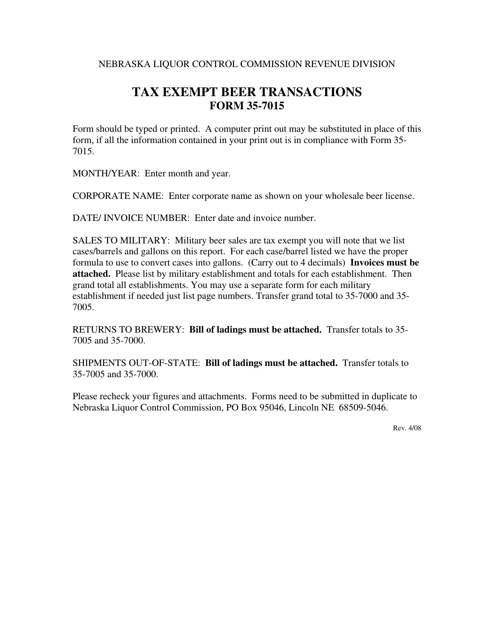

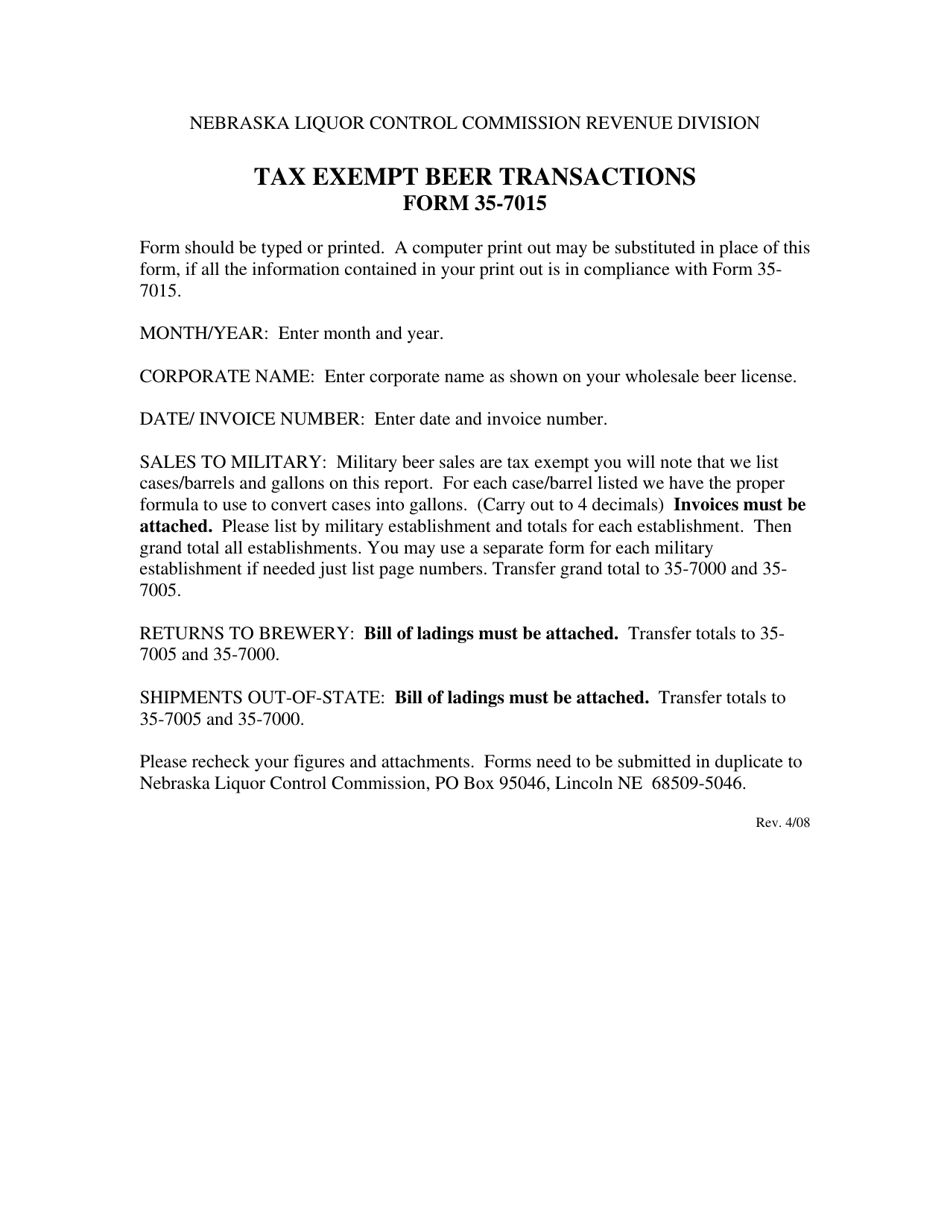

Instructions for Form 35-7015 Tax Exempt Beer Transactions - Nebraska

This document contains official instructions for Form 35-7015 , Tax Exempt Beer Transactions - a form released and collected by the Nebraska Liquor Control Commission.

FAQ

Q: What is Form 35-7015?

A: Form 35-7015 is a tax exemption form for beer transactions in Nebraska.

Q: Who needs to fill out Form 35-7015?

A: Any individual or business involved in beer transactions in Nebraska that qualifies for tax exemption needs to fill out this form.

Q: What is the purpose of Form 35-7015?

A: The purpose of this form is to apply for and claim tax exemption on beer transactions in Nebraska.

Q: What information is required on Form 35-7015?

A: You will need to provide your name, address, taxpayer ID number, type of exemption, description of beer transactions, and other relevant details.

Q: Are there any fees associated with submitting Form 35-7015?

A: No, there are no fees associated with submitting this form.

Q: When is the deadline for submitting Form 35-7015?

A: The form should be submitted at least 10 days before the first tax-exempt transaction.

Q: What happens after I submit Form 35-7015?

A: After submitting the form, the Nebraska Department of Revenue will review your application and notify you of the decision.

Q: How long does it take to process Form 35-7015?

A: The processing time can vary, but it generally takes a few weeks for the Nebraska Department of Revenue to review and process the form.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nebraska Liquor Control Commission.