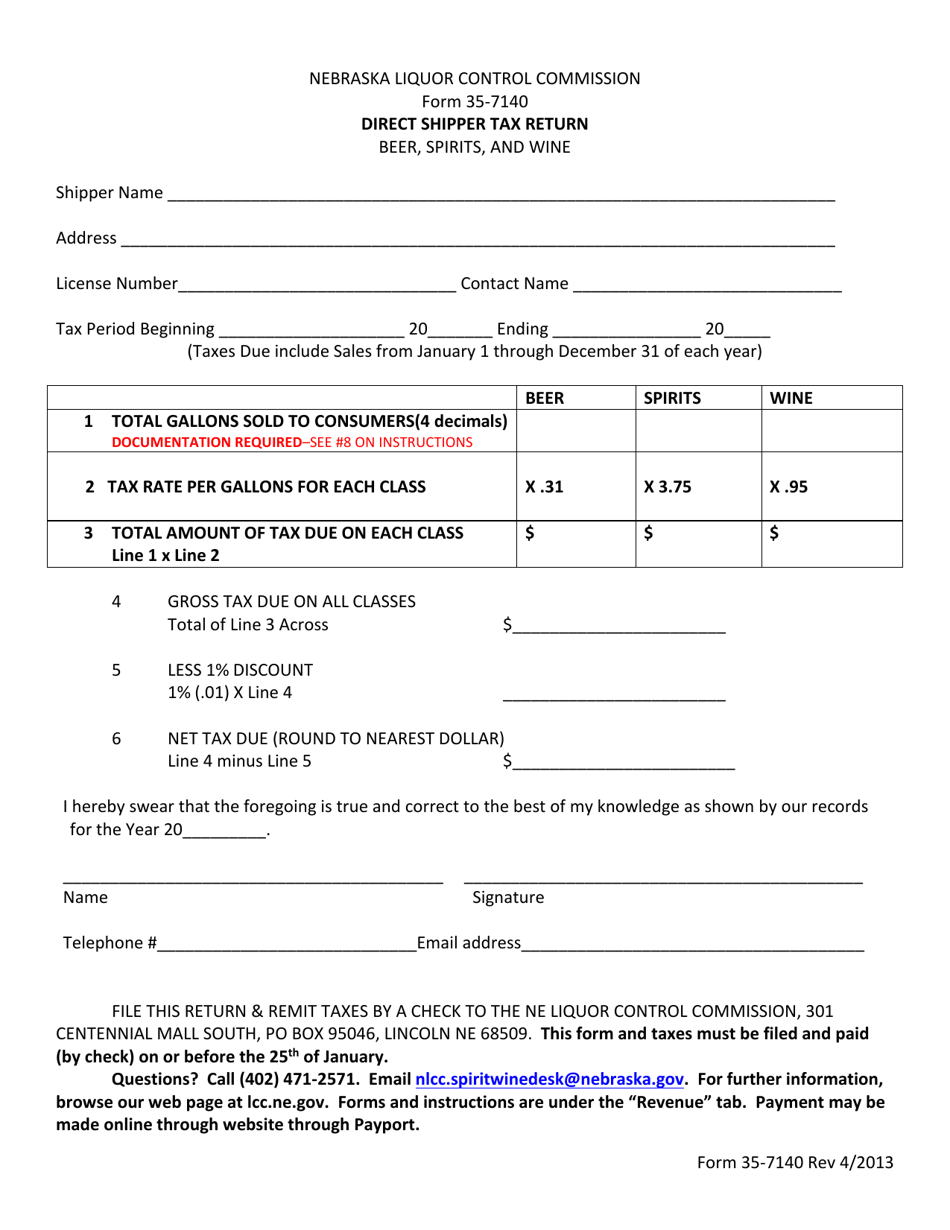

Form 35-7140 Direct Shipper Tax Return - Beer, Spirits, and Wine - Nebraska

What Is Form 35-7140?

This is a legal form that was released by the Nebraska Liquor Control Commission - a government authority operating within Nebraska. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 35-7140?

A: Form 35-7140 is the Direct Shipper Tax Return specifically for beer, spirits, and wine in the state of Nebraska.

Q: Who needs to file Form 35-7140?

A: Any direct shipper of beer, spirits, or wine who wishes to sell and deliver their products directly to consumers in Nebraska must file Form 35-7140.

Q: What is the purpose of Form 35-7140?

A: The purpose of Form 35-7140 is to report and remit the taxes due on beer, spirits, and wine that are sold and shipped directly to consumers in Nebraska.

Q: How often do I need to file Form 35-7140?

A: Form 35-7140 must be filed on a monthly basis.

Q: What information do I need to complete Form 35-7140?

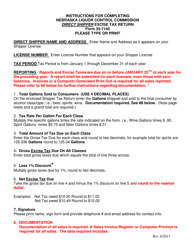

A: To complete Form 35-7140, you will need to provide information such as your business details, the quantity and type of products sold, the amount of tax due, and any other relevant information requested on the form.

Q: Are there any penalties for not filing or filing incorrectly?

A: Yes, there can be penalties for not filing or filing incorrectly. It is important to ensure that all information on Form 35-7140 is accurate and submitted on time to avoid penalties.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Nebraska Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 35-7140 by clicking the link below or browse more documents and templates provided by the Nebraska Liquor Control Commission.