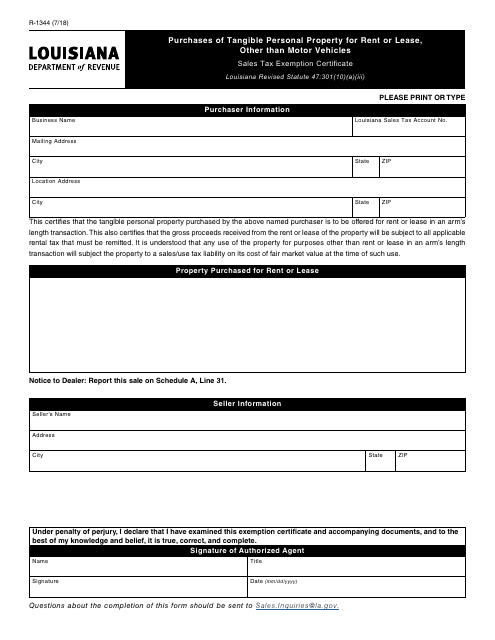

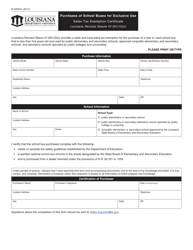

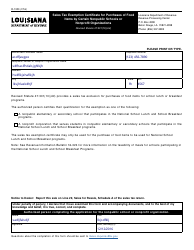

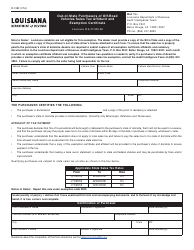

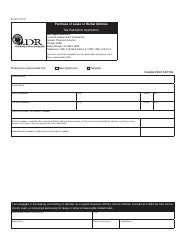

Form R-1344 Purchases of Tangible Personal Property for Rent or Lease, Other Than Motor Vehicles Sales Tax Exemption Certificate - Louisiana

What Is Form R-1344?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1344?

A: Form R-1344 is a sales tax exemption certificate in Louisiana.

Q: Who can use Form R-1344?

A: Form R-1344 can be used by individuals or businesses who purchase tangible personal property for rent or lease, other thanmotor vehicles.

Q: What is the purpose of Form R-1344?

A: The purpose of Form R-1344 is to claim a sales tax exemption on purchases of tangible personal property for rent or lease.

Q: What type of property does Form R-1344 cover?

A: Form R-1344 covers tangible personal property other than motor vehicles.

Q: Is there a deadline for submitting Form R-1344?

A: Yes, Form R-1344 must be submitted within three years from the due date of the original return or within three years from the date the tax was paid, whichever is later.

Q: Is there a fee for using Form R-1344?

A: No, there is no fee for using Form R-1344.

Q: Can I use Form R-1344 for motor vehicle purchases?

A: No, Form R-1344 is specifically for tangible personal property other than motor vehicles.

Q: Are there any limitations or restrictions on sales tax exemption using Form R-1344?

A: Yes, there are certain limitations and restrictions on the sales tax exemption provided by Form R-1344. It is recommended to review the instructions and guidelines provided with the form or consult with the Louisiana Department of Revenue for more information.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1344 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.