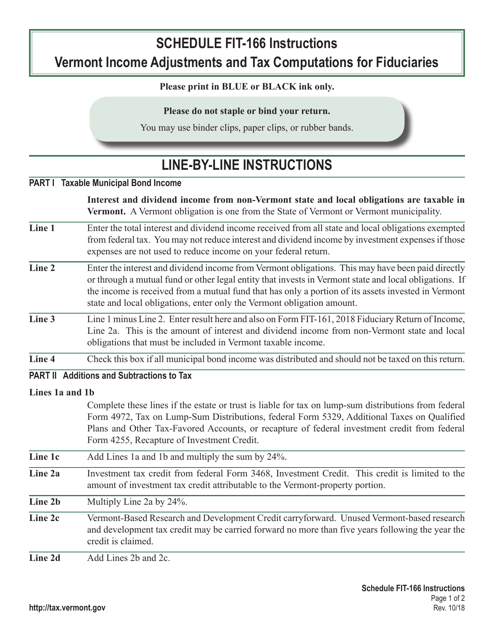

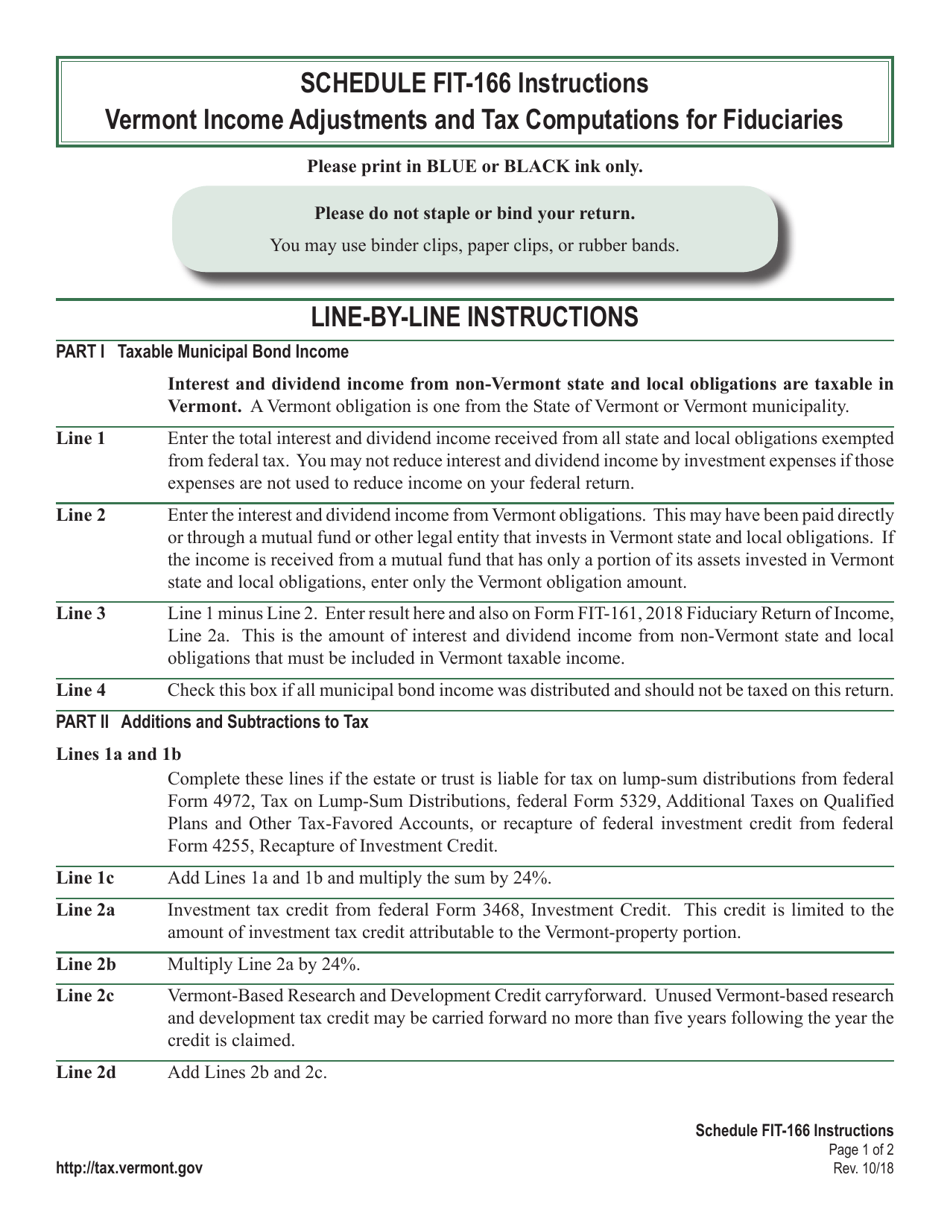

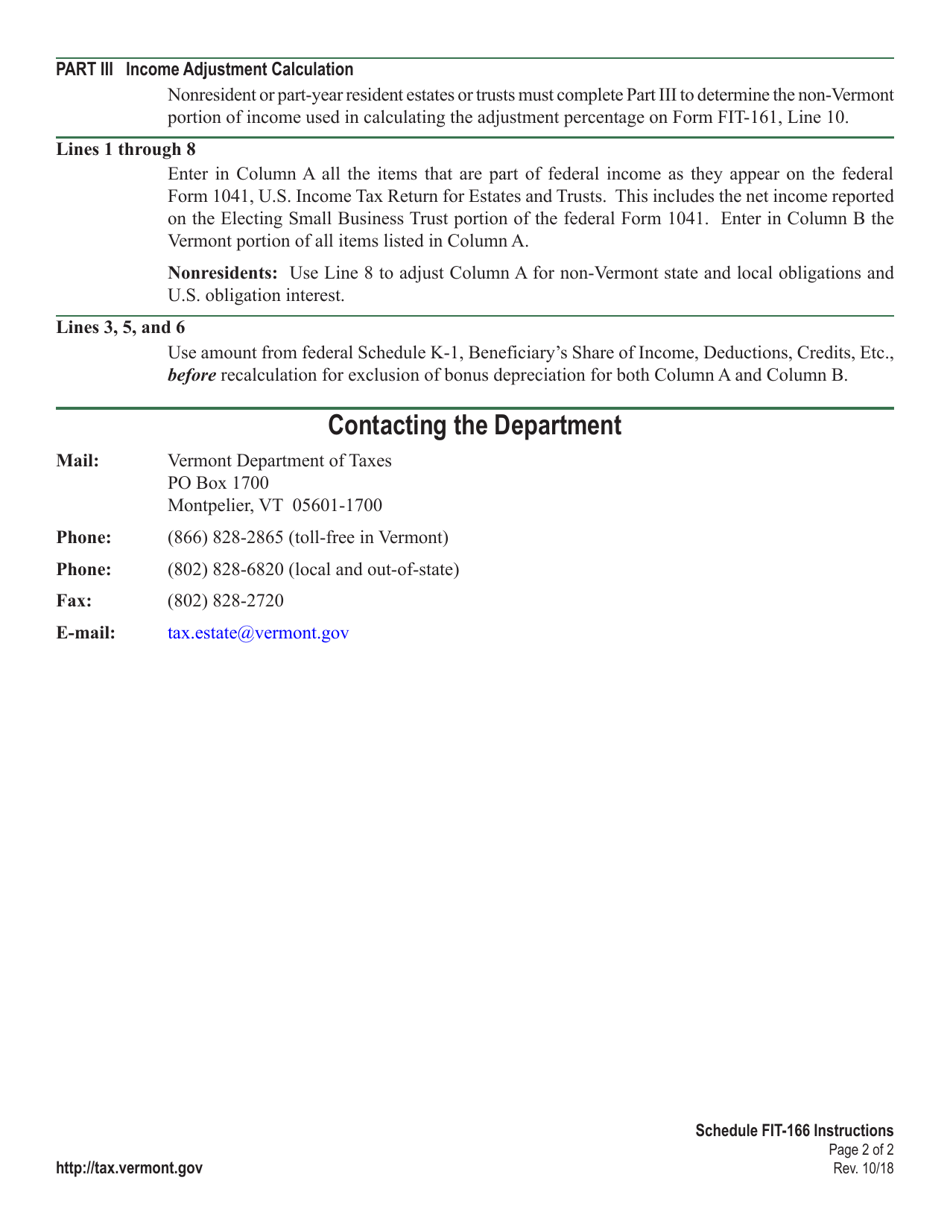

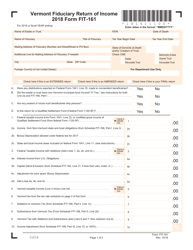

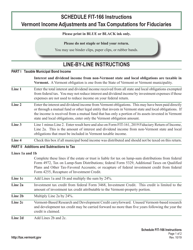

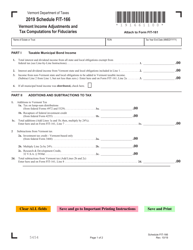

Instructions for VT Form FIT-166 Income Adjustments and Tax Computations for Fiduciaries - Vermont

This document contains official instructions for VT Form FIT-166 , Income Adjustments and Tax Computations for Fiduciaries - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is the VT Form FIT-166?

A: The VT Form FIT-166 is a form used by fiduciaries in Vermont to report income adjustments and tax computations.

Q: Who needs to file the VT Form FIT-166?

A: Fiduciaries in Vermont who are responsible for filing taxes on behalf of an estate or trust need to file the VT Form FIT-166.

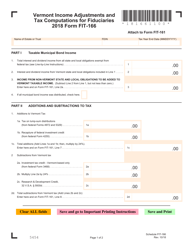

Q: What information is reported on the VT Form FIT-166?

A: The form is used to report income adjustments and tax computations for fiduciaries.

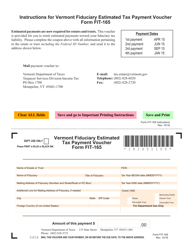

Q: When is the deadline to file the VT Form FIT-166?

A: The deadline to file the VT Form FIT-166 is generally the same as the federal tax filing deadline, which is April 15th.

Q: Are there any penalties for filing the VT Form FIT-166 late?

A: Yes, there may be penalties for filing the VT Form FIT-166 late. It's important to file the form by the deadline to avoid any potential penalties.

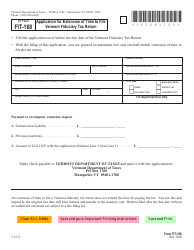

Q: What should I do if I need more time to file the VT Form FIT-166?

A: If you need more time to file the form, you can request an extension from the Vermont Department of Taxes. However, you will still need to estimate your tax liability and pay any taxes owed by the original deadline.

Q: What types of income adjustments are reported on the VT Form FIT-166?

A: Income adjustments reported on the VT Form FIT-166 may include deductions, exemptions, and credits that apply to fiduciary income.

Q: How do I compute the tax owed on the VT Form FIT-166?

A: The tax owed on the VT Form FIT-166 is computed based on the fiduciary income and the applicable tax rates specified by the Vermont Department of Taxes.

Q: Is there a separate form for Vermont individual income tax?

A: Yes, there is a separate form for Vermont individual income tax, which is the VT Form IN-111. The VT Form FIT-166 is specifically for fiduciaries reporting income adjustments and tax computations.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.