Instructions for Form ST-556-D Nontaxable Sales for Resale of Previously Rented or Leased Vehicles - Illinois

This document contains official instructions for Form ST-556-D , Nontaxable Sales for Resale of Previously Rented or Leased Vehicles - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form ST-556-D?

A: Form ST-556-D is a form used in Illinois to report nontaxable sales for resale of previously rented or leased vehicles.

Q: When should Form ST-556-D be filed?

A: Form ST-556-D should be filed within 20 days of the date of sale.

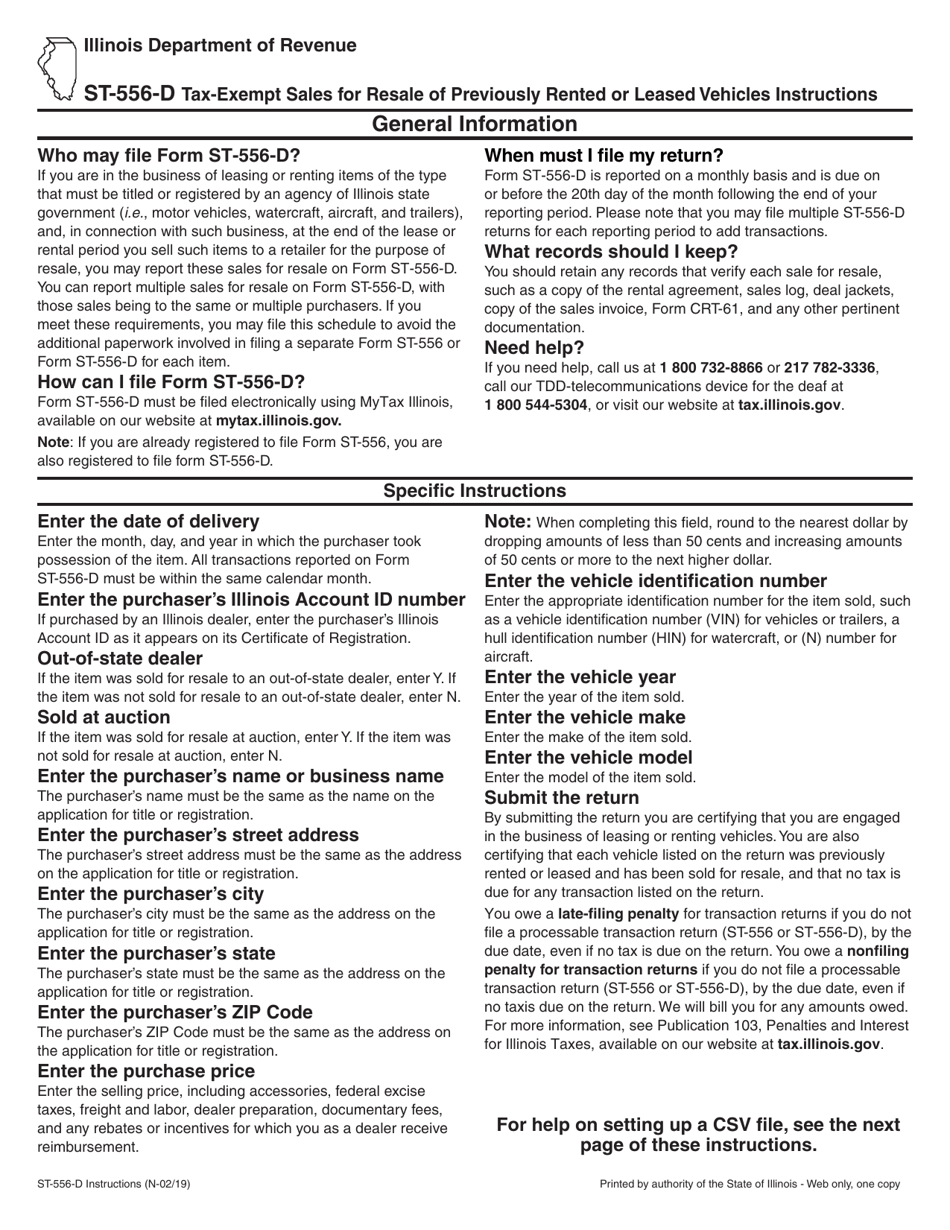

Q: Who needs to file Form ST-556-D?

A: Anyone in Illinois who sells previously rented or leased vehicles for resale and wants to claim nontaxable status needs to file Form ST-556-D.

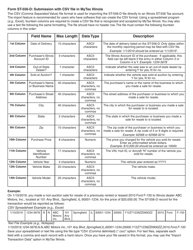

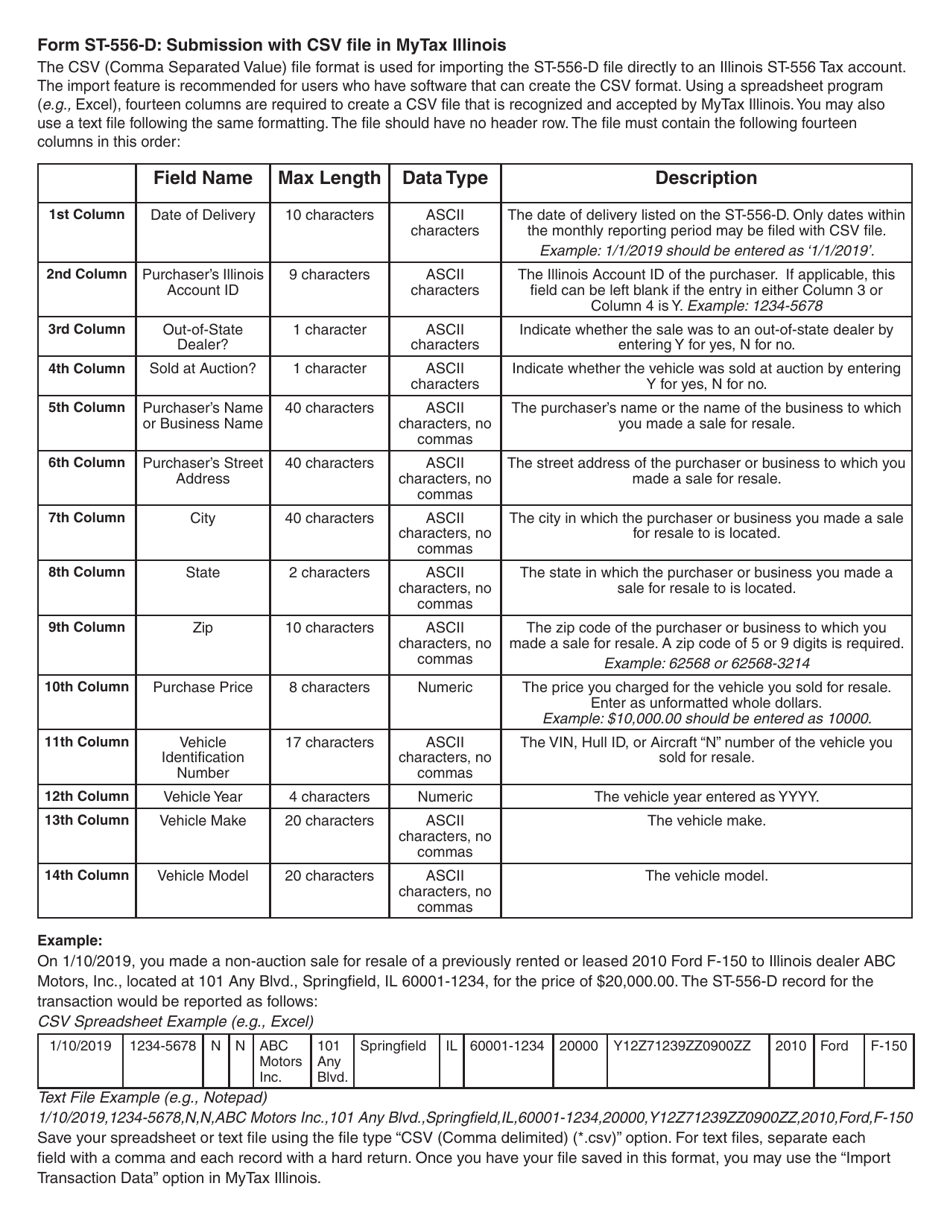

Q: What information is required on Form ST-556-D?

A: Some of the information required on the form includes the buyer and seller's information, vehicle details, and the reason for claiming nontaxable status.

Q: Are there any penalties for not filing Form ST-556-D?

A: Yes, there may be penalties for failure to file Form ST-556-D on time or for providing false information on the form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.