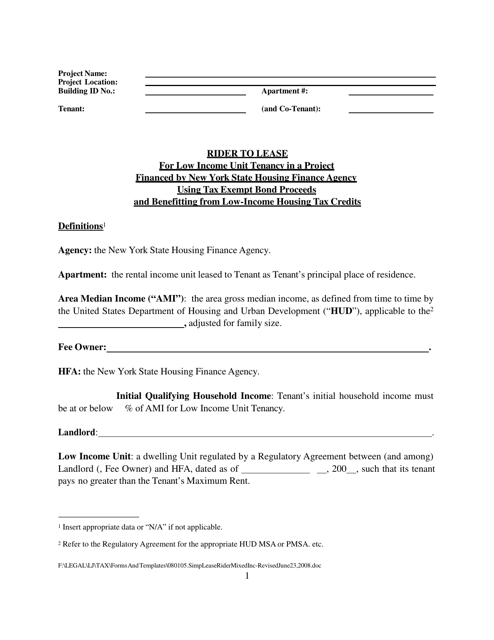

Rider to Lease for Low Income Unit Tenancy in a Project Financed by New York State Housing Finance Agency Using Tax Exempt Bond Proceeds and Benefitting From Low-Income Housing Tax Credits - New York

Rider to Lease for Tax Exempt Bond Proceeds and Benefitting From Low-Income Housing Tax Credits is a legal document that was released by the New York State Homes and Community Renewal - a government authority operating within New York.

FAQ

Q: What is the purpose of the rider to lease for low-income unit tenancy?

A: The purpose is to ensure that low-income individuals are able to rent and live in the project.

Q: What is the New York State Housing Finance Agency?

A: It is a government agency that provides financing for affordable housing projects in New York State.

Q: What are tax-exempt bond proceeds?

A: Tax-exempt bond proceeds are funds raised by the sale of bonds that provide developers with low-cost financing for affordable housing projects.

Q: What are low-income housing tax credits?

A: Low-income housing tax credits are federal tax incentives given to developers to create affordable housing units for low-income individuals.

Q: How does the rider to lease benefit from low-income housing tax credits?

A: The rider to lease benefits from low-income housing tax credits by ensuring that the units are occupied by eligible low-income tenants, which helps the project maintain its eligibility for the tax credits.

Q: Who is eligible to rent low-income units in the project?

A: Low-income individuals who meet the income requirements set by the project are eligible to rent the low-income units.

Q: What is the role of the New York State Housing Finance Agency in this project?

A: The agency provides financing and oversight for the project, ensuring that it adheres to the requirements set by the tax-exempt bond proceeds and low-income housing tax credits.

Q: What is the purpose of the low-income housing tax credits?

A: The purpose of the low-income housing tax credits is to incentivize the development of affordable housing for low-income individuals by providing tax benefits to developers.

Q: What is the purpose of the tax-exempt bond proceeds?

A: The purpose of the tax-exempt bond proceeds is to provide developers with low-cost financing for affordable housing projects, reducing the overall development costs.

Q: How does the rider to lease ensure the affordability of the units?

A: The rider to lease sets income limits and rent restrictions to ensure that the units remain affordable for low-income tenants throughout the duration of the project.

Form Details:

- Released on June 23, 2008;

- The latest edition currently provided by the New York State Homes and Community Renewal;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Homes and Community Renewal.