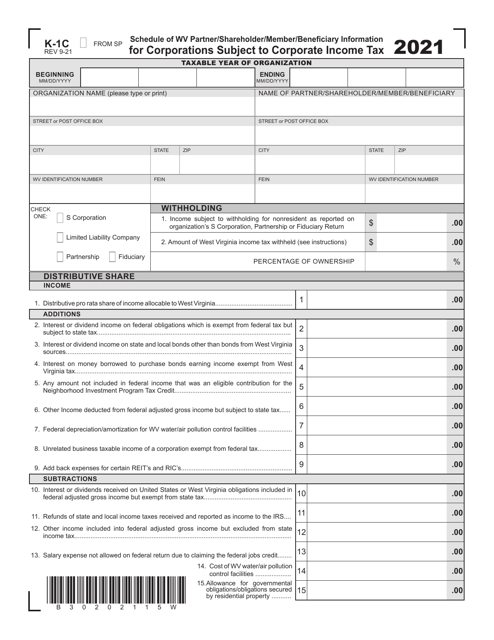

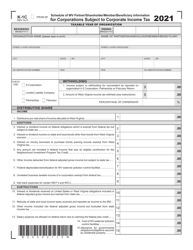

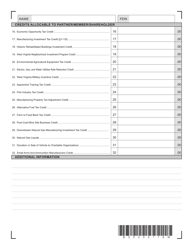

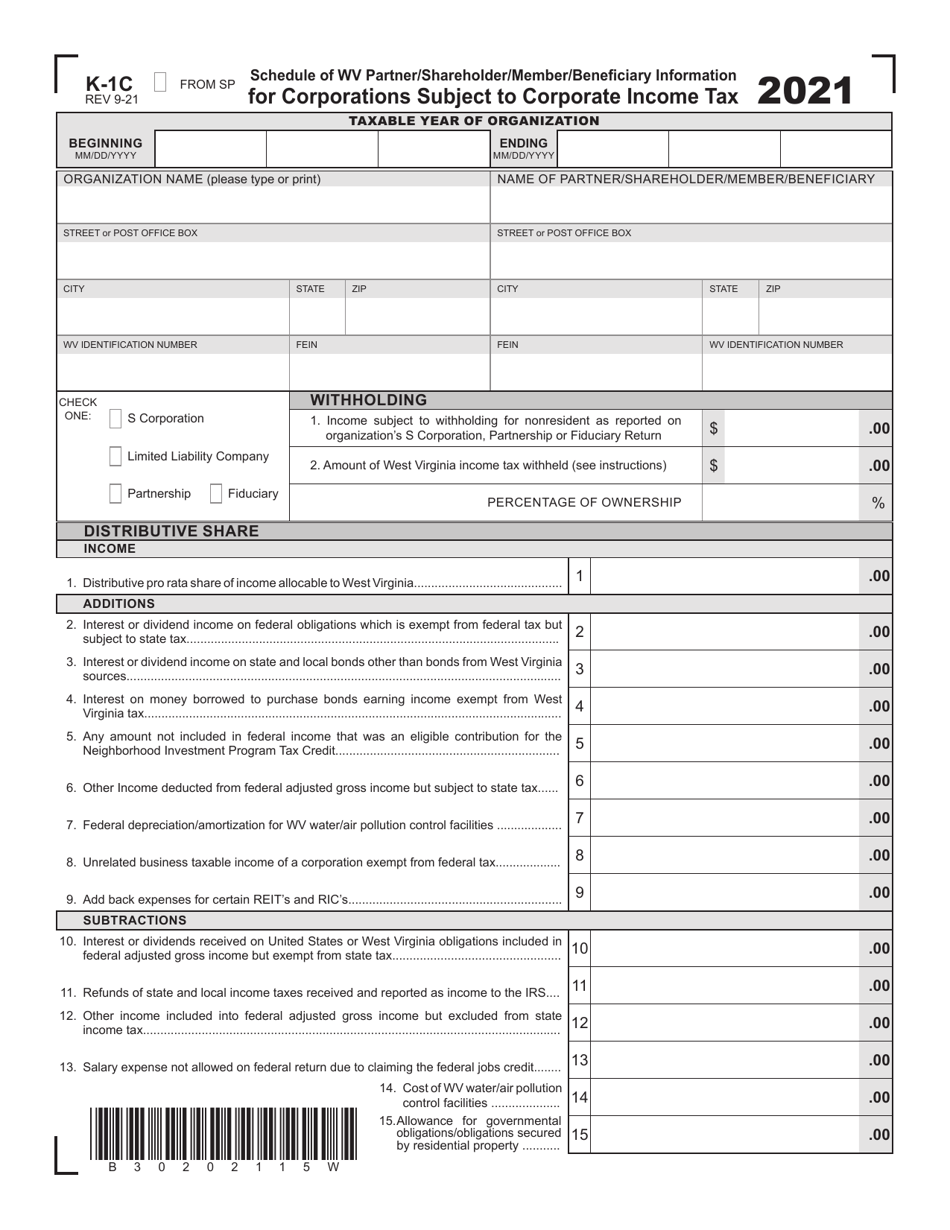

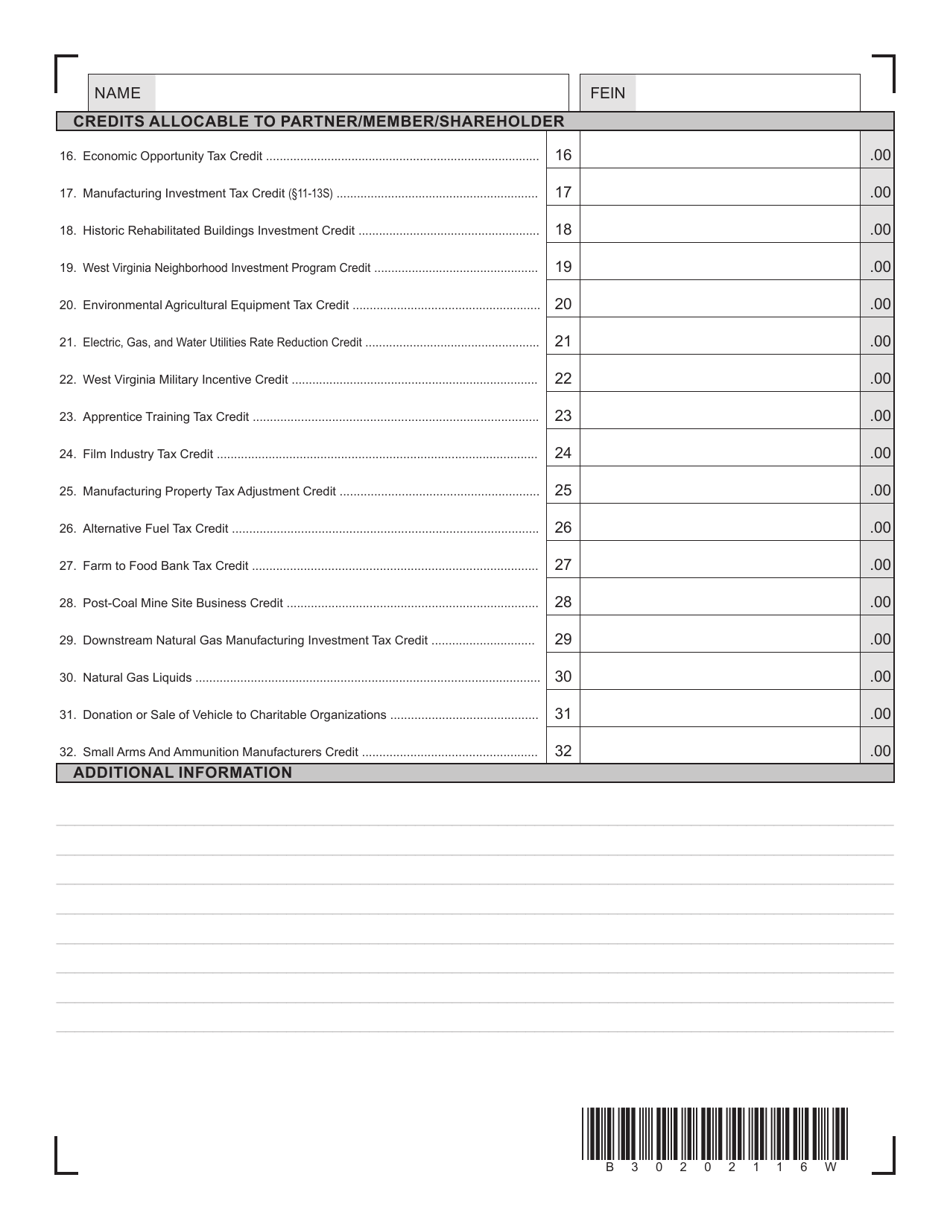

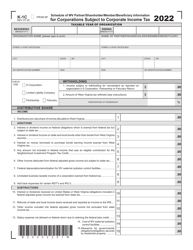

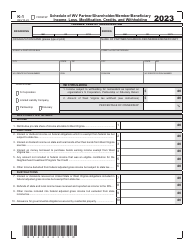

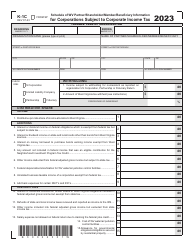

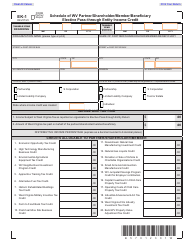

Supplement K1-C Schedule of Wv Partner / Shareholder / Member / Beneficiary Information for Corporations Subject to Corporate Income Tax - West Virginia

What Is Supplement K1-C?

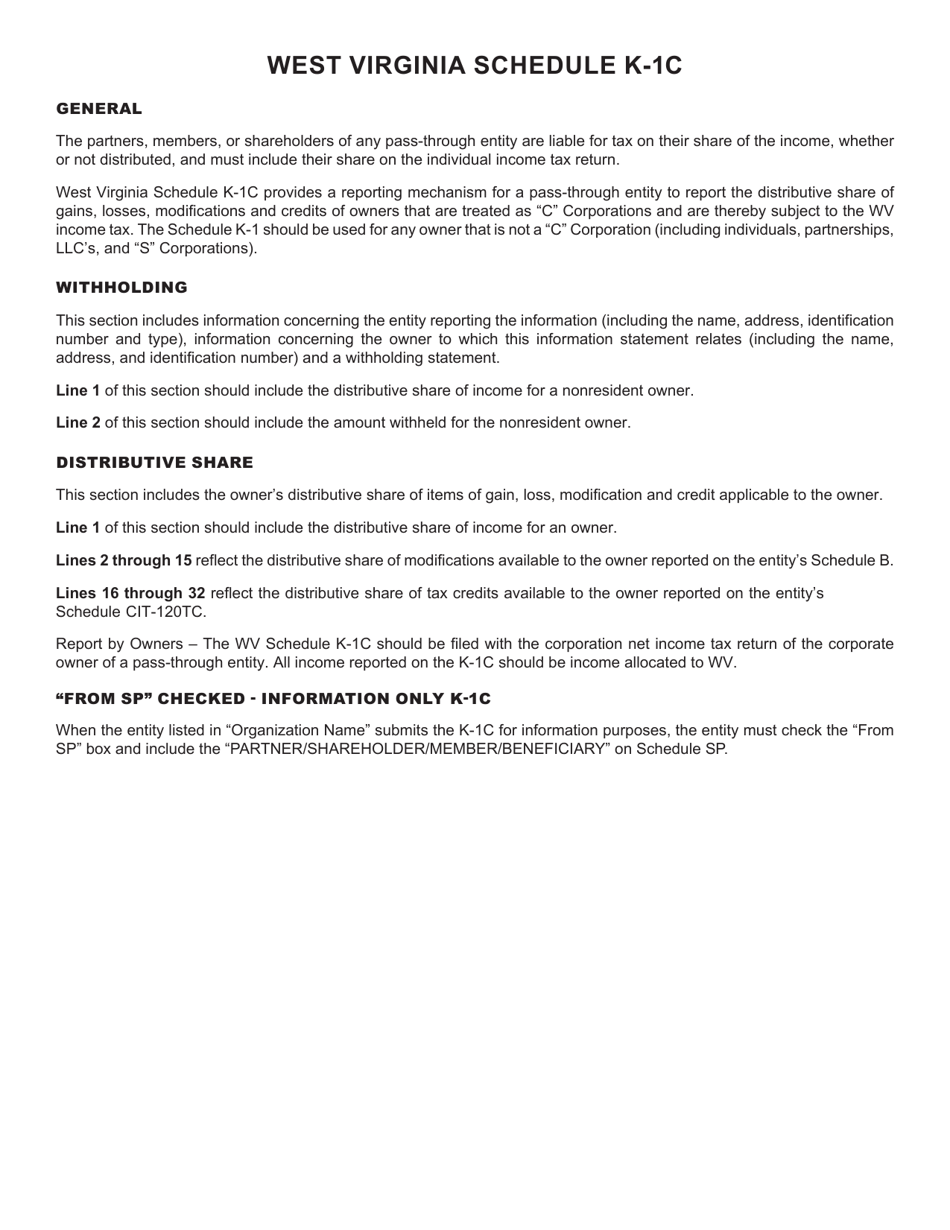

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Supplement K1-C Schedule?

A: Supplement K1-C Schedule is a form that provides information about partner/shareholder/member/beneficiary information for corporations subject to corporate income tax in West Virginia.

Q: Who needs to file Supplement K1-C Schedule?

A: Corporations subject to corporate income tax in West Virginia need to file Supplement K1-C Schedule.

Q: What information is required in Supplement K1-C Schedule?

A: Supplement K1-C Schedule requires information about the partner/shareholder/member/beneficiary of the corporation.

Q: Why is Supplement K1-C Schedule required?

A: Supplement K1-C Schedule is required to report the relevant information about the partner/shareholder/member/beneficiary of the corporation for tax purposes.

Q: Is there a deadline to file Supplement K1-C Schedule?

A: Yes, there is a deadline to file Supplement K1-C Schedule, which is usually the same as the deadline for filing the corporate income tax return in West Virginia.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Supplement K1-C by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.