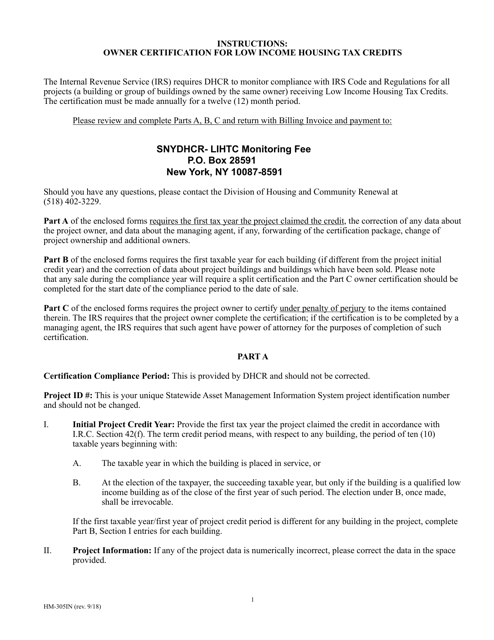

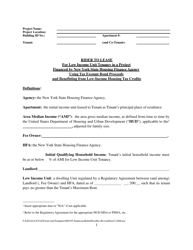

Instructions for Owner Certification for Low Income Housing Tax Credits - New York

This document was released by New York State Homes and Community Renewal and contains the most recent official instructions for Owner Certification for Low Income Housing Tax Credits .

FAQ

Q: What is Owner Certification for Low Income Housing Tax Credits?

A: Owner Certification for Low Income Housing Tax Credits is a process in which property owners in New York certify their eligibility to claim tax credits for providing affordable housing.

Q: Who is required to complete Owner Certification for Low Income Housing Tax Credits?

A: Property owners who want to claim tax credits for providing affordable housing in New York are required to complete Owner Certification.

Q: How can I complete Owner Certification for Low Income Housing Tax Credits?

A: You can complete Owner Certification for Low Income Housing Tax Credits by submitting the required forms and documentation to the appropriate agency or organization in New York.

Q: What forms and documentation are required for Owner Certification?

A: The specific forms and documentation required for Owner Certification may vary, but generally, you will need to provide information about the property, the tenants, and the rent or income limits.

Q: Is there a deadline for completing Owner Certification?

A: Yes, there is typically a deadline for completing Owner Certification for Low Income Housing Tax Credits. It is important to check with the relevant agency or organization in New York for specific deadlines.

Q: What are the benefits of completing Owner Certification?

A: Completing Owner Certification allows property owners to claim tax credits for providing affordable housing in New York, which can help offset costs and support the availability of affordable housing.

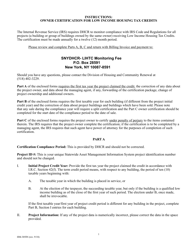

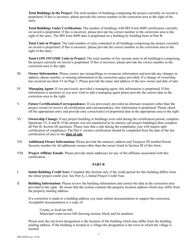

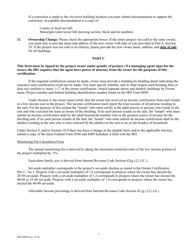

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the New York State Homes and Community Renewal.