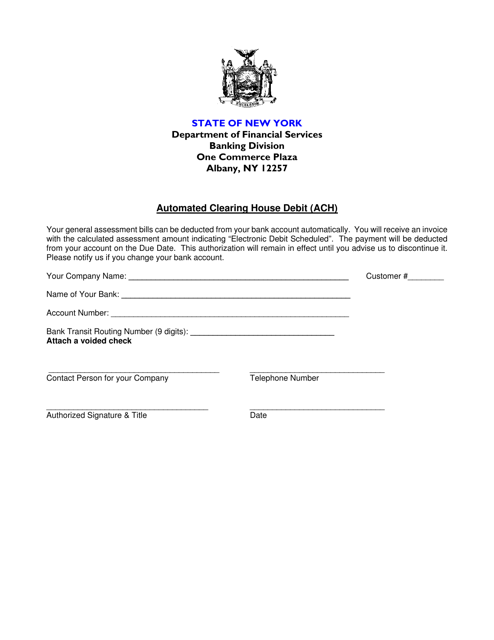

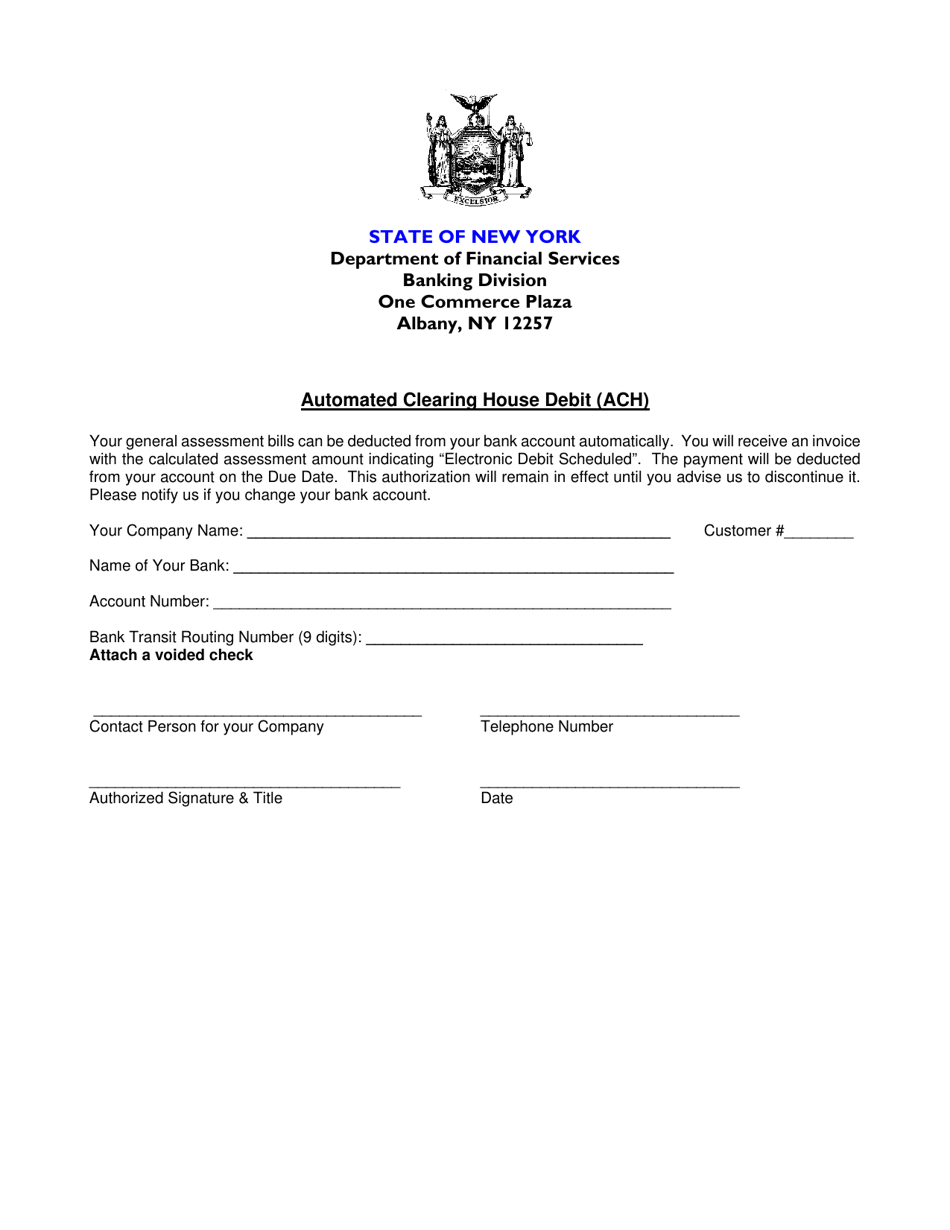

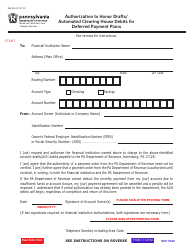

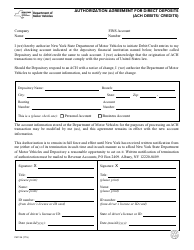

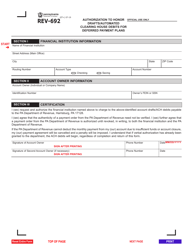

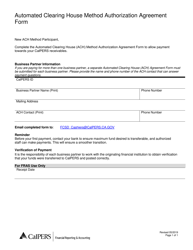

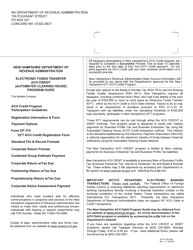

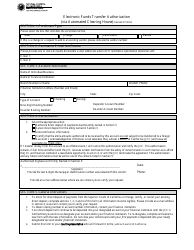

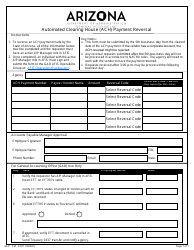

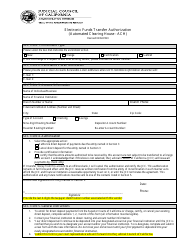

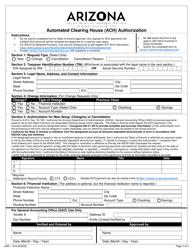

Automated Clearing House Debit (ACH) - New York

Automated Clearing House Debit (ACH) is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is Automated Clearing House Debit (ACH)?

A: ACH is an electronic payment system that allows funds to be transferred between bank accounts.

Q: How does ACH work?

A: ACH works by using electronic files to transfer funds between bank accounts, typically for payments such as direct deposits, bill payments, and transfers between individuals.

Q: What can ACH Debit be used for?

A: ACH Debit can be used for various transactions, including paying bills, making purchases, and transferring funds between accounts.

Q: Is ACH Debit safe?

A: ACH Debit is generally considered safe as it is regulated by the Federal Reserve and has built-in security measures to protect against fraud.

Q: How long does an ACH Debit transaction take?

A: ACH Debit transactions can take anywhere from one to three business days to process, depending on the financial institutions involved.

Q: Are there any fees associated with ACH Debit?

A: Some financial institutions may charge fees for ACH Debit transactions, but it varies depending on the institution and the nature of the transaction.

Q: Can ACH Debit transactions be reversed?

A: ACH Debit transactions can sometimes be reversed, but it depends on the specific circumstances and the policies of the involved financial institutions.

Q: Can I set uprecurring payments with ACH Debit?

A: Yes, ACH Debit can be used to set up recurring payments, such as monthly bills or subscriptions, by providing authorization to the merchant or service provider.

Q: Can I receive funds through ACH Debit in New York?

A: Yes, you can receive funds through ACH Debit in New York, such as direct deposits from employers or payments from individuals or businesses.

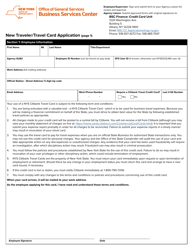

Form Details:

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.