This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form TC-65

for the current year.

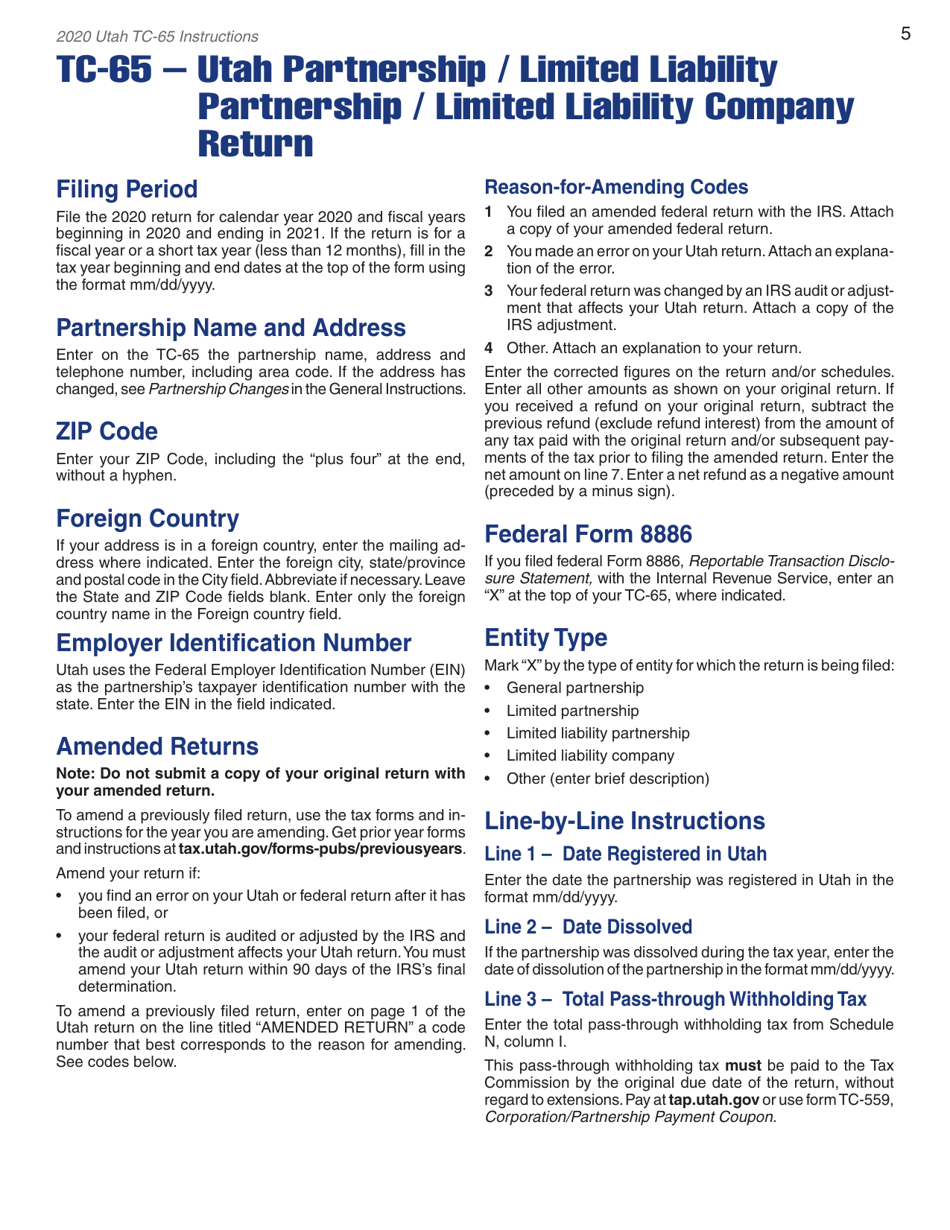

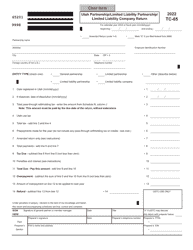

Instructions for Form TC-65 Utah Partnership / Limited Liability Partnership / Limited Liability Company Return - Utah

This document contains official instructions for Form TC-65 , Utah Partnership/Limited Liability Partnership/ Limited Liability Company Return - a form released and collected by the Utah State Tax Commission.

FAQ

Q: What is Form TC-65?

A: Form TC-65 is a tax return form for Partnership/Limited Liability Partnership/ Limited Liability Company in Utah.

Q: Who needs to file Form TC-65?

A: Partnerships, Limited Liability Partnerships, and Limited Liability Companies in Utah need to file Form TC-65.

Q: What information is required on Form TC-65?

A: Form TC-65 requires the business's income, deductions, and other financial information.

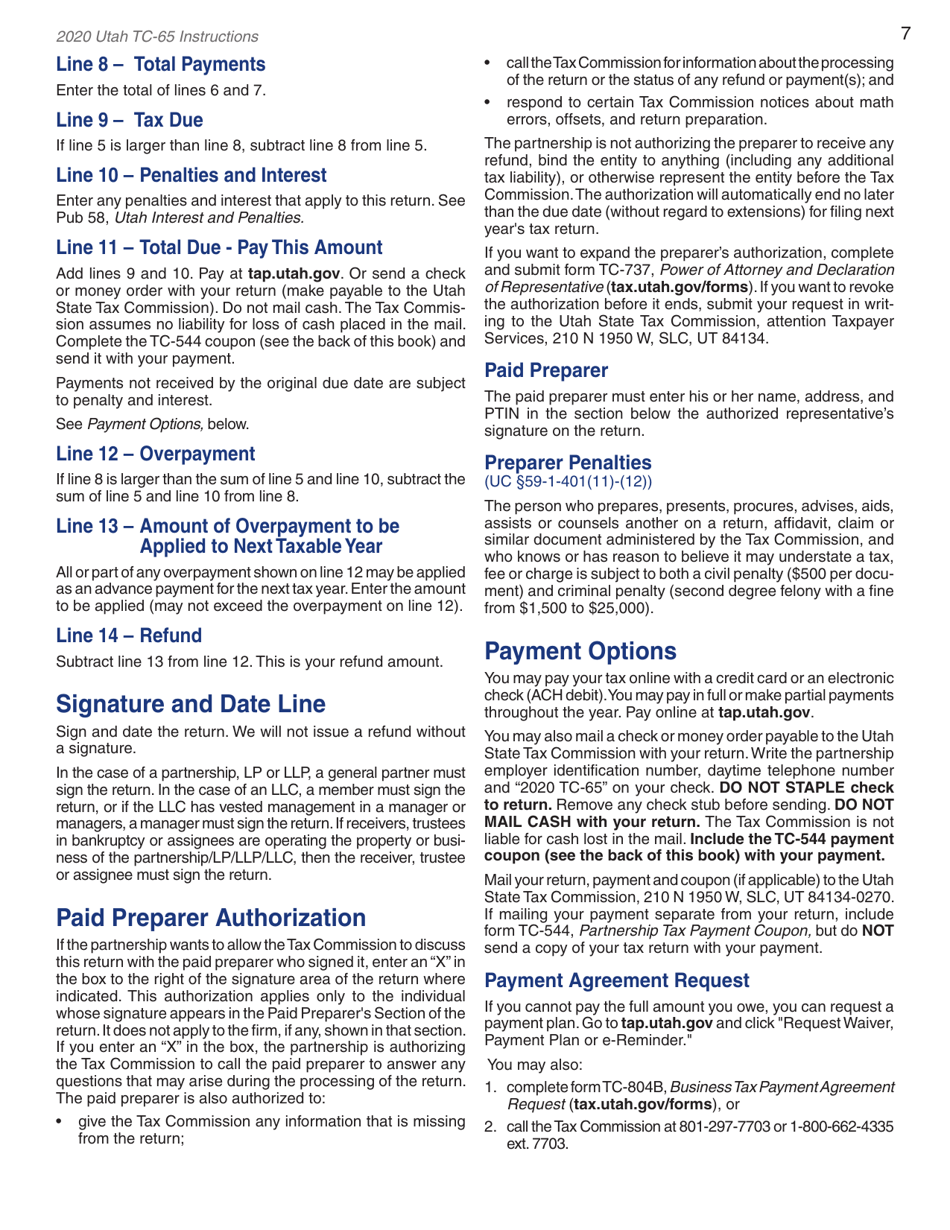

Q: When is Form TC-65 due?

A: Form TC-65 is due on the 15th day of the 4th month following the close of the tax year.

Q: How can I file Form TC-65?

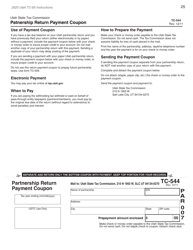

A: Form TC-65 can be filed electronically or by mail.

Q: Is there a fee for filing Form TC-65?

A: Yes, there is a filing fee for Form TC-65. The fee varies depending on the type of entity and the business income.

Q: Can I request an extension to file Form TC-65?

A: Yes, you can request an extension to file Form TC-65. The extension must be requested before the original due date.

Q: What happens if I don't file Form TC-65?

A: Failure to file Form TC-65 may result in penalties and interest.

Instruction Details:

- This 28-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Utah State Tax Commission.