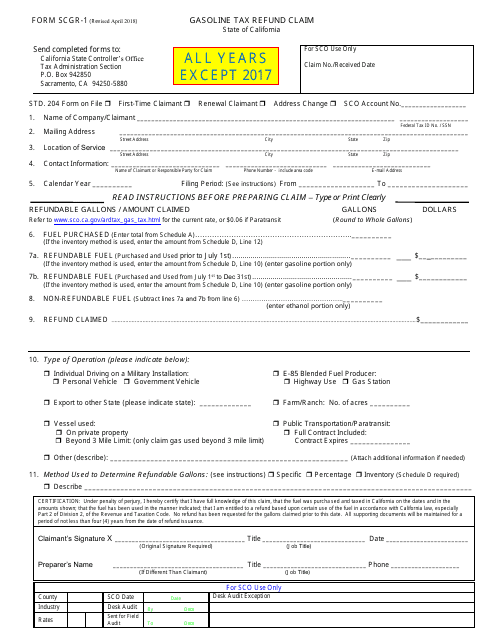

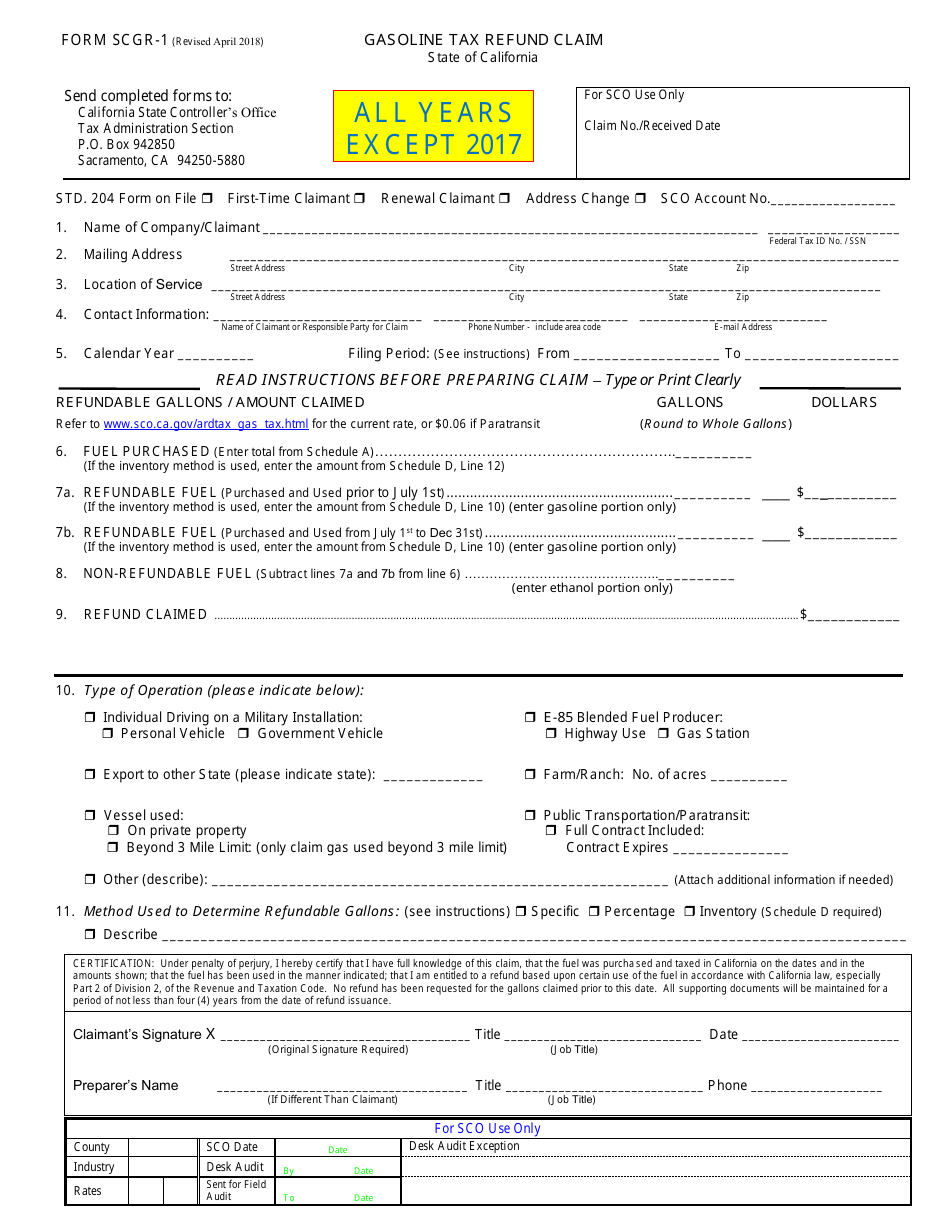

Form SCGR-1 Gasoline Tax Refund Claim - California

What Is Form SCGR-1?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form SCGR-1?

A: Form SCGR-1 is a Gasoline Tax Refund Claim form in California.

Q: What is the purpose of form SCGR-1?

A: The purpose of form SCGR-1 is to claim a refund on gasoline taxes paid in California.

Q: Who can use form SCGR-1?

A: Anyone who paid gasoline taxes in California and is eligible for a refund can use form SCGR-1.

Q: What information do I need to provide on form SCGR-1?

A: You will need to provide information such as your name, address, the amount of gasoline taxes paid, and the reason for the refund.

Q: Is there a deadline to submit form SCGR-1?

A: Yes, form SCGR-1 must be submitted within three years from the date of purchase.

Q: How long does it take to receive a refund after submitting form SCGR-1?

A: It typically takes about 8-12 weeks to receive a refund after submitting form SCGR-1.

Q: Are there any additional requirements for claiming a gasoline tax refund in California?

A: Yes, you must have purchased the gasoline for a non-highway purpose, such as off-highway use or for use on privately owned property.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCGR-1 by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.