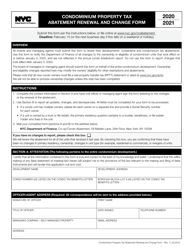

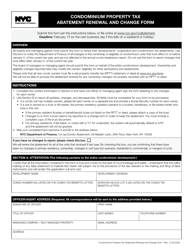

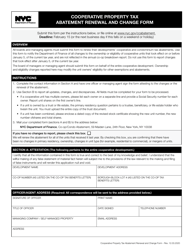

This version of the form is not currently in use and is provided for reference only. Download this version of

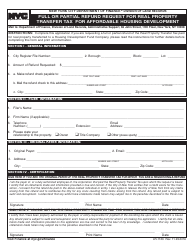

Form REF-01

for the current year.

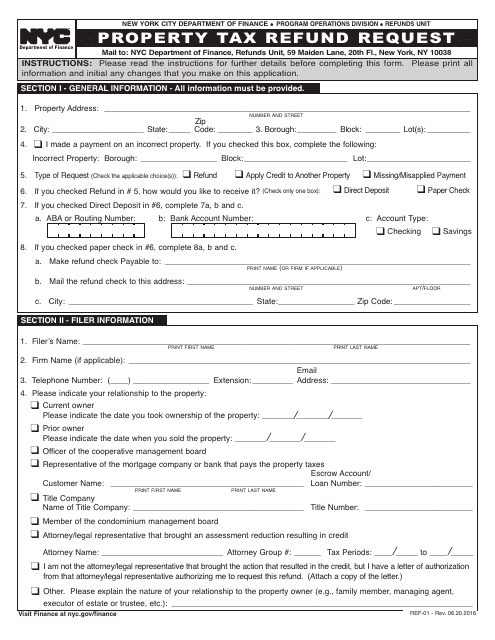

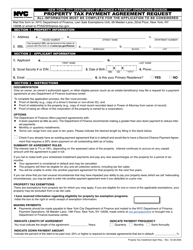

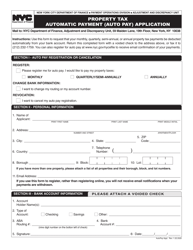

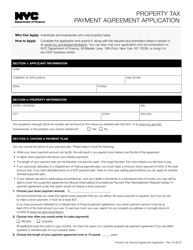

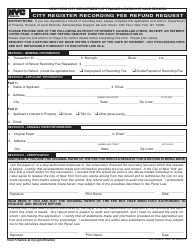

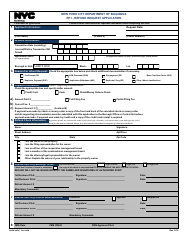

Form REF-01 Property Tax Refund Request - New York City

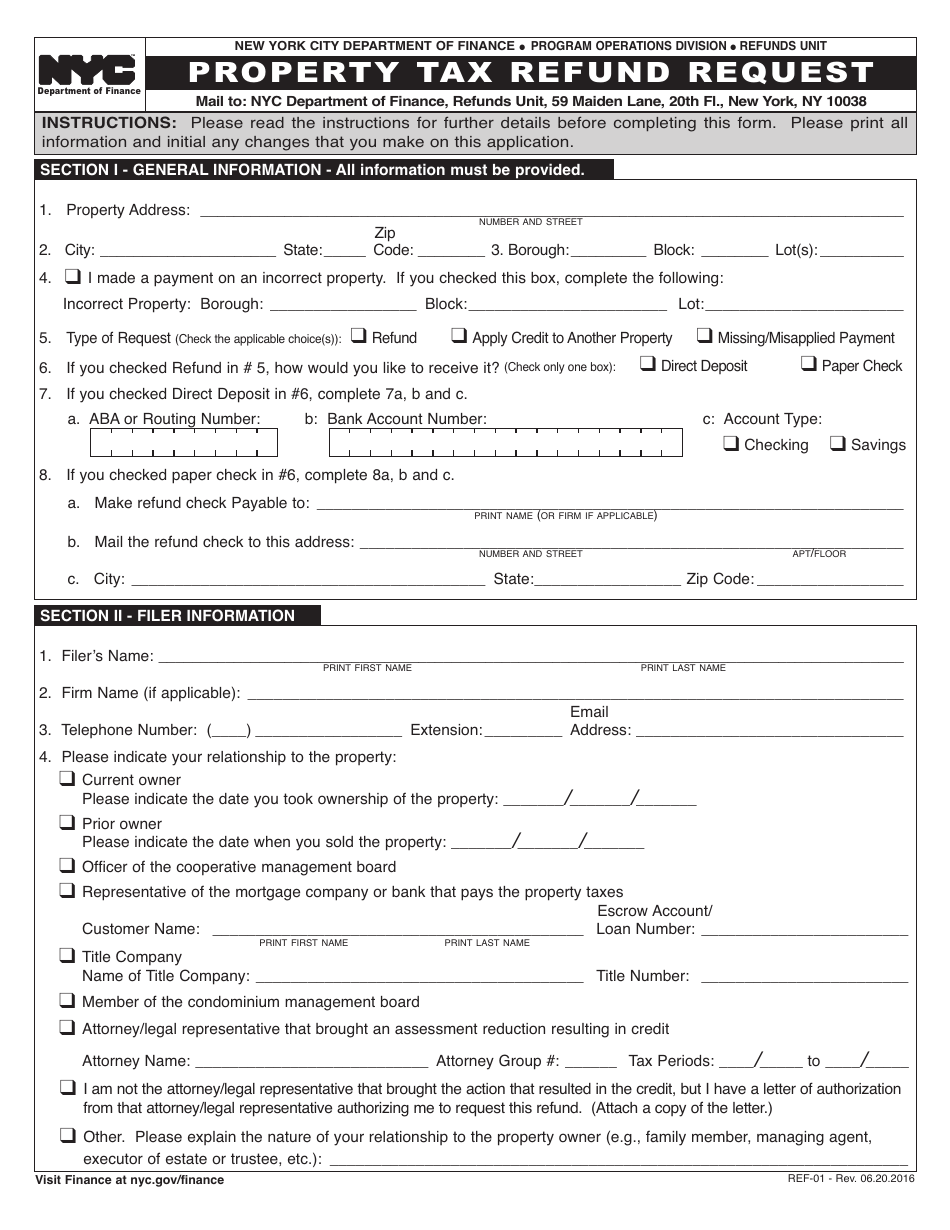

What Is Form REF-01?

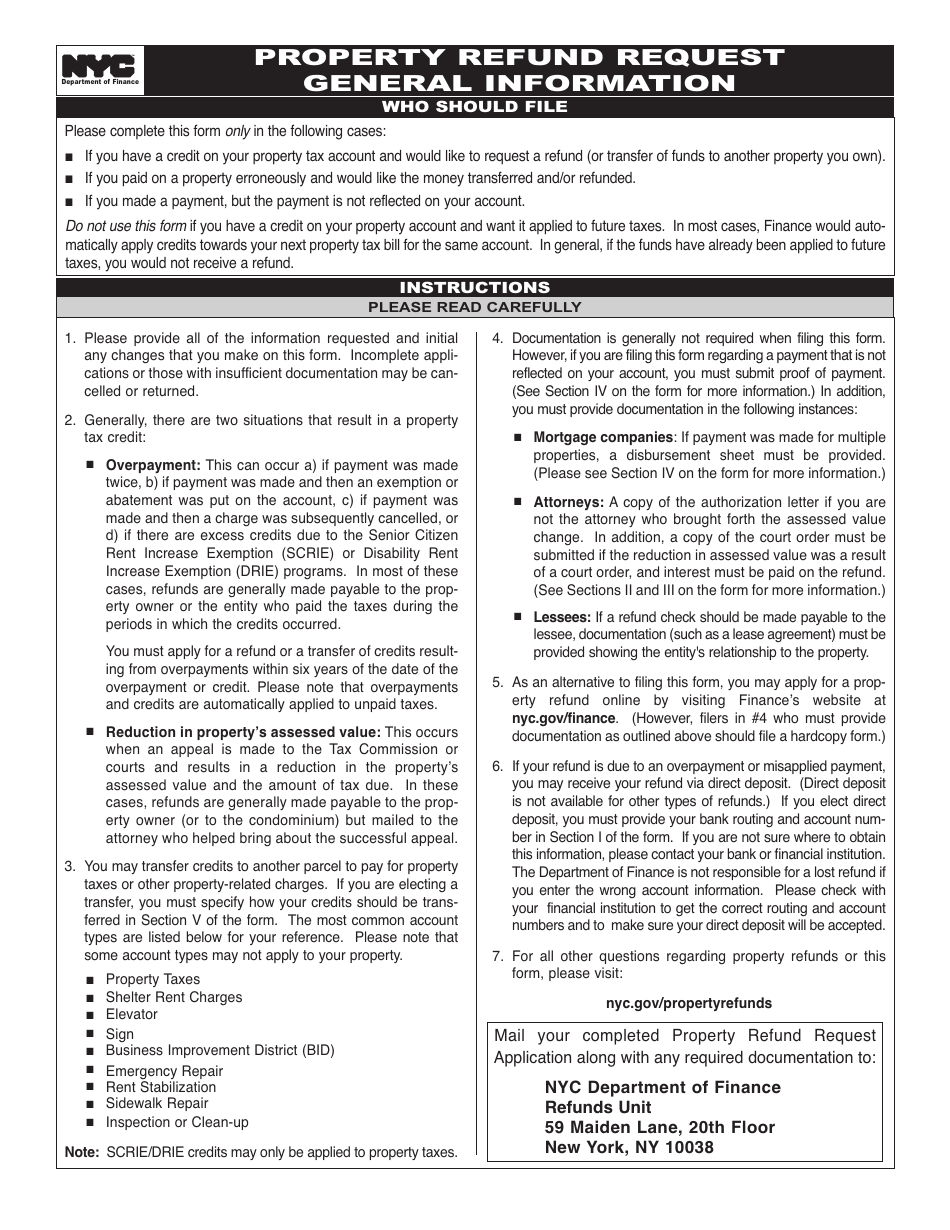

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

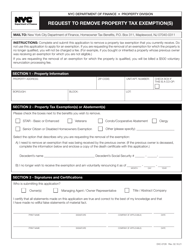

Q: What is Form REF-01?

A: Form REF-01 is a Property Tax Refund Request specific to New York City.

Q: Who can use Form REF-01?

A: New York City residents who want to request a property tax refund can use Form REF-01.

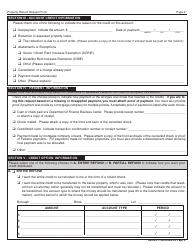

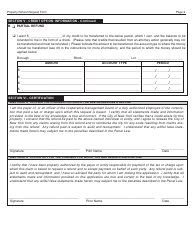

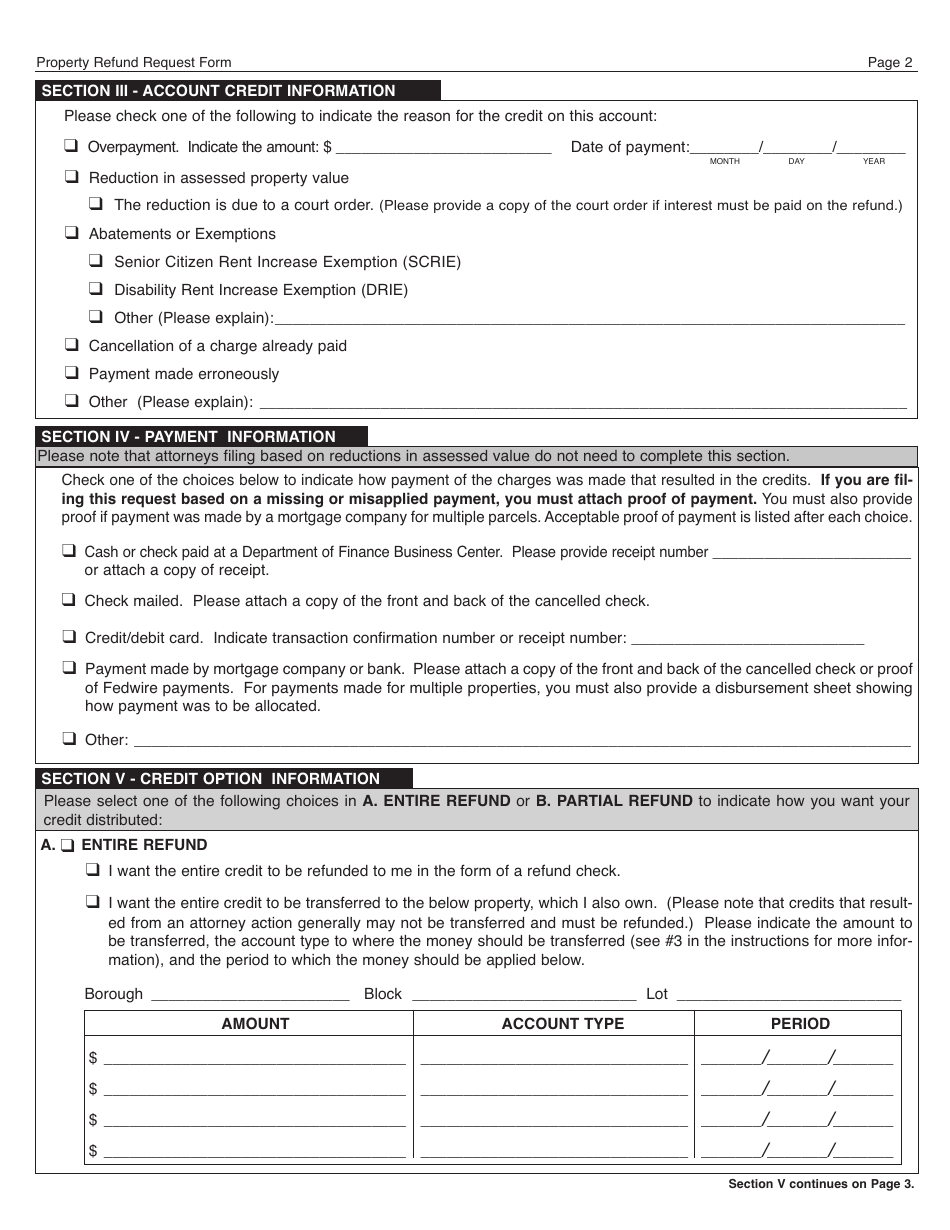

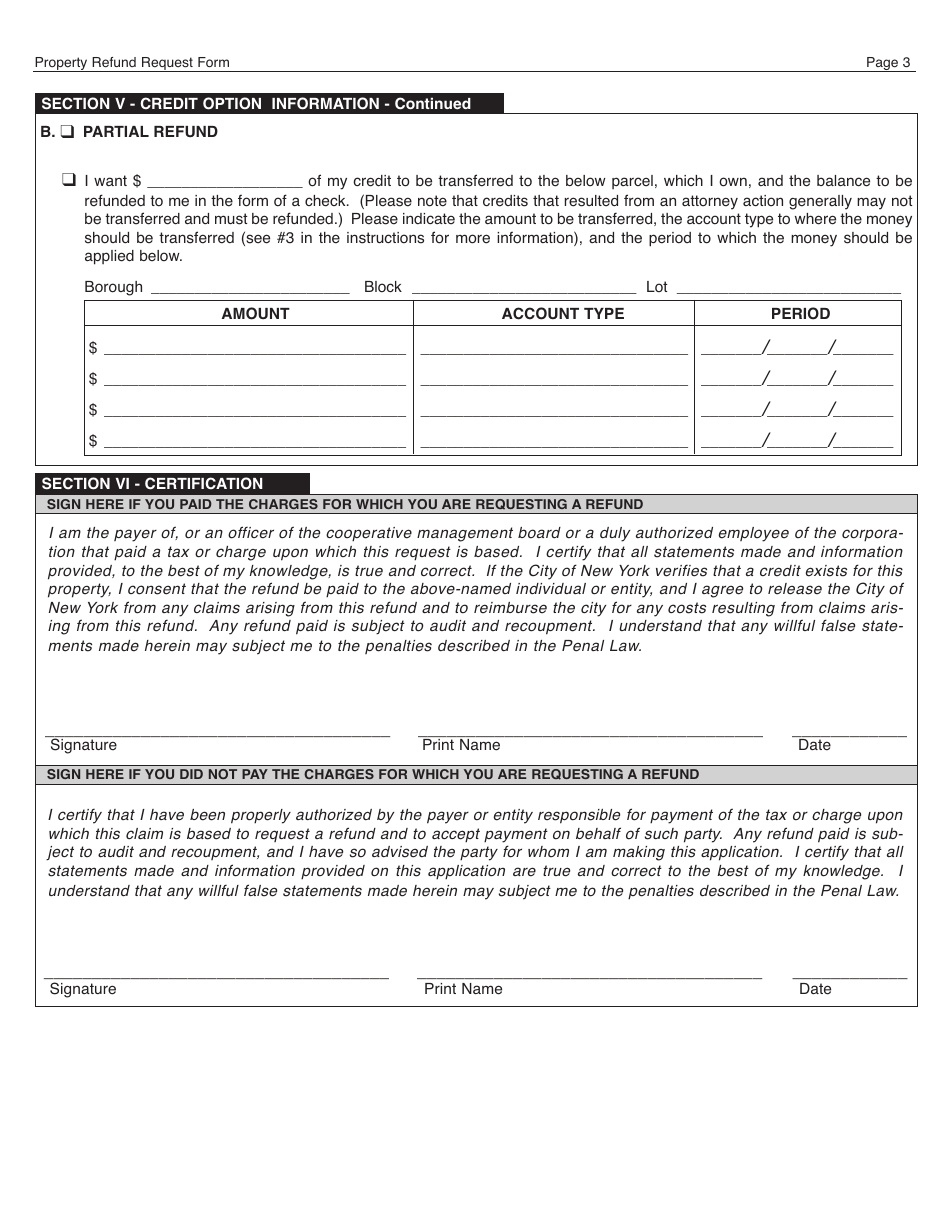

Q: What information is required on Form REF-01?

A: Form REF-01 requires information such as your name, address, property details, and reasons for requesting the refund.

Q: What happens after I submit Form REF-01?

A: After submitting Form REF-01, your request will be reviewed by the New York City Department of Finance. If approved, you will receive a property tax refund.

Q: Can I check the status of my property tax refund request?

A: Yes, you can check the status of your property tax refund request by contacting the New York City Department of Finance.

Q: Can I appeal if my property tax refund request is denied?

A: Yes, you can appeal if your property tax refund request is denied. The process for appealing will be provided to you by the New York City Department of Finance.

Form Details:

- Released on June 20, 2016;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REF-01 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.