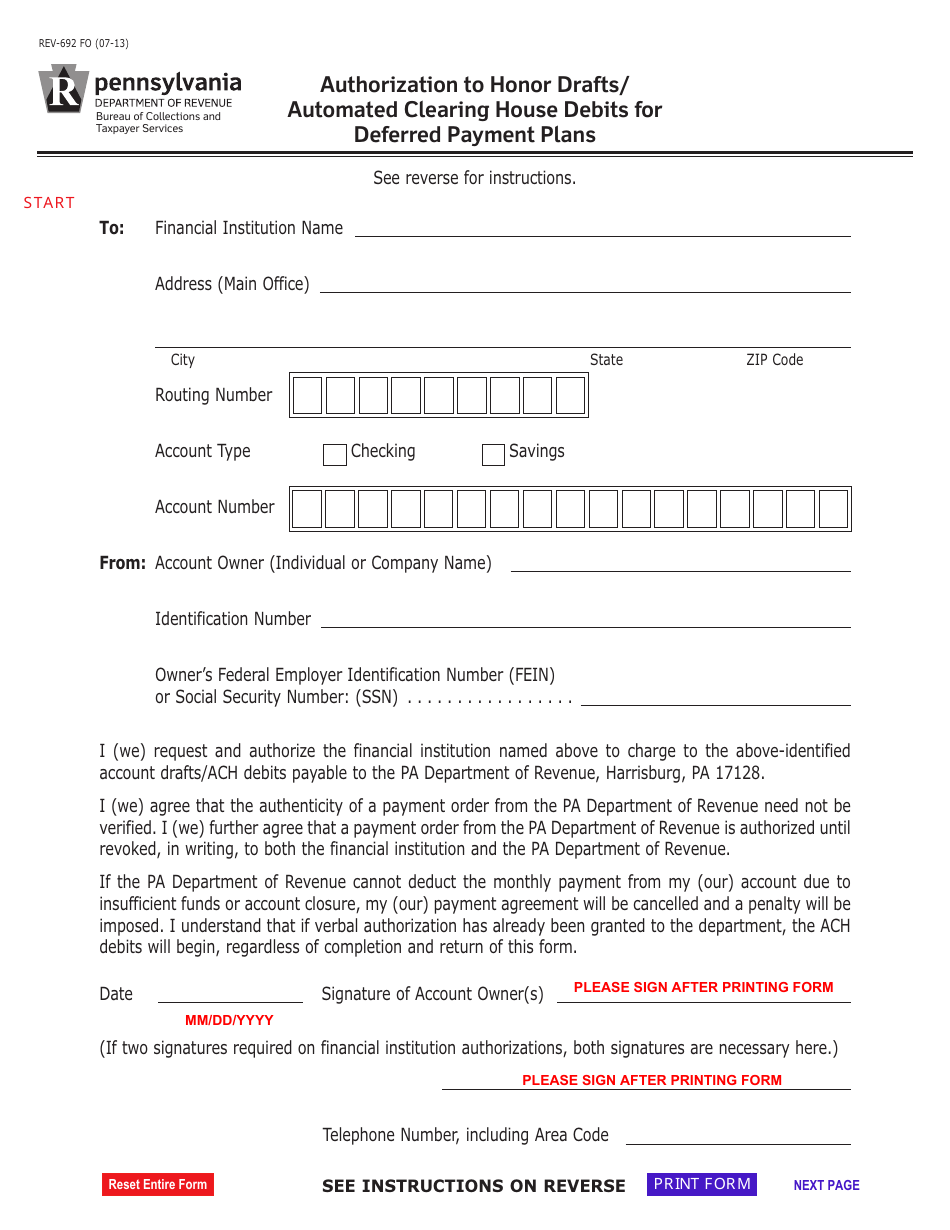

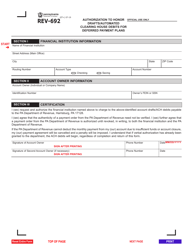

Form REV-692 FO Authorization to Honor Drafts / Automated Clearing House Debits for Deferred Payment Plans - Pennsylvania

What Is Form REV-692 FO?

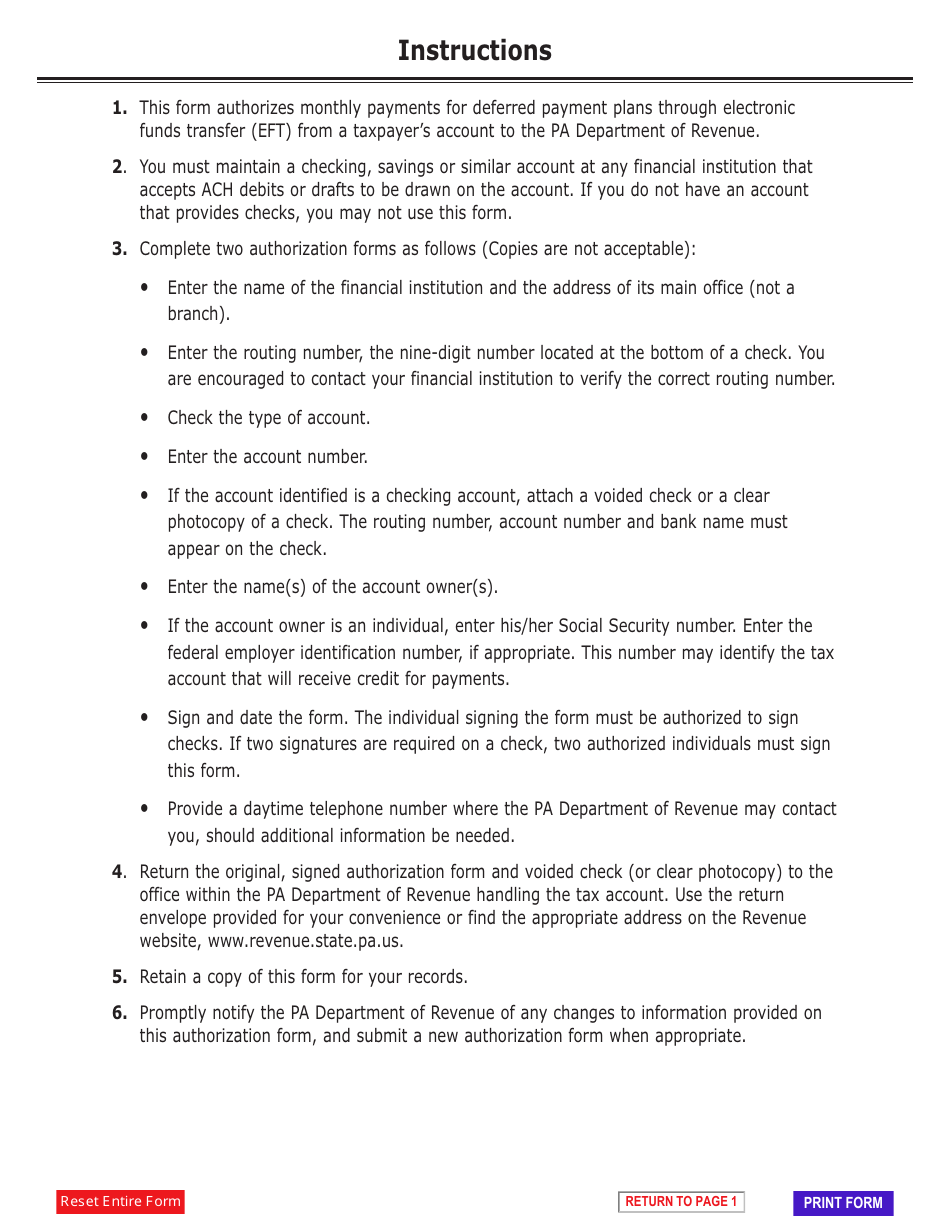

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-692?

A: Form REV-692 is an Authorization to Honor Drafts/Automated Clearing House (ACH) Debits for Deferred Payment Plans in Pennsylvania.

Q: Who needs to use Form REV-692?

A: This form should be used by individuals or businesses in Pennsylvania who wish to authorize the Department of Revenue to initiate ACH debits from their bank account for deferred payment plans.

Q: What is the purpose of Form REV-692?

A: The purpose of Form REV-692 is to authorize the Pennsylvania Department of Revenue to withdraw funds directly from your bank account to satisfy your tax debts through an ACH debit.

Q: Is Form REV-692 specific to Pennsylvania?

A: Yes, Form REV-692 is specific to Pennsylvania and should only be used by individuals or businesses in the state.

Q: What information is required on Form REV-692?

A: Form REV-692 requires information such as your name, address, tax account number, bank account details, and the amount you wish to authorize for ACH debits.

Q: Are there any fees associated with using Form REV-692?

A: There are no fees associated with using Form REV-692, but you may still be responsible for any bank fees related to the ACH debits.

Q: Can I cancel or modify my authorization on Form REV-692?

A: Yes, you can cancel or modify your authorization by contacting the Pennsylvania Department of Revenue.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-692 FO by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.