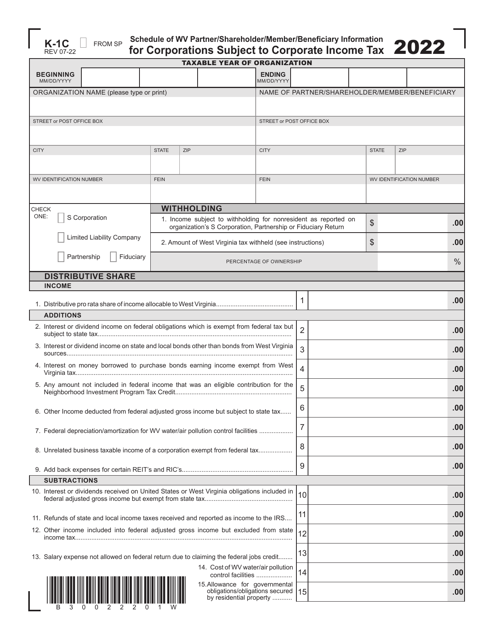

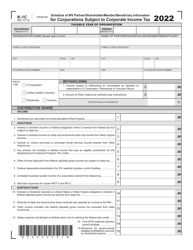

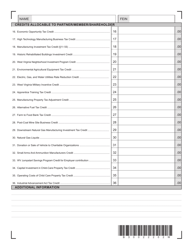

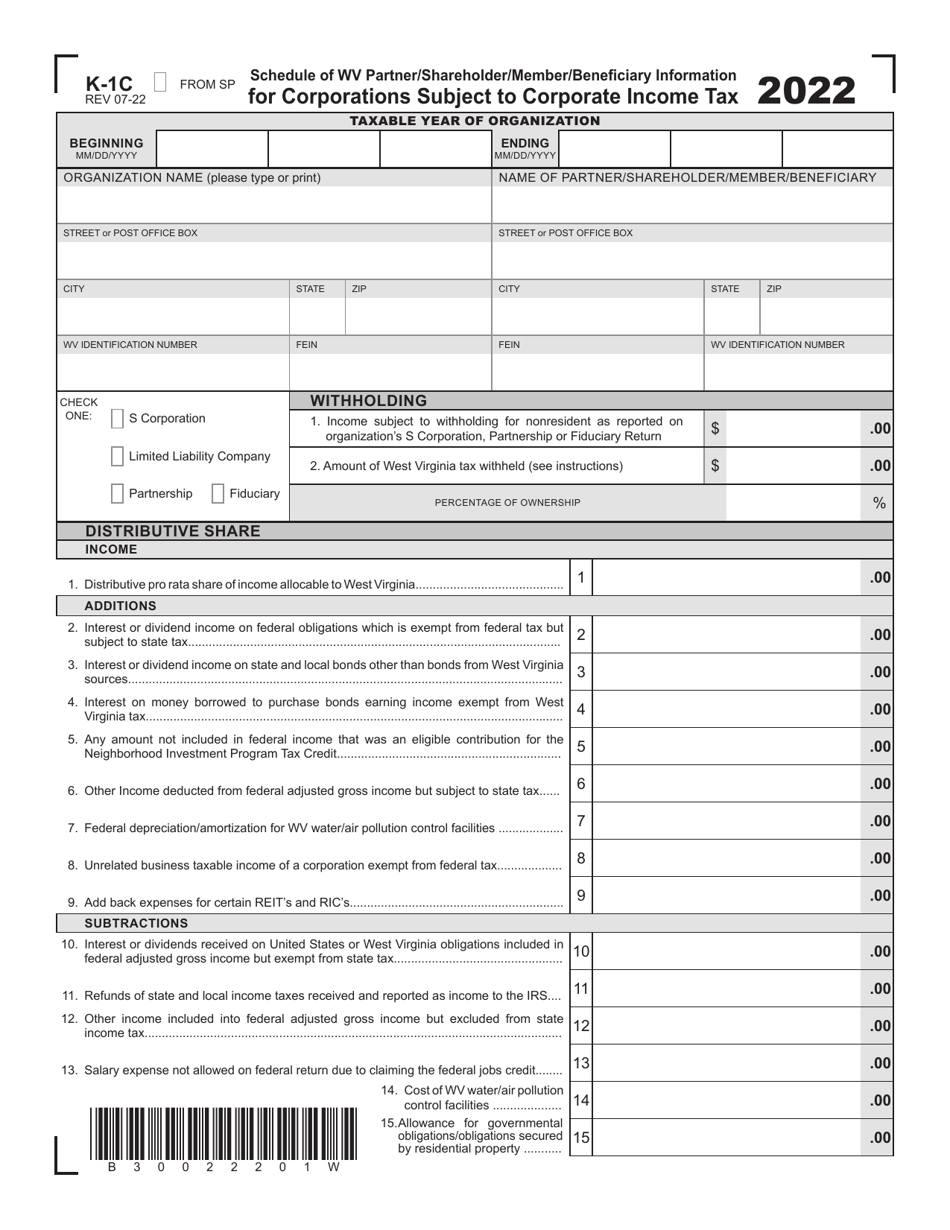

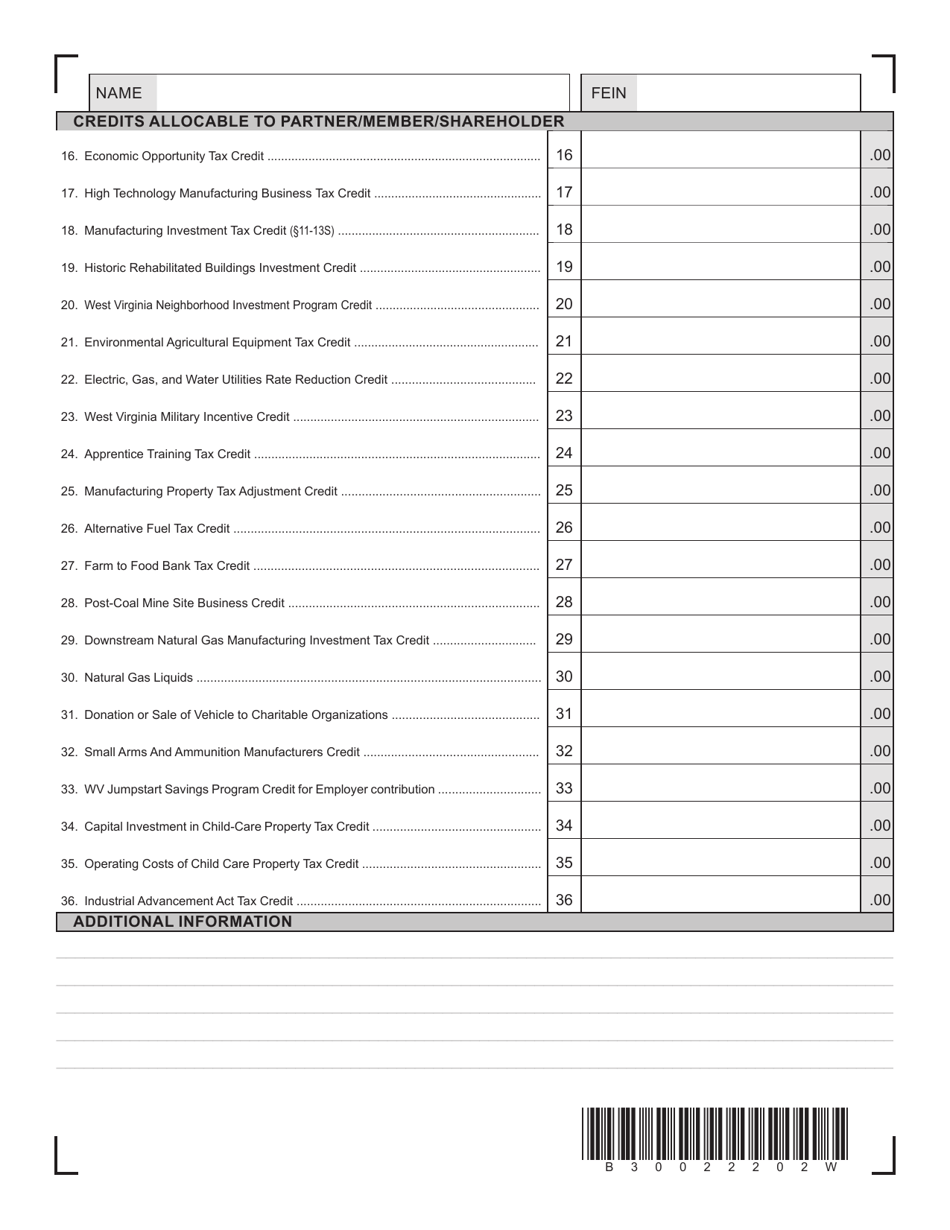

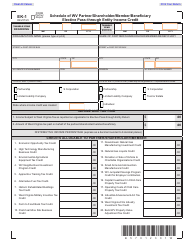

Form K-1C Schedule of Wv Partner / Shareholder / Member / Beneficiary Information for Corporations Subject to Corporate Income Tax - West Virginia

What Is Form K-1C?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-1C?

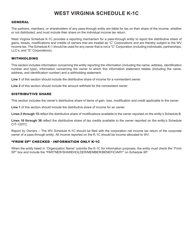

A: Form K-1C is a schedule used by corporations subject to corporate income tax in West Virginia to report partner/shareholder/member/beneficiary information.

Q: Who is required to file Form K-1C?

A: Corporations subject to corporate income tax in West Virginia are required to file Form K-1C.

Q: What information is reported on Form K-1C?

A: Form K-1C reports partner/shareholder/member/beneficiary information, including names, addresses, tax identification numbers, and ownership percentages.

Q: When is Form K-1C due?

A: Form K-1C is typically due on or before the same date as the corporation's tax return filing deadline.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form K-1C by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.