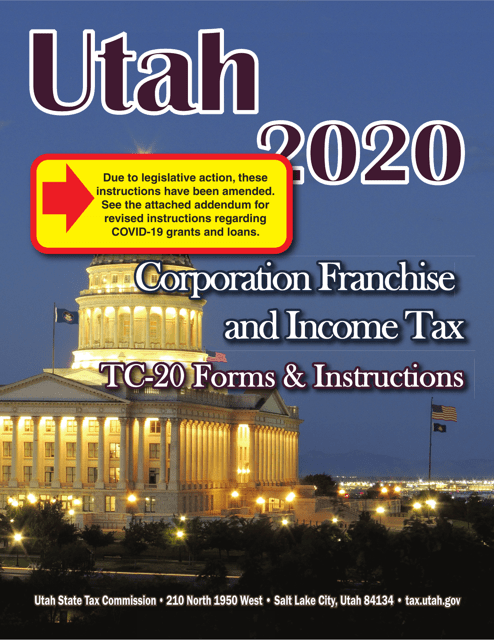

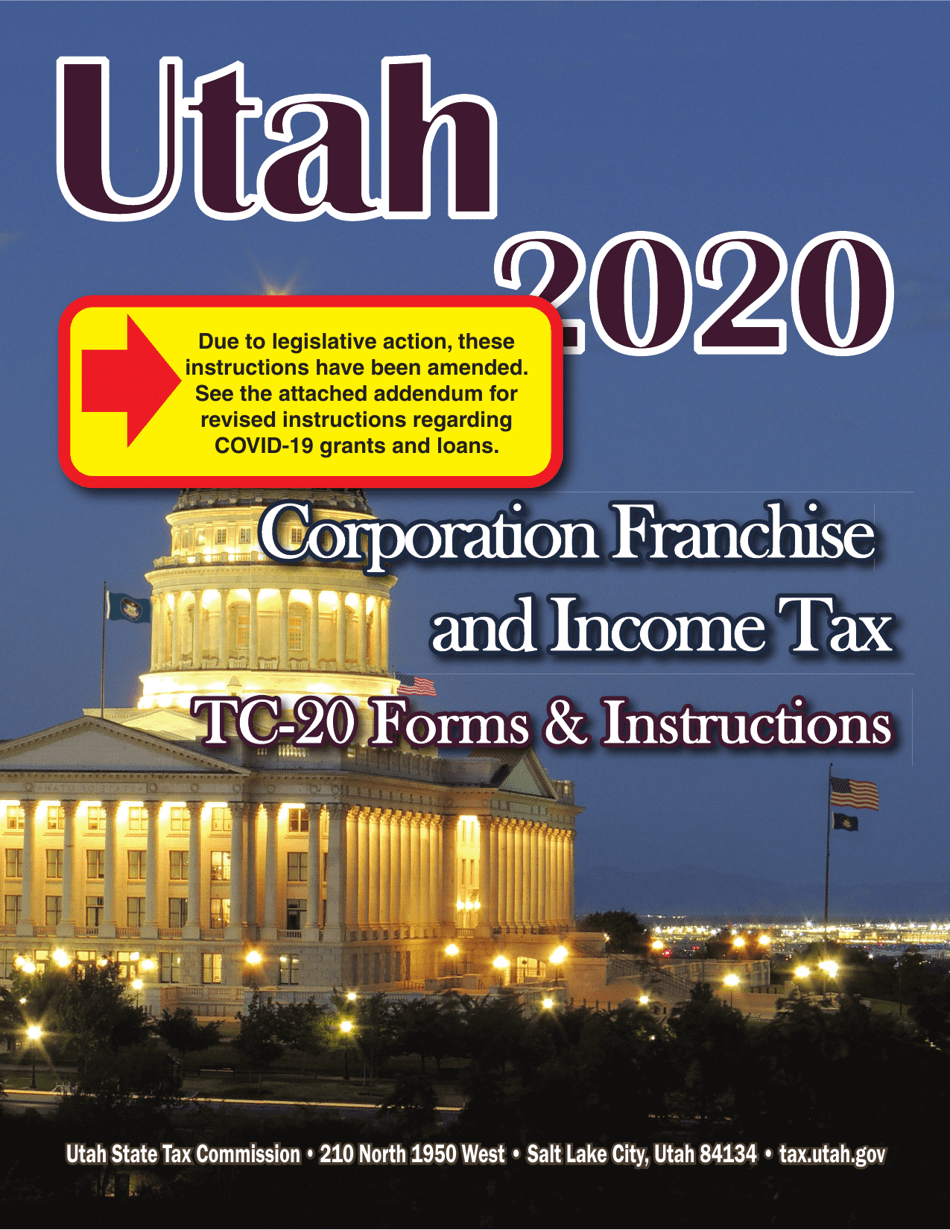

Instructions for Form TC-20 Schedule A, B, C, D, E, H, J, M - Utah

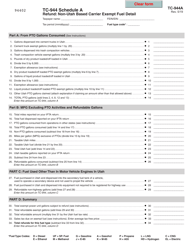

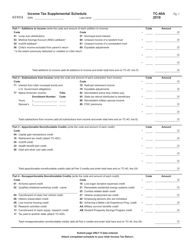

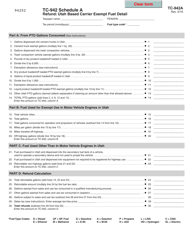

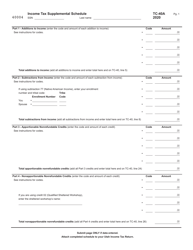

This document contains official instructions for Schedule A , Schedule B , Schedule C , Schedule D , Schedule E , Schedule H , Schedule J , and Schedule M for Form TC-20 . . These documents are released and collected by the Utah State Tax Commission.

FAQ

Q: What is Form TC-20 Schedule A?

A: Form TC-20 Schedule A is an attachment to Form TC-20, which is the Utah Corporation Franchise and Income Tax Return. It is used to report adjustments to federal taxable income.

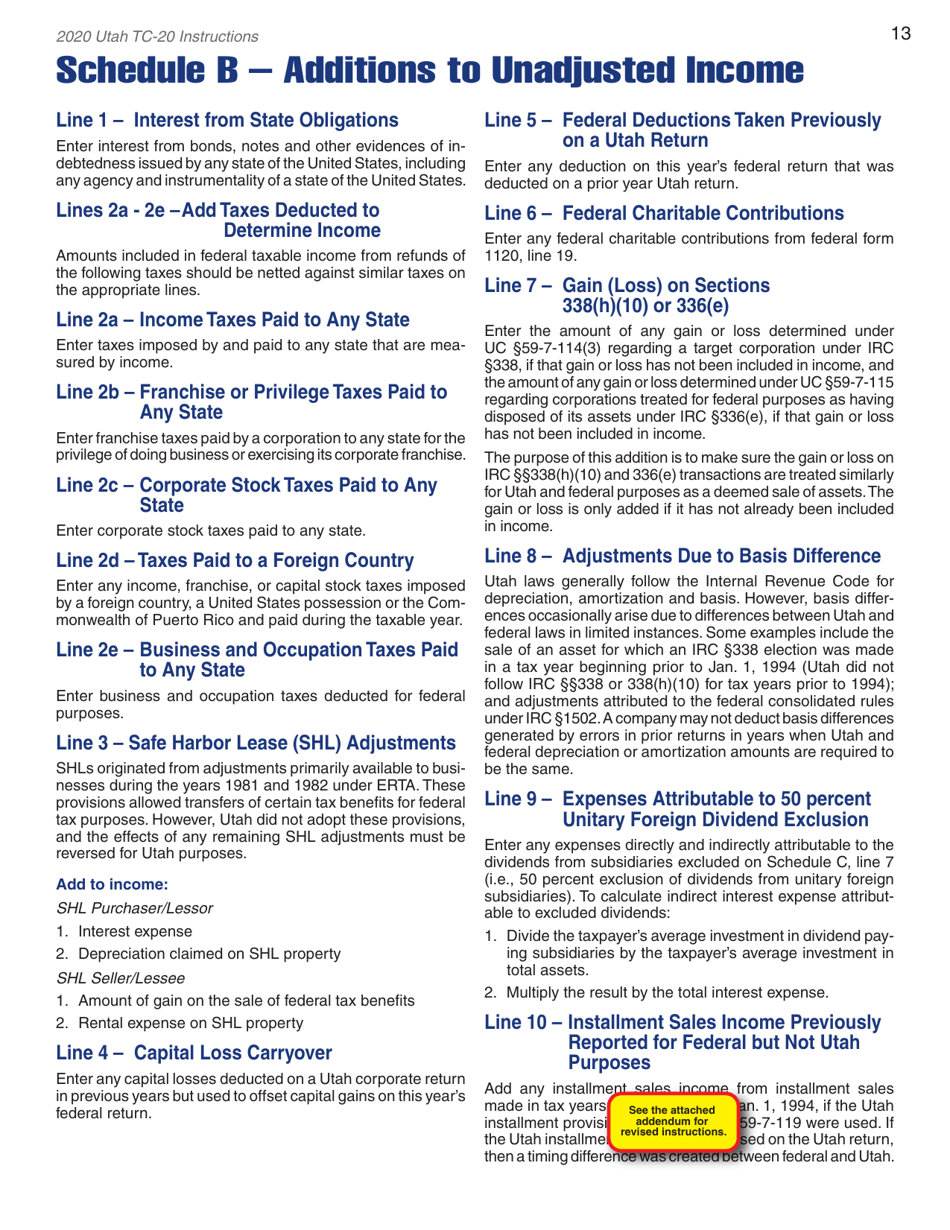

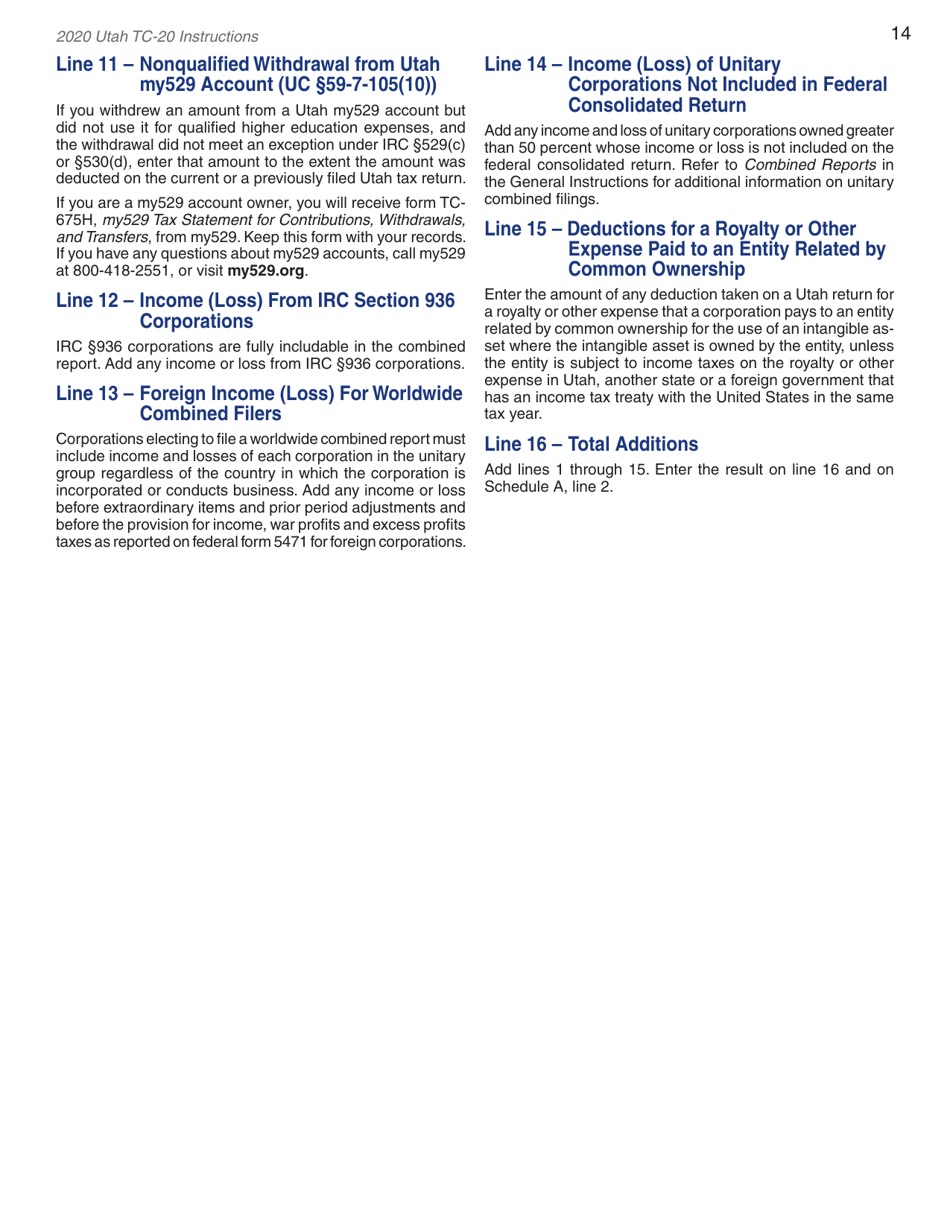

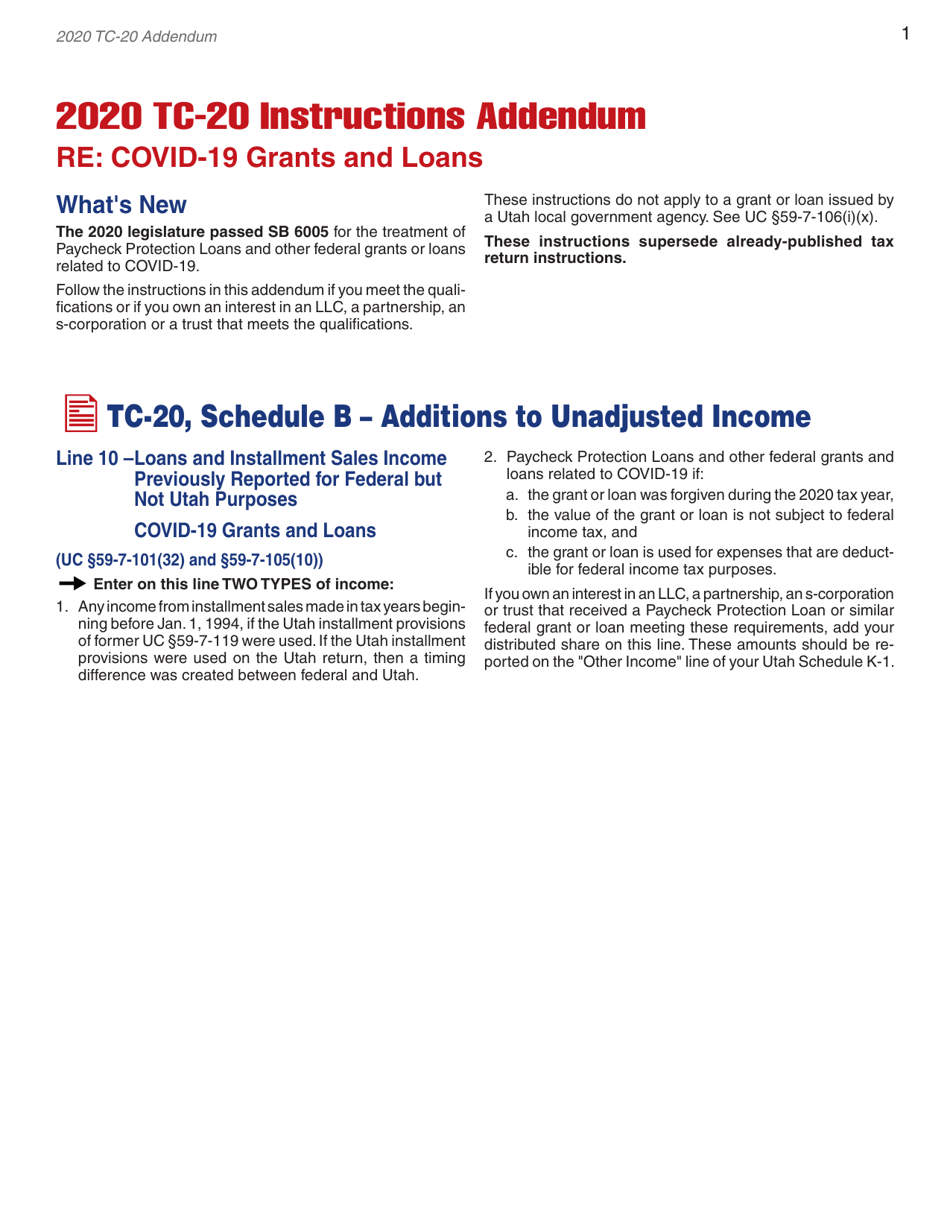

Q: What is Form TC-20 Schedule B?

A: Form TC-20 Schedule B is also an attachment to Form TC-20. It is used to report Utah additions to federal taxable income.

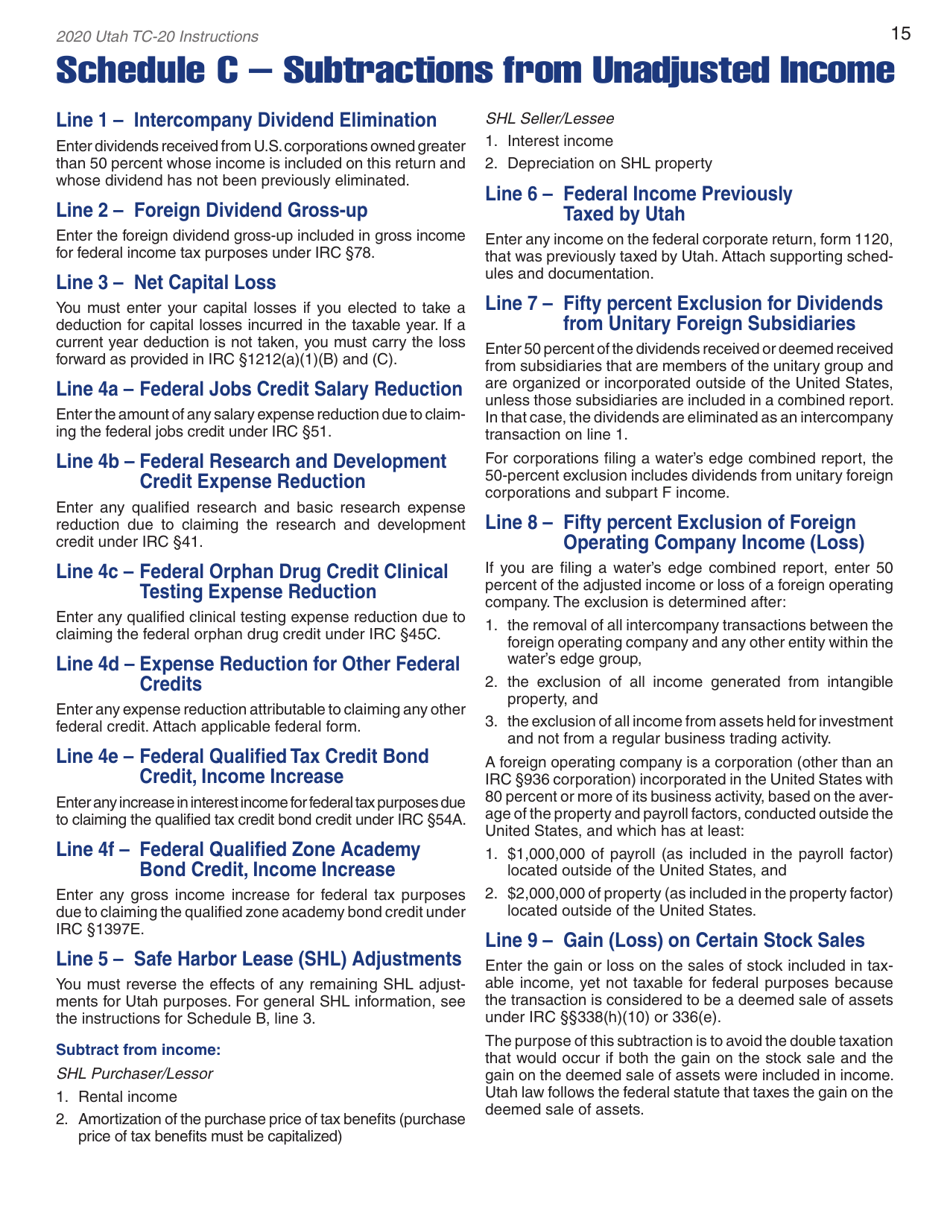

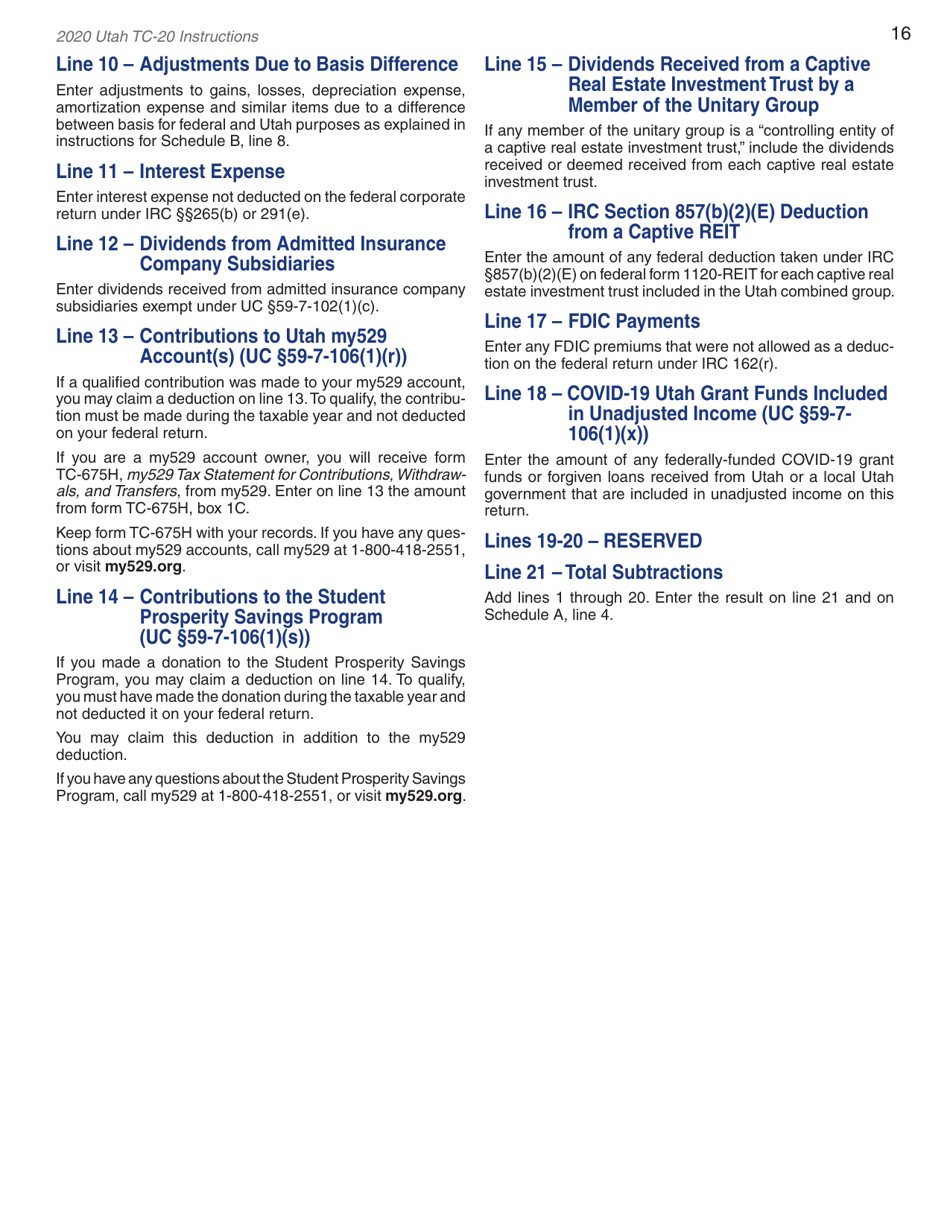

Q: What is Form TC-20 Schedule C?

A: Form TC-20 Schedule C is an attachment to Form TC-20. It is used to report Utah subtractions from federal taxable income.

Q: What is Form TC-20 Schedule D?

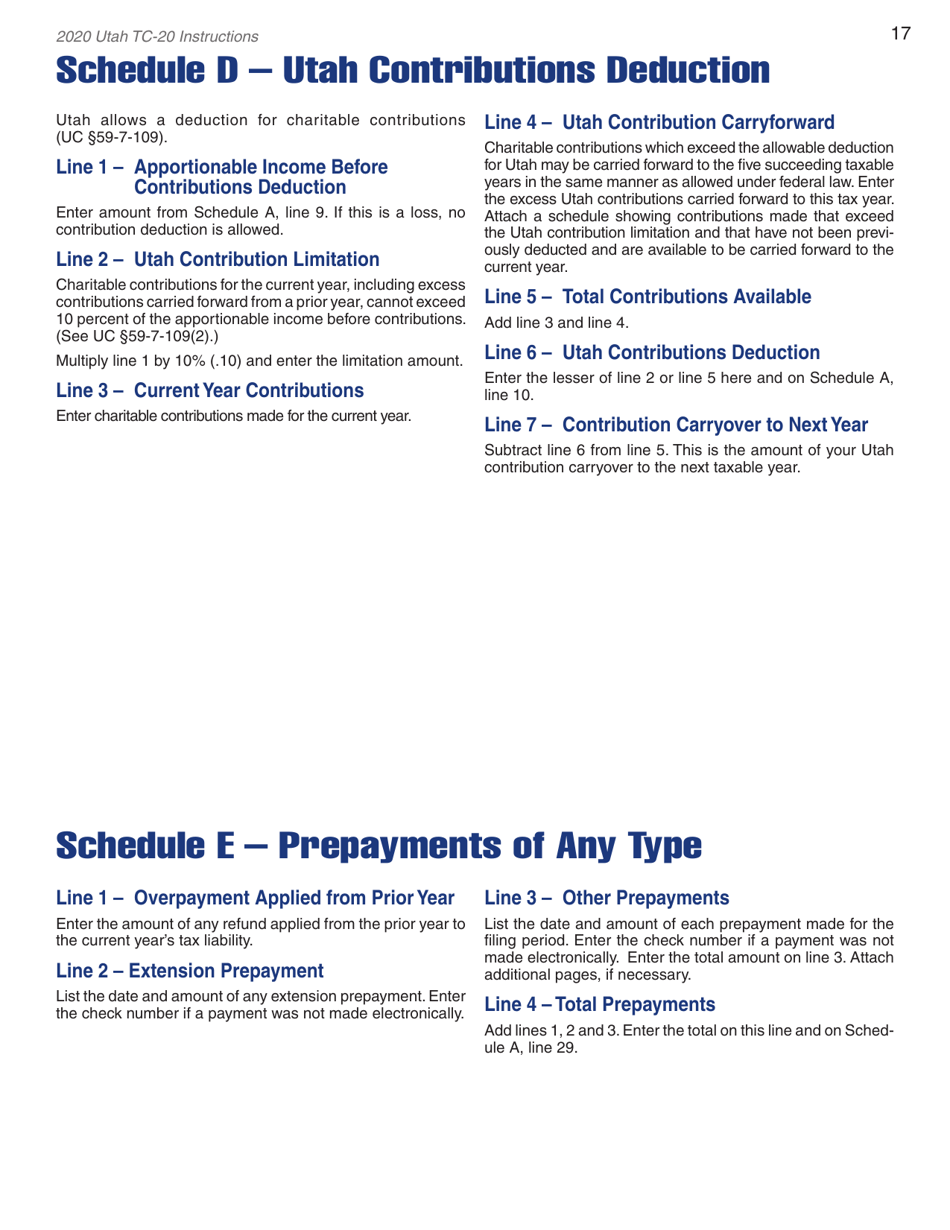

A: Form TC-20 Schedule D is an attachment to Form TC-20. It is used to report Utah modifications to federal taxable income.

Q: What is Form TC-20 Schedule E?

A: Form TC-20 Schedule E is an attachment to Form TC-20. It is used to report Utah alternative minimum tax adjustments and credits.

Q: What is Form TC-20 Schedule H?

A: Form TC-20 Schedule H is an attachment to Form TC-20. It is used to report Utah withholding tax summary.

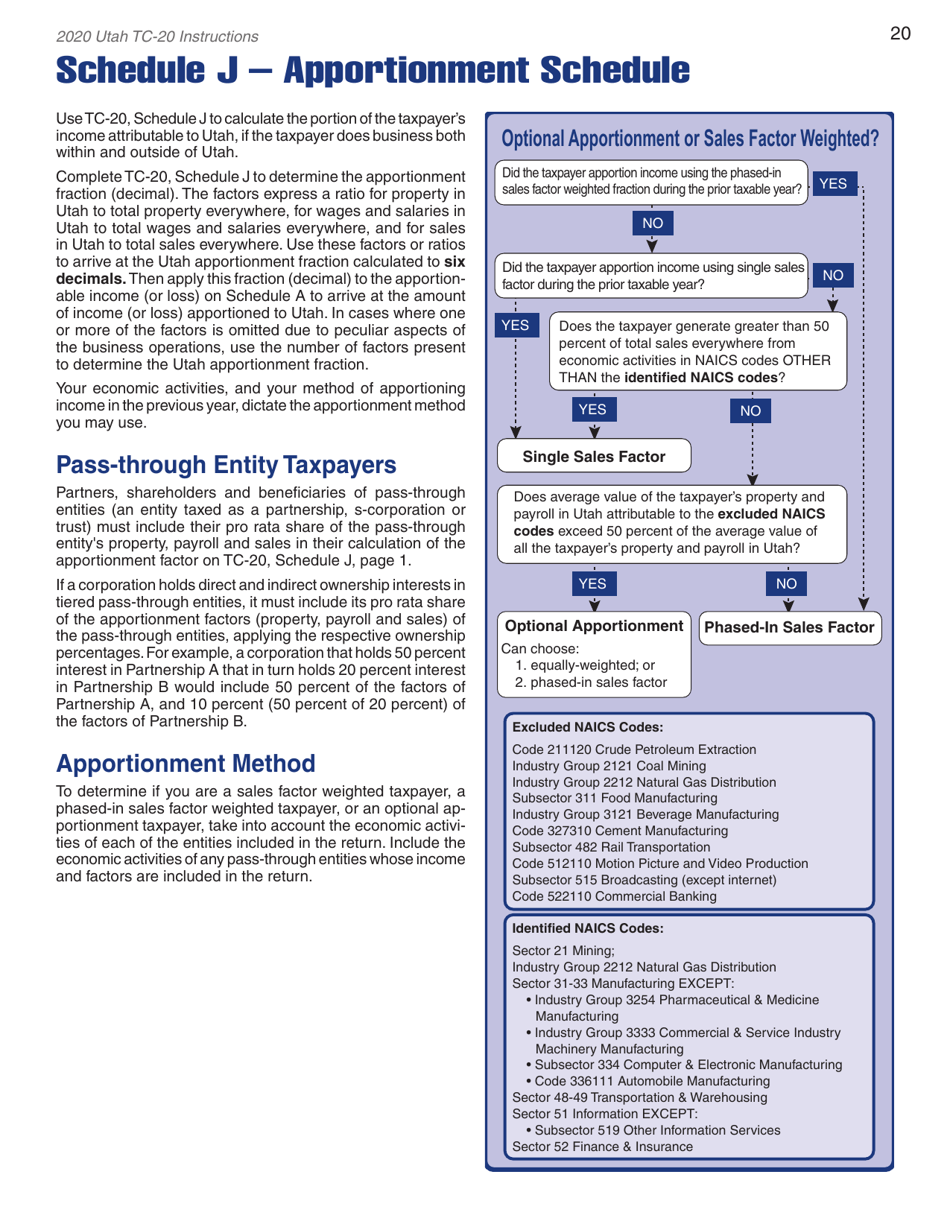

Q: What is Form TC-20 Schedule J?

A: Form TC-20 Schedule J is an attachment to Form TC-20. It is used to report Utah tax credits.

Q: What is Form TC-20 Schedule M?

A: Form TC-20 Schedule M is an attachment to Form TC-20. It is used to report Utah nonrefundable business credits.

Instruction Details:

- This 29-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Utah State Tax Commission.