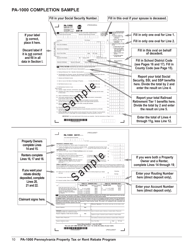

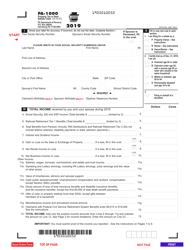

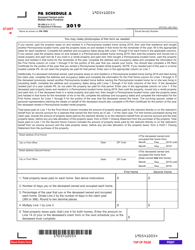

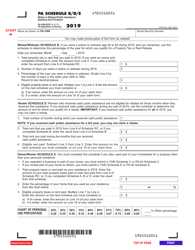

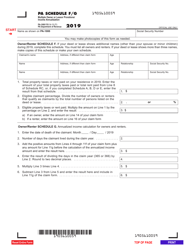

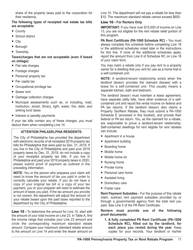

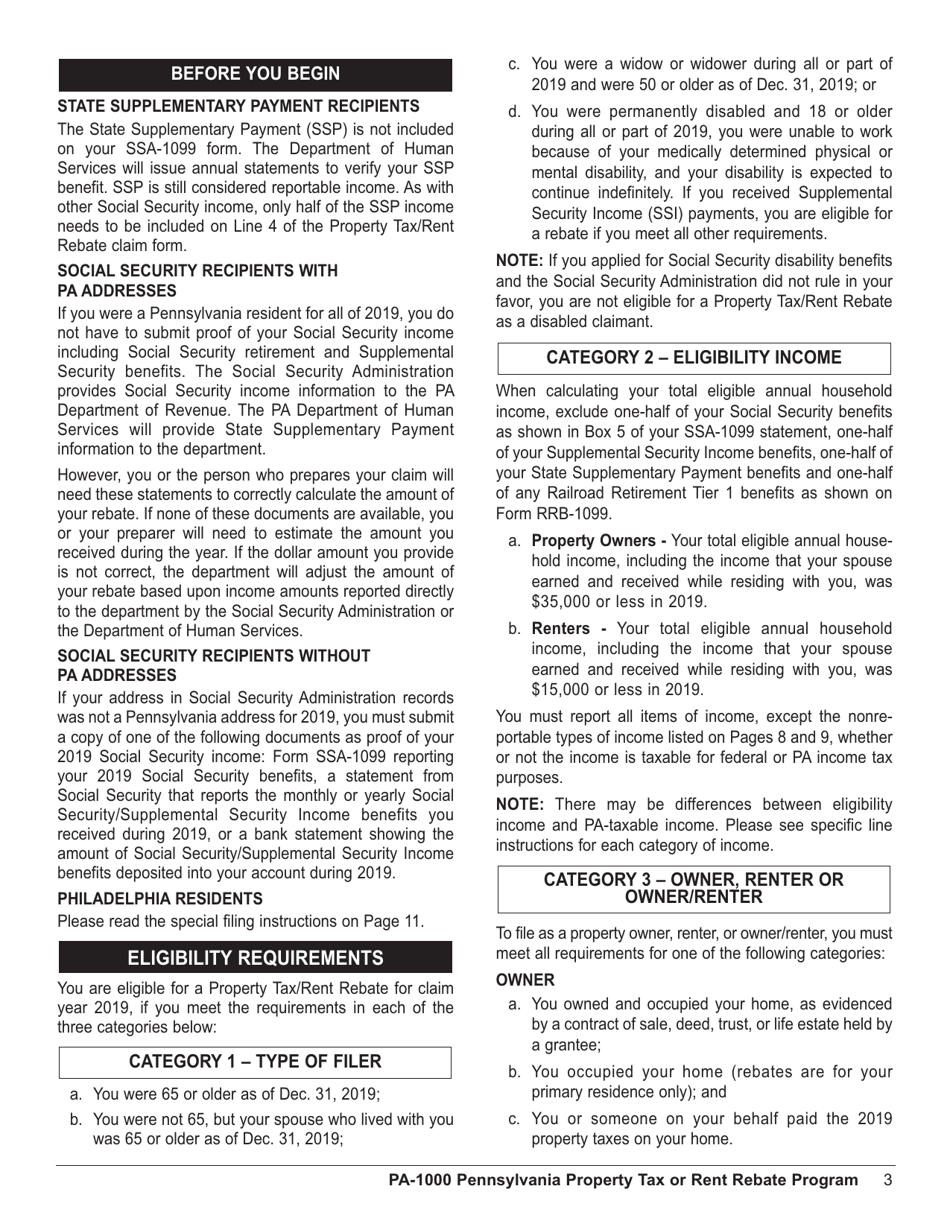

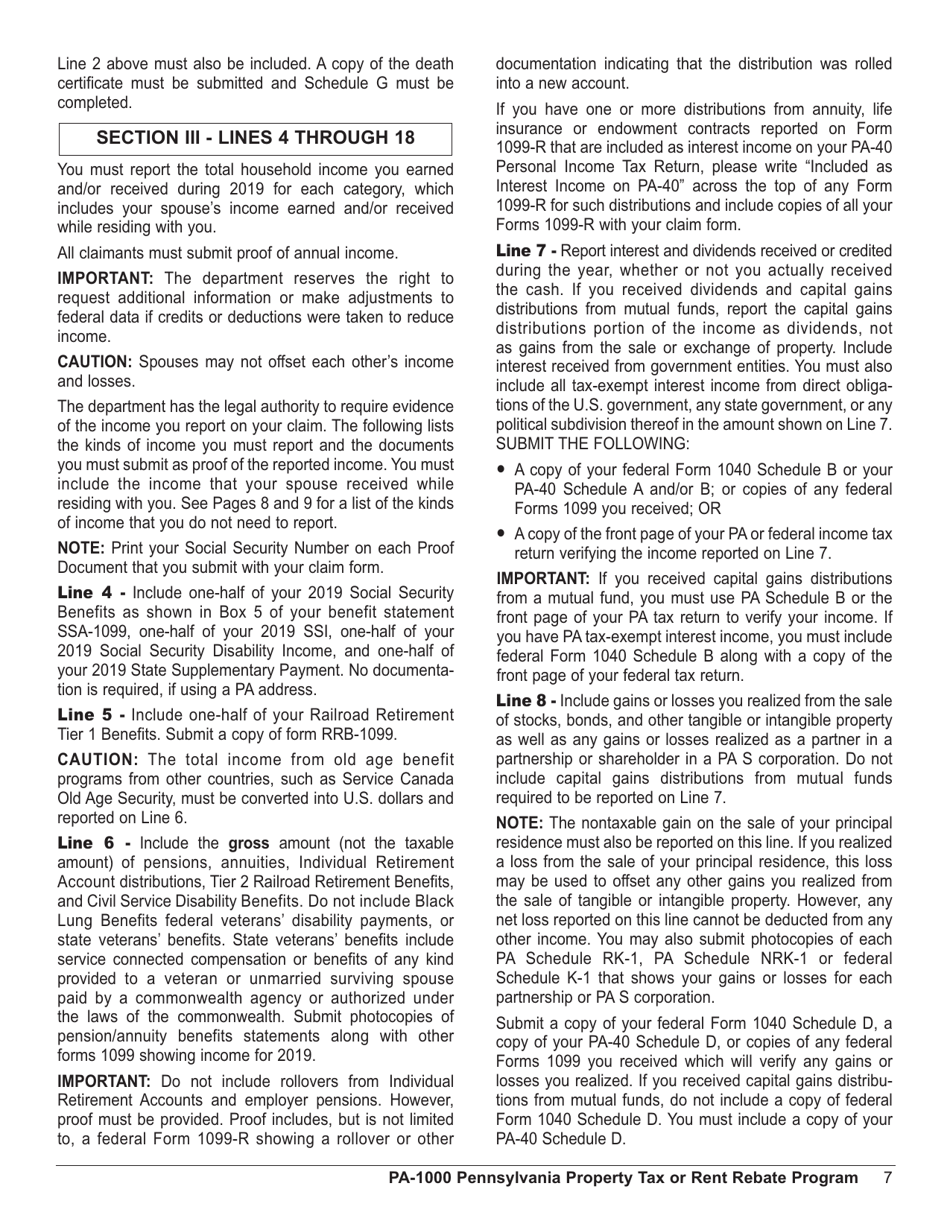

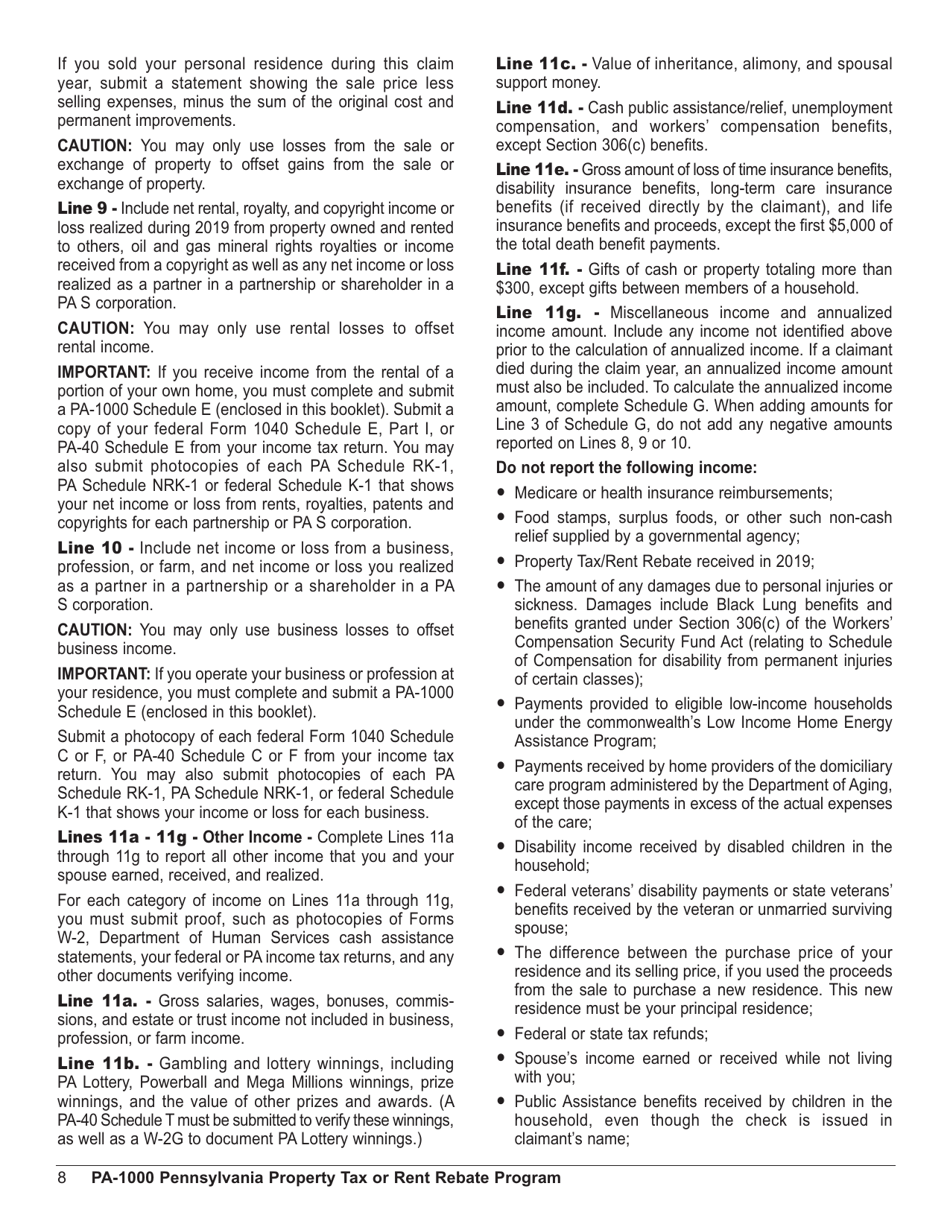

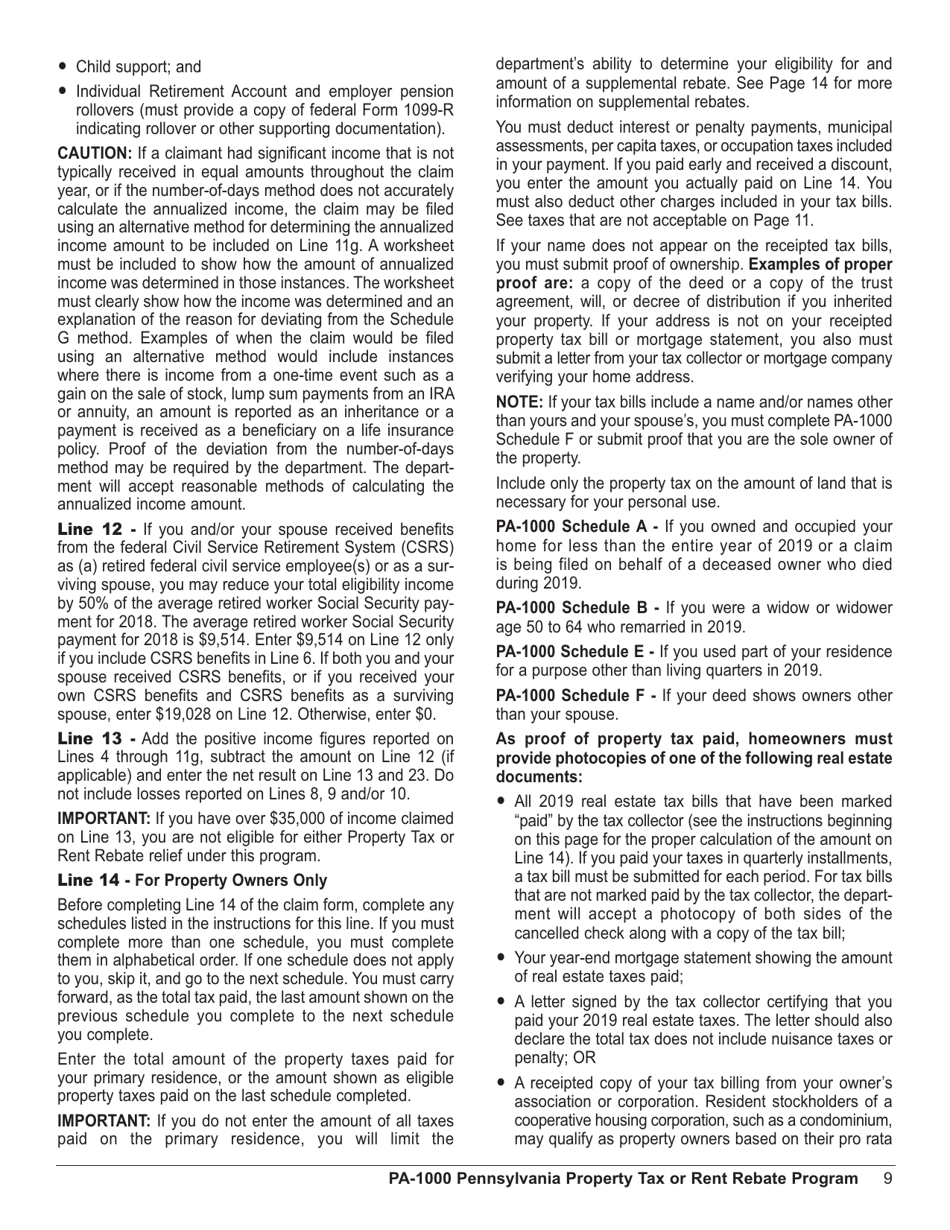

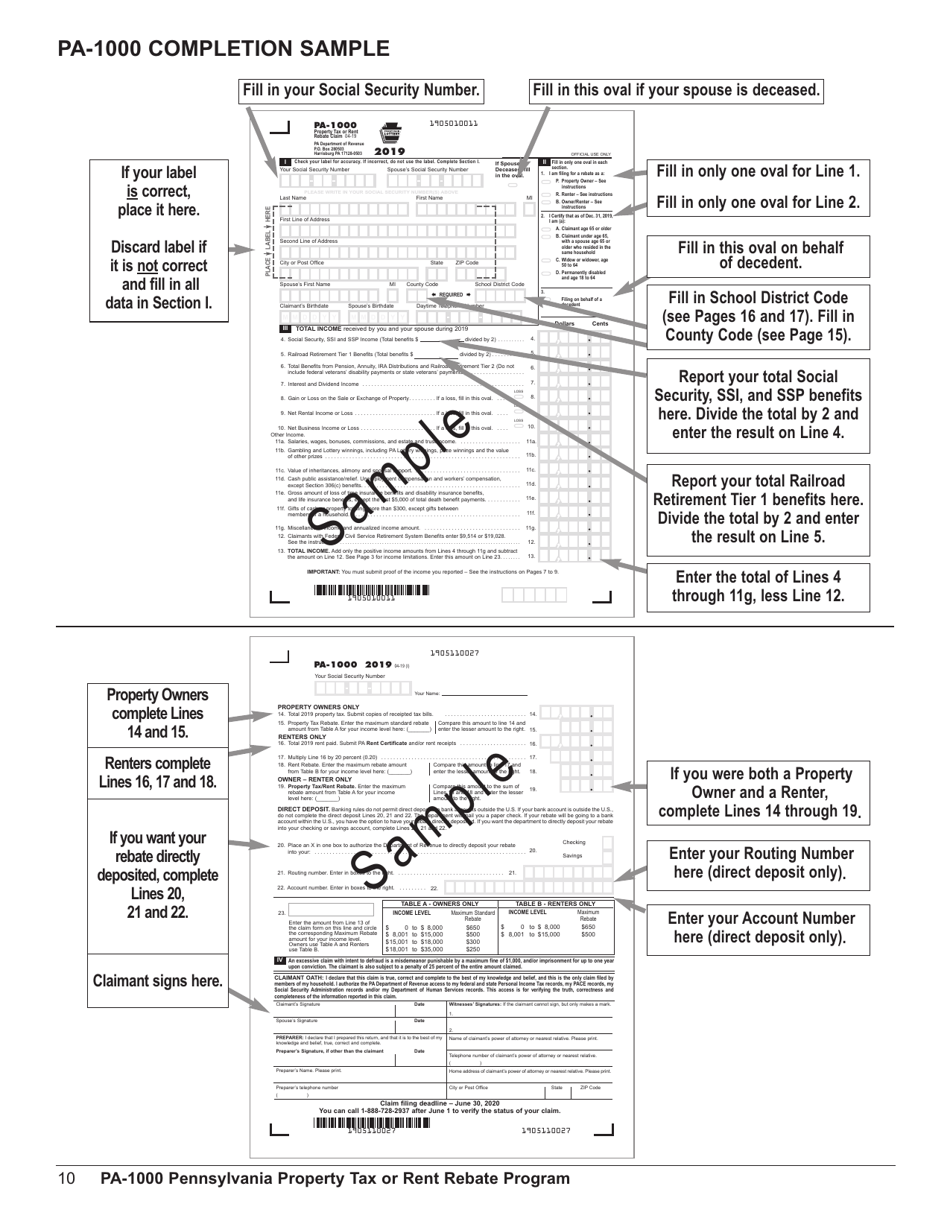

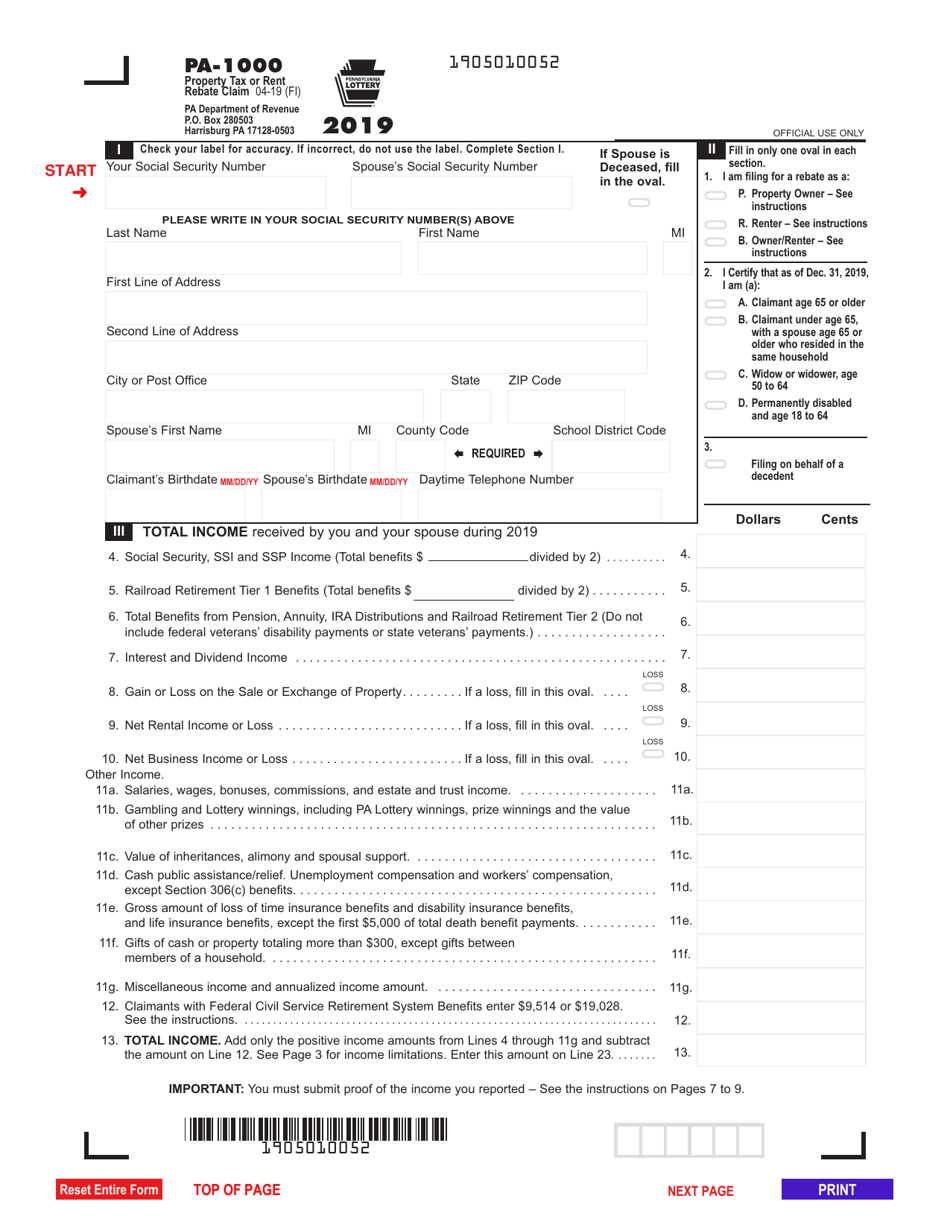

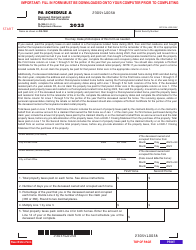

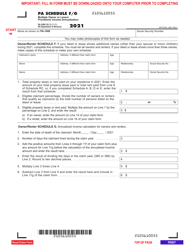

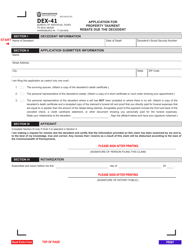

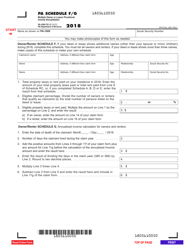

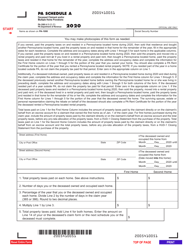

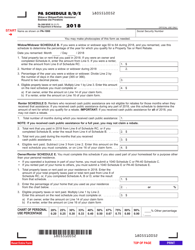

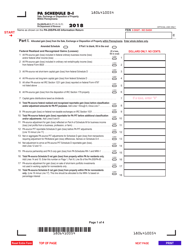

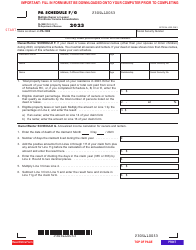

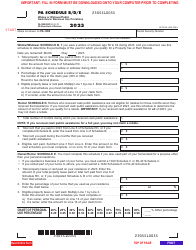

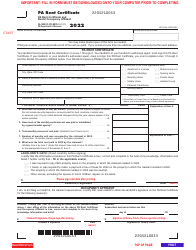

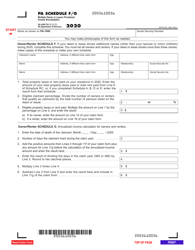

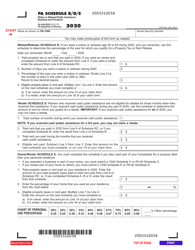

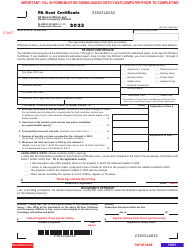

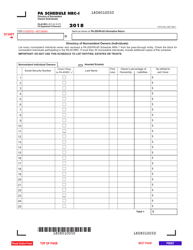

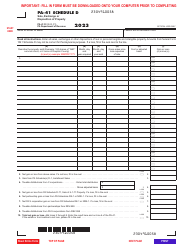

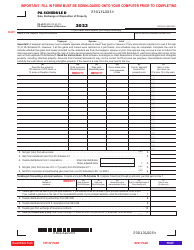

Instructions for Form PA-1000 Property Tax or Rent Rebate Claim - Pennsylvania

This document contains official instructions for Form PA-1000 , Property Tax or Rent Rebate Claim - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form PA-1000 is available for download through this link.

FAQ

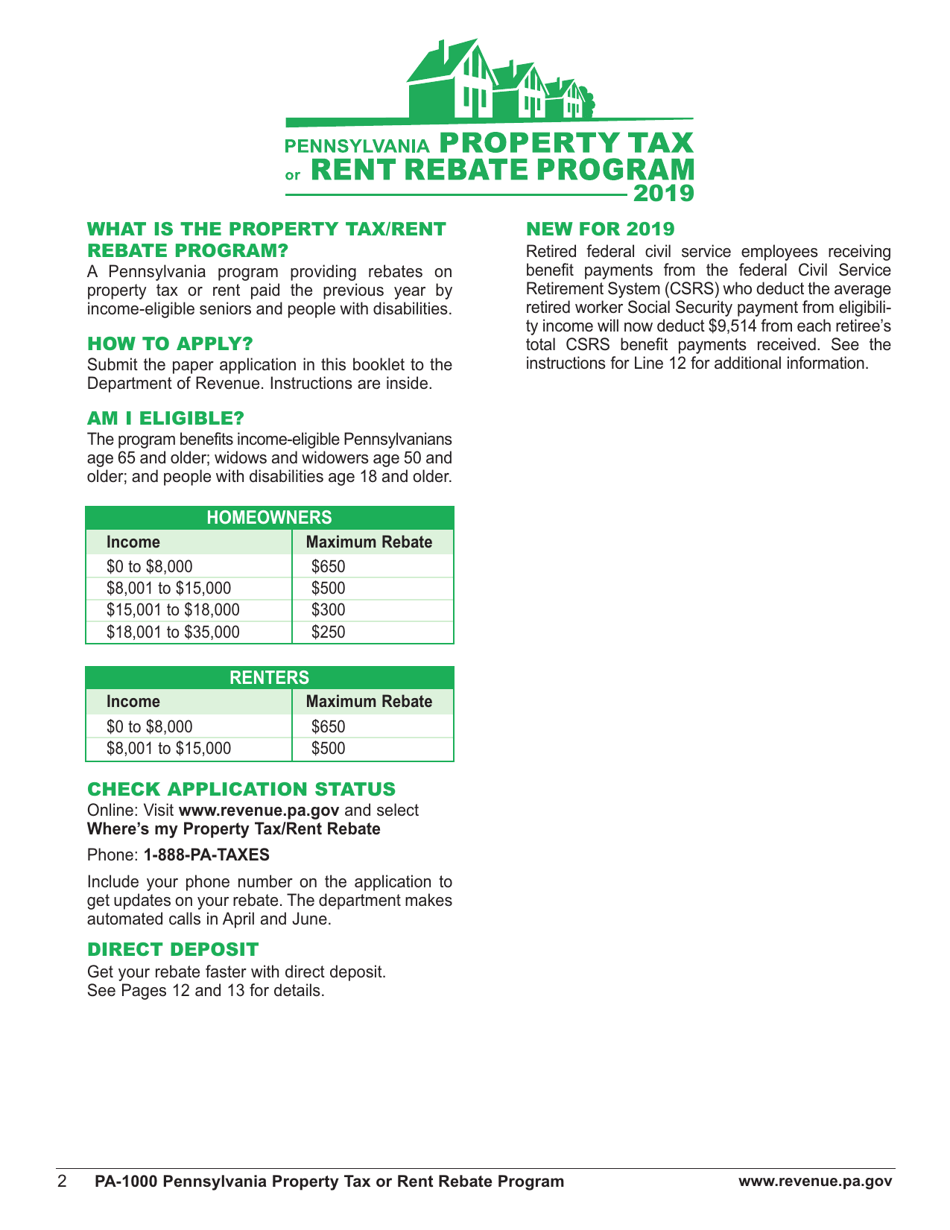

Q: What is Form PA-1000?

A: Form PA-1000 is a form used to claim property tax or rent rebate in Pennsylvania.

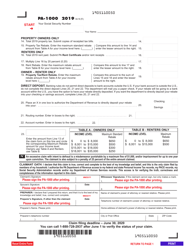

Q: Who can file Form PA-1000?

A: Pennsylvania residents who meet certain criteria can file Form PA-1000 to claim property tax or rent rebate.

Q: What can I claim on Form PA-1000?

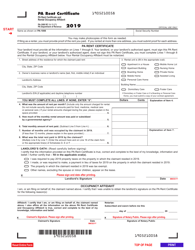

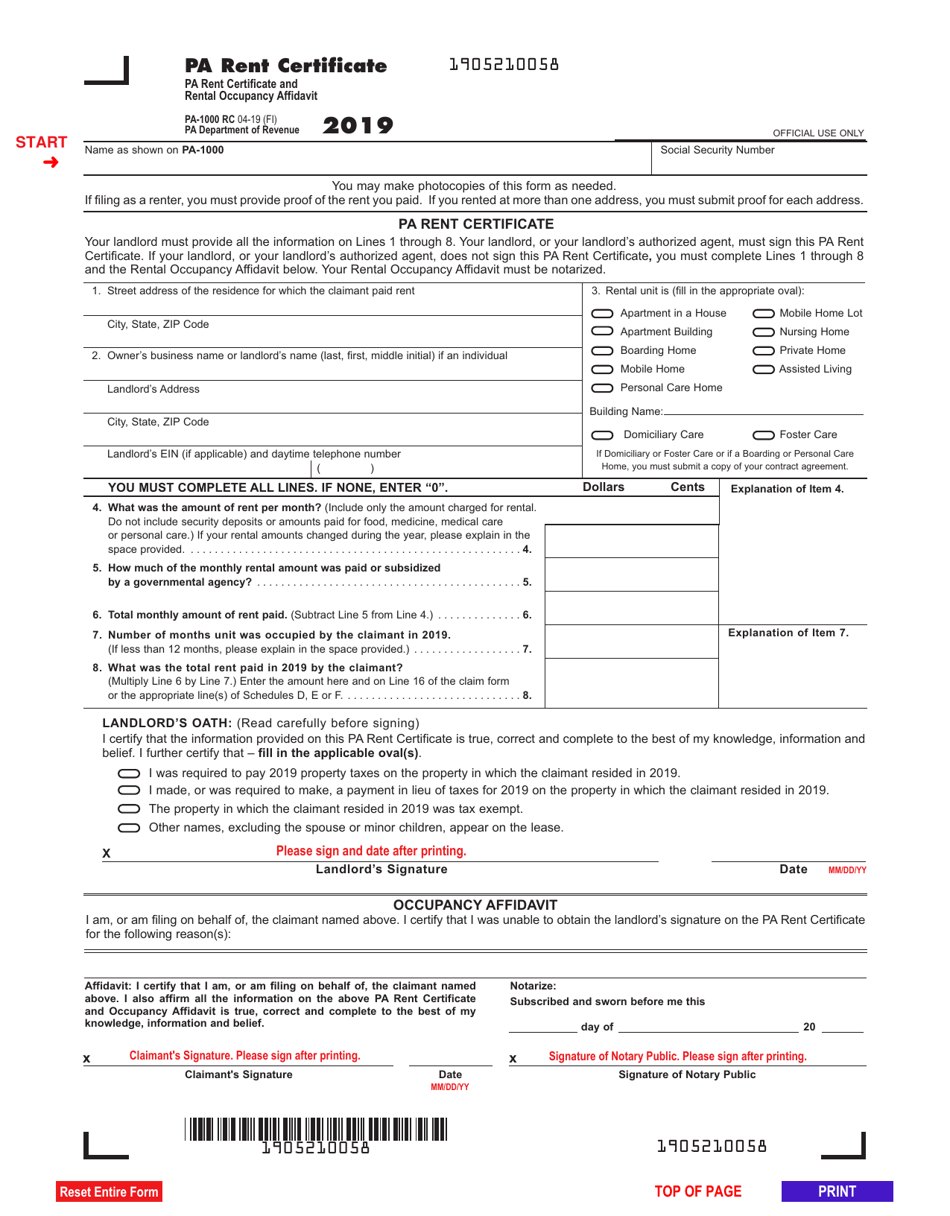

A: You can claim property tax or rent paid during the year on Form PA-1000.

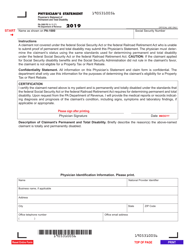

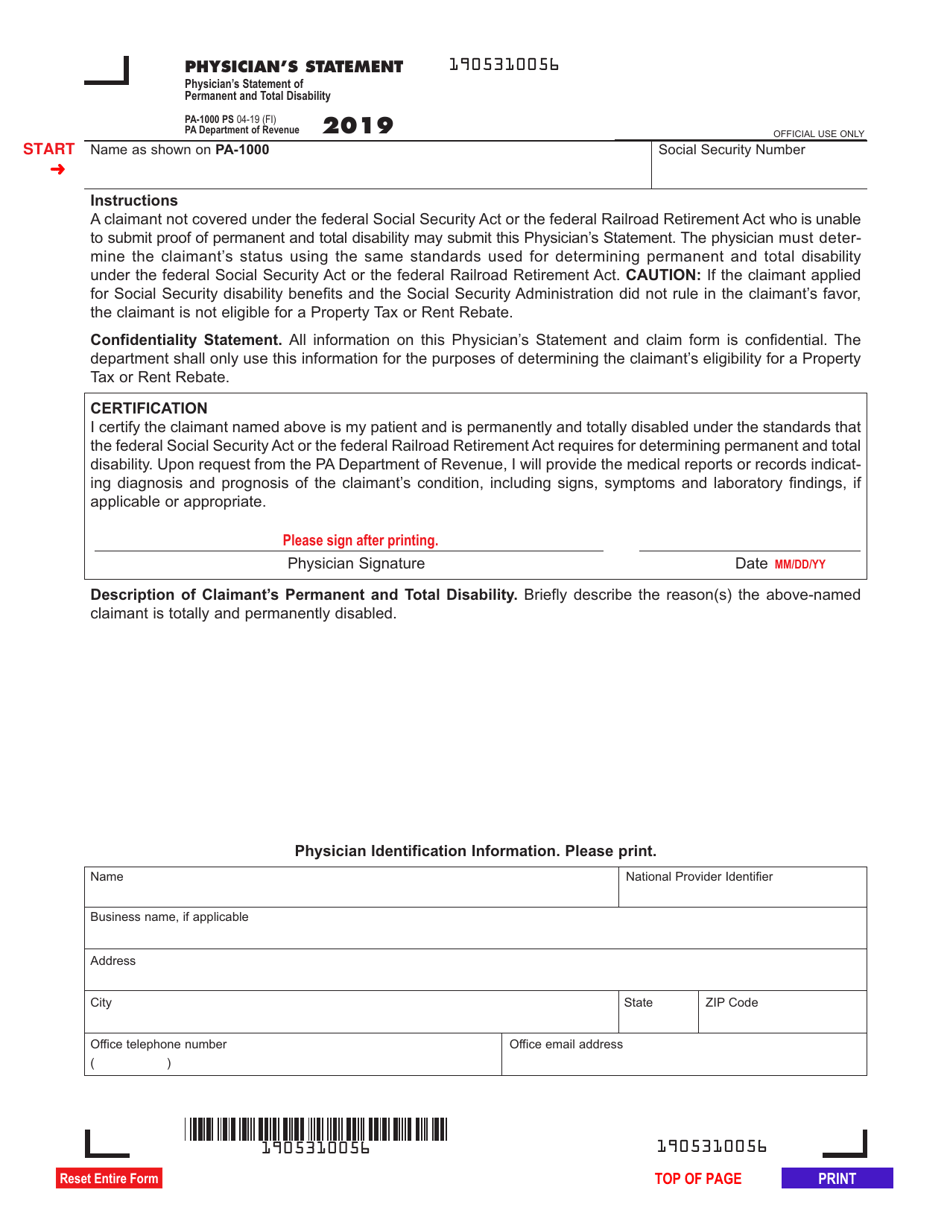

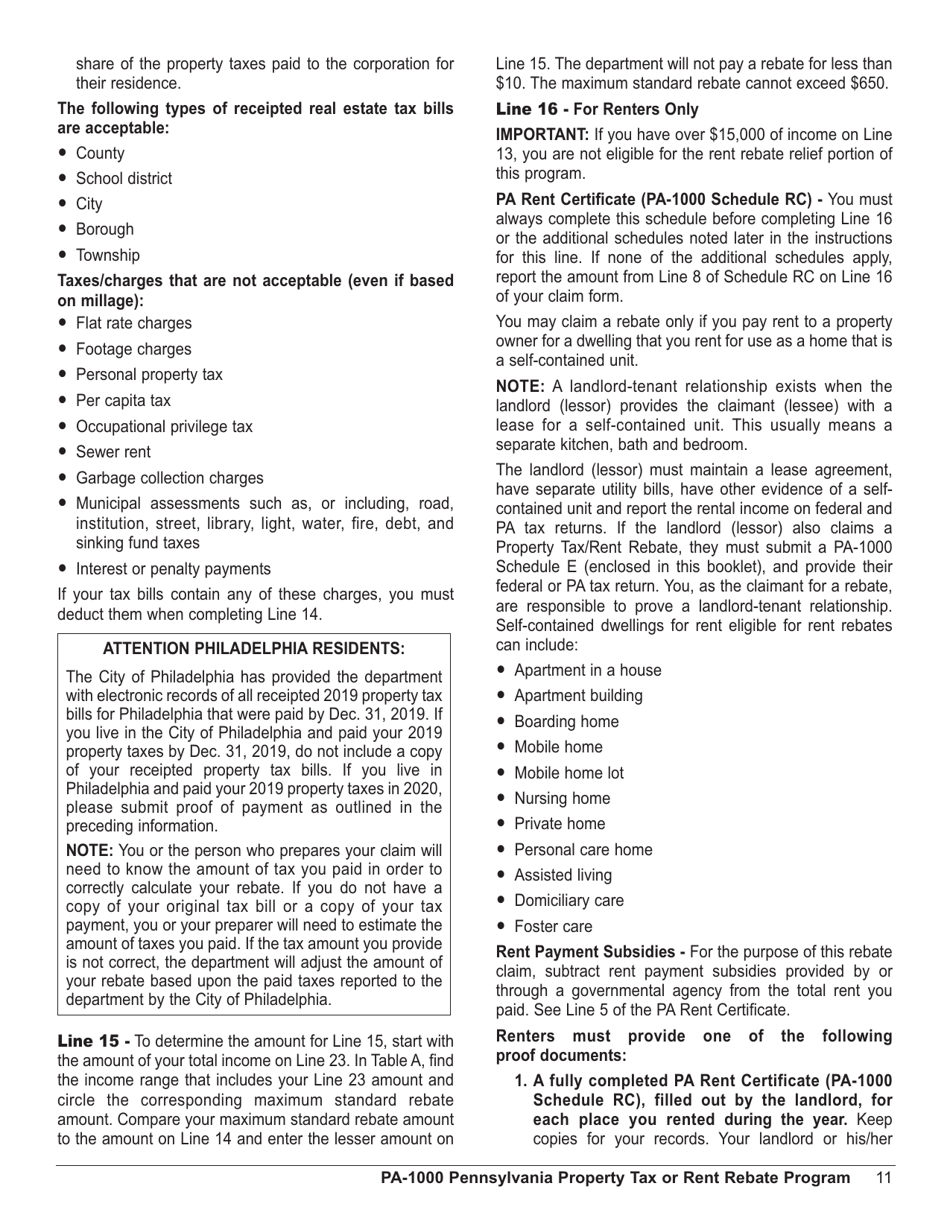

Q: What documents do I need to file Form PA-1000?

A: You will need to provide documents such as proof of age, proof of income, and proof of property tax or rent paid.

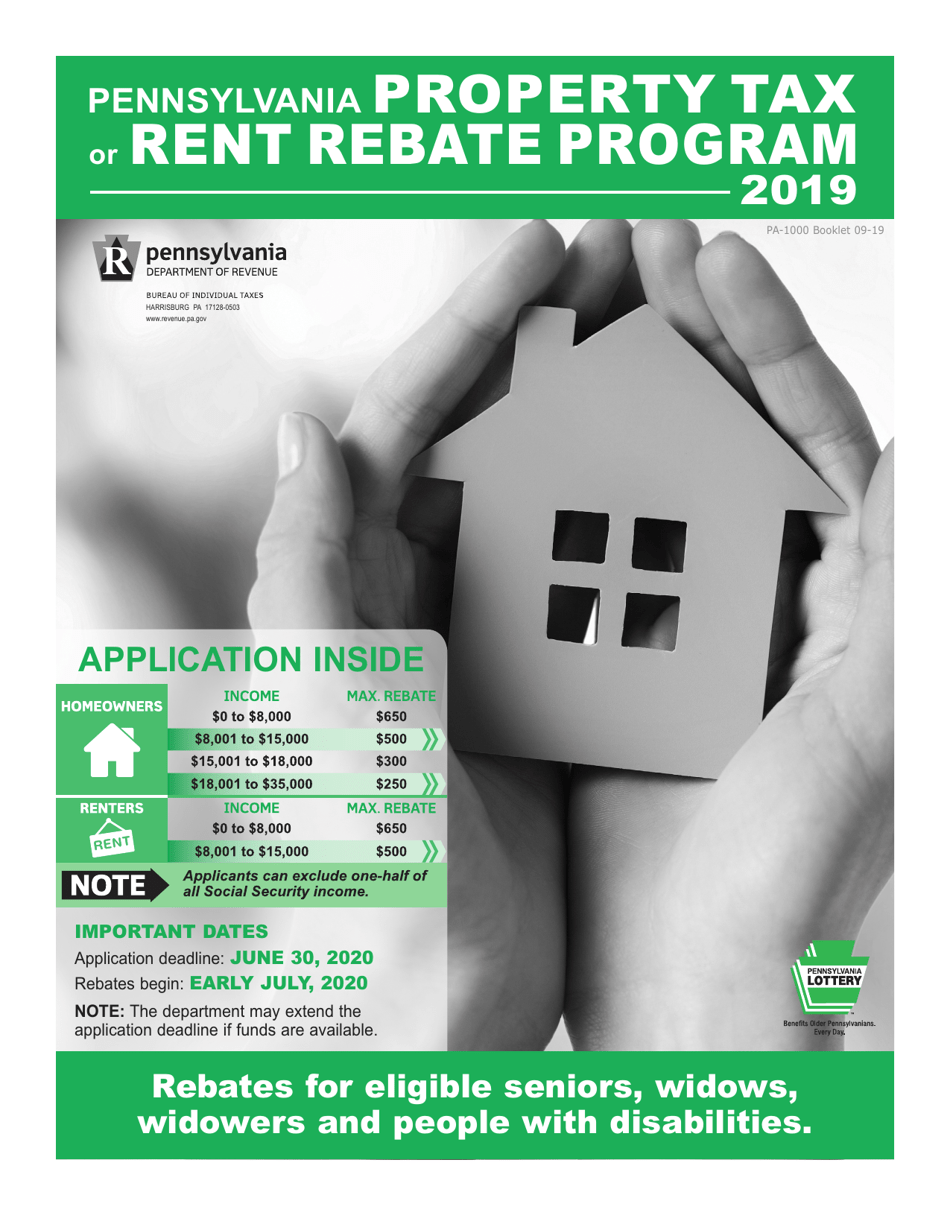

Q: When is the deadline to file Form PA-1000?

A: The deadline to file Form PA-1000 is generally June 30th of the year following the tax year.

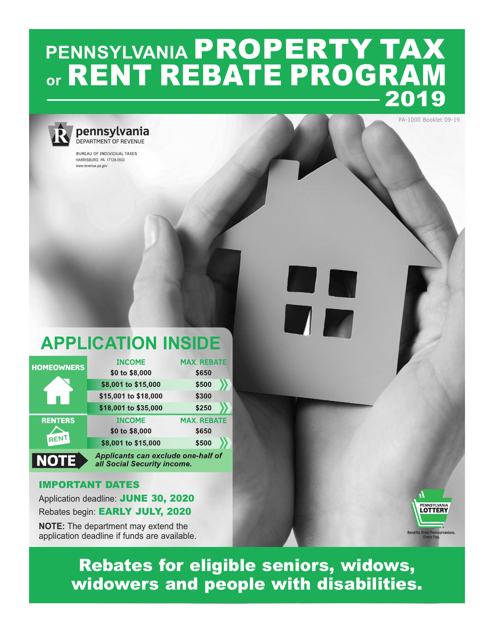

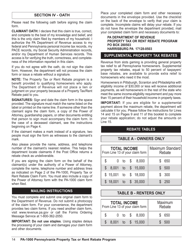

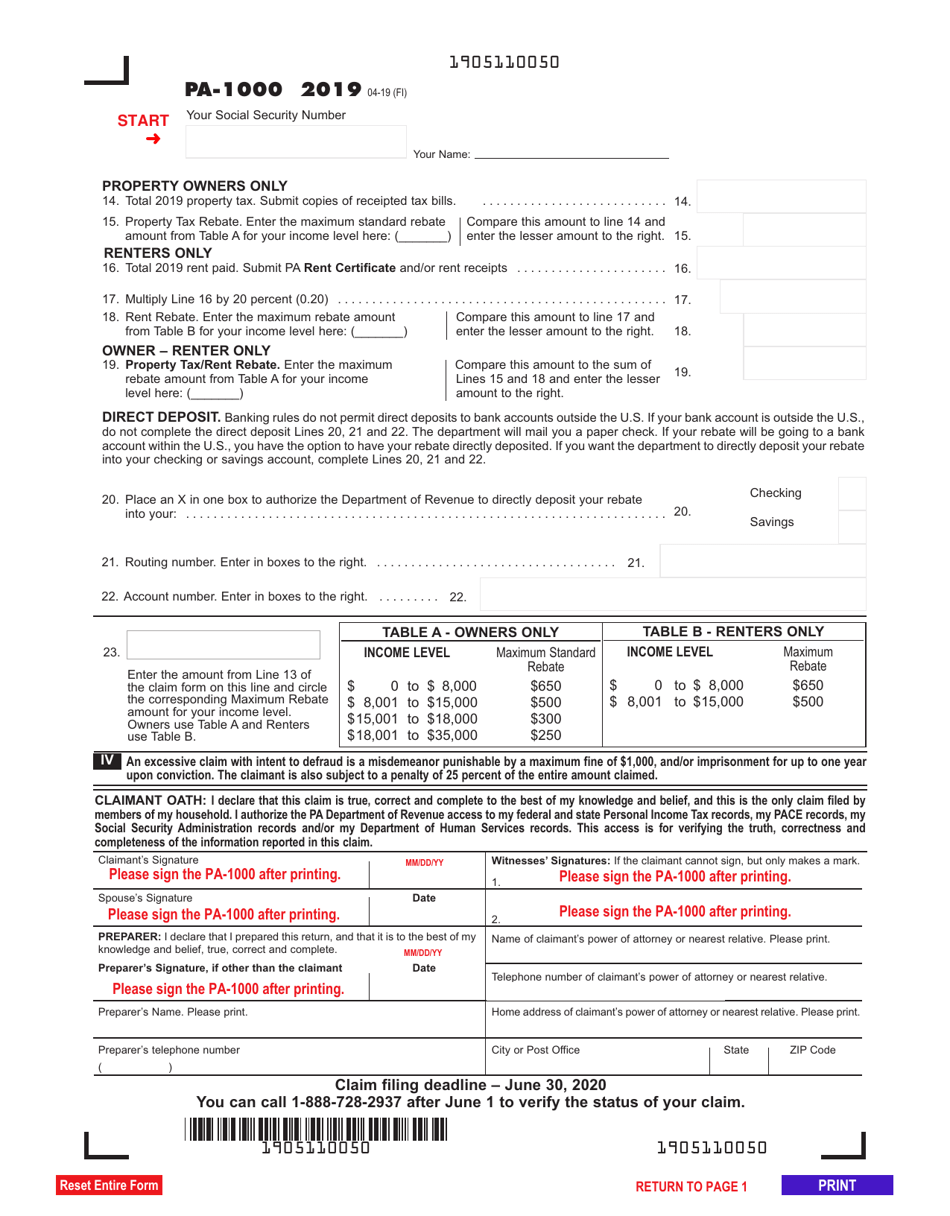

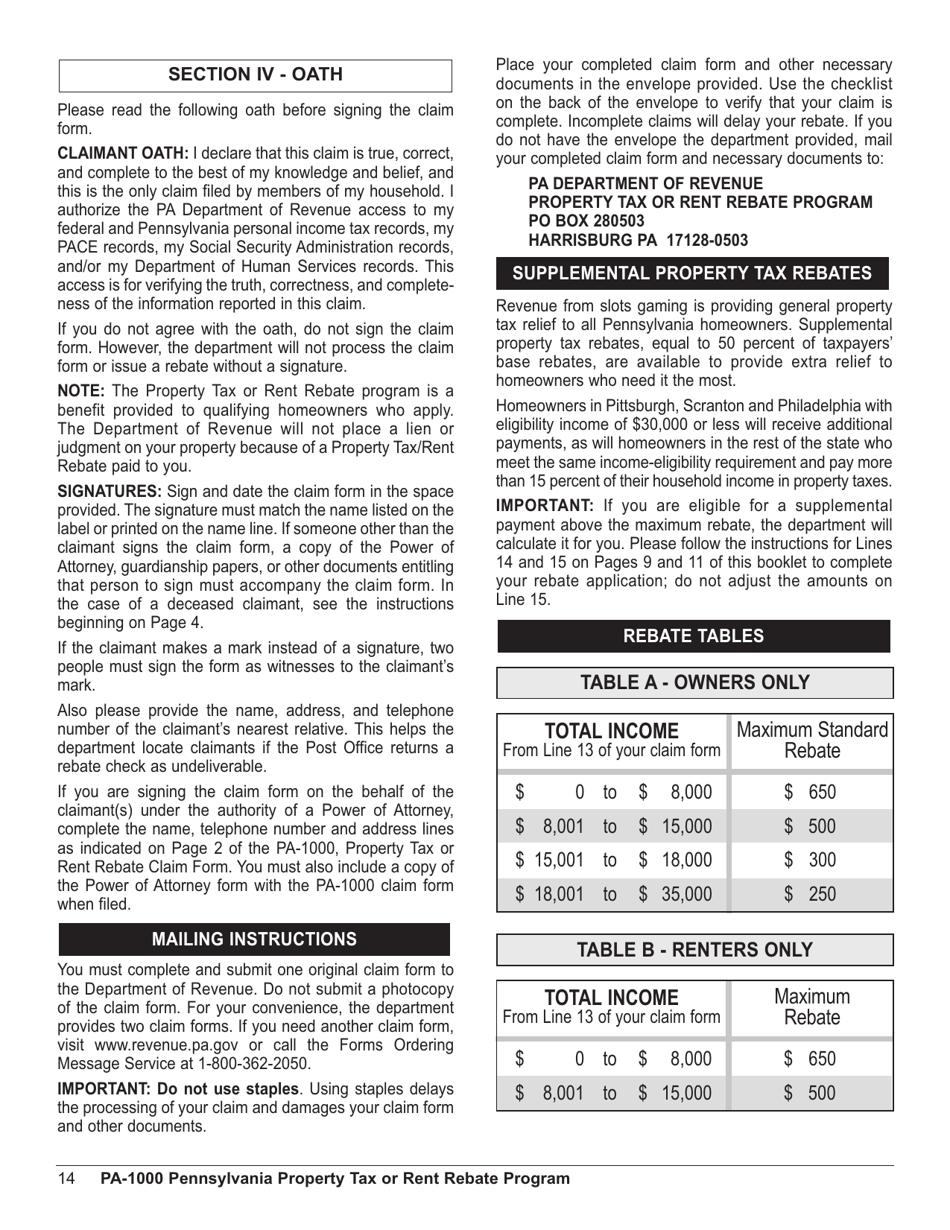

Q: Is there an income limit to qualify for the property tax or rent rebate?

A: Yes, there is an income limit to qualify for the property tax or rent rebate. The income limit varies depending on your marital status and number of dependents.

Q: How much can I expect to receive from the property tax or rent rebate?

A: The amount of property tax or rent rebate you can receive depends on factors such as your income, property tax or rent paid, and certain deductions.

Instruction Details:

- This 27-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.