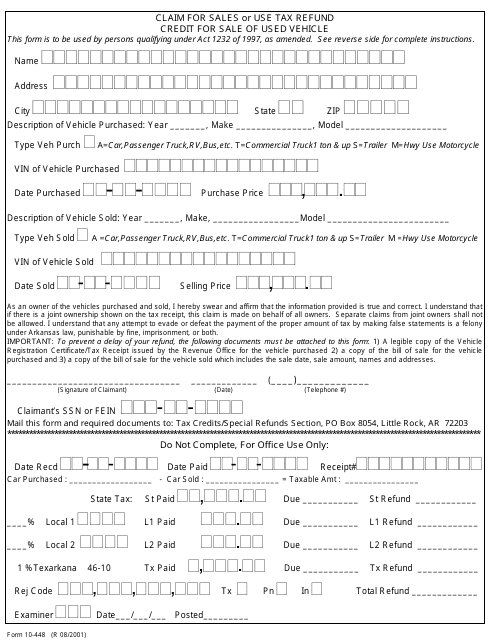

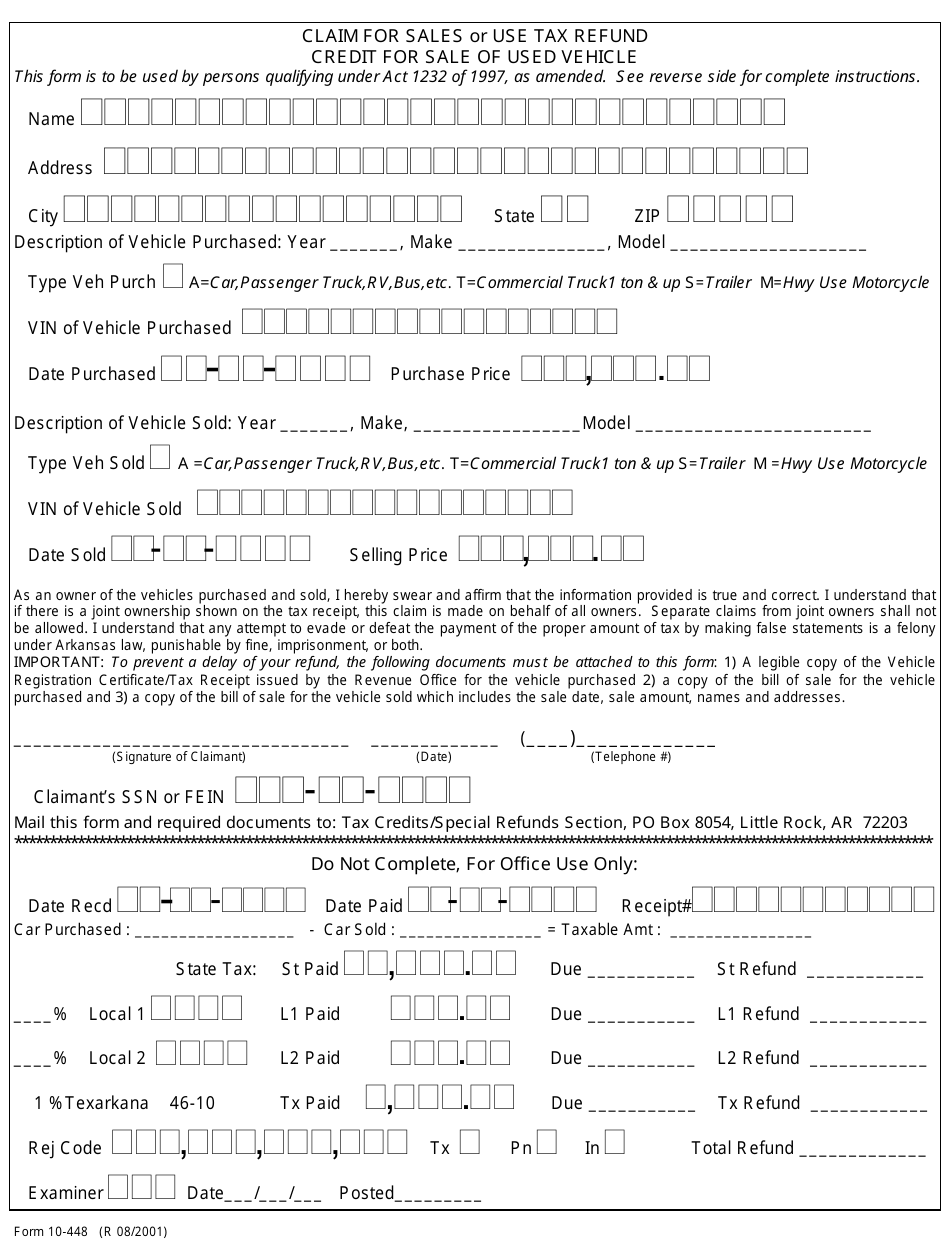

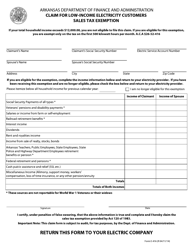

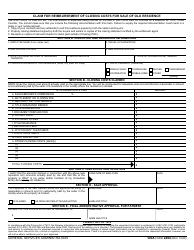

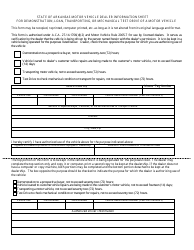

Form 10-448 Claim for Sales or Use Tax Refund: Credit for Sale of Used Vehicle - Arkansas

What Is Form 10-448?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10-448?

A: Form 10-448 is a claim for sales or use tax refund specifically for the credit for the sale of a used vehicle in Arkansas.

Q: What is the purpose of Form 10-448?

A: The purpose of Form 10-448 is to claim a refund for sales or use tax that was paid on the purchase of a used vehicle in Arkansas.

Q: Who can use Form 10-448?

A: Anyone who has purchased and sold a used vehicle in Arkansas may use Form 10-448 to claim a refund for the sales or use tax paid.

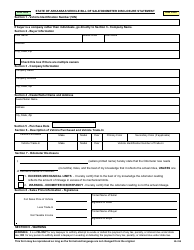

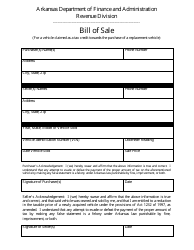

Q: What information is required on Form 10-448?

A: Form 10-448 requires information about the buyer and seller of the used vehicle, as well as details about the sale and the amount of sales or use tax paid.

Form Details:

- Released on August 1, 2001;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 10-448 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.