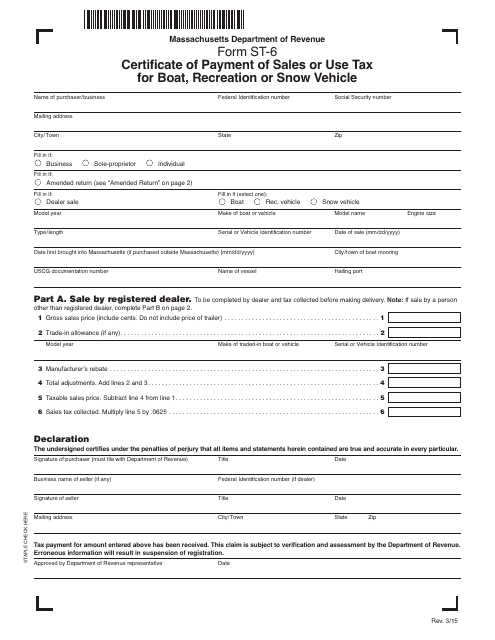

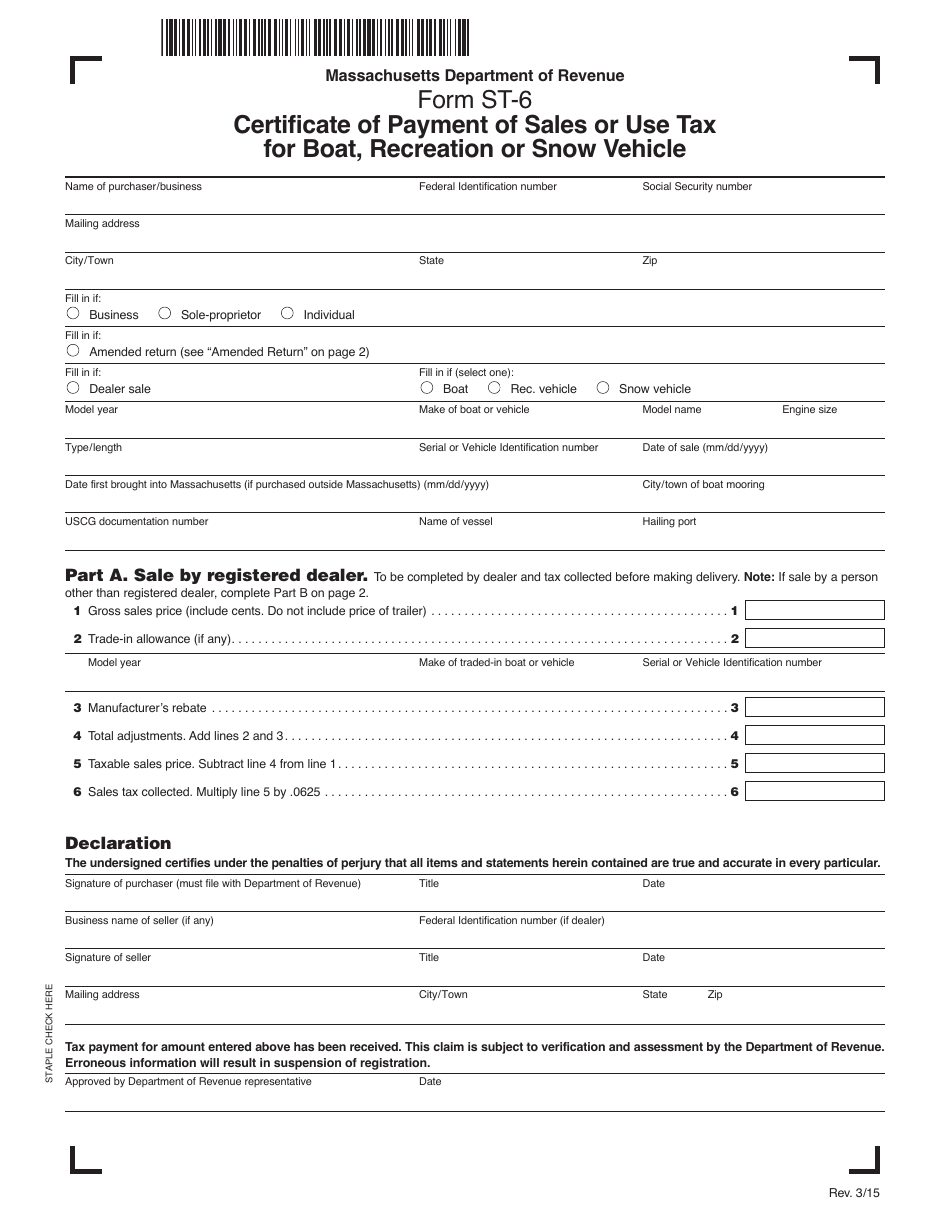

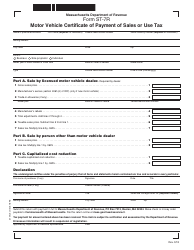

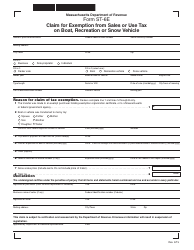

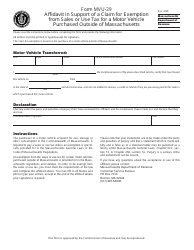

Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle - Massachusetts

What Is Form ST-6?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: The Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle is a form used in Massachusetts to provide proof of payment of sales or use tax for boats, recreational vehicles, or snow vehicles.

Q: Who needs to file the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: Anyone who has purchased or acquired a boat, recreational vehicle, or snow vehicle in Massachusetts and needs to provide proof of tax payment may need to file this form.

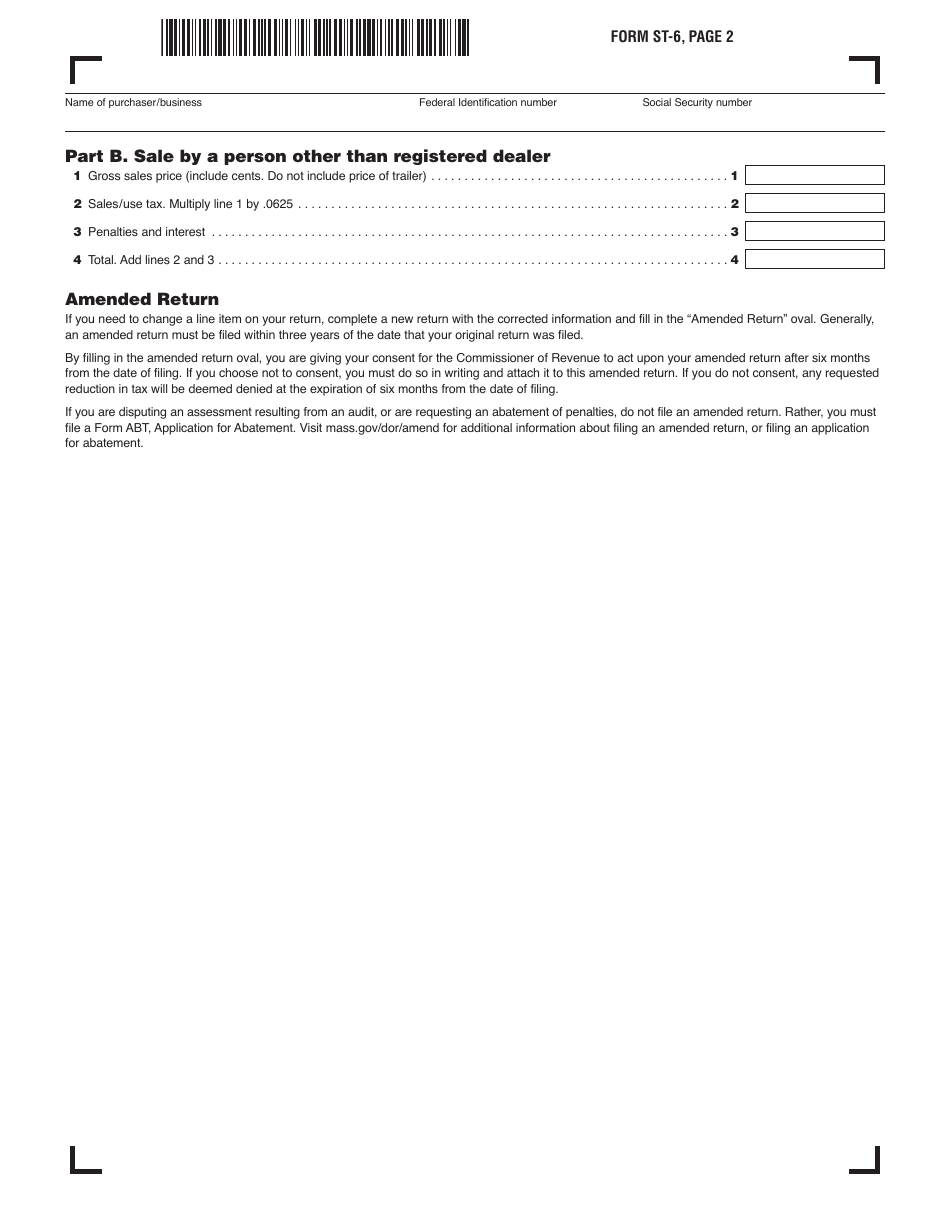

Q: What information is required on the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: The form requires information such as the name and address of the buyer, seller, and vessel, as well as details about the purchase price and payment of sales or use tax.

Q: How do I fill out the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: You need to provide accurate and complete information about the buyer, seller, and vessel, along with details of the purchase price and payment of sales or use tax. Make sure to sign and date the form before submitting it.

Q: Is there a fee for filing the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: There is no specific fee for filing this form, but you may have to pay sales or use tax depending on the purchase price and other factors.

Q: What happens after I submit the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: The Massachusetts Department of Revenue will review the form and verify the payment of sales or use tax. If everything is in order, you will receive a certificate of payment as proof.

Q: Do I need to keep a copy of the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: Yes, it is recommended to keep a copy of the form and the certificate of payment for your records.

Q: Are there any penalties for not filing the Form ST-6 Certificate of Payment of Sales or Use Tax for Boat, Recreation or Snow Vehicle?

A: Failure to file the form or provide proof of tax payment may result in penalties or fines imposed by the Massachusetts Department of Revenue.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-6 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.