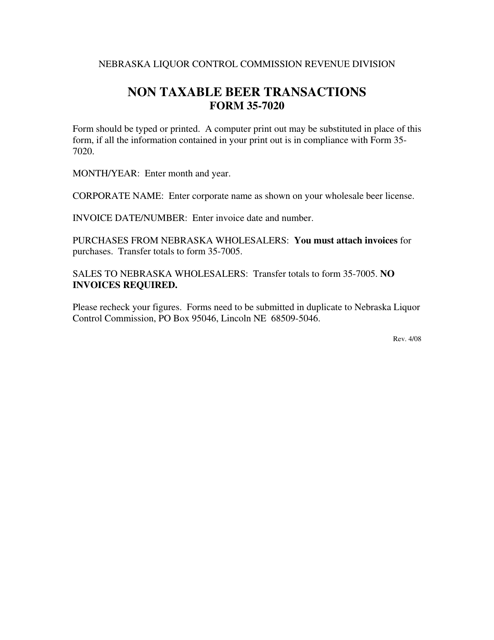

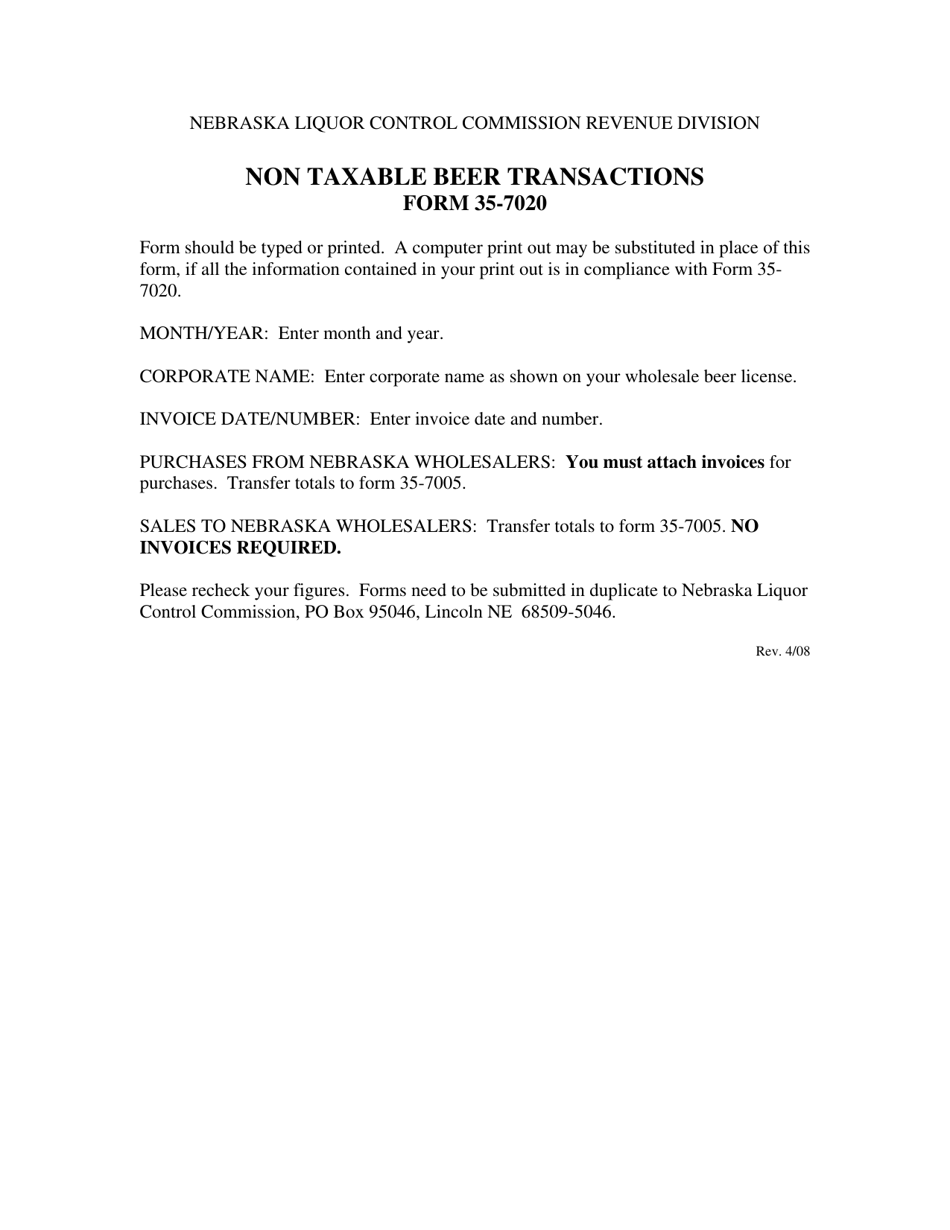

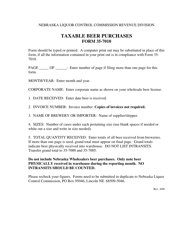

Instructions for Form 35-7020 Non Taxable Beer Transactions - Nebraska

This document contains official instructions for Form 35-7020 , Non Taxable Beer Transactions - a form released and collected by the Nebraska Liquor Control Commission.

FAQ

Q: What is Form 35-7020?

A: Form 35-7020 is a document used for reporting non-taxable beer transactions in Nebraska.

Q: Who needs to fill out Form 35-7020?

A: Anyone engaged in non-taxable beer transactions in Nebraska needs to fill out this form.

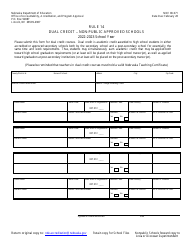

Q: What are non-taxable beer transactions?

A: Non-taxable beer transactions refer to sales or transfers of beer that are exempt from state taxes.

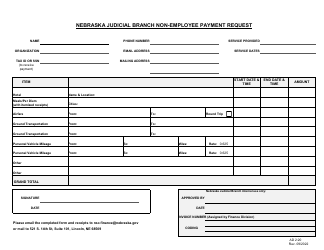

Q: What information is required on Form 35-7020?

A: The form requires detailed information such as the name and address of the parties involved, quantity and type of beer, and reason for exemption.

Q: When is Form 35-7020 due?

A: The specific due date for this form may vary, so it's important to check the instructions or contact the Nebraska Department of Revenue for the deadline.

Q: Are there any penalties for not filing Form 35-7020?

A: Yes, failure to file the form or reporting incorrect information may result in penalties or fines.

Q: Are non-taxable beer transactions common in Nebraska?

A: While non-taxable beer transactions may not be as common as taxable transactions, they do occur for various reasons such as transfers between breweries or for certain events or organizations.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nebraska Liquor Control Commission.