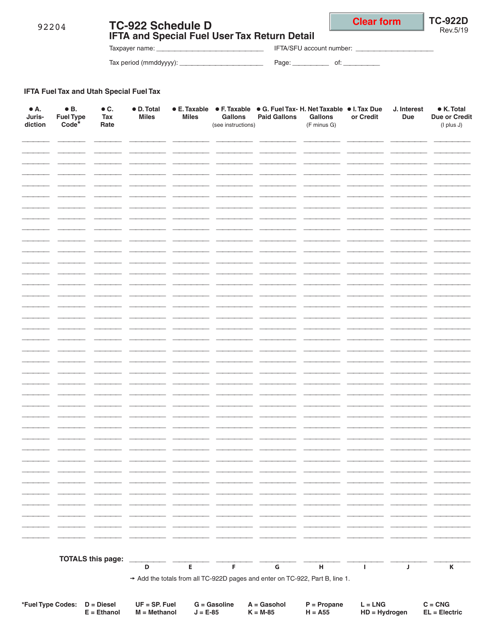

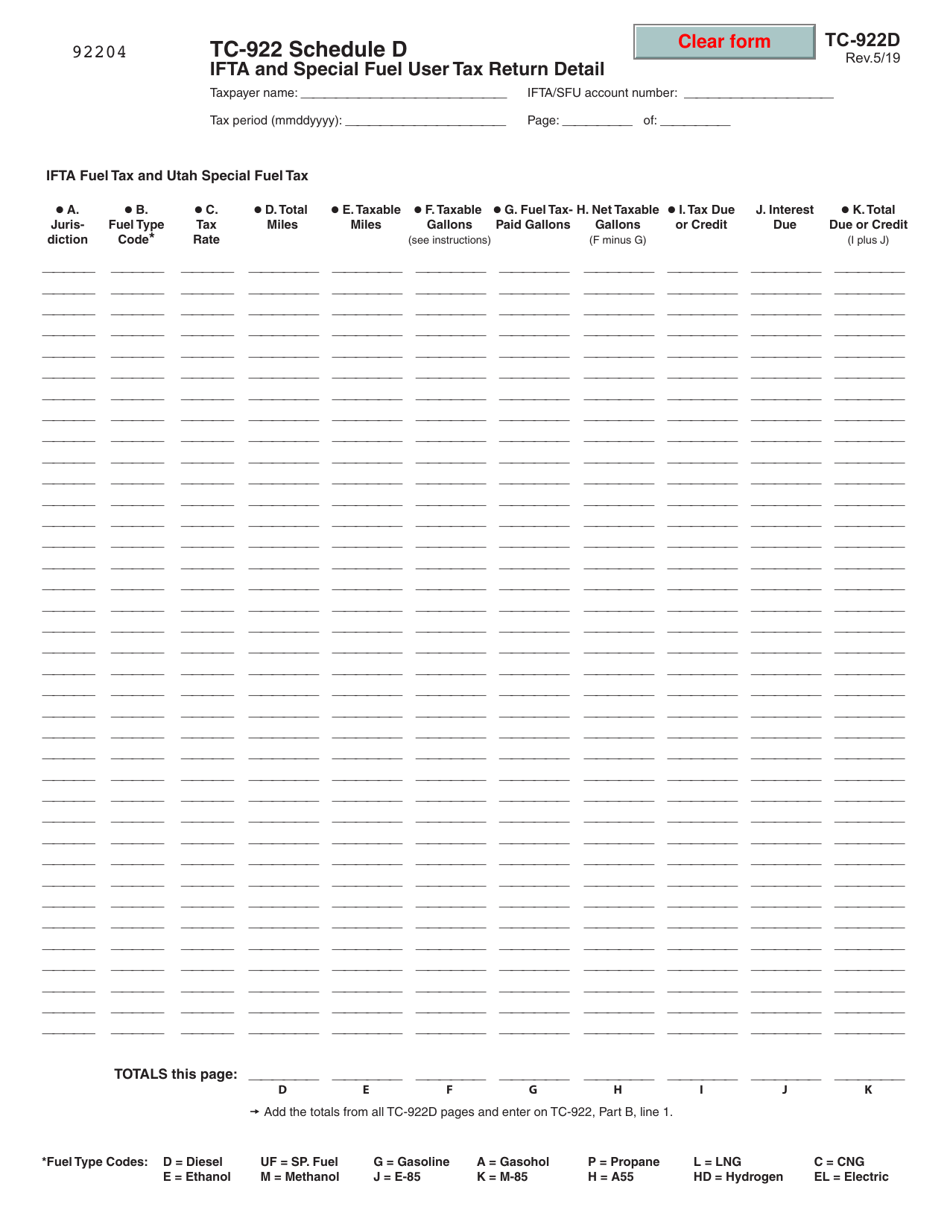

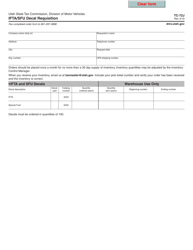

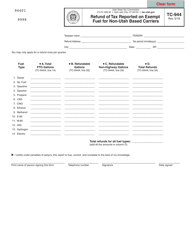

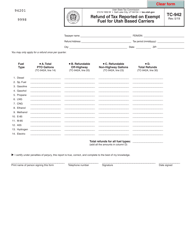

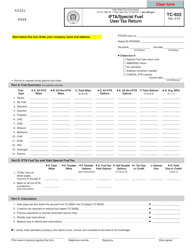

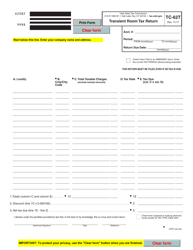

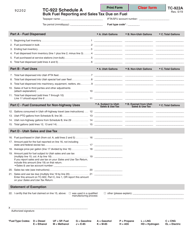

Form TC-922 Schedule D Ifta and Special Fuel User Tax Return Detail - Utah

What Is Form TC-922 Schedule D?

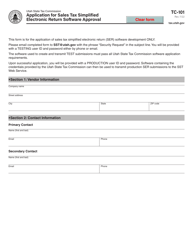

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-922, Ifta/Special Fuel User Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-922?

A: Form TC-922 is the Schedule D IFTA and Special Fuel User Tax Return Detail for Utah.

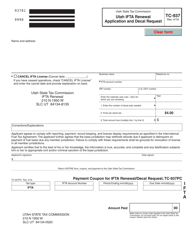

Q: What does IFTA stand for?

A: IFTA stands for International Fuel Tax Agreement.

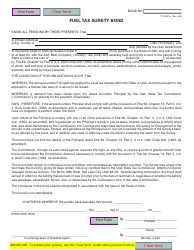

Q: What is the purpose of Form TC-922?

A: Form TC-922 is used to report and pay fuel taxes under the International Fuel Tax Agreement (IFTA) and Special Fuel User Tax in Utah.

Q: Who needs to file Form TC-922?

A: Motor carriers operating qualified motor vehicles in Utah and participating in the IFTA program need to file Form TC-922.

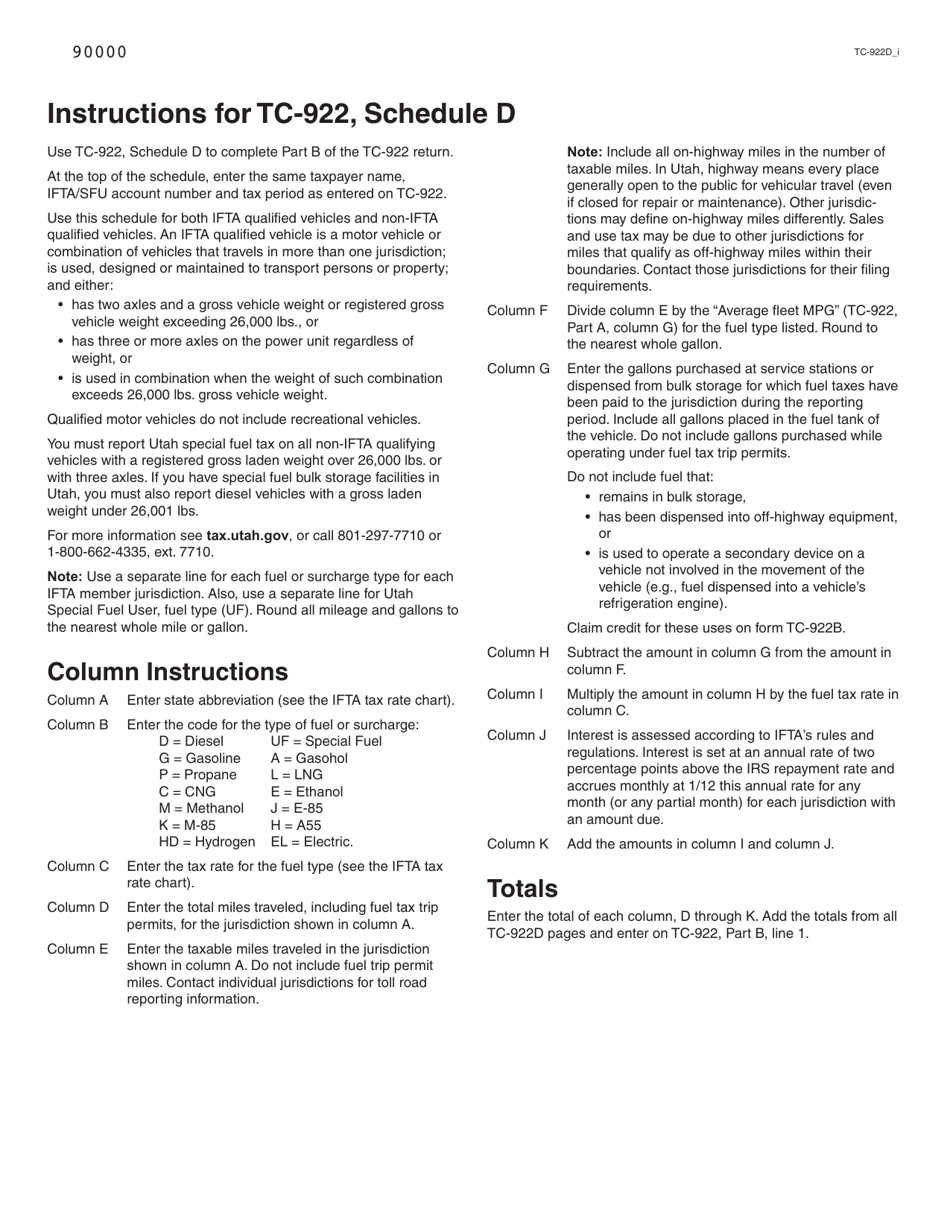

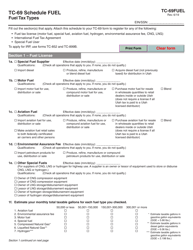

Q: What information is required on Form TC-922?

A: Form TC-922 requires the motor carrier to report miles traveled and fuel usage in Utah and other participating jurisdictions.

Q: When is Form TC-922 due?

A: Form TC-922 is due on the last day of the month following the end of the calendar quarter.

Q: Are there any penalties for late or incorrect filing of Form TC-922?

A: Yes, there are penalties for late or incorrect filing of Form TC-922. It is important to file the form accurately and on time to avoid penalties and interest charges.

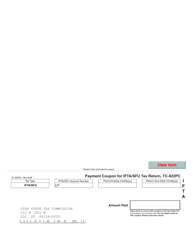

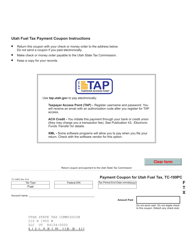

Q: Do I need to include payment with Form TC-922?

A: Yes, motor carriers need to include payment for the fuel taxes owed with Form TC-922.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-922 Schedule D by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.