This version of the form is not currently in use and is provided for reference only. Download this version of

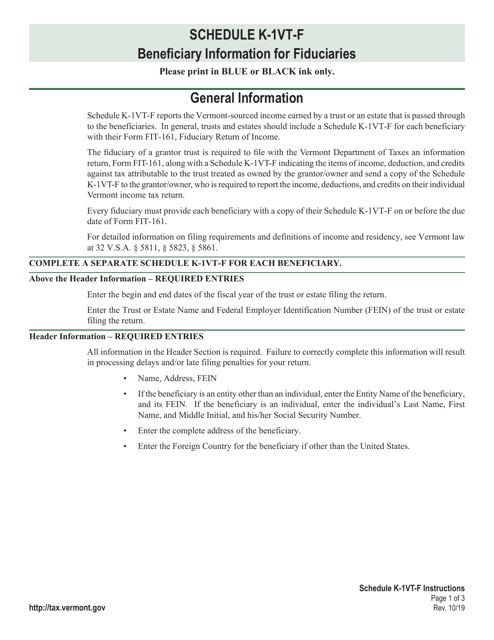

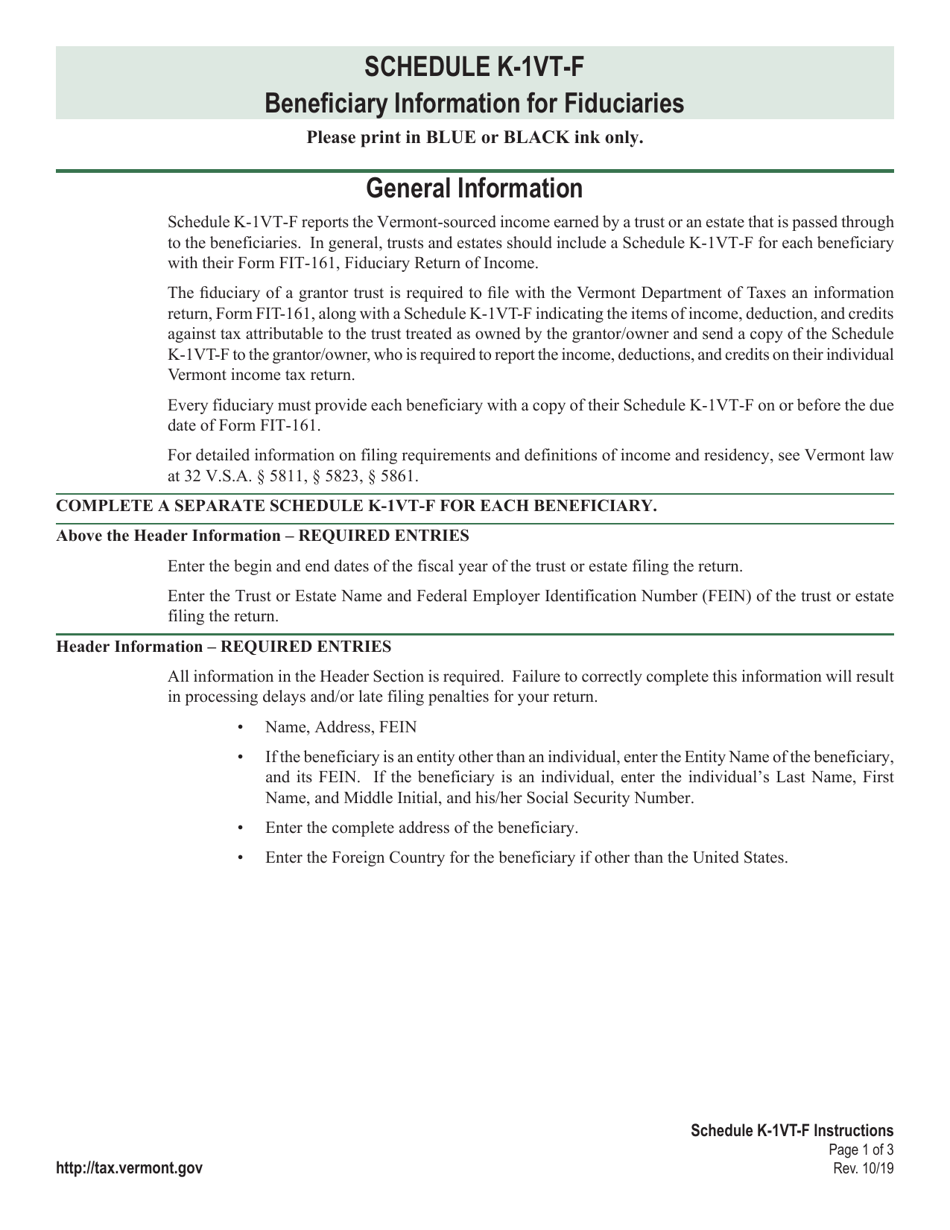

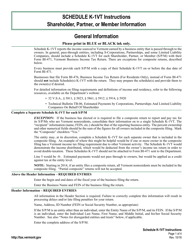

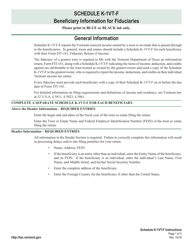

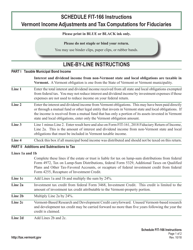

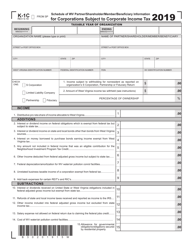

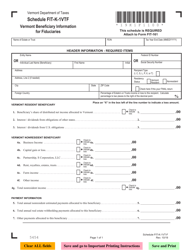

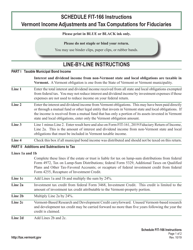

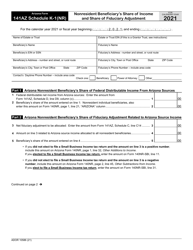

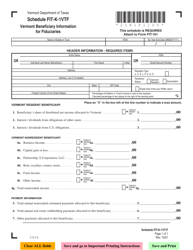

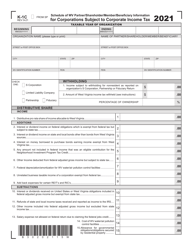

Instructions for Schedule K-1VT-F

for the current year.

Instructions for Schedule K-1VT-F Vermont Beneficiary Information for Fiduciaries - Vermont

This document contains official instructions for Schedule K-1VT-F , Vermont Beneficiary Information for Fiduciaries - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule K-1VT-F?

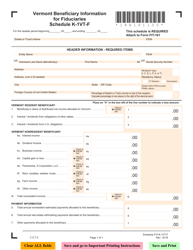

A: Schedule K-1VT-F is a tax form used by fiduciaries in Vermont to provide beneficiary information.

Q: Who needs to fill out Schedule K-1VT-F?

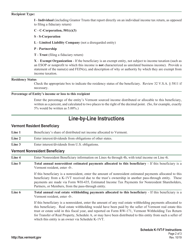

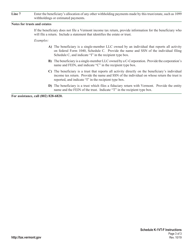

A: Fiduciaries in Vermont who have beneficiaries that are required to report income or make adjustments to their federal income tax return.

Q: What information is required on Schedule K-1VT-F?

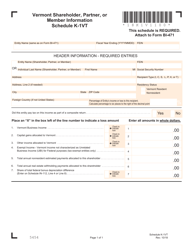

A: Schedule K-1VT-F requires the fiduciary to provide the names and addresses of the beneficiaries, as well as their share of income, deductions, and credits.

Q: When is the deadline to file Schedule K-1VT-F?

A: Schedule K-1VT-F must be filed by the due date of the fiduciary's Vermont Form fiduciary income tax return, which is typically on or before April 15th.

Q: Are there any penalties for not filing Schedule K-1VT-F?

A: Failure to file Schedule K-1VT-F or filing it late may result in penalties imposed by the Vermont Department of Taxes.

Q: Can Schedule K-1VT-F be filed electronically?

A: Yes, Schedule K-1VT-F can be filed electronically using the Vermont Department of Taxes' e-file system.

Q: Do beneficiaries need to attach Schedule K-1VT-F to their tax return?

A: Yes, beneficiaries are generally required to attach Schedule K-1VT-F to their Vermont income tax return.

Q: Is Schedule K-1VT-F used for both individual and business beneficiaries?

A: Yes, Schedule K-1VT-F can be used for both individual and business beneficiaries of a trust or estate.

Q: What should I do if I have questions about filling out Schedule K-1VT-F?

A: If you have questions about filling out Schedule K-1VT-F, it is recommended to seek assistance from a tax professional or contact the Vermont Department of Taxes.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.