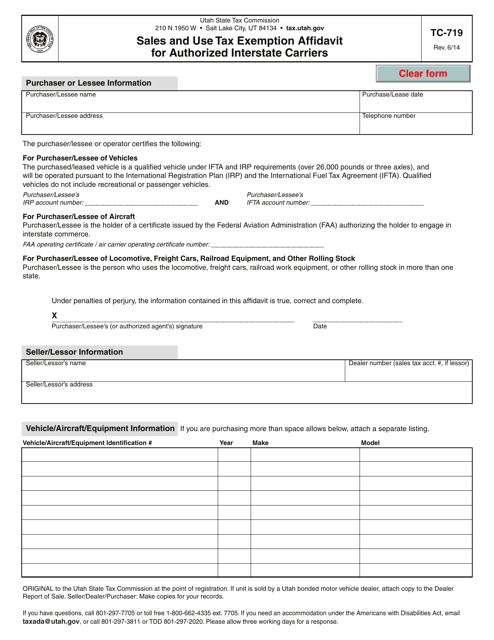

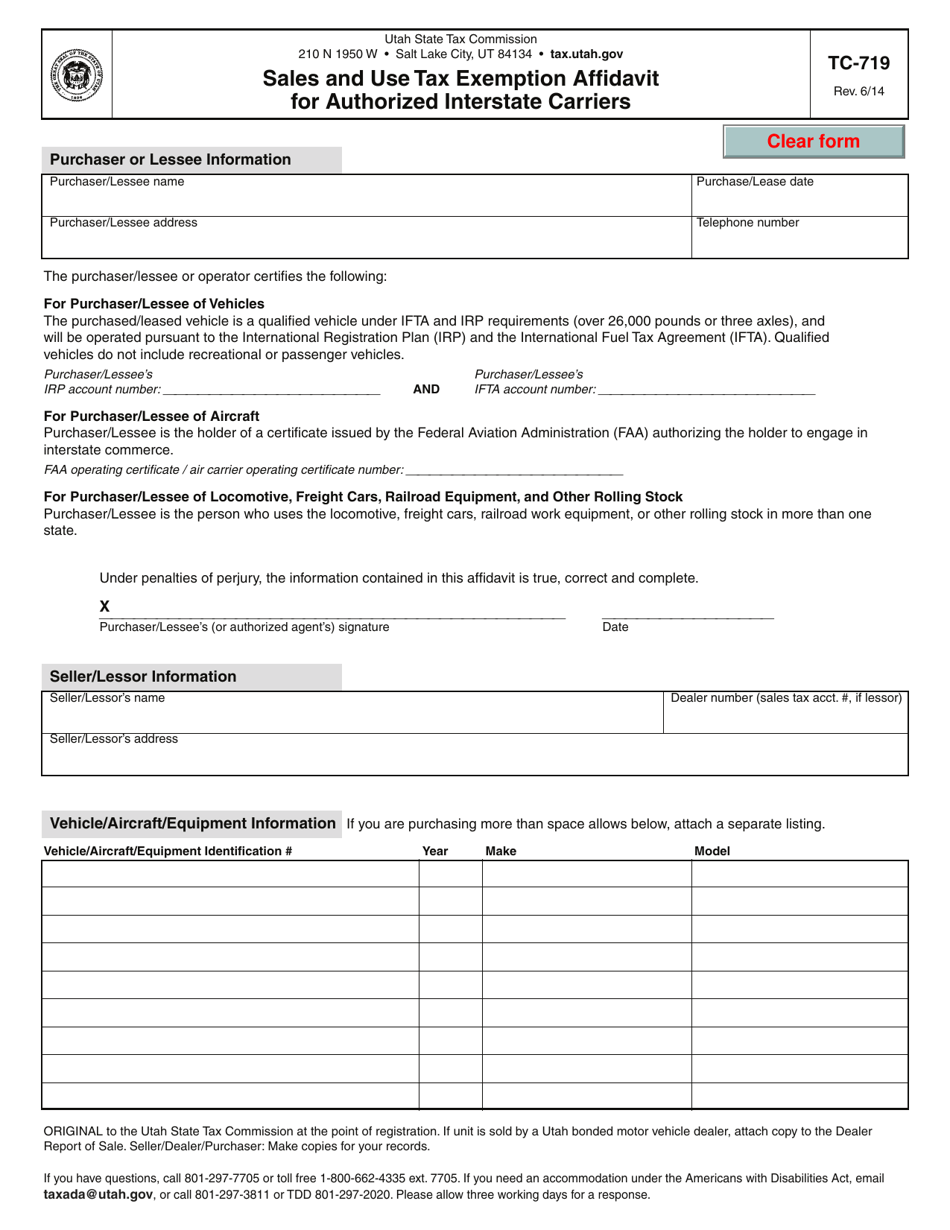

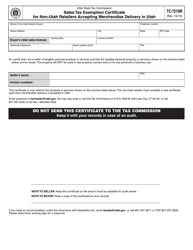

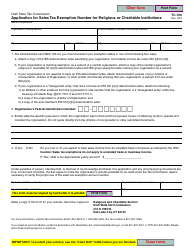

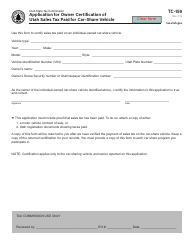

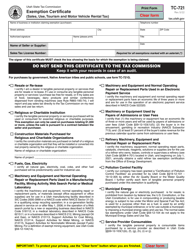

Form TC-719 Sales and Use Tax Exemption Affidavit for Authorized Interstate Carriers - Utah

What Is Form TC-719?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-719?

A: Form TC-719 is the Sales and Use Tax Exemption Affidavit for Authorized Interstate Carriers in Utah.

Q: Who is required to fill out Form TC-719?

A: Authorized interstate carriers in Utah are required to fill out Form TC-719.

Q: What is the purpose of Form TC-719?

A: The purpose of Form TC-719 is to claim a sales and use tax exemption for authorized interstate carriers in Utah.

Q: Do I need to provide any supporting documents with Form TC-719?

A: Yes, you will need to provide a copy of the carrier's current motor carrier certificate or authority from the Federal Motor Carrier Safety Administration (FMCSA).

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-719 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.