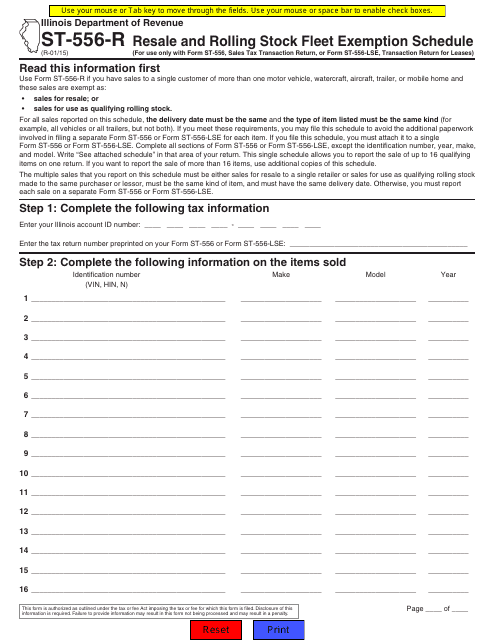

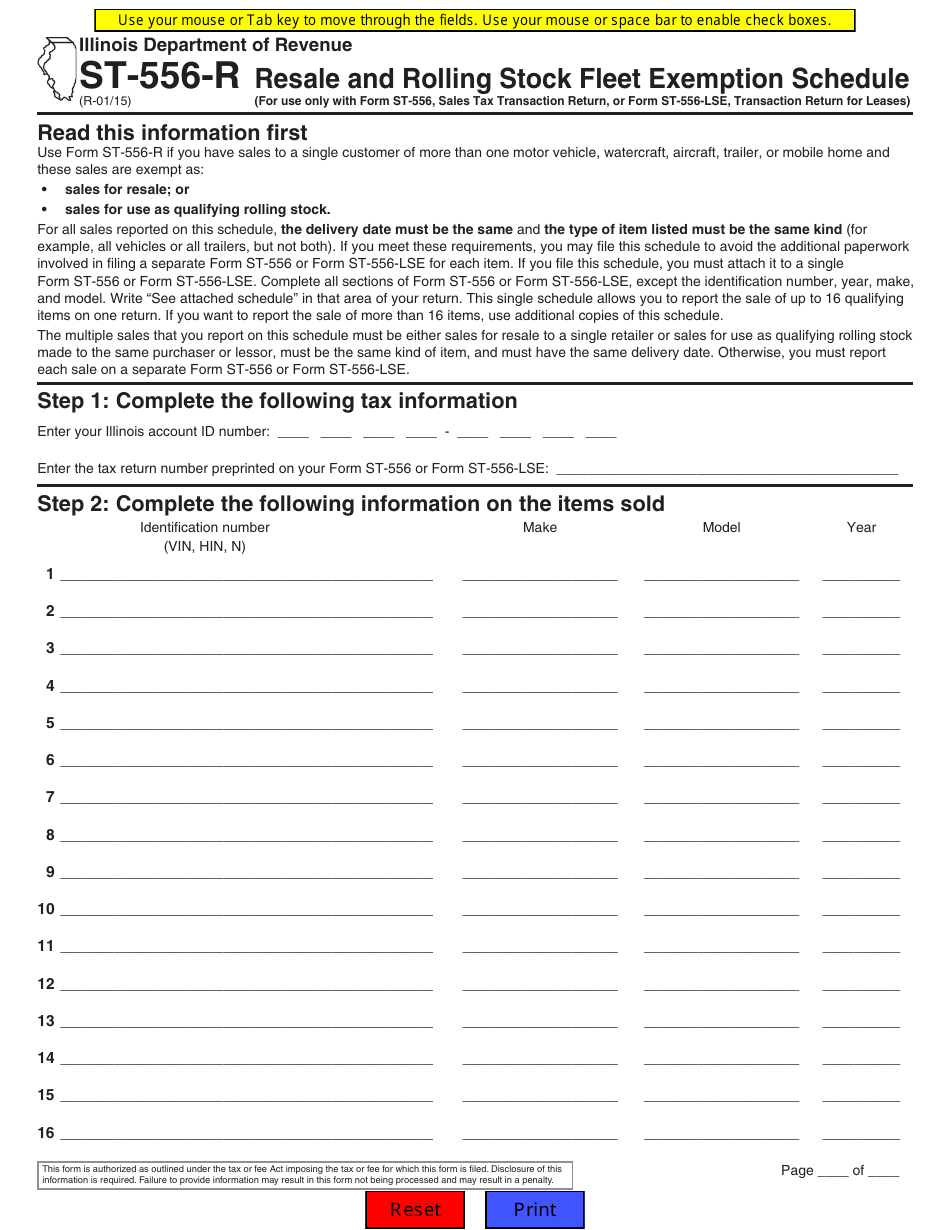

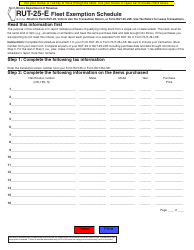

Form ST-556-R Resale and Rolling Stock Fleet Exemption Schedule - Illinois

What Is Form ST-556-R?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-556-R?

A: Form ST-556-R is an exemption schedule used in Illinois for resale and rolling stock fleet transactions.

Q: Who uses Form ST-556-R?

A: This form is used by businesses in Illinois involved in resale and rolling stock fleet transactions.

Q: What is the purpose of Form ST-556-R?

A: The purpose of this form is to report and claim exemption from sales tax on certain transactions.

Q: What are resale transactions?

A: Resale transactions are sales of tangible personal property for the purpose of reselling it.

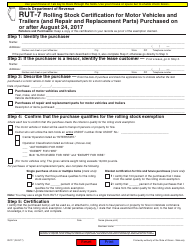

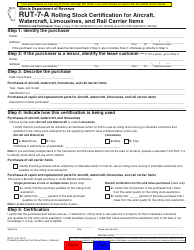

Q: What are rolling stock fleet transactions?

A: Rolling stock fleet transactions are purchases of motor vehicles for use in a fleet of at least 20 vehicles.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-556-R by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.