This version of the form is not currently in use and is provided for reference only. Download this version of

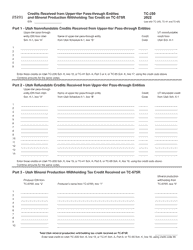

Form TC-65

for the current year.

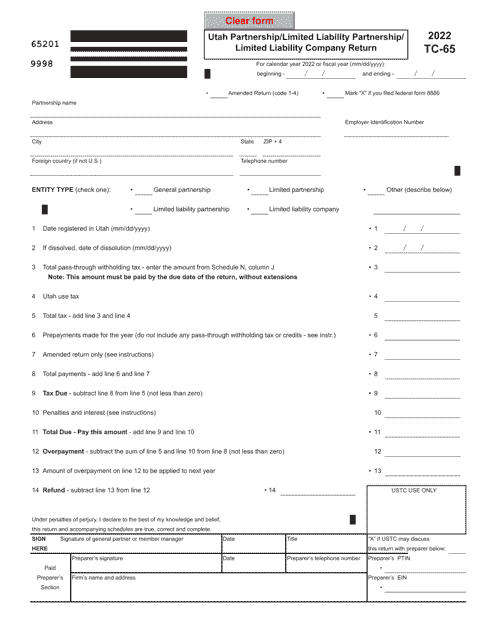

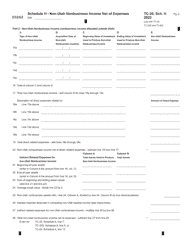

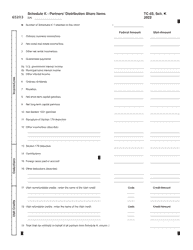

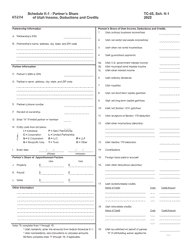

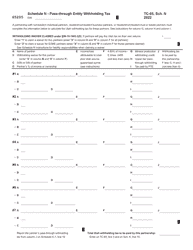

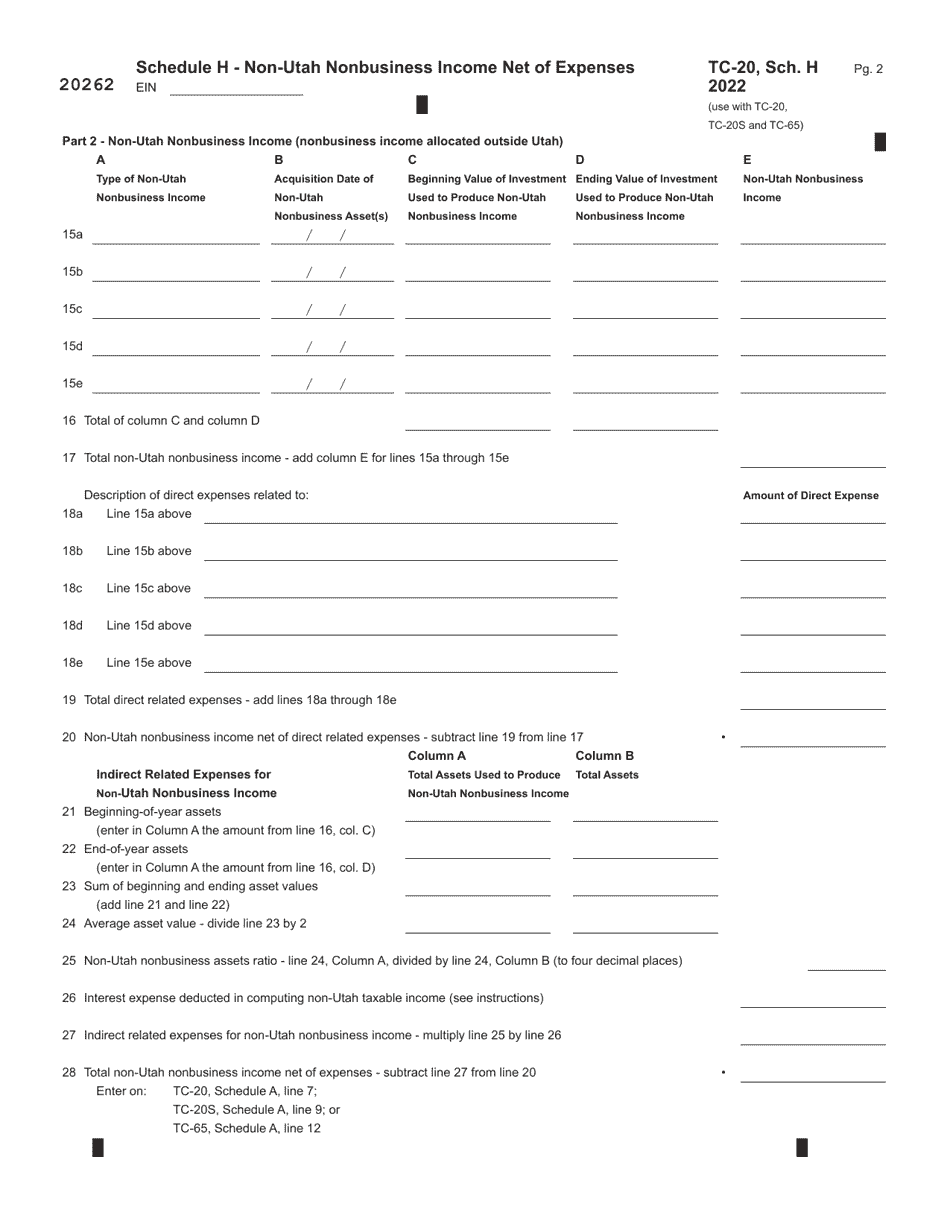

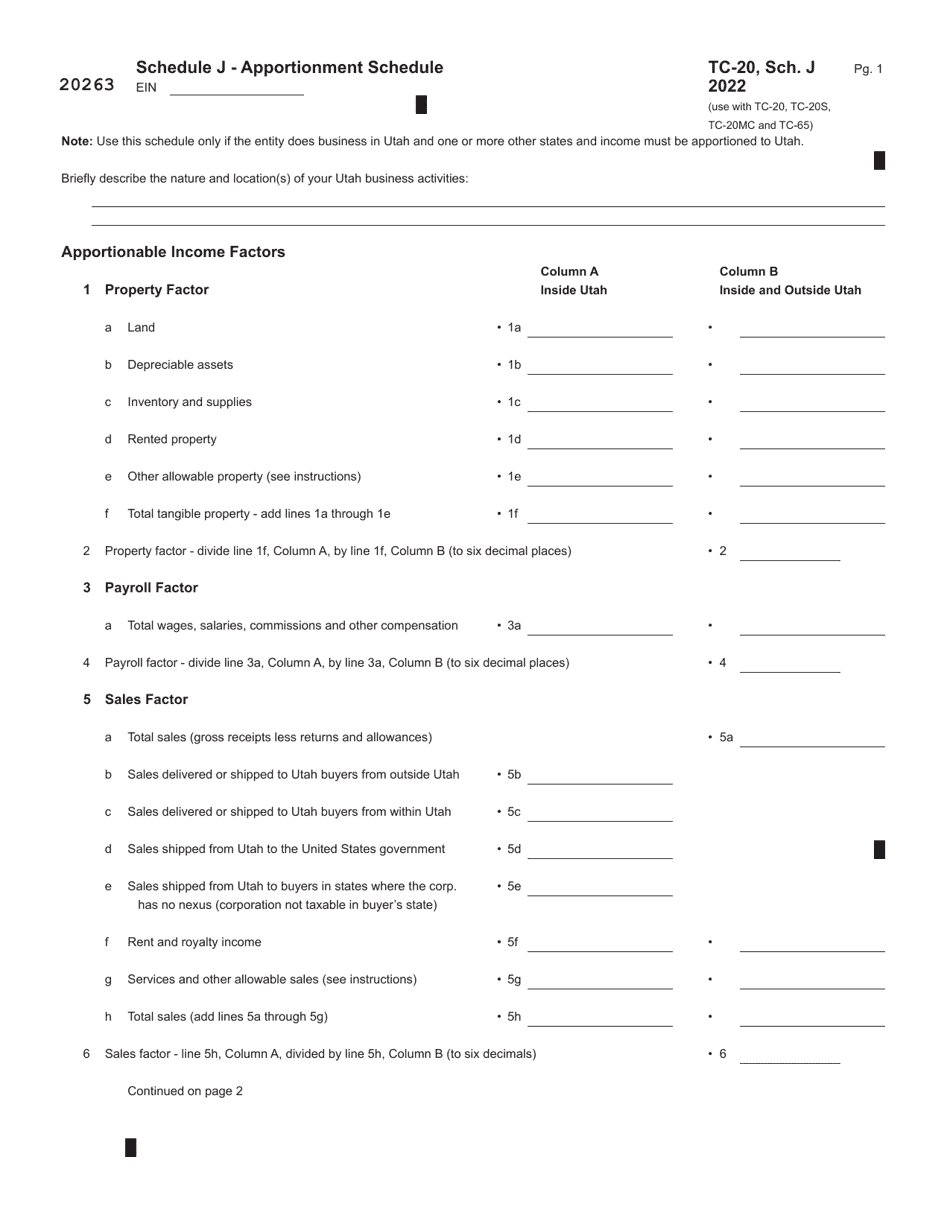

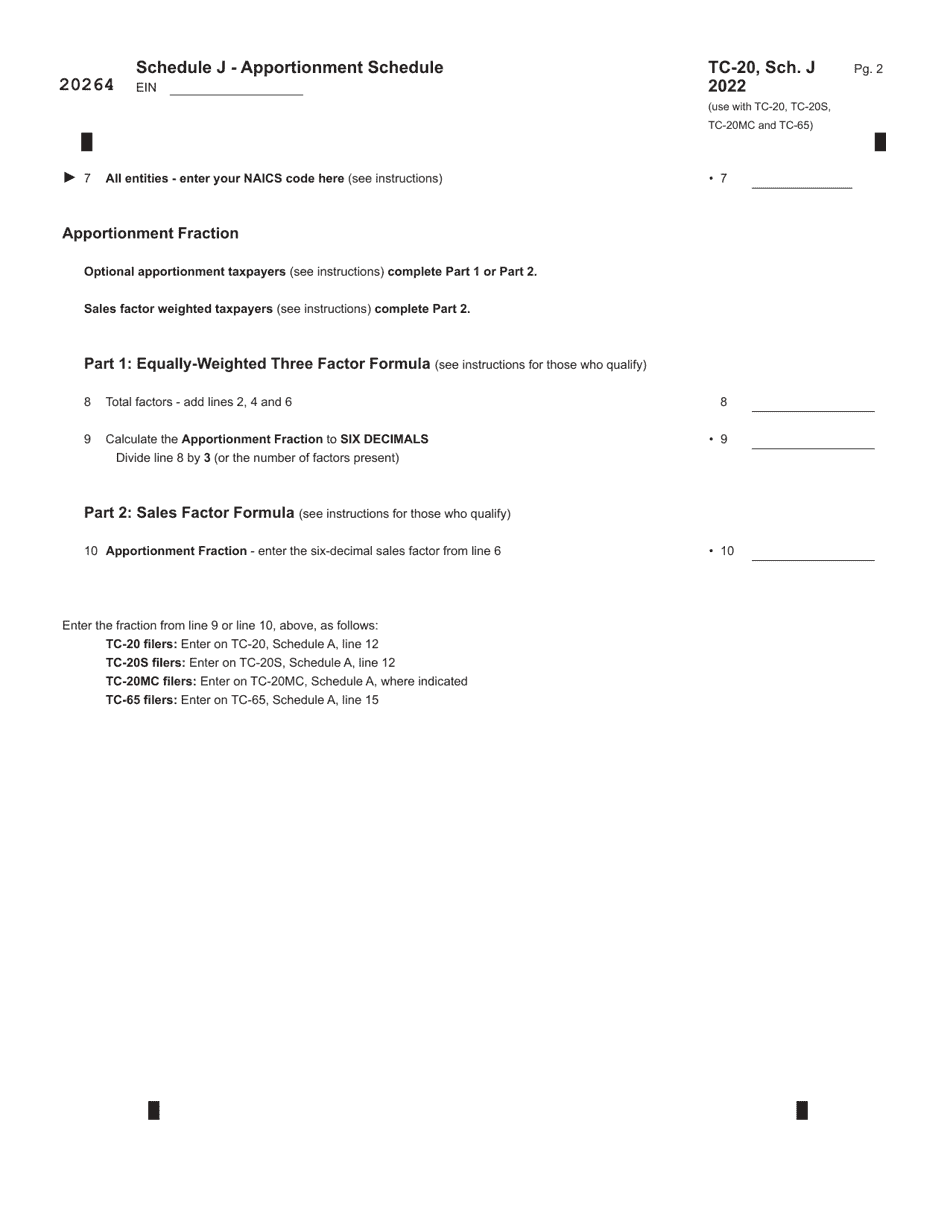

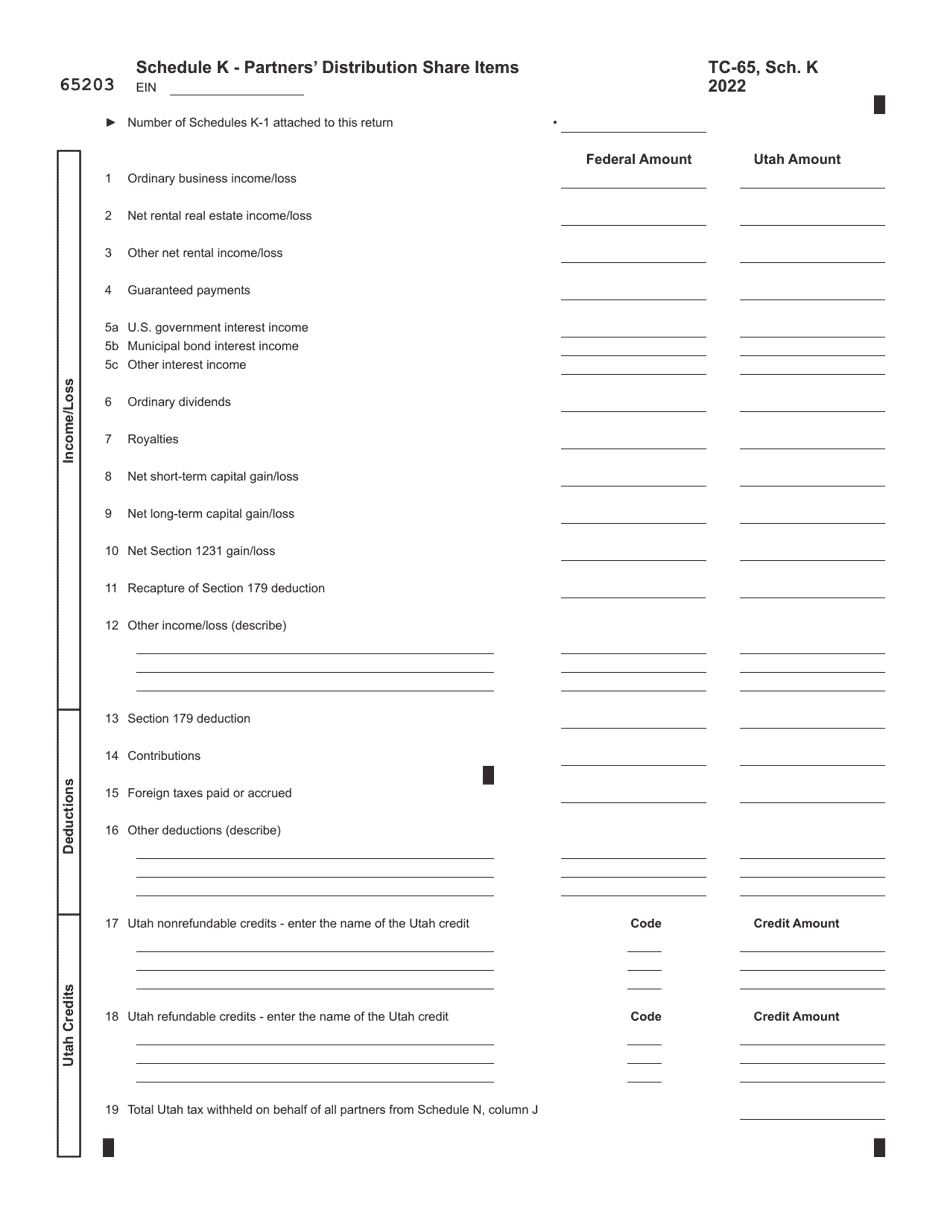

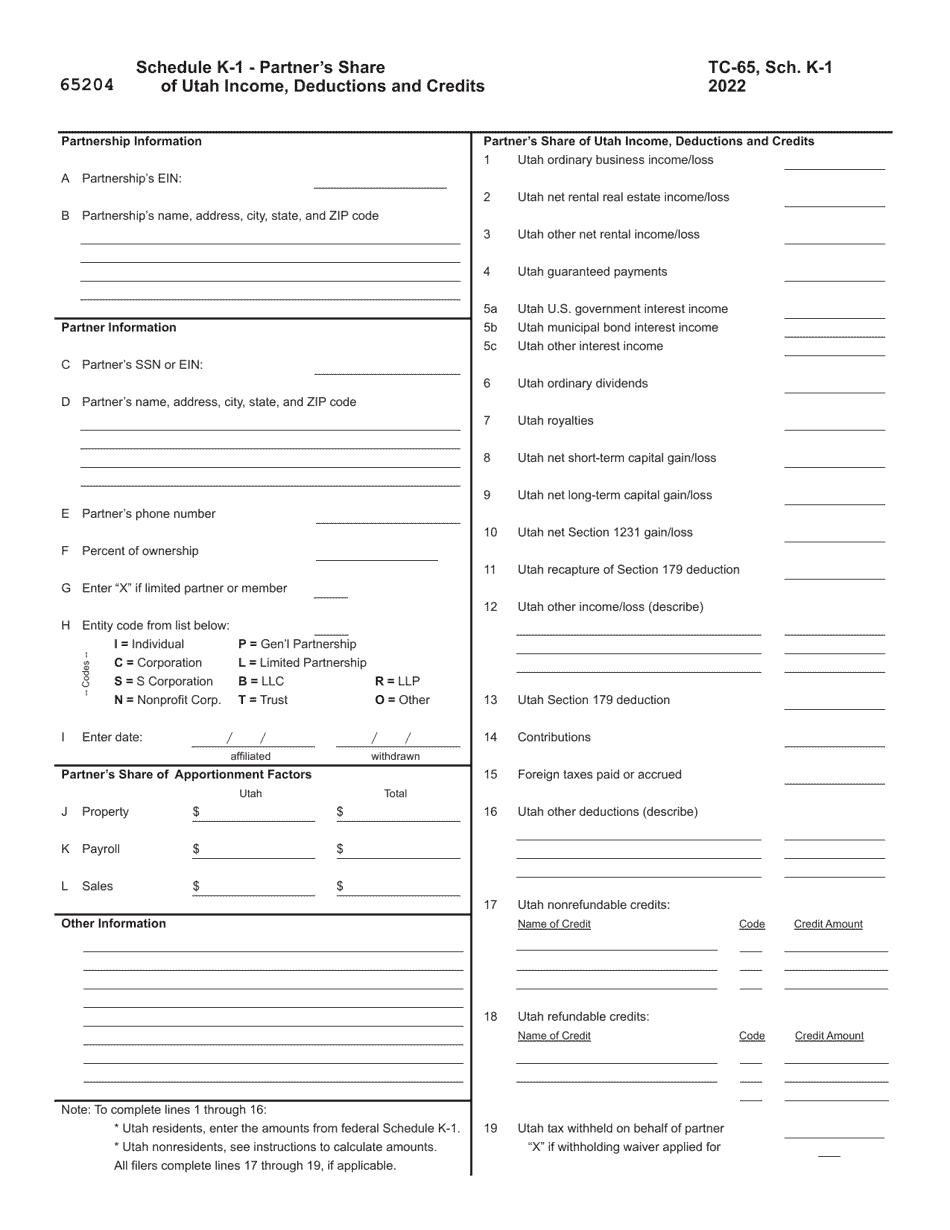

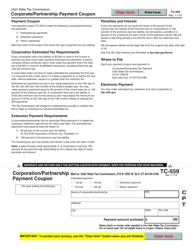

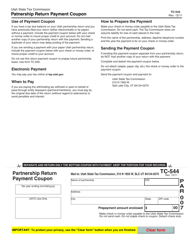

Form TC-65 Utah Partnership / Limited Liability Partnership / Limited Liability Company Return - Utah

What Is Form TC-65?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a TC-65 form?

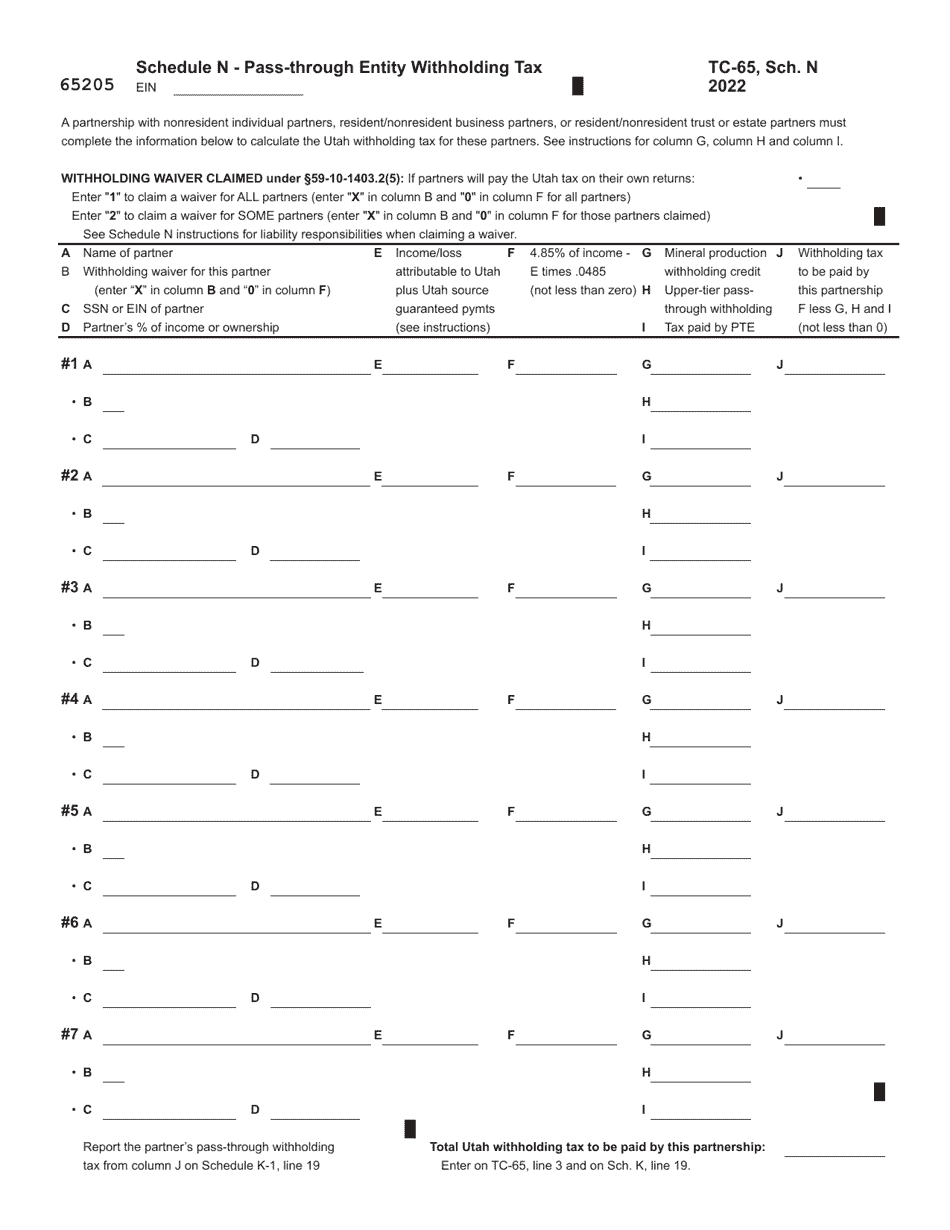

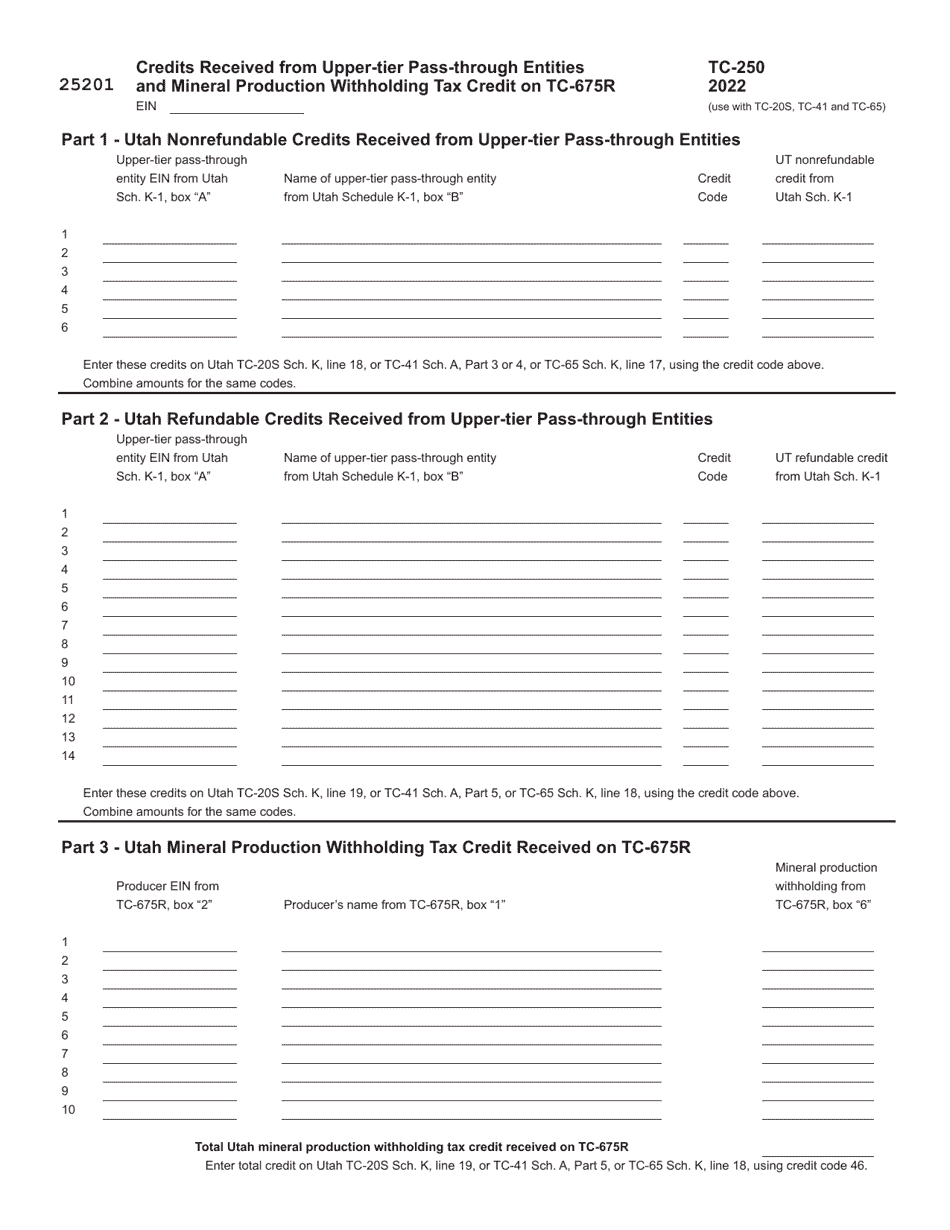

A: The TC-65 form is a tax return form for partnerships, limited liability partnerships (LLPs), and limited liability companies (LLCs) in the state of Utah.

Q: Who needs to file the TC-65 form?

A: Partnerships, LLPs, and LLCs operating in Utah need to file the TC-65 form.

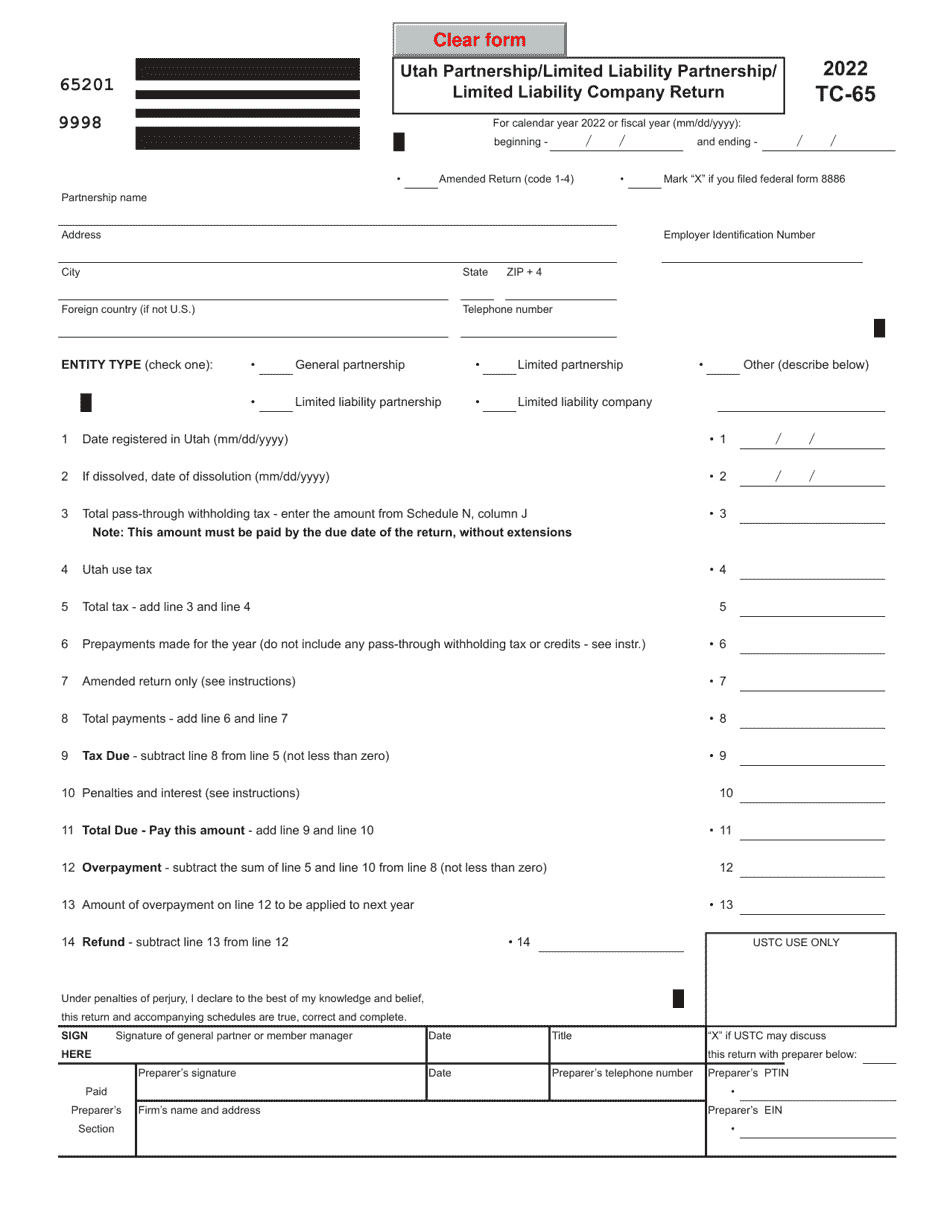

Q: What information does the TC-65 form require?

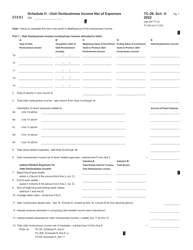

A: The TC-65 form requires information about the partnership/LLP/LLC's income, deductions, credits, and other relevant financial information.

Q: When is the deadline to file the TC-65 form?

A: The deadline to file the TC-65 form is the 15th day of the 4th month following the end of the tax year.

Q: Are there any penalties for not filing the TC-65 form?

A: Yes, failure to file the TC-65 form or filing it late can result in penalties and interest charges.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-65 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.