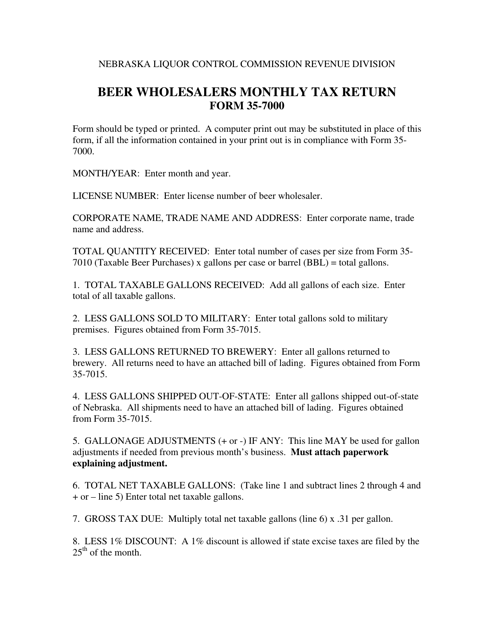

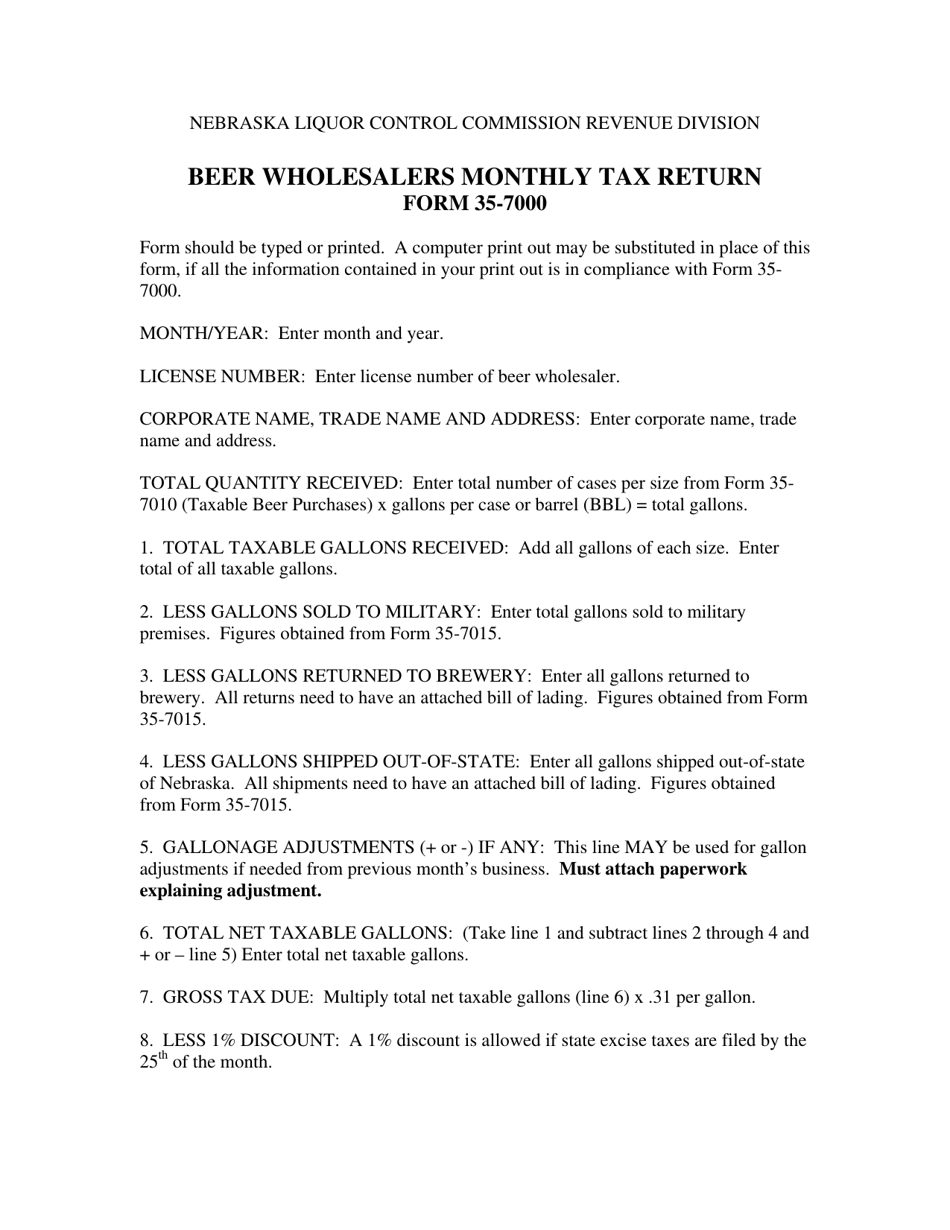

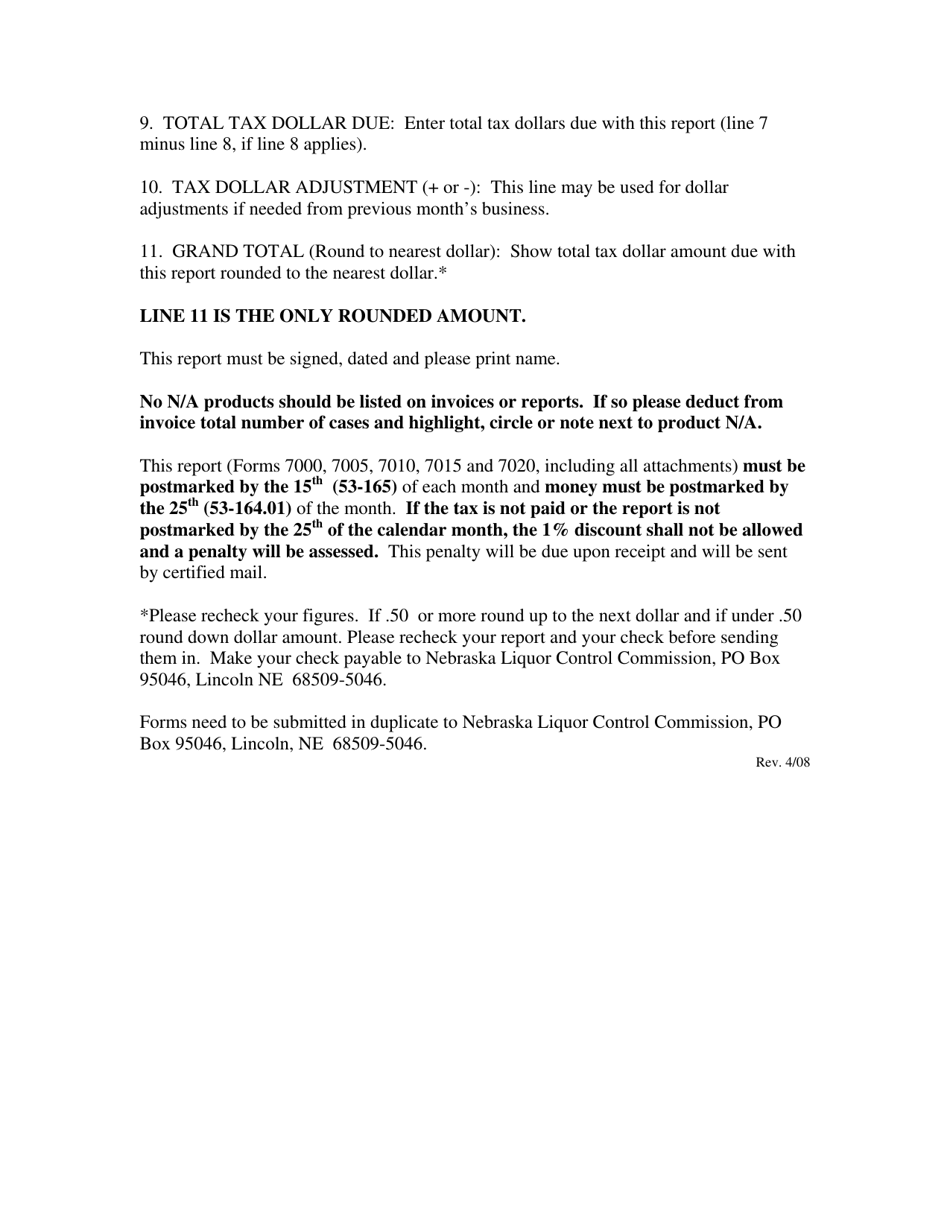

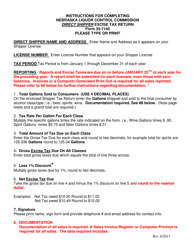

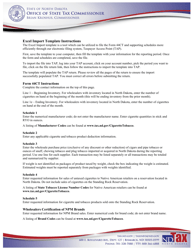

Instructions for Form 35-7000 Beer Wholesalers Monthly Tax Return - Nebraska

This document contains official instructions for Form 35-7000 , Beer Wholesalers Monthly Tax Return - a form released and collected by the Nebraska Liquor Control Commission.

FAQ

Q: What is Form 35-7000?

A: Form 35-7000 is the Beer Wholesalers Monthly Tax Return in Nebraska.

Q: Who needs to file Form 35-7000?

A: Beer wholesalers in Nebraska need to file Form 35-7000.

Q: What is the purpose of Form 35-7000?

A: The purpose of Form 35-7000 is to report and pay taxes on beer sales in Nebraska.

Q: When is Form 35-7000 due?

A: Form 35-7000 is due on the last day of the month following the reporting period.

Q: What information is required on Form 35-7000?

A: Form 35-7000 requires information such as total sales, taxable sales, tax rate, and payment details.

Q: Is there a penalty for late filing of Form 35-7000?

A: Yes, there may be penalties for late filing of Form 35-7000. It is important to file by the due date to avoid penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nebraska Liquor Control Commission.