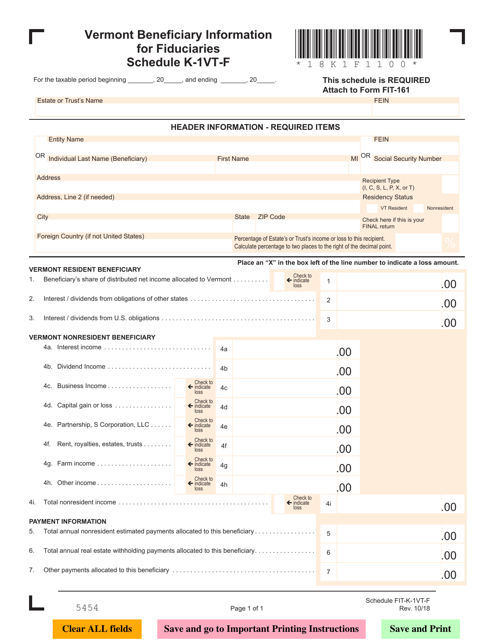

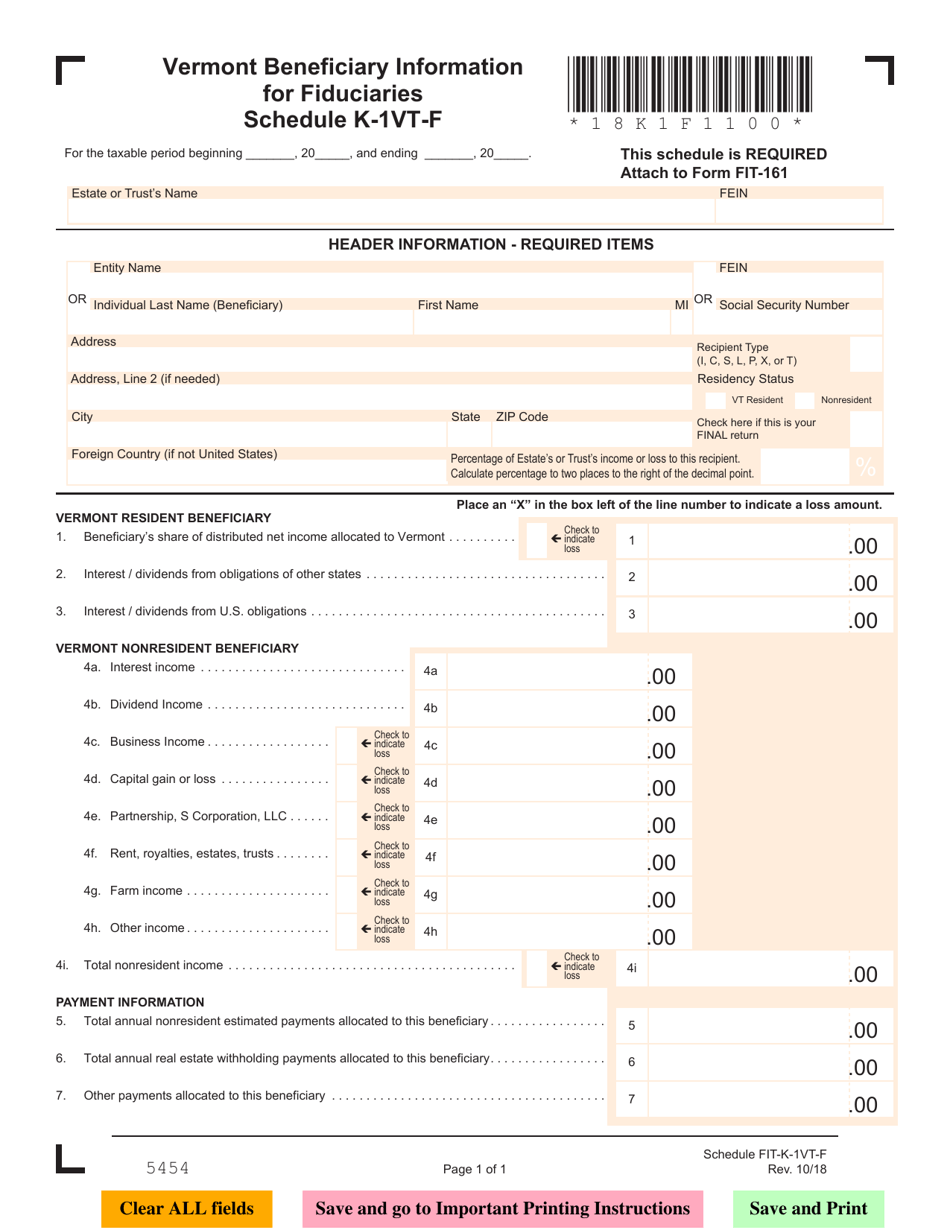

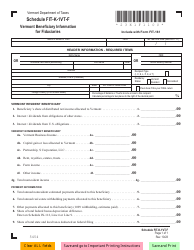

Schedule K-1VT-F Beneficiary Information for Fiduciaries - Vermont

What Is Schedule K-1VT-F?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-1VT-F?

A: Schedule K-1VT-F is a tax form used by fiduciaries in Vermont to report income and deductions for beneficiaries.

Q: Who should use Schedule K-1VT-F?

A: Fiduciaries in Vermont who have beneficiaries with income and deductions to report should use Schedule K-1VT-F.

Q: What information is reported on Schedule K-1VT-F?

A: Schedule K-1VT-F reports the beneficiary's share of income, deductions, and credits from the fiduciary's tax return.

Q: When is Schedule K-1VT-F due?

A: Schedule K-1VT-F is generally due on the same date as the fiduciary's Vermont tax return, which is due on April 15th.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-1VT-F by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.