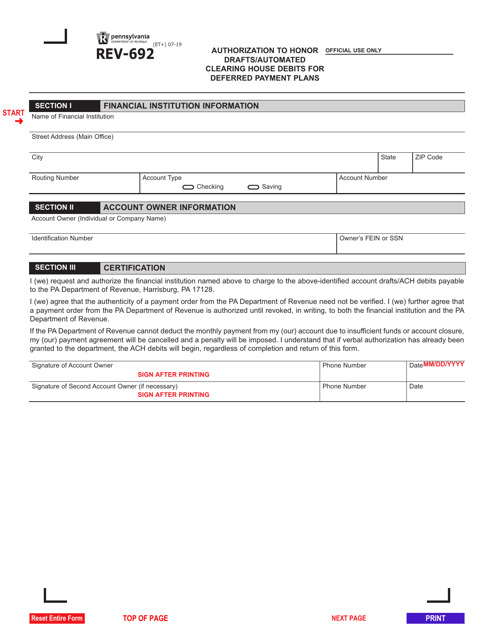

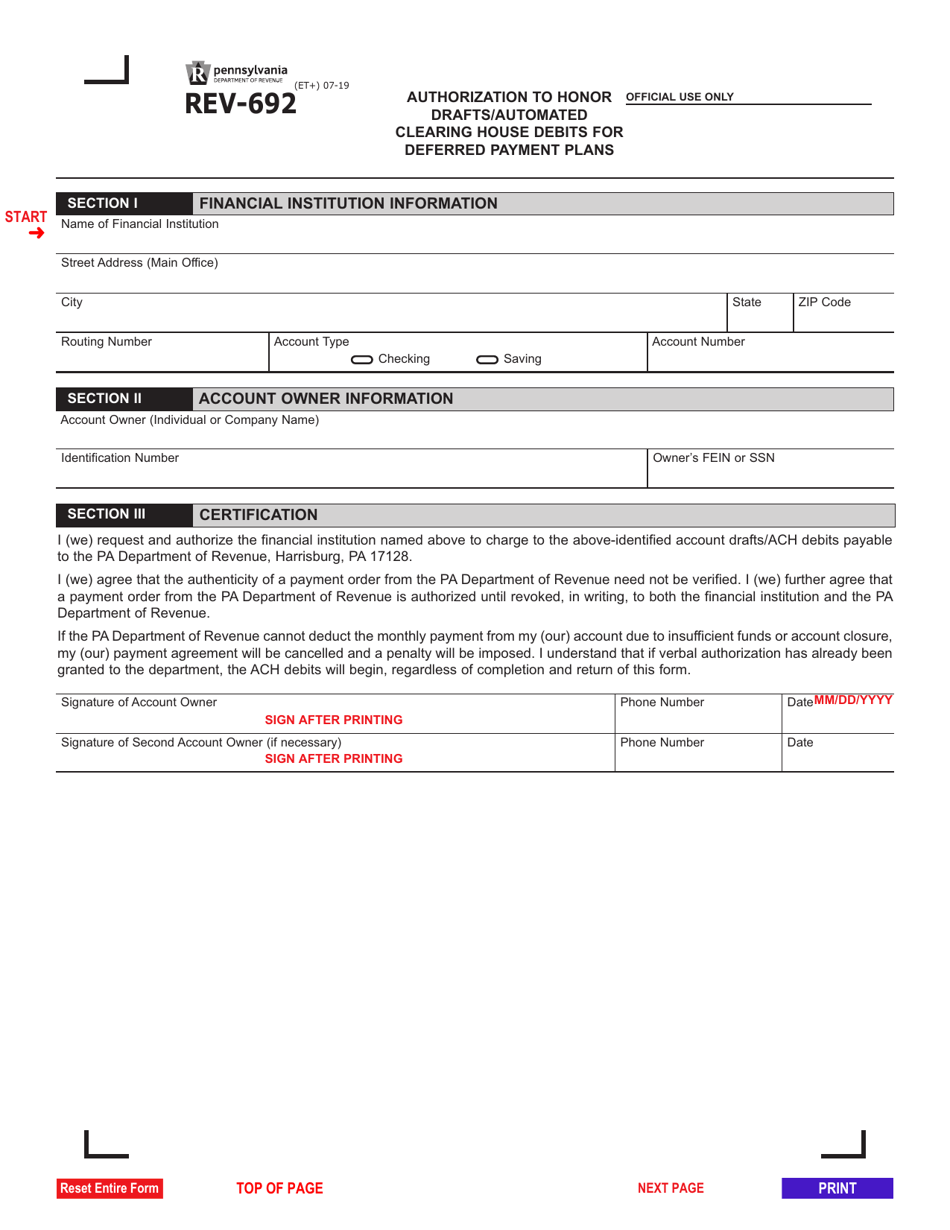

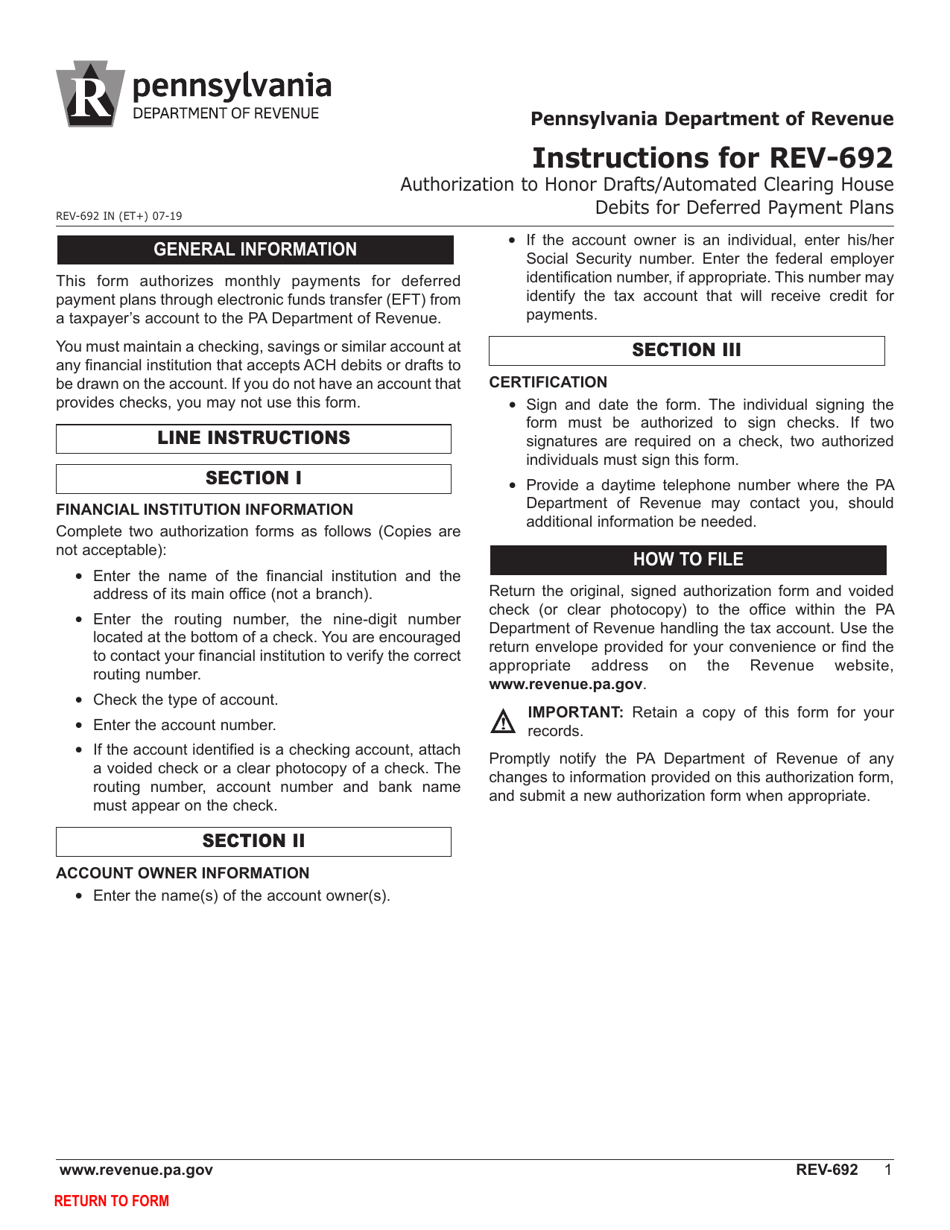

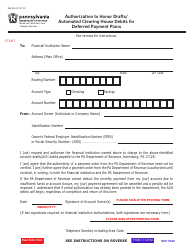

Form REV-692 Authorization to Honor Drafts / Automated Clearing House Debits for Deferred Payment Plans - Pennsylvania

What Is Form REV-692?

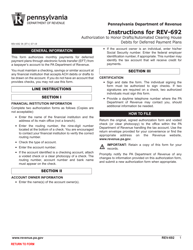

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-692?

A: Form REV-692 is the Authorization to Honor Drafts/Automated Clearing House (ACH) Debits for Deferred Payment Plans in Pennsylvania.

Q: Who needs to use Form REV-692?

A: Anyone who wants to authorize the Pennsylvania Department of Revenue to automatically deduct payments from their bank account for a deferred payment plan needs to use Form REV-692.

Q: What is a deferred payment plan?

A: A deferred payment plan allows taxpayers to make installment payments for their tax debt over time.

Q: Why would someone use Form REV-692?

A: Someone would use Form REV-692 to authorize the Pennsylvania Department of Revenue to automatically deduct payments for a deferred payment plan, making it easier to manage their tax debt.

Q: How long does it take for a deferred payment plan to be approved?

A: The approval process for a deferred payment plan can vary. It is best to contact the Pennsylvania Department of Revenue for more information on timelines.

Q: What if I can't afford the payments for a deferred payment plan?

A: If you can't afford the payments for a deferred payment plan, you may be able to explore other options with the Pennsylvania Department of Revenue, such as an offer in compromise or a temporary delay of collection.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-692 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.